Dogecoin & Other Memecoins No Longer Grabbing Social Media Attention: Santiment

24 Décembre 2024 - 3:30AM

NEWSBTC

The analytics firm Santiment has revealed how social media traders

have moved their attention to Bitcoin from Dogecoin and other

memecoins recently. Dogecoin & Other Top Memecoins Have Seen A

Decline In Social Dominance In a new post on X, Santiment has

talked about how cryptocurrency market sentiment on social media

has changed amid the latest bearish downturn. The indicator of

relevance here is the Social Dominance, which keeps track of the

percentage of social media discussions related to the top 100 coins

by market cap that a particular asset or group of assets is

contributing right now. The indicator measures the degree of

discussion or talk related to an asset by counting up the number of

posts that are making unique mentions of it. The reason it doesn’t

count up the mentions themselves is that they can provide a false

picture of the trend being followed in the sector. Related Reading:

Bitcoin To Top Above $168,500 Based On This Indicator, Analyst

Reveals Focusing on just the posts means that a few outlier ones

with hundreds of mentions can’t skew the data by themselves and the

metric only registers a spike when discussion is spread across the

major social media platforms. In the context of the current topic,

the Social Dominance of two asset classes is of interest: the Layer

1 Top 6 and the Memecoin Top 6. The former includes the six largest

layer 1 networks (that is, blockchains that handle their own

security and aren’t built on top of another network, like Bitcoin)

and the latter the six largest meme-based tokens (like Dogecoin).

Below is the chart shared by the analytics firm that shows the

trend in the Social Dominance for these two types of

cryptocurrencies over the last few weeks: As displayed in the

graph, the Social Dominance of the Memecoin Top 6 was high a couple

of weeks ago, implying social media users were highly interested in

Dogecoin, Shiba Inu, and other such tokens. Since then, however,

the metric has followed an overall downward trajectory for this

class of assets. It would appear that investor attention has

shifted to Bitcoin and other layer 1 assets, as their combined

social dominance has risen during the same period. Historically,

whenever Dogecoin and other memecoins have been at the center of

attention in the market, it has been a sign that the investors are

becoming greedy. Related Reading: XRP Could Be The Altcoin To

Recover Quickly, CryptoQuant Analyst Explains Why Cryptocurrency

markets generally tend to move against the expectations of the

majority, so it may not be a surprise that this greedy sentiment

was followed by a downturn in the sector. The shift in Social

Dominance to safer investments like Bitcoin would imply the

investors are now becoming fearful. It’s possible that the sector

would continue to decline in the coming days, but at least with the

sentiment seeing a flip, there is more of a chance that a bottom

can be reached. DOGE Price At the time of writing, Dogecoin is

floating around $0.31, down more than 24% over the last seven days.

Featured image from Dall-E, Santiment.net, chart from

TradingView.com

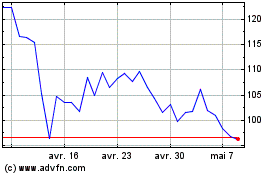

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024