54% Of Bitcoin Supply Inactive Since 2 Years Despite 500% Price Jump

23 Novembre 2024 - 4:30PM

NEWSBTC

On-chain data shows a majority of the Bitcoin supply hasn’t moved

in more than two years, despite the fact that BTC has seen a

significant uplift during this period. Bitcoin Inactive Supply

Trend Suggests HODLing Behavior Remains Strong In a new post on X,

Glassnode co-founder Rafael has discussed about the trend in the

various bands of the Bitcoin Active Supply. The “Active Supply”

includes that part of the BTC circulating supply that has been

involved in at least one transaction over a given timeframe.

Related Reading: Bitcoin Officially In Overheated MVRV Zone, Rally

End Near? Below is the chart shared by the analyst that shows how

the Bitcoin Active Supply has changed for a few different age bands

over the last couple of years. From the graph, it’s visible that

the age bands on the younger side like 1 month to 3 months and 3

months to 6 months have been observing growth recently, which

suggests the relatively recent supply has been churning as a result

of the price surge. The older bands, however, have been more or

less showing a sideways movement on this indicator. The chart

displays all the Active Supply bands up to the 1 year to 2 years

group stacked on top of each other, to showcase what percentage of

the total supply that they make up for. It would appear that these

Active Supply bands add up to 46%, meaning that less than half of

the cryptocurrency’s supply in circulation has witnessed some

movement within the past couple of years. The 2-year cut off

currently sits in November 2022, when the last Bitcoin bear market

reached a bottom. Given the trend in the Active Supply, it seems

that the investors who bought during and prior to the bottom have

largely decided to HODL. Interestingly, this is despite the fact

that the asset’s value has seen an uplift of more than 500% since

then. “HODLing isn’t just a meme,” notes the Glassnode co-founder.

Statistically, the longer investors hold onto their coins, the less

likely they become to participate in selling, so considering that

54% of the supply hasn’t seen movement for over two years now, it’s

possible a lot of these holders would only continue to sit tight in

the near future. Related Reading: Shiba Inu Could See A 53% Surge

If This Resistance Breaks, Analyst Explains In some other news, the

Deribit exchange has observed massive Bitcoin outflows during the

past day, as an analyst has pointed out in a CryptoQuant Quicktake

post. In total, users of the platform have transferred out a net

31,000 BTC to their self-custodial wallets with these transactions.

The investors may have made these moves for accumulation purposes,

which can naturally be a bullish sign for the asset’s price. BTC

Price Bitcoin has now gotten very close to the $100,000 dream

target as its price is currently trading around the $98,900 mark.

Featured image from Dall-E, CryptoQuant.com, chart from

TradingView.com

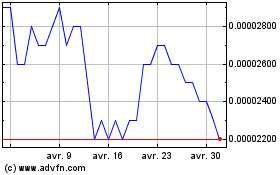

SHIBA INU (COIN:SHIBUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

SHIBA INU (COIN:SHIBUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024