Crypto Watchlist: Top 5 Coins To Watch This Week

16 Décembre 2024 - 11:00AM

NEWSBTC

The crypto ecosystem is on the cusp of yet another significant

week, ushered in by several major developments taking place across

different networks. This week’s spotlight falls on Bitcoin, Fantom,

Avalanche, Stacks, and LayerZero, each of which is facing a pivotal

milestone. The broader macro backdrop is also critical,

particularly the December 18 Federal Open Market Committee (FOMC)

interest-rate decision in the United States. #1 Bitcoin And Crypto

Await The FOMC Decision Bitcoin traders and investors are watching

the Federal Reserve’s policy meeting scheduled for Wednesday,

December 18, at 2:00 pm ET, with Fed Chair Jerome Powell’s press

conference to follow at 2:30 pm ET. Saxo Bank writes in their

latest investor note, “The Federal Reserve is widely expected to

deliver a 25 basis-points (bps) rate cut this week, reducing the

target range for the federal funds rate to 4.25-4.50%.” According

to futures data, there is a 95% probability of this move, which

follows a similar cut in November. While the rate cut is seemingly

priced in, the market will scrutinize the Fed’s Summary of Economic

Projections (SEP) and its “dot plot,” which depict the expected

path of policy rates for 2025 and beyond. Any signal that the

Federal Reserve could limit the pace of future cuts—particularly if

it revises the dot plot from four rate cuts in 2025 down to three

or even two—might weigh on risk-on assets such as Bitcoin and

cryptocurrencies. Many analysts point to the labor market, which

has been softening, and to easing shelter inflation, evidenced by

slowing rental price growth, as key justifications for additional

rate cuts. Related Reading: Crypto Market Hit Hard With $1.7

Billion Liquidated, Largest Event Since 2021 However, the Fed may

convey a more cautious stance and highlight so-called

“Trump-flation” risks, referencing the possibility of renewed trade

tariffs under the incoming Trump administration that could push

inflation higher. If such inflationary risks remain persistent, the

Fed might pause or reduce the pace of cuts in 2025, which would be

viewed as a hawkish twist. The new dot plot for 2025 is currently

expected to show around 3.625%—a baseline assumption of three rate

cuts next year—but the market has speculated that this could move

to 3.875% if the Fed becomes more cautious. The immediate reaction

in Bitcoin will likely hinge on the meeting’s tone, with a less

dovish Fed potentially introducing volatility to BTC price action.

#2 Fantom (FTM) Fantom is entering a new era with the upcoming

Sonic L1 mainnet launch, a transformative upgrade that will

dramatically improve network throughput and cost efficiency.

Developers behind Fantom have highlighted that Sonic is capable of

processing approximately 10,000 transactions per second, with

near-instant finality—a marked leap from current network

capabilities. The planned modifications are also set to cut

operational expenditures, with a reported 66% decrease in validator

node costs and minimized storage requirements. Another important

detail is Fantom’s decision to maintain compatibility with the

Ethereum Virtual Machine, which should make it straightforward for

EVM-based applications to migrate to the upgraded chain without

modifying their underlying code. Sonic will also debut a new token,

denoted as S, which will replace the existing FTM token at a

one-to-one ratio. The crypto trader Jacob Canfield stated via X,

“Shared this setup x subs last week, but FTM is close to a price

discovery break. Needs to clear the bearish impulse base and close

a 4 hour candle and we will probably see swift price discovery. The

chart coincides nicely with the SONIC launch.” #3 Avalanche (AVAX)

Avalanche will be another focal point in the crypto industry, as

the Avalanche9000 upgrade is set to go live on the mainnet today,

on December 16. This follows a testnet debut on the “Fuji” testnet

on November 25. Related Reading: Crypto Market Outlook: VanEck

Issues 10 Predictions, Including Bitcoin Nearing $200,000 The

highly anticipated mainnet launch is described by Avalanche’s core

developers as the most significant upgrade in the chain’s history.

Compounding the buzz is Avalanche’s December 12 announcement of a

$250 million private token sale led by Galaxy Digital, Dragonfly,

and ParaFi Capital, with more than 40 other entities participating.

According to official statements, this fundraising round

strengthens Avalanche’s treasury, already valued at around $3

billion in AVAX tokens, and comes on the back of a previous $230

million token sale in 2021. Avalanche9000 incorporates the Etna

Upgrade and key community proposals ACP-77 and ACP-125, altogether

reimagining how Avalanche’s subnets function—now referred to as

layer-1s. In doing so, Avalanche transitions from a costly

validator system requiring 2,000 AVAX per instance to a more

subscription-like model that charges 1.33 AVAX per month. The

upgrade also focuses on cross-chain connectivity, enabling more

sophisticated interchain communication within Avalanche’s broader

ecosystem. #4 Stacks (STX) Stacks is another name to keep on the

radar as it prepares to launch sBTC on Tuesday, December 17, at

11:00 am ET. This new BTC-backed asset is designed to bring

Bitcoin’s liquidity directly into the DeFi sphere on Stacks,

offering a rewards program that is notably free of staking

requirements. According to the project’s official announcement, the

sBTC Rewards Program provides a 5% annual Bitcoin reward, paid out

in bi-weekly installments, and the distribution is made in actual

Bitcoin, not third-party tokens. The program’s first phase,

commencing on December 17, will focus on deposit functionality and

immediate rewards accrual for sBTC holders. The second phase,

currently planned for March 2025, is expected to layer in more

advanced DeFi capabilities and reward structures, thereby

broadening the utility of sBTC. #5 LayerZero (ZRO) LayerZero rounds

out the week’s watchlist with a governance milestone. On December

20, 2024, at 00:00 UTC, ZRO token holders will engage in the

network’s first-ever fee switch referendum, a vote that could

activate a protocol fee on every LayerZero message. The referendum

is straightforward, posing the single question, “Turn the fee

switch on?” A majority vote of “Yes,” assuming quorum is met, would

enact a fee that matches the underlying DVN and Executor costs for

each message, effectively doubling the cost of each cross-chain

transmission. The collected fees would then be used to buy back and

burn ZRO, potentially reducing the circulating supply and impacting

the token’s economics. ZRO balances across Ethereum, Optimism,

Base, Polygon, Avalanche, BNB Chain, and Arbitrum are all factored

into each holder’s voting power, consolidated seamlessly through

LayerZero’s lzRead feature. The referendum will last seven days,

concluding on December 27, 2024. A 60% quorum of the circulating

supply is required for the vote to be valid; if that threshold is

not met, the outcome defaults to “No.” If the referendum passes,

the protocol fee would be immediately activated, potentially

shifting the dynamics of how developers and users manage

cross-chain communications. This governance mechanism is set to

repeat every six months, though the quorum requirement would

decrease by 5% each time if it is not met, down to a minimum floor

of 20%. At press time, Bitcoin traded at $104,748. Featured image

created with DALL.E, chart from TradingView.com

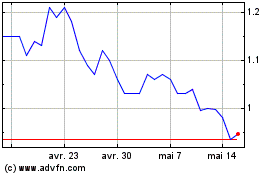

Arbitrum (COIN:ARBUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Arbitrum (COIN:ARBUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025