Brunel reports continued strong revenue and EBIT growth

Amsterdam, 29 July 2022 – Brunel International N.V. (Brunel;

BRNL), a global provider of flexible workforce solutions and

expertise, today announced its second quarter 2022 results.

Key points Q2 2022

- Revenue up 35% to EUR 289 million, 19% like-for-like;

- EBIT up 31% to EUR 10.0 million, 24% like-for-like;

- Strategy execution ahead of plan: continued strong headcount

growth;

- Divestment of Russian operations completed;

- Taylor Hopkinson integration on track, resulting in accelerated

growth.

Key points H1 2022

- Revenue up 32% to EUR 564 million, 19% like-for-like;

- EBIT up 40% to EUR 25.7 million, 35% growth like-for-like;

- Gross profit increase of 25% compared to H1 2021.

Jilko Andringa, CEO of Brunel

International N.V.:

“Following the strong start in the first quarter

of the year, we continued on our growth path and have delivered

another strong quarter with double digit like-for-like revenue and

EBIT growth. Our growth is visible across all regions with Asia and

Australia showing a particularly strong acceleration. We have

successfully developed a capability structure, with new and

upgraded solutions that fit the future needs of our chosen client

segments. This leads to profitable growth, both today and for the

quarters and years to come.

According to plan, we completed the earlier

announced sale of our Russian operations to local management. We

like to thank our former colleagues for their commitment and

contributions over the last 20 years.

In addition, we are close to completing the

post-merger integration of Taylor Hopkinson. The number of projects

in the renewable energy market is increasing very rapidly. Our new

colleagues from Taylor Hopkinson continue to outperform their plan,

strengthening our position in this market. We also see growth

accelerating in our other energy markets, and mining.

Besides a strong growth of our contribution to

the energy transition, we are also making progress on other ESG

targets. Our Brunel Foundation arranged that we planted a tree in

the Brunel Foundation Forest for each Bruneller in the world.

Combined with several other joint initiatives with clients and

stakeholders, the Brunel Foundation Forest now has 15,000 new trees

planted. With our other ESG initiatives and our commitment to be a

net zero emission company this year, we aim to contribute to our

client’s energy transition and to a more sustainable world.

We continue to see increased demand for

specialists for many pioneering projects. The future ahead is

bright, our chosen markets show high levels of investment and we

are confident we have the right team in place to deliver upon our

plans, and more.”

ESG strategy

Our diversification strategy with a primary

focus on the renewables sector is testament to our commitment to

contribute to our clients’ energy transition.

Consistent with our commitments to a more

sustainable world and our updated ESG strategy we are accelerating

our efforts to reduce our CO2 emission, whilst we continue to

offset the remainder. Our largest region DACH has implemented a

100% electrical vehicle policy as per this quarter for their lease

fleet, well ahead of the original deadline of 2025.

|

Brunel International (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

|

| Revenue |

289.1 |

214.1 |

35% |

a |

|

563.7 |

427.1 |

32% |

d |

| Gross

Profit |

59.0 |

47.5 |

24% |

|

|

120.9 |

96.8 |

25% |

|

| Gross

margin |

20.4% |

22.2% |

|

|

|

21.4% |

22.7% |

|

|

| Operating

costs |

48.0 |

39.9 |

20% |

b |

|

93.1 |

78.5 |

19% |

e |

| Operating

result |

11.0 |

7.6 |

46% |

|

|

27.8 |

18.3 |

52% |

|

| Earn out

related share based payments* |

1.0 |

- |

|

|

|

2.1 |

- |

|

|

| EBIT |

10.0 |

7.6 |

31% |

c |

|

25.7 |

18.3 |

40% |

f |

| EBIT % |

3.5% |

3.6% |

|

|

|

4.6% |

4.3% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

11,356 |

9,626 |

18% |

|

|

11,295 |

9,458 |

19% |

|

| Average

indirects |

1,446 |

1,299 |

11% |

|

|

1,441 |

1,305 |

10% |

|

| Ratio direct /

indirect |

7.9 |

7.4 |

|

|

|

7.8 |

7.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 19 % at

like-for-like |

d

19 % at like-for-like |

|

|

| b 9 % at

like-for-like |

e

8 % at like-for-like |

|

|

| c 24 % at

like-for-like |

f

35 % at like-for-like |

|

|

|

Like-for-like is measured excluding the impact of currencies and

acquisitions |

|

|

|

|

|

|

*Relates to the acquisition related expenses for Taylor

Hopkinson |

|

|

|

|

|

H1 2022 results by divisionP&L amounts in

EUR million

Summary:

|

Revenue |

Q2 2022 |

Q2 2021 |

Δ% |

|

H1 2022 |

H1 2021 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

55.1 |

53.4 |

3% |

|

113.5 |

109.2 |

4% |

| The

Netherlands |

45.9 |

45.0 |

2% |

|

94.8 |

92.1 |

3% |

| Australasia |

39.6 |

24.7 |

60% |

|

73.6 |

49.9 |

47% |

| Middle East &

India |

34.9 |

25.0 |

40% |

|

65.8 |

50.2 |

31% |

| Americas |

35.2 |

23.5 |

50% |

|

67.7 |

43.8 |

55% |

| Rest of

world |

78.4 |

42.5 |

85% |

|

148.4 |

81.9 |

81% |

| |

|

|

|

|

|

|

|

|

Total |

289.1 |

214.1 |

35% |

|

563.7 |

427.1 |

32% |

|

EBIT |

Q2 2022 |

Q2 2021 |

Δ% |

|

H1 2022 |

H1 2021 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

3.8 |

3.4 |

11% |

|

10.6 |

9.4 |

14% |

| The

Netherlands |

2.7 |

3.2 |

-16% |

|

7.9 |

7.3 |

9% |

| Australasia |

0.8 |

0.2 |

325% |

|

1.0 |

0.2 |

369% |

| Middle East &

India |

3.1 |

2.1 |

49% |

|

6.2 |

4.5 |

37% |

| Americas |

0.5 |

0.2 |

147% |

|

0.9 |

0.1 |

1390% |

| Rest of

world |

2.1 |

1.6 |

35% |

|

5.0 |

2.9 |

75% |

| Unallocated |

-3.0 |

-3.0 |

1% |

|

-5.9 |

-5.9 |

0% |

| |

|

|

|

|

|

|

|

|

Total |

10.0 |

7.6 |

31% |

|

25.7 |

18.3 |

40% |

In Q2 2022 the Group’s revenue increased by 35% or EUR 75

million y-o-y, driven by all regions, with the largest growth in

Rest of World and Australasia. Within Rest of World, Asia and

Taylor Hopkinson are the largest contributors. The energy

transition and the current high commodity prices result in a strong

increase in project activity in our energy and mining markets. In

traditional energy, a huge number of final investment decisions

(FID) is expected for this year, promising a very high activity

level for the years to come. In renewable energy, the market growth

continues to accelerate, as expected, but also due an increased

need to speed up the energy transition due to the current

circumstances.

The gross margin decreased by 1.8 percentage points in Q2 2022,

mainly due to a change in the mix between low to modest growth,

higher margin business in Europe and fast growth, lower margin

business in the other regions.

The leverage effect of strong growth in combination with our

cost management resulted in an EBIT increase of 31% or EUR 2.4

million y-o-y. Like-for-like, EBIT increased by 24%.

PERFORMANCE BY REGION

|

DACH region (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

| Revenue |

55.1 |

53.4 |

3% |

|

|

113.5 |

109.2 |

4% |

| Gross Profit |

18.4 |

17.6 |

5% |

|

|

39.5 |

37.2 |

6% |

| Gross margin |

33.5% |

32.9% |

|

|

|

34.8% |

34.0% |

|

| Operating

costs |

14.6 |

14.2 |

3% |

|

|

28.9 |

27.8 |

4% |

| EBIT |

3.8 |

3.4 |

11% |

|

|

10.6 |

9.4 |

14% |

| EBIT % |

6.8% |

6.3% |

|

|

|

9.4% |

8.6% |

|

| |

|

|

|

|

|

|

|

|

| Average

directs |

2,014 |

1,935 |

4% |

|

|

1,999 |

1,918 |

4% |

| Average

indirects |

402 |

385 |

4% |

|

|

395 |

381 |

4% |

| Ratio direct /

indirect |

5.0 |

5.0 |

|

|

|

5.1 |

5.0 |

|

The DACH region includes

Germany, Switzerland, Austria and Czech Republic. Revenue in the

region increased by 3% mainly driven by higher rates and headcount,

partly offset by a lower productivity due to illness. In Q2 the

Omicron wave in Germany is visible in the illness rates, and

limiting the increase in gross margin to 0.6 percentage points.

Headcount as of 30 June was 2,033.

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

60 |

66 |

62 |

252 |

|

2021 |

63 |

60 |

66 |

65 |

254 |

|

Brunel Netherlands (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

| Revenue |

45.9 |

45.0 |

2% |

|

|

94.8 |

92.1 |

3% |

| Gross

Profit |

12.7 |

12.6 |

1% |

|

|

27.6 |

26.1 |

6% |

| Gross

margin |

27.6% |

27.9% |

|

|

|

29.1% |

28.3% |

|

| Operating

costs |

10.0 |

9.4 |

6% |

|

|

19.7 |

18.8 |

5% |

| EBIT |

2.7 |

3.2 |

-16% |

|

|

7.9 |

7.3 |

9% |

| EBIT % |

5.9% |

7.2% |

|

|

|

8.3% |

7.9% |

|

| |

|

|

|

|

|

|

|

|

| Average

directs |

1,669 |

1,720 |

-3% |

|

|

1,673 |

1,727 |

-3% |

| Average

indirects |

278 |

277 |

0% |

|

|

277 |

289 |

-4% |

| Ratio direct /

indirect |

6.0 |

6.2 |

|

|

|

6.0 |

6.0 |

|

In The Netherlands the revenue

growth of 2% is driven by higher rates, partially offset by a lower

headcount. The gross margin decreased with 0.3 percentage points as

we witnessed higher illness rates in Q2 2022. Operating costs

increased due to a higher spend on marketing and events.

Headcount as of 30 June was 1,673.

Working days per Q 2022 / 2021:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

61 |

66 |

64 |

255 |

|

2021 |

63 |

61 |

66 |

66 |

256 |

|

Australasia (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

|

|

| Revenue |

39.6 |

24.7 |

60% |

a |

|

73.6 |

49.9 |

47% |

d |

|

| Gross

Profit |

4.0 |

2.6 |

51% |

|

|

7.0 |

5.0 |

41% |

|

|

| Gross

margin |

10.0% |

10.6% |

|

|

|

9.6% |

10.0% |

|

|

|

| Operating

costs |

3.2 |

2.4 |

33% |

b |

|

6.0 |

4.8 |

25% |

e |

|

| EBIT |

0.8 |

0.2 |

325% |

c |

|

1.0 |

0.2 |

369% |

f |

|

| EBIT % |

2.0% |

0.8% |

|

|

|

1.3% |

0.4% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Average

directs |

1,351 |

958 |

41% |

|

|

1,303 |

932 |

40% |

|

|

| Average

indirects |

105 |

87 |

21% |

|

|

103 |

85 |

21% |

|

|

| Ratio direct /

indirect |

12.9 |

11.0 |

|

|

|

12.7 |

11.0 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| a 50 %

like-for-like |

d

41 % at like-for-like |

|

|

|

|

|

|

| b 24 %

like-for-like |

e

23 % at like-for-like |

|

|

|

|

|

|

| c 281 %

like-for-like |

f

312 % at like-for-like |

|

|

|

|

|

|

|

Like-for-like is measured excluding the impact of currencies and

acquisitions |

|

|

|

|

|

|

Australasia includes Australia

and Papua New Guinea. We saw strong growth in this region which is

the result of the investments made in our organisation, markets

opening up for expats again and a favourable currency effect. Gross

margin decreased slightly due to changes in the client mix, while

EBIT % increased due to leverage effects in the operating costs

base.

|

Middle East & India (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

|

| Revenue |

34.9 |

25.0 |

40% |

a |

|

65.8 |

50.2 |

31% |

d |

| Gross

Profit |

5.5 |

4.0 |

39% |

|

|

10.7 |

8.1 |

33% |

|

| Gross

margin |

15.7% |

15.8% |

|

|

|

16.3% |

16.1% |

|

|

| Operating

costs |

2.4 |

1.9 |

26% |

b |

|

4.5 |

3.6 |

25% |

e |

| EBIT |

3.1 |

2.1 |

49% |

c |

|

6.2 |

4.5 |

37% |

f |

| EBIT % |

9.0% |

8.4% |

|

|

|

9.4% |

9.0% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

2,205 |

2,022 |

9% |

|

|

2,192 |

2,050 |

7% |

|

| Average

indirects |

133 |

125 |

7% |

|

|

132 |

125 |

5% |

|

| Ratio direct /

indirect |

16.5 |

16.2 |

|

|

|

16.7 |

16.4 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 24 %

like-for-like |

d

19 % at like-for-like |

|

|

|

|

|

| b 15 %

like-for-like |

e

18 % at like-for-like |

|

|

|

|

|

| c 31 %

like-for-like |

f

23 % at like-for-like |

|

|

|

|

|

|

Like-for-like is measured excluding the impact of currencies and

acquisitions |

|

|

|

|

|

Middle East & India includes Qatar, Kuwait,

Dubai, Oman, Kurdistan, Iraq and India. We continue to see growth

in almost all countries from new projects and extensions in the

region, with only Kuwait trailing slightly. Our existing

organisation is capable to manage this growth efficiently,

resulting in an increase in EBIT %.

|

Americas (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

|

| Revenue |

35.2 |

23.5 |

50% |

a |

|

67.7 |

43.8 |

55% |

d |

| Gross

Profit |

4.8 |

3.0 |

60% |

|

|

9.0 |

5.6 |

60% |

|

| Gross

margin |

13.7% |

12.8% |

|

|

|

13.3% |

12.9% |

|

|

| Operating

costs |

4.3 |

2.8 |

54% |

b |

|

8.1 |

5.5 |

47% |

e |

| EBIT |

0.5 |

0.2 |

147% |

c |

|

0.9 |

0.1 |

1390% |

f |

| EBIT % |

1.5% |

0.9% |

|

|

|

1.4% |

0.1% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

906 |

826 |

10% |

|

|

883 |

793 |

11% |

|

| Average

indirects |

121 |

102 |

18% |

|

|

118 |

101 |

16% |

|

| Ratio direct /

indirect |

7.5 |

8.1 |

|

|

|

7.5 |

7.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 33 %

like-for-like |

d 40

% at like-for-like |

|

|

|

|

|

| b 37 %

like-for-like |

e 32

% at like-for-like |

|

|

|

|

|

| c 119 %

like-for-like |

f

1132 % at like-for-like |

|

|

|

|

|

|

Like-for-like is measured excluding the impact of currencies and

acquisitions |

|

|

|

|

|

In the Americas we continue to see strong

growth in our main markets USA, Canada and Brazil. The growth is

mainly driven by higher rates, new project wins and a favourable

currency effect. EBIT % shows and upward trend, driven by the

revenue and margin increase.

|

Rest of world (unaudited) |

|

P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q2 2022 |

Q2 2021 |

Δ% |

|

|

H1 2022 |

H1 2021 |

Δ% |

|

| Revenue |

78.4 |

42.5 |

85% |

a |

|

148.4 |

81.9 |

81% |

d |

| Gross

Profit |

13.7 |

7.7 |

77% |

|

|

27.0 |

14.8 |

82% |

|

| Gross

margin |

17.4% |

18.2% |

|

|

|

18.2% |

18.1% |

|

|

| Operating

costs |

10.6 |

6.1 |

74% |

b |

|

19.9 |

11.9 |

67% |

e |

| Operating

result |

3.1 |

1.6 |

89% |

|

|

7.1 |

2.9 |

140% |

|

| Earn out

related share based payments* |

1.0 |

- |

|

|

|

2.1 |

- |

|

|

| EBIT |

2.1 |

1.6 |

35% |

c |

|

5.0 |

2.9 |

75% |

f |

| EBIT % |

2.7% |

3.7% |

|

|

|

3.4% |

3.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

3,212 |

2,164 |

48% |

|

|

3,244 |

2,038 |

59% |

|

| Average

indirects |

348 |

262 |

33% |

|

|

357 |

263 |

36% |

|

| Ratio direct /

indirect |

9.2 |

8.3 |

|

|

|

9.1 |

7.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 26 %

like-for-like |

d

30 % at like-for-like |

|

|

|

|

|

| b 9 %

like-for-like |

e

9 % at like-for-like |

|

|

|

|

|

| c 35 %

like-for-like |

f

80 % at like-for-like |

|

|

|

|

|

|

Like-for-like is measured excluding the impact of currencies and

acquisitions |

|

|

|

|

|

|

*Relates to the acquisition related expenses for Taylor

Hopkinson |

|

|

|

|

|

Rest of World includes Asia,

Belgium, Taylor Hopkinson and rest of Europe & Africa. Growth

in this region is mainly driven by a strong performance and

favorable market circumstances in Asia and by the acquisition of

Taylor Hopkinson, partially offset by the divestment of Russia.

EBIT % was down due to the earn out expense relating to the Taylor

Hopkinson acquisition.Divestment of Russia In June

2022 we finalized the transfer of our operations in Russia to local

management. These activities contributed EUR 8 million in revenue

and a breakeven EBIT in Q2. Due to the appreciation of the Russian

Ruble, our net investment in these activities increased to EUR 19

million (from EUR 14 million at 31 March 2022). We agreed a gross

purchase price of EUR 12 million, denominated in Russian Rubles to

be received in four equal annual installments with the first

payment being on 31 December 2023. The fair value of this

receivable of EUR 12 million is determined at

EUR 9 million as at 30 June 2022. As a result, and

including the historic exchange losses of our Russian operations,

we report a one-time loss of in total EUR 10 million on the

divestment.

Tax and net profit

The effective tax rate for the six-month period

ended on 30 June 2022 is 47.8%, mainly due to the non-deductible

loss on the divestment of the Russian operations. Adjusted for

this, the effective tax rate is 27.7% (H1 2021: 32.4%). We expect

this adjusted effective tax rate for the full year to remain at

this level (2021: 29.7%). Including the one-time loss on the

divestment, net profit came in at EUR 6.2 million (H1 2021: EUR

11.3 million), reflecting an earnings per share of EUR 0.12 (H1

2021: EUR 0.22).

Risk profileReference is made

to our 2021 Annual Report (pages 68 - 82). Reassessment of our

earlier identified risks and the potential impact on

occurrence has not resulted in required changes in our internal

riskmanagement and control systems.

Cash positionThe cash balance

at 30 June 2022 was EUR 58.3 million (EUR 112.0 per 31 December

2021), of which EUR 19.1 million restricted (EUR 18.2 million

per 31 December 2021). The decrease is mainly attributable to

additional working capital requirements to support growth, the

normal seasonality and the dividend payment in June. We have

overdraft facilities in place to be able to fund continued growth

or potential M&A activities.

OutlookWe anticipate the high

demand from large customers for engineering power in renewables,

energy and mining to continue in Q3 2022. Supported by seasonality

and additional working days, this will result in an increase in Q3

revenue, gross profit and EBIT, both y-o-y and compared to Q2.

Statement of the Board of

DirectorsThe Board of Directors of Brunel International

N.V. hereby declares that, to the best of its knowledge:

- the interim financial statements

give a true and fair view of the assets, liabilities, financial

position and result of Brunel International N.V. and the companies

jointly included in the consolidation, and

- the interim report gives a true and

fair view of the information referred to in the eighth and, insofar

as applicable, the ninth subsection of Section 5:25d of the Dutch

Act on Financial Supervision and with reference to the section on

related parties in the interim financial statements.

Amsterdam, 29 July 2022Brunel International

N.V.

Jilko Andringa (CEO)Peter de Laat (CFO)Graeme

Maude (COO)

Attachment:

Source: Brunel International NV

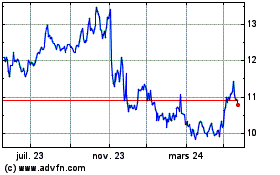

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

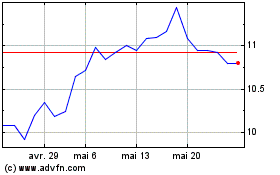

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024