PRESS

RELEASE

AB SCIENCE PRESENTS ITS FINANCIAL

RESULTS FOR THE FIRST HALF OF 2024 AND THE KEY EVENTS OF THE

PERIOD

-

Clinical development

-

Masitinib platform:

-

Ongoing re-examination by EMA and Health Canada of the marketing

authorisation application for masitinib in amyotrophic lateral

sclerosis (ALS)

-

Update on the development of masitinib in progressive forms of

multiple sclerosis following the ECTRIMS 2024 conference

-

Positive results from the phase 2 study of masitinib in

Covid-19

-

Strengthening the intellectual property of masitinib in

mastocytosis

-

Microtubule platform:

-

Update on the AB8939 microtubule program and in in particular on

the ability of AB8939 to generate a response on MECOM

rearrangement

- Financial and corporate

situation

-

Operating deficit of 3.6 million euros as of June 30, 2024, down

59.5% compared to the first half of 2023

-

Cash position of 9.1 million euros as of June 30, 2023, to which is

added 5 million euros from the capital increase by private

placement announced in September 2024

-

Completion of the settlement and delivery of the 5 million euros

capital increase

Paris, October 10, 2024, 8.30am CET

AB Science SA (Euronext -

FR0010557264 - AB) today announces its half-year financial results

as of June 30, 2024 and provides an update on its activities.

KEY EVENTS RELATED TO CLINICAL

DEVELOPMENT DURING THE FIRST HALF OF 2024 AND SINCE JUNE 30,

204

EMA negative opinion on the marketing

authorisation application for masitinib in amyotrophic lateral

sclerosis and ongoing re-examination of the dossier by

EMA

AB Science announced that the Committee for

Medicinal Products for Human Use (CHMP) of the European Medicines

Agency (EMA) has adopted, in line with the trend vote, a negative

opinion on the application for conditional marketing authorization

of masitinib in the treatment of amyotrophic lateral sclerosis

(ALS).

AB Science requested a re-examination on the

basis of:

-

First and foremost, the urgent need for patients to have early

access to a promising treatment.

-

The opportunity of having the dossier re-examined by new

rapporteurs and by a Scientific Advisory Board.

AB Science highlights the difficulty of a

conditional marketing authorization in ALS and cannot guarantee a

positive outcome following this re-examination.

The reasons which nevertheless led AB Science to

request a re-examination of the file are as follows:

-

Acceptable masitinib safety: First, the CHMP confirmed that the

safety of masitinib is deemed acceptable, which is a key

consideration in the context of a conditional marketing

authorization where confirmatory evidence of efficacy is

required.

-

Objection concerning deviations from Good Clinical Practice: As per

EMA guidance (EMA/868942/2011), impact analyses of all protocol

deviations that could not be corrected were performed and showed no

impact, resolving Good Clinical Practice issues as per

guideline.

-

Objection concerning the exclusion of fast progressors: The

amendment transitioning from phase 2 to phase 3 excluding fast

progressors from the primary analysis population was necessary and

well justified, in order to have a more homogenous population with

greater chance of reaching week 48 time point and minimizing

missing data. Furthermore, the amendment was implemented early

enough and while the study was blinded, removing any methodological

issues.

-

Objection concerning the treatment of missing data in the primary

analysis: Multiple sensitivity analysis of the primary analysis;

using non LOCF (Last Observation Carried Forward) methods for

imputation of missing data, are positive and consistent, including

two analyses previously recommended by the CHMP, demonstrating the

robustness of the primary analysis, thus resolving the objection

concerning the treatment of missing data.

-

Objection on the subgroup data: There was an important imbalance in

a subset of patients experiencing complete loss of function (i.e.,

ALSFRS-R score of zero) in one or more of the item scores (20% in

the masitinib arm versus 8% in the placebo arm), because ALSFRS-R

score was minimized but not stratified by category of severity. The

subgroup defined as patients prior to any complete loss of function

(i.e. excluding the overmentioned biased subset) accounted for 86%

of the population and showed extremely compelling results,

including a significant 12 months survival benefit. The subgroup

analysis is the strict application of EMA guidance

(EMA/CHMP/539146/2013), which is applicable to post hoc analysis

and to registration with single pivotal study, thus resolving the

objection regarding subgroup data.

The re-examination of the dossier by EMA is

ongoing.

Notice of Deficiency-Withdrawal (NOD/w)

regarding the New Drug Submission (NDS) for masitinib in the

treatment of amyotrophic lateral sclerosis (ALS) in Canada and

ongoing re-examination of the dossier by Health Canada

AB Science announced in February 2024 that

Health Canada issued a Notice of Deficiency-Withdrawal (NOD/w)

regarding the New Drug Submission (NDS) for masitinib in the

treatment of ALS and indicated its intention to submit a

reconsideration request.

In April 2024, AB Science announced that Health

Canada had granted eligibility for reconsideration request. The

reconsideration process will re-examine, with new assessors, the

decision based on information that was included in the original

submission.

The re-examination is ongoing by Health

Canada.

Update on the AB8939 microtubule program

and in particular on the ability of AB8939 to generate a response

on MECOM rearrangement

AB Science provided an update on the microtubule

program AB8939 and in particular the ability of AB8939 to generate

response on MECOM rearrangement.

AB8939 is a novel microtubule destabilizer

currently evaluated in phase 1 clinical trial (study AB18001,

NCT05211570) in patients with refractory and relapsed acute myeloid

leukemia (AML).

The phase 1 clinical trial of AB8939 completed

its first step, consisting in determining the maximum tolerated

dose following 3 consecutive days of AB8939 treatment, and was

authorized to proceed with the next step, consisting in determining

the maximum tolerated dose following 14 consecutive days of AB8939

treatment.

The phase 1 clinical trial continues to

determine MTD and the study is now at the last cycle of the 14 days

evaluation. The next step will be to determine the MTD in the

combination of AB8939 with Vidaza® (azacitidine).

AB Science previously reported a case of

complete bone marrow response in an AML patient in failure to prior

treatment with azacitidine and presenting with a MECOM gene

rearrangement, which consists of chromosomic aberrations of EVI1

oncogene, leading to one of the worst prognostics in AML and is

associated with lack of response and resistance to conventional

chemotherapy.

New data confirm that there is a signal of

activity against MECOM, with AB8939 generating a complete response

in combination with Vidaza, as evidenced by a synergistic effect in

a patient-derived xenograft (PDX) mouse model bearing the MECOM

rearrangement. PDX are cell lines coming from patients that are

grafted to immune deficient mice to mimic as closely as possible

the human disease.

-

AB8939 was able to generate 50% response when used as a single

agent on MECOM cell lines ex vivo in a non-clinical setting.

-

In the phase 1 trial, 4 patients bore the MECOM rearrangement and

50% responded to AB8939 when used as a single agent.

-

In phase 1, so far, AB8939 does not appear to be toxic to bone

marrow, avoiding severe neutropenia and suggesting the possibility

to use the drug for long-term treatment.

These data taken together confirm the

opportunity to develop AB8939 in phase 2 clinical trial in MECOM as

a single agent or in combination with Vidaza.

The advantage is that a small study could be

sufficient to comply with FDA guideline on accelerated

approval.

Update on the development of masitinib

in progressive forms of multiple sclerosis following the ECTRIMS

2024 conference

AB Science provided an update on the development

of masitinib in progressive forms of multiple sclerosis (MS),

following the European Committee for Treatment and Research in

Multiple Sclerosis (ECTRIMS) 2024 conference.

The development of masitinib in progressive

forms of multiple sclerosis is based on the MAXIMS study (AB20009),

a randomized, double-blind, phase 3 study of masitinib 4.5

mg/kg/day in patients with primary progressive multiple sclerosis

(PPMS) and non-active secondary progressive multiple sclerosis

(nSPMS).

The recent results of tolebrutinib in non-active

secondary progressive MS presented at the ECTRIMS 2024 conference,

reinforce the scientific hypothesis that targeting microglia in

nSPMS is a valid approach. Tolebrutinib belongs to a class of drugs

that target microglia through an enzymatic target called BTK

(Bruton Tyrosine Kinase).

Masitinib also targets microglia but through a

different enzymatic target called M-CSFR1 (Macrophage Colony

Stimulating Factor Receptor-1) and generated positive results in

phase 2B (AB07002), which are consistent with tolebrutinib

data.

-

EDSS progression confirmed at 3 months was reduced by 37% with

masitinib in study AB07002 and by 23% with tolebrutinib in the

Hercules study (although the reduction in study AB07002 did not

reach the conventional 5% p-value since the study was not powered

to detect a significant effect in this secondary endpoint, having

300 patients in the masitinib 4.5 or placebo arms as compared with

1100 patients in the Hercules trial).

-

EDSS progression confirmed at 6 months was reduced by 32% with

masitinib and by 31% with tolebrutinib.

Importantly,

-

Masitinib significantly improved manual dexterity measured by

9-hole Peg test, in study AB07002 (-4,28 ; p=0,0388).

-

Masitinib has shown the ability to decrease serum neurofilament

light chain (NfL) concentration in an animal model of MS, and by

extension therefore, possibly neuronal damage.

-

Masitinib not only targets microglia but also mast cells, which

play a crucial role in progressive MS and in the experimental

autoimmune encephalomyelitis (EAE) model of MS, as shown by

numerous publications.

Masitinib benefits from a large safety database

with long-term exposure across various indications. In non-oncology

indications, around 2,200 patients have received at least one dose

of masitinib, more than 1,300 patients have received masitinib for

more than six months and close to 1,000 patients have received

masitinib for more than one year.

BTK safety profiles shows increase in liver

injury, hypertension and infections which seem to be a class

effect, leaving room for alternative drugs.

As a conclusion, masitinib represents a

potential credible alternative to BTK inhibitors in the development

of new drugs both in primary and non-active secondary progressive

MS.

Positive results from the phase 2 study

of masitinib in Covid-19

AB Science announced the results of a Phase 2

study evaluating masitinib in COVID-19. This Phase 2 study

(AB20001) was designed to evaluate the safety and efficacy of

masitinib plus isoquercetin in hospitalized patients with moderate

COVID-19 (WHO 7-point ordinal scale level 4) or severe COVID-19

(level 5). The study initially planned to recruit 200 patients

(over 18 years of age with no upper age limit). The primary

objective was to improve the clinical status of patients after 15

days of treatment, as measured by the WHO 7-point ordinal scale.

Following a DSMB recommendation, decision was taken to continue the

study only in level 4 patients (i.e. hospitalized patients with

oxygen supply <6 L/min with SpO2 maintained ≥92%).

The study could not recruit the planned 200

patients. The decision was therefore taken to stop inclusion after

95 patients were randomized. The objective was to detect a trending

treatment effect with 95 patients that would translate into a

significant effect when simulating the same effect with the planned

enrolment of 200 patients. If this objective was reached, then the

conclusion would be that it is worth continuing to evaluate

masitinib as an agent in the treatment of covid in patients

hospitalized with moderate need of oxygen.

The study showed an odds ratio of 2.4 in favor

of the treatment arm after 15 days of treatment, superior to the

odds ratio of 2.2 initially hypothesized, with p=0.038 simulated

with 200 patients and p=0.072 detected with 95 patients recruited.

Sensitivity analyses at day 12, 13 and 14 with 95 patients

recruited displayed a p-value of respectively p=0.016, 0.019, 0.018

and odds ratio 3.2, 3.2 and 3.4. This was due to improvement of

certain placebo patients at day 15 but not before. The safety was

in line with the known safety profile of masitinib.

Strengthening the intellectual property

of masitinib in mastocytosis

AB Science announced that the European Patent

Office has issued a Notice of Allowance for a patent relating to

methods of treating severe systemic mastocytosis (i.e. a medical

use patent) with masitinib. This new European patent provides

intellectual property protection for masitinib in this indication

until October 2036.

The same medical use patent strategy has been

successfully applied in amyotrophic lateral sclerosis, with a

worldwide patent granted until 2037, and is being applied in other

indications such as multiple sclerosis, Alzheimer's disease for

protection until 2041, and in prostate cancer for protection until

2042.

CONSOLIDATED FINANCIAL ELEMENTS FOR THE

FIRST HALF OF 2024

The operating result as of June 30, 2024

corresponds to a loss of €3,582k, compared to a loss of €8,850k as

of June 30, 2023, representing a reduction in the operating deficit

of €5,268k (59.5%).

- Operating income

consists exclusively of revenue related to the exploitation of a

veterinary medicine. Revenue is up compared to June 30, 2023 and

amounts to 560 thousand euros as of June 30, 2024 compared to 448

thousand euros as of June 30, 2023. This increase in operating

income over the period compared to the previous period is due to

the resumption of sales from May 2023, after a disruption in the

supply of Masivet between August 2022 and April 2023 following a

change in the synthesis process of the active ingredient of Masivet

which required a request for variation of the marketing file of

Masivet to the European Medicines Agency (EMA). The EMA issued a

favorable decision in April 2023, from which date the exploitation

of Masivet was able to resume.

- Research and

development expenses decreased by 65.5% between the first half of

2024 and the first half of 2023, amounting to 2,564 thousand euros

for the first half of 2024 compared to 7,213 thousand euros for the

first half of 2023. This decrease reflects the implementation of

the partnership research strategy for the continued clinical

development of masitinib.

- Marketing costs

fell by 12.8% from 218 thousand euros as of June 30, 2023 to 190

thousand euros as of June 30, 2024.

-

Administrative expenses decreased by 21.4% between the first half

of 2024 and the first half of 2023.

- The financial

result corresponds to a loss of 887 thousand euros for the first

half of 2024, compared to a loss of 1,569 thousand euros for the

first half of 2023. As of June 30, 2024, other financial income,

which amounted to 274 thousand euros, mainly corresponds to the

following operations:

- to late payment interest collected

with the research tax credit 2020 – 2021 – 2022 (83 thousand

euros)

- to the change in the fair value of

the BSAs linked to the EIB loan (140 thousand euros)

- to the variation in the fair value

of ADPE (49 thousand euros).

Other financial charges (55 thousand euros) are

mainly related

- to the reprocessing of rents in

IFRS 16. (9 thousand euros)

- to the change in the fair value of

the BSAs linked to the EIB loan (45 thousand euros)

These effects have no impact on cash flow.

The net loss as of June 30, 2024 amounted to

4,469 thousand euros, compared to a loss of 10,411 thousand euros

as of June 30, 2023, a decrease of 57.1% for the reasons mentioned

above.

The following table summarizes the half-yearly

consolidated accounts for the first half of 2024 established in

accordance with standards IFRS, and comparative information with

the first half of 2023:

|

In thousands of euros, except for share data |

30/06/2024 |

30/06/2023 |

|

Net turnover |

560 |

448 |

|

Cost of sales and marketing expenses |

(93) |

(219) |

|

Marketing expenses |

(190) |

(218) |

|

Administrative expenses |

(1,295) |

(1,648) |

|

Research and development expenses |

(2,564) |

(7,213) |

|

Operating income |

(3,582) |

(8,850) |

|

Financial income |

322 |

1,042 |

|

Financial expenses |

(1,210) |

(2,610) |

|

Financial income |

(887) |

(1,569) |

|

Net income |

(4,469) |

(10,411) |

|

Other comprehensive income for the period net of

tax |

85 |

51 |

|

Total comprehensive income for the period |

(4,384) |

(10,360) |

|

Basic earnings per share - in euros |

(0.09) |

(0.22) |

|

Diluted earnings per share - in euros |

(0.06) |

(0.22) |

|

In thousands of euros |

30/06/2024 |

31/12/2023 |

|

Cash and cash equivalents |

9 128 |

6,006 |

|

Total assets |

22,982 |

25,499 |

|

Equity |

(24,599) |

(21,010) |

|

Non-current liabilities |

(30,032) |

(27,825) |

|

Trade payables |

(10,584) |

(11,075) |

|

Current liabilities |

(17,548) |

(18,683) |

OTHER CORPORATE INFORMATION FOR THE

FIRST HALF OF 2024 AND SINCE JUNE 30, 2024

Capital increase by private placement

for an amount of 5 million euros

AB Science has announced a capital increase of

5.0 million euros through the issue of 5,368,725 new ordinary

shares, each of which is attached to share subscription warrants.

This capital increase was subscribed by qualified European

investors.

The Capital Increase consisted of a private

placement pursuant to Articles L. 225-136 of the French Commercial

Code and L. 411-2 1° of the French Monetary and Financial Code and

has been carried out with a waiver of preferential subscription

rights, pursuant to the delegation of authority granted to the

Board of Directors under the 19th resolution of the Combined

General Shareholders’ Meeting of June 26, 2024. The Capital

Increase has taken the form of the issuance of 5,368,725 new

ordinary shares (the “New Shares”) to each of which are attached a

share subscription warrant (the “Warrants”).

Two tranches of New Shares have been issued:

-

for the first tranche of 4,294,980 New Shares, two Warrants give

right to the subscription of one ordinary share;

-

for the second tranche of 1,073,745 New Shares, three Warrants give

right to the subscription of one ordinary share.

The Capital Increase is made through a cash

contribution of 5.0 million euros.

All of the 5,368,725 New Shares and all of the

2,505,405 new shares that would be issued upon exercise of the

warrants, i.e. a total of 7,874,130 shares in the Company,

represent 13.3% of the Company's current share capital.

The issue price of the New Shares has been set

at 0.93132 euro (0.01 euro par value and 0,92132 euro of issue

premium) and the exercise price of the Warrants at 1.16415 euro,

representing a total fundraising of 5.0 million euros (taking into

account the exercise of the warrants, the maximum amount of the

Capital Increase could be increased to a total amount of 7.9

million euros). The issue price of the New Shares has been

calculated based on the volume-weighed average price of AB Science

shares over the last three trading days (on Euronext Paris)

preceding the price calculation, with a 10% discount.

The Warrants may be exercised from November 26,

2026 to December 31, 2028, will be immediately detached from the

New Shares upon their issuance and will not be listed.

AB Science completed the settlement and delivery

of this capital increase.

The proceeds of the Capital Increase will

provide AB Science with the additional resources necessary to

finance its activities over the next twelve months.

Subscription by Alpha Blue Ocean of a

tranche of one million shares within the framework of the Term

Capital Increase Program (PACTTM)

The PACT TM program entered into with Alpha Blue

Ocean (ABO) was renewed on April 28, 2023 for a period of 24

months. The Board of Directors of AB Science decided to draw down

one million shares under this program, on the basis of the 17th

resolution of the combined general meeting of shareholders of June

30, 2023 (reserved cash capital increase with waiver of

preferential subscription rights). They were subscribed by Alpha

Blue Ocean at the end of March 2024 at a price of 2.5701 euros

(i.e. the volume-weighted average price of AB Science's shares on

Euronext Paris during the three trading sessions preceding the

drawdown request). AB Science received the entire proceeds from the

issue of the shares subscribed by Alpha Blue Ocean, and 80% of

these proceeds were placed in an escrow account. Alpha Blue Ocean

is now responsible for selling, in an orderly manner, the

subscribed AB Science shares. During the first half of 2024,

377,393 shares were placed. 95% of the sale proceeds (reduced by a

structuring fee equal to 3% of the issue price) is paid monthly to

AB Science, directly by Alpha Blue Ocean or by drawing on the

escrow account referred to above, after deduction of the 20%

deposit of the issue proceeds retained by AB Science. In total,

over the first half of 2024, these disposals resulted in payments

by ABO, net of commission, of 682,181 euros (including the 20% of

the issue proceeds initially retained by AB Science).

The IFRS accounting treatment of the PACT TM

program is detailed in note 13 of the appendix to the half-yearly

accounts (impact on equity and debts, cash receipts, amount of the

escrow account as of June 30).

Coverage initiation by DNA Finance and

In Extenso Finance

AB Science announced that two financial analysis

firms, DNA Finance and In Extenso Finance, have initiated the

coverage of the Company.

DNA Finance estimates that AB Science stands out

as a compelling investment opportunity in the biotech sector.

In Extenso has initiated a strong buy opinion on

the share.

These new coverages aim to strengthen the AB

Science visibility among French and international institutional

investors and to broaden its investor base. They are in addition to

the coverage by Chardan, an investment bank based in the United

States and specialized in biotechnologies and health

technologies.

Partial payments of 2020, 2021 and 2022

research tax credit by the tax administration in 2024, for a total

amount of 7,913 thousand euros

Confirmation by the Paris Court of

Appeal of the acquittal of the CEO of AB Science, Alain Moussy, and

reduction of the amount of the financial penalty imposed on AB

Science

AB Science and the Chairman of the French market

regulator (Autorité des Marchés Financiers - AMF) had filed an

appeal to the Paris Court of Appeal against the decision of the AMF

Sanctions commission, dated March 24, 2022, which acquitted Alain

Moussy, CEO of AB Science, for an alleged insider trading and

sanctioned AB Science for a failure to comply with some of its

communication obligations (as part of the assessment of conditions

for a deferral of privileged information publication), as indicated

in the AB Science press release of March 29, 2022.

The Paris Court of Appeal confirmed the fully

acquittal of Alain Moussy and reduced by 200,000 euros the amount

of the financial penalty pronounced against AB Science. This amount

of 200,000 euros will have to be reimbursed by the French Treasury,

as AB Science has paid the full financial penalty initially

pronounced by the AMF Sanctions commission on March 24, 2022.

Cancellation of category C preference

shares in March 2024

The balance of 262,704 category C preference

shares (the “ADPC”) was repurchased for a symbolic euro by AB

Science with a view to their cancellation, in application of the

financial restructuring agreement signed on April 21, 2023.

About AB ScienceFounded in

2001, AB Science is a pharmaceutical company specializing in the

research, development and commercialization of protein kinase

inhibitors (PKIs), a class of targeted proteins whose action are

key in signaling pathways within cells. Our programs target only

diseases with high unmet medical needs, often lethal with short

term survival or rare or refractory to previous line of treatment.

AB Science has developed a proprietary portfolio of molecules and

the Company’s lead compound, masitinib, has already been registered

for veterinary medicine and is developed in human medicine in

oncology, neurological diseases, inflammatory diseases and viral

diseases. The company is headquartered in Paris, France, and listed

on Euronext Paris (ticker: AB).

Further information is available on AB Science’s

website: www.ab-science.com.

Forward-looking Statements - AB

ScienceThis press release contains forward-looking

statements. These statements are not historical facts. These

statements include projections and estimates as well as the

assumptions on which they are based, statements based on projects,

objectives, intentions and expectations regarding financial

results, events, operations, future services, product development

and their potential or future performance.

These forward-looking statements can often be

identified by the words "expect", "anticipate", "believe",

"intend", "estimate" or "plan" as well as other similar terms.

While AB Science believes these forward-looking statements are

reasonable, investors are cautioned that these forward-looking

statements are subject to numerous risks and uncertainties that are

difficult to predict and generally beyond the control of AB Science

and which may imply that results and actual events significantly

differ from those expressed, induced or anticipated in the

forward-looking information and statements. These risks and

uncertainties include the uncertainties related to product

development of the Company which may not be successful or to the

marketing authorizations granted by competent authorities or, more

generally, any factors that may affect marketing capacity of the

products developed by AB Science, as well as those developed or

identified in the public documents published by AB Science. AB

Science disclaims any obligation or undertaking to update the

forward-looking information and statements, subject to the

applicable regulations, in particular articles 223-1 et seq. of the

AMF General Regulations.

For additional information, please contact:

AB ScienceFinancial

Communication & Media Relations investors@ab-science.com

- AB SCIENCE press release S1 2024 VENG VF

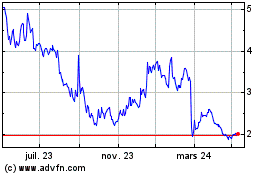

Ab Science (EU:AB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

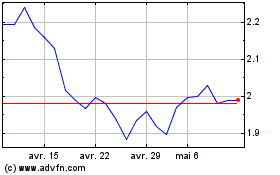

Ab Science (EU:AB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024