Miami, Florida, November 1st, 2024,

Chainwire

Transak, a global leader in Web3

payments infrastructure, is proud to announce its Canadian entity’s

(Transak Canada) official registration with FINTRAC

(Financial Transactions and Reports Analysis Centre of

Canada).

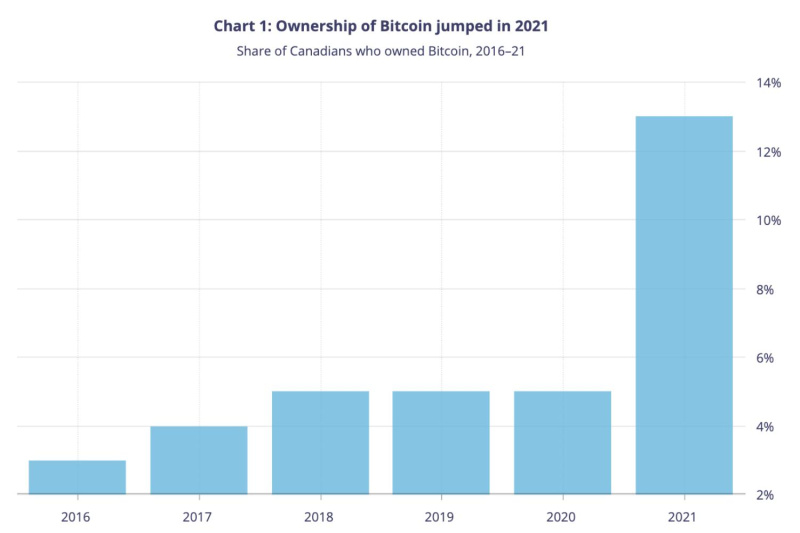

This achievement comes during

significant growth in the Canadian cryptocurrency market. According

to a study by the Bank of

Canada, approximately 13% of Canadians owned Bitcoin in 2021,

showcasing a rising interest in digital assets.

The growing interest in cryptocurrency

adoption is evident from Chainalysis reports spanning 2022, 2023,

and 2024. While Canada did not make the top 20 list in 2022, it

climbed to 19th place in

2023 and further improved to 18th in

2024, reflecting steady progress in the country’s

embrace of digital assets.

"Canada is a very important market for

Transak and the cryptocurrency industry in general. So, want

Canadians to be able to purchase digital assets without having to

figure our compliance on their own. We believe that clear and

consistent regulation is crucial for the long-term growth of the

crypto industry. By engaging with regulatory bodies like FINTRAC,

we aim to foster a safe and transparent environment for all

participants in the Canadian crypto ecosystem," said Bryan Keane, Compliance Officer at Transak.

FINTRAC is Canada’s national financial

intelligence agency, responsible for safeguarding the financial

system from money laundering, terrorist financing, and other

financial crimes. By obtaining this registration, Transak

is recognized as a Money Services Business (MSB),

affirming its commitment to transparent operations and compliance

with Canadian financial regulations.

The process to become a

FINTRAC-registered MSB involves the following:

- Rigorous KYC/AML compliance measures.

- Demonstrating robust AML/ATF controls.

- Development and submission of detailed financial

reporting policies.

- Ongoing monitoring systems to ensure

transactions are legitimate and aligned with legal

requirements.

"We believe that strong legal and

compliance frameworks are essential for fostering trust and

confidence in the crypto industry. This registration involved a

thorough review of our operations and close collaboration with

Canadian authorities. Now, FINTRAC registration opens doors for

Transak and the entire Canadian crypto community,” said Bryan Keane, Compliance Officer at Transak.

Canadian customers can now enjoy a

broader range of payment options, including credit cards,

debit cards, and Interac e-Transfers, making it easier to

purchase digital assets.

Businesses and developers integrating

Transak's services can be assured of a compliant and reliable

solution for their Canadian user base. This simplifies the process

of adding crypto on/off ramps to their applications because they

now get a ready-made compliance

infrastructure.

About Transak

Transak is the world's most

compliant and largest Web3 payments infrastructure provider,

serving over 8.13 million users across 160 countries. It powers

350+ platforms, facilitating the purchase and sale of digital

assets with its API-driven fiat-crypto on/off-ramp, NFT checkout,

and other solutions that simplify KYC, compliance, payment methods,

and customer support.

Headquartered in Miami, Florida, and

incorporated in Delaware, Transak has a tech hub in Bengaluru and

offices in London, Milan, Dubai, and Hong Kong.

For more information, visit transak.com or follow us on x.com/transak and linkedin.com/company/transak.

Contact

Harshit

Gangwar

harshit.gangwar@transak.com