Brunel reports continued margin expansion and profit acceleration

in Q2 2021

Amsterdam, 30 July 2021 - Brunel International N.V. (Brunel;

BRNL), a global provider of flexible workforce solutions and

expertise today announced its second quarter (Q2) 2021 results.

Key points Q2 2021

- Gross Profit increase of 14% compared to Q2 2020;

- Gross margin increased by 3.3 percentage points to 22.2%;

- EBIT increased strongly to EUR 7.6 million;

- Revenue of EUR 214 million down 3%, with positive

month-on-month trend;

- All regions profitable.

Key points H1 2021

- Gross margin increased by 2.5 percentage points to 22.7%;

- Cost savings of EUR 8.7 million add to EBIT growth, up 108% to

EUR 18.3 million

- Net profit up to EUR 11.3 million, an increase of earnings per

share by 347% to EUR 0.22;

- Strong cash position maintained at EUR 129.9 million.

Jilko Andringa, CEO of Brunel

International N.V.:

“Building on our strong performance in Q1, the

second quarter underlined the resilience of our business model. All

regions are now profitable and margins are improving across the

board. This is driven by our strategic focus on higher added value

for our clients as we help them manage the fundamental and ongoing

shift to a more sustainable world. We are capitalizing on our key

focus areas of specialization, diversification, disciplined

execution and capabilities building.

While the ongoing restrictions of COVID-19 still

limit travel in a number of regions, our Q2 gross profit increased

versus last year due to stronger focus of productivity and rates.

Almost all regions achieved a higher gross margin. Combined with

strict cost management and operational excellence, this brings our

EBIT up to healthy levels.

Revenue is growing month on month in multiple

regions, supporting the growth plans we presented at our capital

markets day. Our Brunellers are eager to take the company to the

next stage of growth and despite the delays in easing of COVID-19

restrictions, I am confident that we will return to topline growth

in the second half of 2021, providing the fundament for high single

digit growth in the years to come."

|

Brunel International (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

|

| Revenue |

214.1 |

220.4 |

-3% |

a |

|

427.1 |

476.2 |

-10% |

b |

| Gross

Profit |

47.5 |

41.6 |

14% |

|

|

96.8 |

96.0 |

1% |

|

| Gross

margin |

22.2% |

18.9% |

|

|

|

22.7% |

20.2% |

|

|

| Operating

costs |

39.9 |

40.8 |

-2% |

c |

|

78.5 |

87.2 |

-10% |

d |

| EBIT |

7.6 |

0.8 |

889% |

|

|

18.3 |

8.8 |

108% |

|

| EBIT % |

3.6% |

0.4% |

|

|

|

4.3% |

1.9% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

9,626 |

10,345 |

-7% |

|

|

9,458 |

10,896 |

-13% |

|

| Average

indirects |

1,299 |

1,480 |

-12% |

|

|

1,305 |

1,524 |

-14% |

|

| Ratio direct /

indirect |

7.4 |

7.0 |

|

|

|

7.2 |

7.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a

-1 % at constant currencies |

|

|

|

|

|

|

| b

-8 % at constant currencies |

|

|

|

|

|

|

| c

-1 % at constant currencies |

|

|

|

|

|

|

| d

-9 % at constant currencies |

|

|

|

|

|

|

H1 2021 results by divisionP&L amounts in

EUR million

Summary:

|

Revenue |

Q2 2021 |

Q2 2020 |

Δ% |

|

H1 2021 |

H1 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

53.4 |

52.8 |

1% |

|

109.2 |

122.4 |

-11% |

| The

Netherlands |

45.0 |

46.4 |

-3% |

|

92.1 |

97.2 |

-5% |

| Australasia |

24.7 |

28.4 |

-13% |

|

49.9 |

58.4 |

-14% |

| Middle East &

India |

25.0 |

30.0 |

-16% |

|

50.2 |

63.7 |

-21% |

| Americas |

23.5 |

22.8 |

3% |

|

43.8 |

51.3 |

-15% |

| Rest of

world |

42.5 |

40.0 |

6% |

|

81.9 |

82.4 |

-1% |

| Unallocated |

0.0 |

0.1 |

-100% |

|

0.0 |

0.9 |

-100% |

| |

|

|

|

|

|

|

|

|

Total |

214.1 |

220.4 |

-3% |

|

427.1 |

476.2 |

-10% |

| Gross

Profit |

Q2 2021 |

Q2 2020 |

Δ% |

|

H1 2021 |

H1 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH

region |

17.6 |

14.3 |

23% |

|

37.2 |

35.6 |

4% |

| The

Netherlands |

12.6 |

11.5 |

10% |

|

26.1 |

25.6 |

2% |

|

Australasia |

2.6 |

2.2 |

18% |

|

5.0 |

4.8 |

5% |

| Middle East

& India |

4.0 |

4.5 |

-12% |

|

8.1 |

10.4 |

-22% |

| Americas |

3.0 |

2.5 |

22% |

|

5.6 |

5.7 |

0% |

| Rest of

world |

7.7 |

6.7 |

16% |

|

14.8 |

14.0 |

6% |

| |

|

|

|

|

|

|

|

|

Total |

47.5 |

41.6 |

14% |

|

96.8 |

96.0 |

1% |

|

EBIT |

Q2 2021 |

Q2 2020 |

Δ% |

|

H1 2021 |

H1 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

3.4 |

-0.6 |

|

|

9.4 |

3.4 |

176% |

| The

Netherlands |

3.2 |

1.7 |

93% |

|

7.3 |

4.9 |

49% |

| Australasia |

0.2 |

-0.3 |

|

|

0.2 |

-0.3 |

|

| Middle East &

India |

2.1 |

1.9 |

12% |

|

4.5 |

5.1 |

-12% |

| Americas |

0.2 |

-0.7 |

|

|

0.1 |

-1.4 |

|

| Rest of

world |

1.6 |

0.8 |

83% |

|

2.9 |

1.9 |

51% |

| Unallocated |

-3.0 |

-2.0 |

-49% |

|

-5.9 |

-4.7 |

-25% |

| |

|

|

|

|

|

|

|

|

Total |

7.6 |

0.8 |

889% |

|

18.3 |

8.8 |

108% |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

In Q2 2021, the Group’s revenue

decreased by 3% or EUR 6.3 million y-o-y, and was flat compared to

Q1 2021. Higher rates, higher productivity, and one additional

working day resulted in a gross margin of 22.2%. This is a strong

increase of 3.3 percentage point versus Q2 2020. All regions are

profitable and total EBIT increased by EUR 6.8 million compared to

Q2 2020.

PERFORMANCE BY REGION

|

DACH region (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

| Revenue |

53.4 |

52.8 |

1% |

|

|

109.2 |

122.4 |

-11% |

| Gross Profit |

17.6 |

14.3 |

23% |

|

|

37.2 |

35.6 |

4% |

| Gross margin |

32.9% |

27.1% |

|

|

|

34.0% |

29.1% |

|

| Operating

costs |

14.2 |

14.9 |

-5% |

|

|

27.8 |

32.2 |

-14% |

| EBIT |

3.4 |

-0.6 |

|

|

|

9.4 |

3.4 |

176% |

| EBIT % |

6.3% |

-1.2% |

|

|

|

8.6% |

2.8% |

|

| |

|

|

|

|

|

|

|

|

| Average

directs |

1,935 |

2,032 |

-5% |

|

|

1,918 |

2,290 |

-16% |

| Average

indirects |

385 |

481 |

-20% |

|

|

381 |

496 |

-23% |

| Ratio direct /

indirect |

5.0 |

4.2 |

|

|

|

5.0 |

4.6 |

|

Revenue per working day in DACH

decreased by 0.5%, mainly driven by a 5% lower headcount, while

both rates and productivity were higher over the quarter. This led

to a significant increase in gross margin adjusted for working days

to 31.8% in Q2 2021 (Q2 2020: 27.1%).The number of specialists in

short-time working reduced from 75 in Q1 2021 to 9 at the end of Q2

2021.

Headcount as of 30 June was 1,946.

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2021 |

63 |

60 |

66 |

65 |

254 |

|

2020 |

64 |

59 |

66 |

65 |

254 |

|

Netherlands (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

| Revenue |

45.0 |

46.4 |

-3% |

|

|

92.1 |

97.2 |

-5% |

| Gross Profit |

12.6 |

11.5 |

10% |

|

|

26.1 |

25.6 |

2% |

| Gross margin |

27.9% |

24.7% |

|

|

|

28.3% |

26.3% |

|

| Operating

costs |

9.4 |

9.8 |

-4% |

|

|

18.8 |

20.7 |

-9% |

| EBIT |

3.2 |

1.7 |

93% |

|

|

7.3 |

4.9 |

49% |

| EBIT % |

7.2% |

3.6% |

|

|

|

7.9% |

5.0% |

|

| |

|

|

|

|

|

|

|

|

| Average

directs |

1,720 |

1,899 |

-9% |

|

|

1,727 |

1,957 |

-12% |

| Average

indirects |

277 |

343 |

-19% |

|

|

289 |

355 |

-19% |

| Ratio direct /

Indirect |

6.2 |

5.5 |

|

|

|

6.0 |

5.5 |

|

Revenue per working day in The

Netherlands decreased by 4.6%, with a stable headcount

through the quarter. The y-o-y development is impacted by the low

added value activities we stopped in Q1. The business line Legal

continued its strong performance. Gross margin adjusted for working

days increased to 27.1% in Q2 2021 (Q2 2020: 24.7%), mainly driven

by higher rates and a higher productivity. EBIT increased by 93% as

a result of higher gross profit and lower operating cost.

Headcount as of 30 June was 1,718.

Working days per Q 2021 / 2020:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2021 |

63 |

61 |

66 |

66 |

256 |

|

2020 |

64 |

60 |

66 |

65 |

255 |

|

Australasia (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

|

| Revenue |

24.7 |

28.4 |

-13% |

a |

|

49.9 |

58.4 |

-14% |

b |

| Gross Profit |

2.6 |

2.2 |

18% |

|

|

5.0 |

4.8 |

5% |

|

| Gross margin |

10.6% |

7.8% |

|

|

|

10.0% |

8.2% |

|

|

| Operating

costs |

2.4 |

2.5 |

-4% |

c |

|

4.8 |

5.1 |

-6% |

d |

| EBIT |

0.2 |

-0.3 |

|

|

|

0.2 |

-0.3 |

|

|

| EBIT % |

0.8% |

-0.9% |

|

|

|

0.4% |

-0.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

958 |

1,040 |

-8% |

|

|

932 |

1,049 |

-11% |

|

| Average

indirects |

87 |

83 |

4% |

|

|

85 |

82 |

3% |

|

| Ratio direct /

indirect |

11.0 |

12.5 |

|

|

|

11.0 |

12.7 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a -15

% at constant currencies |

|

|

|

|

|

|

| b -18

% at constant currencies |

|

|

|

|

|

|

| c -4

% at constant currencies |

|

|

|

|

|

|

| d -9

% at constant currencies |

|

|

|

|

|

|

Australasia includes Australia

and Papua New Guinea. The focus on higher added value activities

has resulted in a considerable increase in gross margin. Supported

by tight cost control, EBIT for the region has turned positive. In

PNG we continue to be hindered by the restrictions to mobilize

expats.

|

Middle East & India (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

|

| Revenue |

25.0 |

30.0 |

-16% |

a |

|

50.2 |

63.7 |

-21% |

b |

| Gross Profit |

4.0 |

4.5 |

-12% |

|

|

8.1 |

10.4 |

-22% |

|

| Gross margin |

15.8% |

15.0% |

|

|

|

16.1% |

16.3% |

|

|

| Operating

costs |

1.9 |

2.6 |

-27% |

c |

|

3.6 |

5.3 |

-32% |

d |

| EBIT |

2.1 |

1.9 |

12% |

|

|

4.5 |

5.1 |

-12% |

|

| EBIT % |

8.4% |

6.3% |

|

|

|

9.0% |

8.0% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

2,022 |

2,506 |

-19% |

|

|

2,050 |

2,608 |

-21% |

|

| Average

indirects |

125 |

141 |

-11% |

|

|

125 |

144 |

-13% |

|

| Ratio direct /

Indirect |

16.2 |

17.8 |

|

|

|

16.4 |

18.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a -10

% at constant currencies |

|

|

|

|

|

|

| b -15

% at constant currencies |

|

|

|

|

|

|

| c -24

% at constant currencies |

|

|

|

|

|

|

| d -28

% at constant currencies |

|

|

|

|

|

|

In Middle East & India we

continue to see a decrease in revenue, as several projects were

completed, while we experienced a delay in the start of new won

projects and currency effects. The travel restrictions have eased

slightly in Qatar and the Emirates, but are still limiting our

activities in Kuwait and India. The project pipeline remains

healthy, and will drive strong growth when the travel restrictions

ease. Operating cost remained at the same level as in Q1 2021,

resulting from considerable cost savings y-o-y.

|

Americas (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

|

| Revenue |

23.5 |

22.8 |

3% |

a |

|

43.8 |

51.3 |

-15% |

b |

| Gross Profit |

3.0 |

2.5 |

22% |

|

|

5.6 |

5.7 |

0% |

|

| Gross margin |

12.8% |

10.8% |

|

|

|

12.9% |

11.0% |

|

|

| Operating

costs |

2.8 |

3.2 |

-13% |

c |

|

5.5 |

7.1 |

-23% |

d |

| EBIT |

0.2 |

-0.7 |

|

|

|

0.1 |

-1.4 |

|

|

| EBIT % |

0.9% |

-3.0% |

|

|

|

0.1% |

-2.8% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

826 |

747 |

11% |

|

|

793 |

812 |

-2% |

|

| Average

indirects |

102 |

102 |

0% |

|

|

101 |

112 |

-10% |

|

| Ratio direct /

Indirect |

8.1 |

7.3 |

|

|

|

7.8 |

7.3 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 8 %

at constant currencies |

|

|

|

|

|

|

| b -9

% at constant currencies |

|

|

|

|

|

|

| c -7

% at constant currencies |

|

|

|

|

|

|

| d -16

% at constant currencies |

|

|

|

|

|

|

Revenue growth in the Americas is mainly driven

by the strong growth in Brazil and Canada, offsetting the decrease

in revenue in the USA. Activities in the USA are still impacted by

the current crisis. Gross margin increased by 2.0 ppt. mainly

driven by higher margin projects in Canada and an increase in

recruitment revenue. Supported by continued cost control, the

region has returned to profitability.

|

Rest of world (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2021 |

Q2 2020 |

Δ% |

|

|

H1 2021 |

H1 2020 |

Δ% |

|

| Revenue |

42.5 |

40.0 |

6% |

a |

|

81.9 |

82.4 |

-1% |

b |

| Gross Profit |

7.7 |

6.7 |

16% |

|

|

14.8 |

14.0 |

6% |

|

| Gross margin |

18.2% |

16.7% |

|

|

|

18.1% |

17.0% |

|

|

| Operating

costs |

6.1 |

5.9 |

3% |

c |

|

11.9 |

12.1 |

-2% |

d |

| EBIT |

1.6 |

0.8 |

83% |

|

|

2.9 |

1.9 |

51% |

|

| EBIT % |

3.7% |

2.1% |

|

|

|

3.5% |

2.3% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

2,164 |

2,105 |

3% |

|

|

2,038 |

2,150 |

-5% |

|

| Average

indirects |

262 |

264 |

-1% |

|

|

263 |

270 |

-3% |

|

| Ratio direct /

Indirect |

8.3 |

8.0 |

|

|

|

7.8 |

8.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 16

% at constant currencies |

|

|

|

|

|

|

| b 8 %

at constant currencies |

|

|

|

|

|

|

| c 10

% at constant currencies |

|

|

|

|

|

|

| d 4 %

at constant currencies |

|

|

|

|

|

|

Rest of world includes Asia, Russia &

Caspian, Belgium and rest of Europe & Africa. The main driver

of growth is Asia, more specifically China and Singapore. Europe

& Africa again had a strong contribution and in Russia we see

increased activity with new projects at higher margins. The

region’s growth in activity is partially offset by unfavourable

exchange rate developments.

Tax and net profitThe effective

tax rate in the first half year of 2021 was 32.4% (H1 2020 at

56.4%). We expect the effective tax rate for the full year to come

down to around 30% (H1 2020: 38.5%). Net profit came in at EUR 11.3

million (H1 2020: EUR 2.5 million, reflecting an earnings per share

of EUR 0.22 (H1 2020: EUR 0.05)).

Risk profileReference is made

to our 2020 Annual Report (pages 64 - 80). Reassessment of our

earlier identified risks and the potential impact on

occurrence has not resulted in required changes in our internal

risk management and control systems

Cash positionThe cash balance

at 30 June 2021 stood at EUR 129.9 million (EUR 155.0 per 31

December 2020), of which EUR 17.0 million restricted (EUR 15.1

per 31 December 2020). The cash balance decreased compared to 31

December 2020 in line with the normal seasonality, the distribution

of dividend and the share buyback program.

OutlookWe expect the current

trend to continue in Q3 2021, supported by seasonality and

additional working days, resulting in an increase in revenue and

gross profit y-o-y and also compared to Q2.

Statement of the Board of

DirectorsThe Board of Directors of Brunel International

N.V. hereby declares that, to the best of its knowledge:

- the interim financial statements

give a true and fair view of the assets, liabilities, financial

position and result of Brunel International N.V. and the companies

jointly included in the consolidation, and

- the interim report gives a true and

fair view of the information referred to in the eighth and, insofar

as applicable, the ninth subsection of Section 5:25d of the Dutch

Act on Financial Supervision and with reference to the section on

related parties in the interim financial statements.

Amsterdam, 30 July 2021Brunel International

N.V.

Jilko Andringa (CEO)Peter de Laat (CFO)Graeme

Maude (COO)

- Press Release Q2 2021.pdf

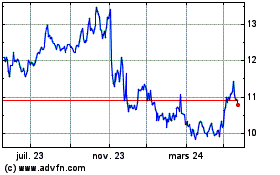

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

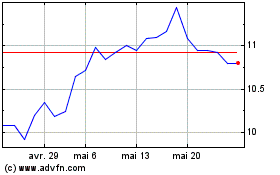

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024