Brunel Q4 and FY 2021 results: accelerated growth with continued

high profitability

Amsterdam, 18 February 2022 – Brunel International N.V. (Brunel;

BRNL), a global provider of flexible workforce solutions and

expertise today announced its fourth quarter and full year 2021

results.

Key points Q4 2021

- Revenue up 17% to EUR 245.4 million

with all regions contributing

- Gross margin up 1.1 percentage point

to 24.2%

- EBIT increased 60% to EUR 15.7

million driven by higher gross margin and higher operating

leverage

- The Netherlands returned to growth

with strong uptick in EBIT-margin reaching 12.2%

- Leading position established in

renewables recruitment solutions through acquisition of

fast-growing recruitment specialist Taylor Hopkinson

Key points full year 2021

- EBIT increased 65% to EUR 47.7

million driven by higher gross margin and higher operating

leverage. Highest EBIT in the last 6 years.

- Revenue up 1% to EUR 899.7 million

with 13% growth in H2 2021

- Gross margin up from 21.4% to 23.4%

due to improved pricing through specialization, higher productivity

and improved mix effects

- Chosen markets (renewables, mining,

future mobility, life science and Oil & Gas continue to

accelerate with high level of capital investments

- Strong cash position maintained at

EUR 112 million despite cash outflow for acquisition of Taylor

Hopkinson.

- Net profit reaches EUR 33.0 million,

up 88%; earnings per share of EUR 0.61 with a proposed dividend of

EUR 0.45 (pay-out: 74%)

Jilko Andringa, CEO of Brunel International

N.V.: “We have ended the year with a strong fourth quarter

achieving high revenue growth and an EBIT-margin of more than 6%.

Over the full year 2021, EBIT was up 65% at EUR 47.7 million,

reflecting a leap in EBIT-margin from 3.2% to 5.3%, and the highest

level in the last 6 years. These results demonstrate the continued

success of our strategy to focus on specialization,

diversification, disciplined execution and capabilities building.

We are proud and grateful to see that Brunellers across the globe

are contributing to the success of our company and strive to set

new standards of performance and delivery in all the regions we

operate.

The fourth quarter has been our best quarter of the year with

double digit revenue, gross margin and EBIT growth. The Netherlands

made a particular strong contribution with a return to growth and a

high EBIT, resulting in a 9.5% EBIT-margin for the full year. In

the Middle East, we were successful in providing services to a

large shutdown project: we managed to mobilize and employ over 400

specialists.

To further accelerate our vertical strategy, we acquired Taylor

Hopkinson, the global leader in specialist recruitment in the

renewables sector. The combined capabilities of Brunel and Taylor

Hopkinson allow us to benefit from the rapid growth in the

renewables sector and play a key role in supporting our clients in

their energy transition.

To underline our ambitions to create a better and more

sustainable future for our clients and our professionals and

demonstrate the potential of Brunel’s unique and future-proof

business model, we have recently updated our ESG strategy. We find

high engagement with all Brunellers to deliver on our people,

planet and community goals. As such, we have also committed

ourselves to reduce our footprint and become a Net Zero Emission

company in 2022.

With COVID-19 restrictions being lifted around

the globe and a continuing increase in demand for specialists in

our chosen market segments, we are looking ahead to 2022 with

positive energy and confidence. In line with our five year plan, we

expect to continue to grow our revenue, gross margin and EBIT as we

will connect more and more specialists to pioneering projects."

|

Brunel International (unaudited) |

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

|

| Revenue |

245.4 |

209.3 |

17% |

a |

|

899.7 |

892.6 |

1% |

b |

| Gross Profit |

59.4 |

48.3 |

23% |

|

|

210.6 |

191.4 |

10% |

|

| Gross margin |

24.2% |

23.1% |

|

|

|

23.4% |

21.4% |

|

|

| Operating costs |

43.7 |

38.5 |

14% |

c |

|

162.9 |

162.6 |

0% |

d |

| EBIT |

15.7 |

9.8 |

60% |

|

|

47.7 |

28.8 |

65% |

|

| EBIT % |

6.4% |

4.7% |

|

|

|

5.3% |

3.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

10,728 |

9,518 |

13% |

|

|

9,909 |

10,227 |

-3% |

|

| Average indirects |

1,344 |

1,324 |

2% |

|

|

1,313 |

1,442 |

-9% |

|

| Ratio direct / Indirect |

8.0 |

7.2 |

|

|

|

7.5 |

7.1 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 15 % like-for-like |

|

|

|

|

|

|

| b 1 % like-for-like |

|

|

|

|

|

|

| c 12 % like-for-like |

|

|

|

|

|

|

| d 0 % like-for-like |

|

|

|

|

|

|

| |

|

Q4

2021 and

FY 2021 results

by division

Summary (amounts in EUR

million):

|

Revenue |

Q4 2021 |

Q4 2020 |

Δ% |

|

FY 2021 |

FY 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

53.9 |

53.5 |

1% |

|

218.6 |

230.5 |

-5% |

| The Netherlands |

49.6 |

47.9 |

3% |

|

186.1 |

190.6 |

-2% |

| Australasia |

31.4 |

25.4 |

24% |

|

109.0 |

110.4 |

-1% |

| Middle East & India |

31.8 |

24.7 |

29% |

|

107.6 |

113.4 |

-5% |

| Americas |

27.6 |

18.8 |

47% |

|

96.8 |

88.3 |

10% |

| Rest of world |

51.2 |

38.8 |

32% |

|

181.5 |

158.3 |

15% |

| Unallocated |

0.0 |

0.2 |

-100% |

|

0.0 |

1.0 |

-100% |

| |

|

|

|

|

|

|

|

| Total |

245.4 |

209.3 |

17% |

|

899.7 |

892.6 |

1% |

|

Gross Profit |

Q4 2021 |

Q4 2020 |

Δ% |

|

FY 2021 |

FY 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

20.9 |

19.7 |

6% |

|

79.0 |

74.9 |

6% |

| The Netherlands |

16.8 |

13.4 |

25% |

|

57.1 |

51.3 |

11% |

| Australasia |

3.0 |

2.6 |

18% |

|

10.9 |

9.7 |

12% |

| Middle East & India |

5.5 |

4.1 |

36% |

|

17.8 |

18.5 |

-4% |

| Americas |

3.8 |

2.8 |

39% |

|

12.9 |

10.6 |

22% |

| Rest of world |

9.4 |

6.4 |

46% |

|

32.8 |

26.9 |

22% |

| Unallocated |

0.0 |

-0.6 |

100% |

|

0.0 |

-0.6 |

100% |

| |

|

|

|

|

|

|

|

| Total |

59.4 |

48.3 |

23% |

|

210.6 |

191.4 |

10% |

|

EBIT |

Q4 2021 |

Q4 2020 |

Δ% |

|

FY 2021 |

FY 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

7.4 |

6.8 |

9% |

|

24.2 |

17.0 |

42% |

| The Netherlands |

6.1 |

4.0 |

53% |

|

17.7 |

11.8 |

50% |

| Australasia |

0.2 |

0.3 |

-36% |

|

0.7 |

0.2 |

305% |

| Middle East & India |

3.1 |

2.3 |

38% |

|

9.8 |

9.4 |

5% |

| Americas |

0.2 |

-0.3 |

189% |

|

0.5 |

-2.2 |

123% |

| Rest of world |

1.9 |

0.8 |

154% |

|

7.0 |

3.7 |

87% |

| Unallocated |

-3.3 |

-4.1 |

19% |

|

-12.3 |

-11.1 |

-11% |

| |

|

|

|

|

|

|

|

| Total |

15.7 |

9.8 |

60% |

|

47.7 |

28.8 |

65% |

In Q4 2021, the Group’s revenue increased by 17% or EUR 36.1

million y-o-y. Higher rates and a higher productivity resulted in

an improved gross margin of 24.4%, an increase of 1.3 percentage

point versus Q4 2020. Almost all regions have increased both their

gross margins and profitability, resulting in an EBIT of 6.4%, an

increase of EUR 5.9 million y-o-y, or 60% compared to the same

period last year. Unallocated in Q4 includes EUR 0.8 million

one-off cost relating to the acquisition of Taylor Hopkinson.

Taylor Hopkinson is included in our consolidated figures from 31

December 2021, and therefore did not yet impact the results in

Q4.

BREAKDOWN BY REGION

|

DACH region (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

| Revenue |

53.9 |

53.5 |

1% |

|

|

218.6 |

230.5 |

-5% |

| Gross Profit |

20.9 |

19.7 |

6% |

|

|

79.0 |

74.9 |

6% |

| Gross margin |

38.7% |

36.7% |

|

|

|

36.2% |

32.5% |

|

| Operating costs |

13.5 |

12.9 |

5% |

|

|

54.8 |

57.9 |

-5% |

| EBIT |

7.4 |

6.8 |

9% |

|

|

24.2 |

17.0 |

42% |

| EBIT % |

13.8% |

12.8% |

|

|

|

11.1% |

7.4% |

|

| |

|

|

|

|

|

|

|

|

| Average directs |

1,997 |

1,992 |

0% |

|

|

1,951 |

2,148 |

-9% |

| Average indirects |

391 |

392 |

0% |

|

|

381 |

454 |

-16% |

| Ratio direct / Indirect |

5.1 |

5.1 |

|

|

|

5.1 |

4.7 |

|

The DACH region includes Germany, Switzerland,

Austria and Czech Republic.

Taking into account the relatively low

productivity due to holidays, DACH had a strong quarter. Revenue

increased by 1%, largely driven by higher rates, resulting in a

strong increase in gross margin of 2.0 percentage point to 38.7%.

Headcount remained largely stable compared to Q4 last year. EBIT

margin reached 13.8% over the quarter.Headcount as of December 31st

2021 was 2,001 (2020: 1,960).

Working days:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

63 |

61 |

66 |

62 |

252 |

|

2021 |

63 |

60 |

66 |

65 |

254 |

|

2020 |

64 |

59 |

66 |

65 |

254 |

|

Brunel Netherlands (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

| Revenue |

49.6 |

47.9 |

3% |

|

|

186.1 |

190.6 |

-2% |

| Gross Profit |

16.8 |

13.4 |

25% |

|

|

57.1 |

51.3 |

11% |

| Gross margin |

33.8% |

27.9% |

|

|

|

30.7% |

26.9% |

|

| Operating costs |

10.7 |

9.4 |

14% |

|

|

39.4 |

39.5 |

0% |

| EBIT |

6.1 |

4.0 |

53% |

|

|

17.7 |

11.8 |

50% |

| EBIT % |

12.2% |

8.3% |

|

|

|

9.5% |

6.2% |

|

| |

|

|

|

|

|

|

|

|

| Average directs |

1,740 |

1,838 |

-5% |

|

|

1,720 |

1,899 |

-9% |

| Average indirects |

276 |

311 |

-11% |

|

|

281 |

337 |

-17% |

| Ratio direct / Indirect |

6.3 |

5.9 |

|

|

|

6.1 |

5.6 |

|

In Q4 2021, revenue increased 3% versus last

year and gross margin increased 5.9 percentage point. Revenue

growth per working day came in at 1.4%. The increase was achieved

in almost all business lines and mainly driven by higher sales

rates, higher productivity and one additional working day.

EBIT-margin increased 3.9 percentage point to 12.2%.The headcount

development in 2021 is as follows:

Headcount as of December 31th 2021 was 1,764

(2020: 1,836).

Working days:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

61 |

66 |

64 |

255 |

|

2021 |

63 |

61 |

66 |

66 |

256 |

|

2020 |

64 |

60 |

66 |

65 |

255 |

Gross margin The gross margin adjusted for

working days was 32.7% (2020: 27.9%). The increase in gross margin

was achieved in almost all business lines, mainly driven by higher

rates and higher productivity.

|

Australasia (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

|

| Revenue |

31.4 |

25.4 |

24% |

a |

|

109.0 |

110.4 |

-1% |

b |

| Gross Profit |

3.0 |

2.6 |

18% |

|

|

10.9 |

9.7 |

12% |

|

| Gross margin |

9.7% |

10.1% |

|

|

|

10.0% |

8.8% |

|

|

| Operating costs |

2.8 |

2.3 |

22% |

c |

|

10.2 |

9.5 |

7% |

d |

| EBIT |

0.2 |

0.3 |

-36% |

|

|

0.7 |

0.2 |

305% |

|

| EBIT % |

0.7% |

1.3% |

|

|

|

0.7% |

0.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,119 |

960 |

17% |

|

|

991 |

999 |

-1% |

|

| Average indirects |

100 |

76 |

32% |

|

|

91 |

80 |

14% |

|

| Ratio direct / Indirect |

11.2 |

12.7 |

|

|

|

10.9 |

12.5 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 20 % like-for-like |

|

|

|

|

|

|

| b -4 % like-for-like |

|

|

|

|

|

|

| c 23 % like-for-like |

|

|

|

|

|

|

| d 4 % like-for-like |

|

|

|

|

|

|

| |

|

Australasia includes Australia and Papua New

Guinea. With travel restrictions in PNG lifted and new projects in

Australia started, revenue was up 24% over Q4 2020. Operating cost

increased due to investment in staff to support future growth.

|

Middle East & India (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

|

| Revenue |

31.8 |

24.7 |

29% |

a |

|

107.6 |

113.4 |

-5% |

b |

| Gross Profit |

5.5 |

4.1 |

36% |

|

|

17.8 |

18.5 |

-4% |

|

| Gross margin |

17.4% |

16.4% |

|

|

|

16.5% |

16.3% |

|

|

| Operating costs |

2.4 |

1.8 |

33% |

c |

|

8.0 |

9.1 |

-12% |

d |

| EBIT |

3.1 |

2.3 |

38% |

|

|

9.8 |

9.4 |

5% |

|

| EBIT % |

9.8% |

9.1% |

|

|

|

9.1% |

8.3% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,307 |

2,085 |

11% |

|

|

2,119 |

2,348 |

-10% |

|

| Average indirects |

127 |

125 |

2% |

|

|

125 |

135 |

-7% |

|

| Ratio direct / Indirect |

18.2 |

16.7 |

|

|

|

16.9 |

17.3 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 23 % like-for-like |

|

|

|

|

|

|

| b -3 % like-for-like |

|

|

|

|

|

|

| c 28 % like-for-like |

|

|

|

|

|

|

| d -11 % like-for-like |

|

|

|

|

|

|

| |

|

Middle East & India includes Qatar, Kuwait,

Dubai, Oman, Kurdistan, Iraq and India. Q4 revenue increased 29%

and gross margin increased 1.0 percentage point, due to the large

shutdown project and extensions of infrastructure and oil & gas

projects in Qatar. The shutdown project was finalized in December.

Operating cost increased to support the revenue growth. These

developments resulted in an increase in EBIT margin of 0.7

percentage point to 9.8%.

|

Americas (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

|

| Revenue |

27.6 |

18.8 |

47% |

a |

|

96.8 |

88.3 |

10% |

b |

| Gross Profit |

3.8 |

2.8 |

39% |

|

|

12.9 |

10.6 |

22% |

|

| Gross margin |

13.9% |

14.7% |

|

|

|

13.4% |

12.0% |

|

|

| Operating costs |

3.6 |

3.1 |

16% |

c |

|

12.4 |

12.8 |

-3% |

d |

| EBIT |

0.2 |

-0.3 |

189% |

|

|

0.5 |

-2.2 |

123% |

|

| EBIT % |

0.8% |

-1.4% |

|

|

|

0.5% |

-2.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

832 |

686 |

21% |

|

|

809 |

750 |

8% |

|

| Average indirects |

106 |

103 |

3% |

|

|

103 |

108 |

-4% |

|

| Ratio direct / Indirect |

7.8 |

6.6 |

|

|

|

7.8 |

7.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 40 % like-for-like |

|

|

|

|

|

|

| b 11 % like-for-like |

|

|

|

|

|

|

| c 15 % like-for-like |

|

|

|

|

|

|

| d -2 % like-for-like |

|

|

|

|

|

|

| |

|

The Americas include Canada, United States,

Mexico, Guyana and Brazil. Revenue growth in the Americas came in

at 47% in Q4 with double digit growth in all countries in the

region, largely driven by an increase in headcount of 21%. Combined

with a modest increase in staff costs, the region turned the loss

in 2020 around and delivered a positive EBIT over Q4 and FY

2021.

|

Rest of world (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q4 2021 |

Q4 2020 |

Δ% |

|

|

FY 2021 |

FY 2020 |

Δ% |

|

| Revenue |

51.2 |

38.8 |

32% |

a |

|

181.5 |

158.3 |

15% |

b |

| Gross Profit |

9.4 |

6.4 |

46% |

|

|

32.8 |

26.9 |

22% |

|

| Gross margin |

18.3% |

16.6% |

|

|

|

18.1% |

17.0% |

|

|

| Operating costs |

7.5 |

5.6 |

34% |

c |

|

25.8 |

23.2 |

11% |

d |

| EBIT |

1.9 |

0.8 |

154% |

|

|

7.0 |

3.7 |

87% |

|

| EBIT % |

3.8% |

1.9% |

|

|

|

3.8% |

2.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,734 |

1,956 |

40% |

|

|

2,320 |

2,070 |

12% |

|

| Average indirects |

295 |

257 |

15% |

|

|

274 |

264 |

3% |

|

| Ratio direct / Indirect |

9.3 |

7.6 |

|

|

|

8.5 |

7.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 33 % like-for-like |

|

|

|

|

|

|

| b 20 % like-for-like |

|

|

|

|

|

|

| c 28 % like-for-like |

|

|

|

|

|

|

| d 12 % like-for-like |

|

|

|

|

|

|

| |

|

Rest of world includes Asia, Russia &

Caspian, Belgium and rest of Europe & Africa. Q4 saw another

strong quarter in Russia, China and Singapore. Europe & Africa

was able to stabilize revenues in Q4 and developed new business

after projects for a large customer had been completed. Revenue

increased by 32% and gross margin increased by 1.7 percentage

point. Overall, the strong performance resulted in a 1.9 percentage

point increased EBIT margin for the quarter, reaching

3.8%.

Tax and net profit

The effective tax rate decreased from 38.5% in

2020 to 29.7% in 2021. Net profit came in at EUR 33.0 million

(2020: EUR 17.5 million), up 88% and resulting in an earnings per

share of EUR 0.61 (2020: EUR 0.31).

DividendWe propose a cash

dividend of EUR 0.45 per share over the 2021 financial year, which

represents a pay-out ratio of 74%.

Cash positionThe cash balance

at 31 December is EUR 112.0 million (EUR 155.0 per 31 December

2020), of which EUR 18.2 million is restricted (EUR 15.1 per 31

December 2020). The decrease is mainly the result of the

acquisition of Taylor Hopkinson.

Outlook Q1 2022

We expect revenue growth to continue, and Q1

2022 revenue (including Taylor Hopkinson) will be slightly higher

than in Q4 2021. In line with the normal seasonality, gross margins

will be slightly lower in Q1 2022 compared to Q4 2021. Operating

costs will increase due to further investments to support continued

growth.

Source: Brunel International NV

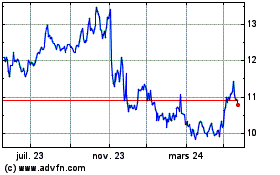

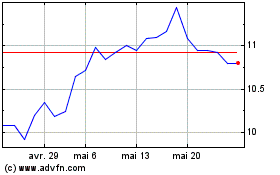

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024