The Akash Network Phenomenon: Breaking Down Its 2400% Uptrend And Market Outperformance

11 Mai 2024 - 4:00AM

NEWSBTC

Decentralized and open-source computing platform Akash Network has

captured significant attention in the cryptocurrency market as its

native token, AKT, has outperformed the top 100 cryptocurrencies

with a 2400% price increase year-to-date. While Bitcoin (BTC)

and other major cryptocurrencies experience price corrections, the

Akash Network and its native token are surging at a remarkable

pace. To comprehend the driving factors behind this uptrend, it is

crucial to delve deeper into what the Akash Network represents and

its underlying technology. What Is The Akash Network? The Akash

Network, founded in March 2018 by Overclock Labs, emerged as a

distributed cloud computing marketplace with the objective of

decentralizing cloud computing. Originally focused on building a

traditional multi-cloud deployment platform, Overclock Labs decided

to launch Akash. According to Messari, the network facilitates the

connection between server owners in need of computing power to host

applications and users offering cloud computing resources through

the Akash Marketplace, where computing resources are bought and

sold. At the core of the Akash Network lies its blockchain

infrastructure known as Akash, built using the Cosmos SDK and based

on the Tendermint consensus mechanism. Related Reading: XRP

All Talk, No Action? Social Media Booms, But Price Stuck In The

Bear Pit Since the launch of Akash Mainnet in September 2020, the

network has undergone notable upgrades to increase its

functionality. These upgrades include the introduction of the Akash

Marketplace, flexible bid pricing, Inter-Blockchain Communication

(IBC) compatibility, deployment tools for improved user experience,

audited attributes, and Tendermint’s State Sync. Subsequent

upgrades introduced features such as persistent storage, authorized

spending, an inflation decay curve, fractional uAKT to eliminate

minimum cost deployment, IP leases, provider service splits, Cosmos

IBC3 update, and Interchain Accounts (ICA). Messari points out that

the most recent upgrades have positioned Akash as a prominent

player in the cloud computing and artificial intelligence (AI)

development space. Mainnet 6 introduced support for GPUs and stable

payments, establishing Akash as an open-source marketplace for

high-density GPUs and a distributed cloud for large language models

(LLM). In conjunction with this upgrade, Overclock Labs

launched Akash ML, a cloud infrastructure that offers AI developers

GPU spot instances, with plans to provide on-demand access in the

future. Subsequent upgrades focused on enforcing minimum

validator commissions, improving GPU visibility, and ensuring

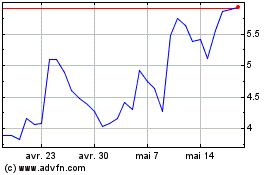

validated bids on multi-service deployments. AKT Token Breaks Key

Trendline In terms of price action, the Akash Network’s native

token, AKT, has recently demonstrated a notable breakthrough. Over

the past 24 hours, AKT has experienced a significant surge of

15.63%, propelling its trading value to $5.64. One key indicator of

this positive development is the token’s ability to surpass a

diagonal trendline in the 4-hour timeframe. Breaking this trendline

suggests a potential reversal of the previous downward trajectory

and opens up the possibility of further bullish market sentiment

for AKT. Moving forward, the focus for AKT is to sustain the

previous week’s high of $5.095 as a crucial level of support. By

maintaining this level, the token aims to consolidate its recent

gains and solidify its position in the market. Related Reading:

Crypto Analyst Says XRP Price Can Break Out From Falling Pennant,

But Can It Reach $1? In summary, the price increase of AKT can be

attributed to several factors. The success of the Akash Network’s

underlying technology and its value proposition in the

decentralized cloud computing space contribute to the positive

sentiment surrounding the token. As the network gains recognition

and attracts users, demand for AKT may increase, resulting in

upward pressure on the price. In addition, the successful break of

the diagonal trend line represents a potential shift in market

dynamics as investors may take this as a bullish signal, leading to

increased buying activity and further price appreciation. Featured

image from Shutterstock, chart from TradingView.com

Akash Network (COIN:AKTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Akash Network (COIN:AKTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024