Bitcoin Path To $85K: Analysts Say It’s Behaving ‘As Predicted’

08 Novembre 2024 - 12:00PM

NEWSBTC

Crypto analysts said that Bitcoin remains on course for a massive

price hike after Donald Trump reclaimed the US presidency through a

historic win against US Vice President Kamala Harris. Related

Reading: Binance Coin Breaks $600! Is There More Upside Ahead For

BNB? Bitcoin’s price trajectory has been the subject of many

speculations in the last few weeks but with the election of a known

pro-crypto candidate, it seems BTC is moving in the upward

direction. At the time of writing, BItcoin was trading at $76,033,

up 1.7% and 9.5% in the daily and weekly timeframes, data from

Coingecko shows. The figure marks bitcoin new all-time high.

Bitcoin: $85,000 Feasible? A prominent crypto analyst suggested

that Bitcoin will soon reach $85,000, claiming that the price surge

will be fueled by Trump’s return to the White House. In a post, Ali

Martinez said that the firstborn cryptocurrency is “playing as

predicted.” Martinez predicted that Bitcoin would hit $78,000 but

would fall to $71,500 before soaring to an all-time high of

$85,000. This is playing as predicted. I think #Bitcoin hits

$78,000, retraces to $71,500 and then rebounds to $85,000!

https://t.co/8xKUNGZYI8 — Ali (@ali_charts) November 6, 2024

Martinez assured that despite the coin experiencing brief

pullbacks, BTC’s price trajectory remains on track, noting the

coin’s price stabilized at $74,812 after reaching an all-time

record of $76,493. In an earlier post, Martinez has already stated

that Bitcoin is “going according to plan.” He said that BTC will

increase to $72,000, and then go down to $69,000 before

skyrocketing to $78,000. BTC’s Uptrend Another market observer

predicted that there is a high likelihood that Bitcoin will

increase by 30% to 40% but he does not see that the crypto will

repeat the 368% hike which occurred in previous cycles. BTCUSD

trading at $75,885 on the daily chart: TradingView.com Ki Young Ju

of CryptoQuant made the prediction after BTC hit $75,000 which he

believed was influenced greatly by the results of the US election.

Ju explained that it triggered the price rally to reach that level,

further positioning Bitcoin as one of the largest financial assets

in terms of market capitalization. Ju urged investors for subtle

profit-taking during the “max pain” phases which are essential to

understand the market dynamics of BTC. He said that Bitcoin follows

a cyclical nature, explaining that new traders usually endure

losses when the market is bearish. After two years, investors see

their digital assets change hands when the “max pain” phase dies

down. According to him, BTC’s current market environment matched

well with an easing period. Related Reading: Fueled By Election

Buzz, Memecoins Soar 22% On Pure Speculation—Report Potential

Cooling Off However, some analysts projected a possible cooling off

for BTC coming after the recent price hike, saying that it has

breached the upper Bollinger Band serving as a cue for overbought

conditions. They suggested that there could be increasing pressure

to sell and profit-taking because of the emergence of red

candlestick formations. BTC used to be in the overbought zone or a

score above 70 in the Relative Strength Index (RSI) chart but now,

it has retreated to 67.34, indicating “a loss of bullish momentum”

and a potential price correction. Featured image from StormGain,

chart from TradingView

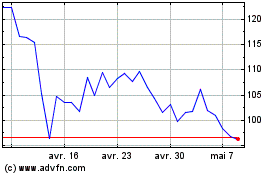

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025