Cabka 2023 Half Year: Profitable revenue growth to € 104 million

with net income from operations at € 3 million

Amsterdam August 22, 2023.

Cabka N.V. (together with its subsidiaries, the “Company”)

a company specialized in transforming hard to recycle plastic waste

into innovative Reusable Transport Packaging (RTP), listed at

Euronext Amsterdam, announces its non-audited results for the first

six months ended June 30, 2023 (“2023HY”), today.1

Highlights 2023 Half Year

- Sales of € 104.3 million representing a 2%

Year-on-Year (YoY) growth

- Gross profit from operations increased to €

50.8 million (2022HY: € 47.3 million) representing an improved

margin of 49% over sales compared to last year

(2022HY: 46%)

- EBITDA from operations at €

13.4 million (2022HY: € 13.1 million) at 13% (2022HY: 13%),

recovering from a volatile second half of 2022

- Net Income from operations showing recovery to

€ 3.0 million (2022HY: € 0.7million)

- Net result € 0.8 million, recovering from

net-loss mainly due to IPO related costs in 2022HY (€ -1.9

million)

- Earnings per share € 0.03 up € 0.11 from the

same period in 2022 (2022HY € -0.08 per share)

- Net Working Capital remains stable at € 37.0

million, or 18% of sales

- CAPEX of € 13.0 million, similar to 2022HY,

including maintenance & replacement investments of € 3.6

million or 3.5% of sales excluding US flooding related

investments2

- Recycled material used in products 88% of

total compared to a European average3 of 14%

- Cabka North America as planned returned to

full production by end of June

- Frank Roerink appointed CFO at June 8 Annual

General Meeting

Cabka CEO Tim Litjens, commented:

“We can report positive progress, despite facing

some challenges in the first six months of 2023. Customized

Solutions demonstrated growth of 40%, primarily driven by a

significant increase in the US market, fueled by Target.

Additionally, our Portfolio business in the EU demonstrated steady

growth, with an 11% rise compared to the same period in 2022. This

progress is partly offset by a 20% decline in our Contract

Manufacturing business, albeit, mainly driven by a gradual

reduction in non-strategic products. Overall, our strategic focus

segments showed solid improvement, growing by 6% compared to the

very strong growth in the first half of 2022.

After our US operation in St. Louis suffered

from a flash flooding one year ago, recovery was completed as

planned. Last month we have celebrated the reopening of the US

plant, which is a testament to the resilience and dedication of our

team. This progress ends our reliance on the use of external

tolling production capacity, and we have returned to full in-house

production as of the end of June. We have invested in upgrading and

expanding our facilities, reducing the average age of our machine

park from 13 to 3 years and are ideally equipped for

re-establishing our strong commercial position in the market.

In the past 12 months, Cabka has faced the

challenge of volatile material and energy pricing. We have taken

efforts to mitigate the effects from this volatility, and meanwhile

markets have reached similar pricing levels as before the start of

the war in Ukraine. This combined brings less uncertainty around

our input costs. As a result, our EBITDA has shown a great

improvement, from the challenging second half of 2022, at 13% over

Sales. Despite the slower sales growth, we have demonstrated a

strong recovery in profitability, delivering on the most recent

outlook statement we provided. We will continue to focus on

improving operational efficiencies to sustain this positive

trend.

As we move forward, it is essential to

acknowledge that the current economic uncertainty presents

challenges for our business and the wider market especially on

sales for the year. As we remain cautiously optimistic navigating

through these economic uncertainties, we stand by our outlook of 13

-15% EBITDA margin for 2023.“

Key figures first six months 2023 including split in

operational and non-operational items

| Condensed income statement

bridge regular operations to IFRS4 |

|

|

|

|

|

| in

Euro million |

2023 HY |

2022 HY5 |

Change |

|

|

| |

|

|

|

|

|

|

|

|

|

Sales |

104.3 |

102.2 |

2% |

|

|

|

|

|

|

|

|

|

|

Other operating income items |

0.4 |

4.5 |

-90% |

|

|

|

Total Operating Income |

104.7 |

106.8 |

-2% |

|

|

|

|

|

|

|

|

|

|

Expenses for materials, energy and purchased services |

(53.9) |

(59.5) |

-9% |

|

|

|

Gross Profit from regular operations |

50.8 |

47.3 |

7% |

|

|

|

|

|

|

|

|

|

|

Operating expenses |

(37.4) |

(34.2) |

9% |

|

|

|

EBITDA from regular operations |

13.4 |

13.1 |

2% |

|

|

|

|

|

|

|

|

|

|

Depreciation, amortization and impairment of intangible and

tangible fixed assets |

(8.0) |

(9.3) |

-14% |

|

|

|

EBIT /Operating Income |

5.3 |

3.7 |

43% |

|

|

|

|

|

|

|

|

|

|

Financial results |

(1.3) |

(1.1) |

20% |

|

|

|

Earnings before taxes |

4.0 |

2.6 |

53% |

|

|

|

|

|

|

|

|

|

|

Taxes |

(1.0) |

(1.9) |

-47% |

|

|

|

Net income from regular operations |

3.0 |

0.7 |

429% |

|

|

| |

|

|

|

|

|

|

Non-operational items as reported |

|

|

|

|

|

|

Net impact of flooding |

(3.1) |

- |

|

|

|

|

Changes of value in special shares/warrants |

0.1 |

3.5 |

|

|

|

|

Extraordinary items 2022 (incl. IPO Related costs) |

- |

(6.1) |

|

|

|

|

Non-operational tax impact |

0.8 |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

- |

(0.1) |

|

|

|

|

|

|

|

|

|

|

|

Net result reported IFRS |

0.8 |

(1.9) |

n.m. |

|

|

| |

|

|

|

|

|

|

| Specification non-operational

impact of flooding |

|

|

|

|

| in

Euro million |

|

Shown in IFRS accounting as |

|

|

| |

|

|

|

|

|

|

|

|

Reversal 2022 impairment on production line |

0.5 |

Other operating income |

|

|

|

Insurance proceeds received |

1.2 |

Other operating income |

|

|

|

Extra ordinary expenses flooding |

(1.7) |

Other operating expenses |

|

|

|

Extra tolling expenses due to flooding |

(3.1) |

Purchased services |

|

|

|

|

|

|

|

|

|

Net impact of flooding 2023HY |

(3.1) |

|

|

|

OutlookBased on Cabka’s strong

fundamentals we reiterate our mid-term guidance6. Based on current

challenging market conditions, we expect 2023 revenues of € 200 -

210 million with a recovery of EBITDA margin towards 13-15%.

Share capitalAfter March 15,

2023, following the lock up period, Cabka issued in total 398,022

Ordinary Shares from treasury to cover its obligations under its

share program plans for key staff, resulting in a total of

24,380,213 Ordinary Shares issued per June 30, 2023, and 15,989,978

Ordinary Shares remaining in treasury.

An overview of total number of shares per end of

2022 and per end of 2023HY is provided in the table below.

|

Cabka shares per |

06.30.2023 |

12.31.2022 |

ISIN |

| Ordinary Shares issued |

24,380,213 |

23,982,191 |

CABKA

/ NL00150000S7 |

| Ordinary Shares in treasury |

15,989,978 |

16,388,000 |

DSC2S

/ NL00150002R5 |

| |

|

|

|

| Total Ordinary Shares |

40,370,191 |

40,370,191 |

|

| Special Shares |

97,778 |

97,778 |

|

| |

|

|

|

|

Total shares |

40,467,969 |

40,467,969 |

|

Relevant events after June 30, 2022

ORBIS Corporation (US) and Cabka jointly agreed

to extend their successful existing manufacturing contract for

another three years. The contract between ORBIS and Cabka is

considered material with regards to the estimated annual revenues

involved.

Appointment of new CTIO

Mr. Javier Fernández Vázquez

has been appointed Chief Technology & Innovation Officer (CTIO)

and Managing Director of Cabka Spain as of October 1, 2023. Javier

Fernández is currently director Program Management Europe &

Asia at SRG Global. In his capacity as CTIO he will also join the

Executive Committee of Cabka Group.

At the same time Chief Product Officer Material

Handling Jean-Marc van Maren will change to a new

role as advisor to the Board. Both Javier Fernández and Jean-Marc

van Maren will report directly to CEO Tim Litjens.

Proposed distribution 2022FY

The proposed distribution for Full Year 2022 of

€ 0.15 per share of which € 0.05 in cash and € 0.10 in ordinary

shares will be paid on Friday August 25.

The number of ordinary share distribution rights

entitled to one new ordinary share will be determined based on the

volume-weighted average price ("VWAP") of all traded Company’s

ordinary shares at Euronext Amsterdam on Monday August 21, 2023,

and Tuesday August 22, 2023. Rights to fractions of ordinary shares

shall be paid in cash. There will be no trading in ordinary share

distribution rights. Cabka will publish a press release with the

total number of ordinary shares issued to cover the share

distribution on August 24.

Financial Calendar

- August 22

Publication Half Year Results 2023

- August 25

Dividend* Payment Date

- October 19

Trading Update Q3 2023

- March 20, 2024 Publication

Preliminary Results 2023

* Reference to ‘dividend’ refers to proposed distribution

For more information, please contact:David

Brilleslijper, Investor & Press contactE: IR@cabka.com, or

D.Brilleslijper@cabka.com, M: +316 109 42514W:

investors.cabka.com

About Cabka

Cabka is in the business of recycling plastics

from post-consumer and post-industrial waste into innovative

reusable transport packaging (RTP), like pallets- and large

container solutions enhancing logistics chain sustainability. ECO

products are mainly construction and road safety products produced

exclusively out of post-consumer waste.

Cabka is leading the industry in its integrated

approach closing the loop from waste, to recycling, to

manufacturing. Backed by its own innovation center it has the rare

industry knowledge, capability, and capacity of making maximum use

bringing recycled plastics back in the production loop at

attractive returns. Cabka is fully equipped to exploit the full

value chain from waste to end-products.

Cabka is listed at Euronext Amsterdam as of

March 1, 2022, under the CABKA ticker with international securities

identification number NL00150000S7.

Disclaimer

The content of this press release may include

statements that are, or may be deemed to be, ‘’forward-looking

statements’’. These forward-looking statements may be identified by

the use of forward-looking terminology, including the terms

‘’believes’’, ‘’estimates’’, ‘’plans’’, ‘’projects’’,

‘’anticipates’’, ‘’expects’’, ‘’intends’’, ‘’may’’, ‘’will’’ or

‘’should’’ or, in each case, their negative or other variations or

comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements reflect the Company’s current view

with respect to future events and are subject to risks relating to

future events and other risks, uncertainties and assumptions

relating to the Company’s business, results of operations,

financial position, liquidity, prospects, growth, or

strategies.

Readers are cautioned that any forward-looking

statements are not guarantees of future performance. Given

these uncertainties, the reader is advised not to place any undue

reliance on such forward-looking statements. These forward-looking

statements speak only as of the date of publication of this press

release. The Company undertakes no obligation to publicly update or

revise the information in this press release, including any

forward-looking statements, except as may be required by law.

This document contains information that

qualifies as inside information within the meaning of Article 7(1)

of Regulation (EU) No 596/2014 on market abuse.

1 This press release contains a summary of the 2023HY results,

for full report see the attached Half Year Report 2023

2 Including the US, € 8.2 million, or 7.9% of sales mainly

driven by flooding related investments

3 Systemiq April 2022 report Reshaping plastics. Pathway to a

circular climate neutral plastics system in Europe

4 The condensed income statement provides

operational and non-operational result items for insight on

underlying operational performance. The statements in the attached

Half Year Report 2023 provide integral IFRS statements without this

distinction.

5 As Cabka was still working on the accounting

of the De-SPAC/listing transaction at the publication date of the

2022HY results and therefore only included the expenses at 2022FY

-and as reported in Cabka’s Annual Report 2022 published April 25,

2023- but not in its 2022HY results as published on August 17,

2022, all affected comparable figures for 2022HY are provided as

published on August 17, 2022 i.e. without taking into account

listing expenses.

6 Mid-term guidance: High single digit revenue growth; >20%

EBITDA margin; ~4% maintenance and replacement CAPEX and ~20% NWC

as percentage of revenues; ~30-35% pay-out ratio of net profit (€

0.15 for 2022FY)

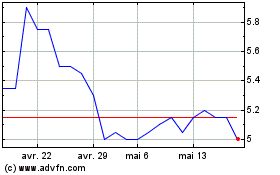

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025