Aegon reports first half year 2023 results

Please click here to access all 1H2023 results related

documents

The Hague, August 17, 2023 - Starting the next chapter

of Aegon’s transformation with solid 1H 2023

performance

- IFRS results from now on reported under the new insurance

accounting standard IFRS 17

- Net loss of EUR 199 million reflects previously announced

investments and assumption updates in the US

- Operating result increases by 3% compared with the first half

of 2022 to EUR 818 million

- Operating capital generation before holding funding and

operating expenses increases by 13% compares with the first half of

2022 to EUR 620 million reflecting business growth and improved

claims experience

- The capital ratios of main units remain above their respective

operating levels; Group Solvency II ratio amounts to 202%

- Cash Capital at Holding decreases to EUR 1.3 billion, mainly as

a result of capital returns to shareholders

- 2023 interim dividend increases by EUR 0.03 compared with 2022

interim dividend to EUR 0.14 per common share

- Transaction combining Aegon’s Dutch businesses with a.s.r.

closed in July; related EUR 1.5 billion share buyback has

begun

- Strong sales growth in US, UK Workplace business, and life

insurance businesses in China and Brazil. Sales momentum in asset

management and UK Retail businesses affected by challenging market

conditions

Statement of Lard Friese, CEO“Aegon had a solid

first half of the year. Our operating result increased by 3%

compared with the same period in 2022, and reflects improved

results in all insurance units while asset management was

negatively impacted by a challenging market environment. Our net

result was a loss of EUR 199 million, and reflects previously

announced items in the US that will position us well for future

growth. Our operating capital generation was strong, driven largely

by our US business. The capital ratios of our main units remained

above their respective operating levels in the first half of 2023.

These results provide a solid basis to raise the interim

dividend by 3 eurocents compared with the 2022 interim dividend

to 14 eurocents per share.

In the US, Transamerica performed well. New Life sales increased

by 17% compared with the previous year, driven by another strong

increase in the number of World Financial Group (WFG) agents, now

at a record-high of 70,000. Written sales of mid-sized retirement

plans increased almost 70%, driven largely by a pooled plan sale of

USD 1.7 billion. Aegon’s UK Workplace solutions platform also

continued to deliver strong results, with a significant increase in

net deposits driven by the onboarding of new schemes and higher net

deposits on existing schemes. We also saw increased sales in our

partnerships in China and Brazil. At the same time, results at

Aegon’s asset management and UK Retail businesses continued to be

affected by adverse market conditions.

We took significant steps in our transformation. We completed

the sale of Aegon’s insurance, pension and asset management

business in Central and Eastern Europe, and we announced the sale

of our stake in our business in India. In addition, we closed the

transaction with a.s.r. for which Aegon received EUR 2.2 billion

and a 29.99% stake in a.s.r., and we have started the related

EUR 1.5 billion share buyback program.

Now we have begun the next chapter in our transformation. At our

2023 Capital Markets Day held in June, we outlined how we will

invest in our Strategic Assets. In the US, we will ensure that

Transamerica captures its full potential and becomes America’s

leading middle market life insurance and retirement company. At the

same time, Transamerica will continue to reduce its exposure to

Financial Assets and to improve the level and predictability of

capital generation. In this respect, we welcome the fact that we

have been able to execute an additional reinsurance transaction on

14,000 universal life policies with secondary guarantees,

generating approximately USD 225 million of capital that will be

used to further reduce Aegon’s exposure to Financial Assets

over time. Together with the prior reinsurance transaction

undertaken in 2021, a total of 25% of the statutory reserves

backing these policies have now been reinsured.

As part of our strategy, we are also investing in our

partnerships. Aegon Asset Management and La Banque Postale have

extended their partnership via their joint venture, La Banque

Postale Asset Management (LBP AM), through to 2035. Through our

shareholding, Aegon has also participated in LBP AM’s acquisition

of La Financière de l’Echiquier, which will accelerate LBP AM’s

growth strategy. In the UK, Aegon has extended its partnership with

Nationwide Building Society (NBS) under which Aegon UK will

integrate NBS’ financial planning teams in order to support its

strategy to be the leading digital platform provider in the

workplace and retail markets. In addition, Aegon has increased its

economic ownership in its Brazilian joint venture, Mongeral Aegon

Group, to almost 60%.

I would like to thank our colleagues for all their hard work and

dedication in ensuring the success of our ongoing

transformation."

Contacts

| Media

relations |

Investor

relations |

| Carolien van der

Giessen |

Hielke

Hielkema |

| +31(0) 6

11953367 |

+31(0) 70 344

7697 |

|

carolien.vandergiessen@aegon.com |

hielke.hielkema@aegon.com |

| |

|

Additional information

PresentationThe conference call presentation is

available on aegon.com as of 7.00 a.m. CET.

SupplementsAegon’s first half 2023 Financial

Supplement and other supplementary documents are available on

aegon.com.

Conference call including Q&AThe conference

call starts at 9:00 am CET, with an audio webcast on aegon.com. To

join the conference call and/or participate in the Q&A, you

will need to register via the following registration link. Directly

after registration you will see your personal pin on the

confirmation screen and additionally you will receive an email with

the call details and again your personal pin to enter the

conference call. To avoid any unforeseen connection issues, it’s

recommended to make use of the ‘call me’ option. Two hours after

the conference call, a replay will be available on aegon.com.

Click to joinWith ‘Call me’, there’s no need to dial-in. Simply

click the following registration link and select the option ‘Call

me’. Enter your information and you will be called back to directly

join the conference. The link becomes active 15 minutes prior to

the scheduled start time. Should you wish not to use the ‘click to

join’ function, dial-in numbers are also available.

Dial-in numbers for conference callUnited States: +1 864 991

4103 (local) United Kingdom: +44 808 175 1536 (toll-free) The

Netherlands: +31 800 745 8377 (toll-free) The Netherlands: +31 970

102 86838 (toll)

Passcode: you will receive a personal pin upon registration.

Financial calendar 2023Extraordinary general

meeting – September 29 and 30, 2023 Trading update third quarter

2023 – November 16, 2023

About AegonAegon is an international financial

services holding company. Aegon’s ambition is to build leading

businesses that offer their customers investment, protection and

retirement solutions. Its portfolio of businesses includes fully

owned subsidiaries in the US, UK and a global asset manager. In

addition, Aegon has partnerships in Spain & Portugal, Brazil,

and China, which create value by combining strong local partners

with Aegon’s international expertise. In the Netherlands, Aegon

generates value via a strategic shareholding in a market leading

insurance and pensions company.

Aegon's purpose of helping people live their best lives runs

through all its activities. As a leading global investor and

employer, Aegon seeks to have a positive impact by addressing

critical environmental and societal issues, with a focus on climate

change and inclusion & diversity. Aegon is headquartered in The

Hague, the Netherlands, and listed on Euronext Amsterdam and the

New York Stock Exchange. More information can be found at

aegon.com.

Local currencies and constant currency exchange

ratesThis document contains certain information about

Aegon’s results, financial condition and revenue generating

investments presented in USD for the Americas and in GBP for the

United Kingdom, because those businesses operate and are managed

primarily in those currencies. Certain comparative information

presented on a constant currency basis eliminates the effects of

changes in currency exchange rates. None of this information is a

substitute for or superior to financial information about Aegon

presented in EUR, which is the currency of Aegon’s primary

financial statements.

Cautionary note regarding non-EU-IFRS

measuresThis document includes the following non-EU-IFRS

financial measures: operating result, MCVNB, IFRS new business

value, return on equity and addressable expenses. These non-EU-IFRS

measures, except for addressable expenses, are calculated by

consolidating on a proportionate basis Aegon’s joint ventures and

associated companies. Operating result reflects Aegon’s result from

underlying business operations and excludes components that relate

to accounting mismatches that are dependent on market volatility or

relate to events that are considered outside the normal course of

business. MCVNB is the abbreviation for Market Consistent Value of

New Business and is not based on EU-IFRS and should not be viewed

as a substitute for EU-IFRS financial measures. Aegon may define

and calculate market consistent value of new business differently

than other companies. IFRS new business value is calculated as the

sum of the new business contractual service margin and new onerous

contracts, after reinsurance (excluding retrospective impacts) and

tax. Return on equity is a ratio using a non-EU-IFRS measure and is

calculated by dividing the operating result after tax less cost of

leverage by the average shareholders’ equity. Operating expenses

are all expenses associated with selling and administrative

activities (excluding commissions). This includes certain expenses

recorded in other charges for segment reporting, including

restructuring charges. Addressable expenses are calculated by

excluding the following items from operating expenses: direct

variable acquisition expenses, restructuring expenses (including

expenses related to the operational improvement plan), expenses in

joint ventures and associates and expenses related to acquisitions

and disposals. Addressable expenses are reported on a constant

currency basis. Aegon believes that these non-EU-IFRS measures,

together with the EU-IFRS information, provide meaningful

supplemental information about the operating results of Aegon’s

business including insight into the financial measures that senior

management uses in managing the business.

Forward-looking statementsThe statements

contained in this document that are not historical facts are

forward-looking statements as defined in the US Private Securities

Litigation Reform Act of 1995. The following are words that

identify such forward-looking statements: aim, believe, estimate,

target, intend, may, expect, anticipate, predict, project, counting

on, plan, continue, want, forecast, goal, should, would, could, is

confident, will, and similar expressions as they relate to Aegon.

These statements may contain information about financial prospects,

economic conditions and trends and involve risks and uncertainties.

In addition, any statements that refer to sustainability,

environmental and social targets, commitments, goals, efforts and

expectations and other events or circumstances that are partially

dependent on future events are forward-looking statements. These

statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict.

Aegon undertakes no obligation, and expressly disclaims any duty,

to publicly update or revise any forward-looking statements.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which merely reflect company

expectations at the time of writing. Actual results may differ

materially and adversely from expectations conveyed in

forward-looking statements due to changes caused by various risks

and uncertainties. Such risks and uncertainties include but are not

limited to the following:

- Unexpected delays, difficulties, and expenses in executing

against Aegon’s environmental, climate, diversity and inclusion or

other “ESG” targets, goals and commitments, and changes in laws or

regulations affecting us, such as changes in data privacy,

environmental, safety and health laws;

- Changes in general economic and/or governmental conditions,

particularly in the United States, the Netherlands and the United

Kingdom;

- Civil unrest, (geo-) political tensions, military action or

other instability in a country or geographic region;

- Changes in the performance of financial markets, including

emerging markets, such as with regard to:

- The frequency and severity of defaults by issuers in Aegon’s

fixed income investment portfolios;

- The effects of corporate bankruptcies and/or accounting

restatements on the financial markets and the resulting decline in

the value of equity and debt securities Aegon holds;

- The effects of declining creditworthiness of certain public

sector securities and the resulting decline in the value of

government exposure that Aegon holds;

- The impact from volatility in credit, equity, and interest

rates;

- Changes in the performance of Aegon’s investment portfolio and

decline in ratings of Aegon’s counterparties;

- Lowering of one or more of Aegon’s debt ratings issued by

recognized rating organizations and the adverse impact such action

may have on Aegon’s ability to raise capital and on its liquidity

and financial condition;

- Lowering of one or more of insurer financial strength ratings

of Aegon’s insurance subsidiaries and the adverse impact such

action may have on the written premium, policy retention,

profitability and liquidity of its insurance subsidiaries;

- The effect of the European Union’s Solvency II requirements,

applicable equivalent solvency requirements and other regulations

in other jurisdictions affecting the capital Aegon is required to

maintain;

- Changes affecting interest rate levels and low or rapidly

changing interest rate levels;

- Changes affecting currency exchange rates, in particular the

EUR/USD and EUR/GBP exchange rates;

- Changes affecting inflation levels, particularly in the United

States, the Netherlands and the United Kingdom;

- Changes in the availability of, and costs associated with,

liquidity sources such as bank and capital markets funding, as well

as conditions in the credit markets in general such as changes in

borrower and counterparty creditworthiness;

- Increasing levels of competition, particularly in the United

States, the Netherlands, the United Kingdom and emerging

markets;

- Catastrophic events, either manmade or by nature, including by

way of example acts of God, acts of terrorism, acts of war and

pandemics, could result in material losses and significantly

interrupt Aegon’s business;

- The frequency and severity of insured loss events;

- Changes affecting longevity, mortality, morbidity, persistence

and other factors that may impact the profitability of Aegon’s

insurance products;

- Aegon’s projected results are highly sensitive to complex

mathematical models of financial markets, mortality, longevity, and

other dynamic systems subject to shocks and unpredictable

volatility. Should assumptions to these models later prove

incorrect, or should errors in those models escape the controls in

place to detect them, future performance will vary from projected

results;

- Reinsurers to whom Aegon has ceded significant underwriting

risks may fail to meet their obligations;

- Changes in customer behavior and public opinion in general

related to, among other things, the type of products Aegon sells,

including legal, regulatory or commercial necessity to meet

changing customer expectations;

- Customer responsiveness to both new products and distribution

channels;

- Third-party information used by us may prove to be inaccurate

and change over time as methodologies and data availability and

quality continue to evolve impacting our results and

disclosures;

- As Aegon’s operations support complex transactions and are

highly dependent on the proper functioning of information

technology, operational risks such as system disruptions or

failures, security or data privacy breaches, cyberattacks, human

error, failure to safeguard personally identifiable information,

changes in operational practices or inadequate controls including

with respect to third parties with which Aegon does business may

disrupt Aegon’s business, damage its reputation and adversely

affect its results of operations, financial condition and cash

flows;

- The impact of acquisitions and divestitures, restructurings,

product withdrawals and other unusual items, including Aegon’s

ability to complete, or obtain regulatory approval for,

acquisitions and divestitures, integrate acquisitions, and realize

anticipated results, and its ability to separate businesses as part

of divestitures;

- Aegon’s failure to achieve anticipated levels of earnings or

operational efficiencies, as well as other management

initiatives related to cost savings, Cash Capital at Holding, gross

financial leverage and free cash flow;

- Changes in the policies of central banks and/or

governments;

- Litigation or regulatory action that could require Aegon to pay

significant damages or change the way Aegon does business;

- Competitive, legal, regulatory, or tax changes that affect

profitability, the distribution cost of or demand for Aegon’s

products;

- Consequences of an actual or potential break-up of the European

monetary union in whole or in part, or the exit of the United

Kingdom from the European Union and potential consequences if other

European Union countries leave the European Union;

- Changes in laws and regulations, particularly those affecting

Aegon’s operations’ ability to hire and retain key personnel,

taxation of Aegon companies, the products Aegon sells, and the

attractiveness of certain products to its consumers;

- Regulatory changes relating to the pensions, investment, and

insurance industries in the jurisdictions in which Aegon

operates;

- Standard setting initiatives of supranational standard setting

bodies such as the Financial Stability Board and the International

Association of Insurance Supervisors or changes to such standards

that may have an impact on regional (such as EU), national or US

federal or state level financial regulation or the application

thereof to Aegon, including the designation of Aegon by the

Financial Stability Board as a Global Systemically Important

Insurer (G-SII);

- Changes in accounting regulations and policies or a change by

Aegon in applying such regulations and policies, voluntarily or

otherwise, which may affect Aegon’s reported results, shareholders’

equity or regulatory capital adequacy levels;

- Changes in ESG standards and requirements, including

assumptions, methodology and materiality, or a change by Aegon in

applying such standards and requirements, voluntarily or otherwise,

may affect Aegon’s ability to meet evolving standards and

requirements, or Aegon’s ability to meet its sustainability and

ESG-related goals, or related public expectations; and

- Reliance on third-party information in certain of Aegon’s

disclosures, which may change over time as methodologies and data

availability and quality continue to evolve. These factors, as well

as any inaccuracies in third-party information used by Aegon,

including in estimates or assumptions, may cause results to differ

materially and adversely from statements, estimates, and beliefs

made by Aegon or third-parties. Moreover, Aegon’s disclosures based

on any standards may change due to revisions in framework

requirements, availability of information, changes in its business

or applicable governmental policies, or other factors, some of

which may be beyond Aegon’s control. Additionally, Aegon may

provide information that is not necessarily material for SEC

reporting purposes but that is informed by various ESG standards

and frameworks (including standards for the measurement of

underlying data), internal controls, and assumptions or third-party

information that are still evolving and subject to change.

This document contains information that qualifies, or may

qualify, as inside information within the meaning of Article 7(1)

of the EU Market Abuse Regulation (596/2014). Further details of

potential risks and uncertainties affecting Aegon are described in

its filings with the Netherlands Authority for the Financial

Markets and the US Securities and Exchange Commission, including

the [2022 Integrated] Annual Report. These forward-looking

statements speak only as of the date of this document. Except as

required by any applicable law or regulation, Aegon expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Aegon’s expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based.

World Financial Group (WFG)WFG consists

of:In the United States, World Financial Group

Insurance Agency, LLC (in California, doing business as World

Financial Insurance Agency, LLC), World Financial Group Insurance

Agency of Hawaii, Inc., World Financial Group Insurance Agency of

Massachusetts, Inc., and / or WFG Insurance Agency of Puerto Rico,

Inc. (collectively WFGIA), which offer insurance and annuity

products. In the United States, Transamerica

Financial Advisors, Inc. is a full-service, fully licensed,

independent broker-dealer and registered investment advisor.

Transamerica Financial Advisors, Inc. (TFA), Member FINRA,

MSRB, SIPC , and registered investment advisor, offers

securities and investment advisory services. In

Canada, World Financial Group Insurance Agency of Canada

Inc. (WFGIAC), which offers life insurance and segregated funds.

WFG Securities Inc. (WFGS), which offers mutual funds. WFGIAC and

WFGS are affiliated companies.

- 20230817_PR_Aegon reports first half year 2023 results

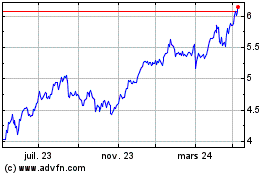

Aegon (EU:AGN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Aegon (EU:AGN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025