Cabka announces 1 August 2024 EGM Agenda

Cabka announces 1 August 2024 EGM

Agenda

Amsterdam 20 June 2024.

Cabka N.V. (together with its subsidiaries “Cabka”, or the

“Company”), a company specialized in transforming hard to recycle

plastic waste into innovative Reusable Transport Packaging (RTP),

listed at Euronext Amsterdam, invites its shareholders to attend

the Company's extraordinary general meeting (the “General

Meeting”), to be held on Thursday 1 August 2024 at 14:00

CEST.

The Company looks forward to welcoming

its shareholders both in-person and virtual at John M. Keynesplein

10, 1066 EP Amsterdam, the Netherlands. Registration for admission

to the General Meeting starts at 13:00 CEST. The language of the

General Meeting shall be English.

AGENDA

-

Opening

-

Appointment of managing director (voting

item)

-

Amendment of the remuneration policy of the management

board (voting item)

- Any

other business

-

Closing

EXPLANATORY NOTES TO THE AGENDA

Agenda item 2: Appointment of managing

director (voting item)

As announced in the press releases on 19 March

2024 and 2 May 2024, Mr. Tim Litjens announced his decision to step

down as managing director and CEO of the Company respectively the

supervisory board has nominated Mr. Alexander G. Masharov to be

appointed as managing director effective as of the date of this

General Meeting for a term ending at the end of the annual general

meeting to be held in 2028. Subject to the appointment taking

effect, (i) the supervisory board has designated Mr. Alexander G.

Masharov as CEO of the management board of the Company and (ii) Mr.

Tim Litjens will step down as managing director and CEO of the

Company.

The personal details of Mr. Alexander G.

Masharov and the reason for his nomination are as follows:

|

Name: |

Alexander G. Masharov |

|

Age: |

44 |

|

Nationality: |

Israeli |

| Current

position: |

CEO of B&C International, part of Springs Window Fashions

Group |

| Previous

positions: |

Managing Director roles within the KETER Group (2013 - 2023) |

| |

COO of Bytplast (2011 - 2013) |

| |

Head of Industry of Asteros (2010 - 2011) |

| |

Co-Founder of Emerald Information Systems (2006 - 2010) |

| Other

(board) positions: |

Not applicable |

|

Motivation: |

Alexander Masharov is nominated for appointment as managing

director and CEO. With his profound professional background and his

passion for a more sustainable environment, Alexander Masharov is

the perfect fit for the Company. His expertise in the field will

help the Company to grow and create long-term success. Since there

was a mutual click between Alexander Masharov, the supervisory

board, the CFO, Frank Roerink, and given the fact that the

nomination guarantees a good balance in the management board, it

was decided to -nominate Alexander Masharov as managing director

and CEO of the Company. |

Main elements of management agreement of

Alexander G. Masharov

Alexander Masharov will enter into a management

agreement with Cabka N.V. as of the date of appointment. The

management agreement is governed by Dutch law and entered into for

an indefinite period of time.

The management agreement of Alexander Masharov

can be terminated with due observance of a notice period of six

months for Alexander Masharov, and twelve months for Cabka N.V. The

management agreement does not contain a contractual severance

arrangement. Furthermore, Alexander Masharov is entitled to 29

holidays and is entitled to a company car.

It will be specified that the remuneration shall

be determined by the supervisory board in accordance with the

remuneration policy of the Company as adopted by the general

meeting from time to time. Based on the remuneration policy

Alexander Masharov will be entitled to an annual fee as

compensation for the services to be performed for the Company.

The management agreement will contain

restrictive covenants, such as (i) a confidentiality clause, (ii) a

non-competition clause, (iii) a non-solicitation and non-poaching

clause and (iv) a protection of intellectual property clause.

The management agreement shall terminate by

operation of law, without notice being required or any compensation

being due, on the earlier of (i) the date directly following the

annual general meeting in 2028, unless Alexander Masharov is

reappointed as a managing director, in which case the term

terminates by operation of law on the date directly after the

annual general meeting in 2032, unless determined otherwise by the

general meeting, and (ii) the moment that Alexander Masharov is no

longer a member of the management board due to a termination for an

urgent cause.

Under the management agreement, Alexander

Masharov is entitled to a maximum annual base fee of EUR 390.000,00

gross for the services to be performed for the Company and its

subsidiaries.

Short-term incentive program

Alexander Masharov is eligible to participate in

the short-term incentive (STI) program of the Company. The STI

amount is based on 2/12 of the annual base fee and the payout is

based on a minimum of 100% target achievement to be determined by

the supervisory board.

Long-term incentive program

Alexander Masharov is eligible to participate in

the long-term incentive (LTI) program of the Company.

It is intended that Alexander Masharov will be

awarded Restricted Stock Units (RSUs) as follows:

The LTI is based on 50% of the annual base fee

and will be payable in the form of RSUs. The payout will be subject

to the achievement of a three-year cumulative EBITDA target, which

EBITDA target will be determined by the supervisory board. For the

financial year 2024 the RSUs will be granted on a pro rata basis.

The number of RSUs is calculated on the basis of the last 60-days

volume-weighted average price (VWAP) before the date of grant.

Vesting will be subject to continued engagement

of the managing director with the Company. The main elements of the

LTI program are further detailed under agenda item 3 under

‘Long-term incentives’.

Shares

Alexander Masharov does not hold any shares in

the share capital of the Company.

Agenda item 3: Amendment of the

remuneration policy of the management board (voting

item)

Based on the advice of the remuneration

committee, a proposed new remuneration policy for the management

board has been drawn up. Apart from the following deviations as

described below, the proposed policy will be the same as the

current remuneration policy as originally adopted by the general

meeting on 8 June 2023.

Short-term incentives

It is proposed to amend the variable

remuneration pursuant to the STI program for the managing director

with the title of CEO as follows:

two monthly salary for achieving a

(non-normalized) EBIDTA to be determined by the supervisory board

on a proposal of the remuneration committee and for every EUR 1.5

million EBITDA exceeding the aforementioned determined EBITDA, one

additional monthly salary (calculated proportionally).

Long-term incentives

In addition to the current LTI program, it is

proposed to introduce a new LTI program for among others the

management board in order to share Cabka’s future success, reward

contributions and promote long-term commitment.

The new LTI program will consist of two types of

incentives, being (i) stock options (which will provide for a right

to purchase shares in the share capital of the Company at a

predetermined price) and (ii) RSUs (which will provide for a right

to receive shares in the share capital of the Company at a

predefined moment in the future).

The eligible group of managers, the type of

incentive (stock options and/or RSUs) and the grant levels under

the new LTI program will be subject to the approval of the

management board and the supervisory board. Under the new LTI

program it is further envisaged that the management board will

establish a grant allocation scheme with the number of stock

options and/or RSUs to be granted based on the position of the

relevant participant within the Company.

Under the new LTI program, the relevant

instruments (stock options and RSUs) will be subject to a vesting

scheme. Non-vested stock options cannot be exercised and non-vested

RSUs cannot be settled. If a participant leaves the Company, all

granted but unvested stock options will be forfeited.

The grant will be adjustable (from 0% to 130%)

based on the job performance of the relevant participant. The

adjustment of the grant will be determined after the vesting period

of the stock options and/or RSUs based on the achievement of a

cumulative three-year EBITDA target, which EBITDA target will be

determined by the supervisory board. Accelerated vesting will be

subject to the approval of the supervisory board and the

supervisory board will have the right to overwrite and/or adjust

any grant of stock options and/or RSUs.

Participants will not be allowed to exercise

stock options or sell shares received pursuant to the vesting of

RSUs within the first 5 years following the date of grant.

If the new LTI program will be approved, no more

grants under the current LTI program will be issued.

Agenda item 4: Any other

business

Under this agenda item the General Meeting will

be invited to ask remaining questions.

AVAILABILITY OF MEETING DOCUMENTS

The agenda with explanatory notes and other

documents are made available on

https://investors.cabka.com/corporate-governance/shareholder-meetings.

These documents are also made available by ABN AMRO Bank N.V.

("ABN AMRO") and can be downloaded from

www.abnamro.com/evoting, and are available for review by

shareholders (by appointment through IR@cabka.com) at the office of

the Company.

RECORD DATE

The management

board of the Company has determined that for this meeting the

persons who will be considered as entitled to attend the meeting,

are those holders of shares who on Thursday 4 July 2024, after

close of trading on Euronext Amsterdam (the "Record

Date"), hold those rights and are registered as such in

one of the following (sub)registers:

- for holders of

deposit shares: the administrations of the banks and brokers which

are intermediaries according to the Dutch Securities Giro

Transactions Act (Wet giraal effectenverkeer);

- for holders of

non-deposit shares: the shareholders’ register of the Company.

REGISTRATION TO VOTE

Shareholders are entitled to vote up to the

total number of shares that they held at the close of trading at

the Record Date, provided they have registered their shares

timely.

Upon registration via ABN AMRO (via

www.abnamro.com/evoting) shareholders will be requested to specify

if they will attend the meeting in-person or virtually.

Alternatively, shareholders may also grant a proxy to vote as

referred to below.

A holder of deposit shares (electronic

securities) who wishes to attend the meeting in-person or

virtually must register with ABN AMRO (via www.abnamro.com/evoting)

as of the Record Date and no later than Thursday 25 July 2024,

17:00 CEST. A confirmation by the intermediary in which

administration the holder is registered for the deposit shares (the

"Intermediary") must be submitted to ABN AMRO (via

www.abnamro.com/intermediary), stating that such shares were

registered in his/her name at the Record Date. This confirmation

should be provided by the Intermediary to ABN AMRO no later than

Friday 26 July 2024, 13:00 CEST. With this confirmation,

Intermediaries are furthermore requested to include the full

address details of the relevant holder in order to be able to

verify the shareholding on the Record Date in an efficient manner.

If a holder wishes to attend the meeting virtually, his valid email

address, securities account and mobile phone number are required

for authentication purposes in order to provide virtual access. The

receipt (of registration) to be supplied by ABN AMRO will serve as

admission ticket to the meeting for those attending the meeting

in-person.

A holder of non-deposit shares

who wishes to attend the meeting must register no later than

Thursday 25 July 2024, 17:00 CEST, in the manner as set out in the

letter of notification. A holder of only non-deposit shares cannot

attend the meeting virtually.

VOTING BY PROXY

Without prejudice to the obligation to register

for the meeting, the right to attend and to vote at the meeting may

be exercised by a holder of a written proxy. A form of a written

proxy is available free of charge in the manner set out under

"Availability of meeting documents" above. The written proxy must

be received by the Company no later than on Thursday 25 July 2024,

17:00 CEST. A copy of the proxy will need to be presented at the

registration for admission to the meeting.

The proxy to represent a shareholder that

includes a voting instruction may (but needs not) be granted

electronically to B.J. Kuck, civil-law notary in Amsterdam, or his

deputy, via www.abnamro.com/evoting no later than Thursday 25 July

2024, 17:00 CEST. The Intermediaries must submit to ABN AMRO a

confirmation including the number of shares notified for

registration and held by that shareholder at the Record Date. This

confirmation should be provided by the Intermediary to ABN AMRO no

later than Friday 26 July 2024, 13:00 CEST.

Shareholders who have chosen upon registration

to attend the meeting virtually will not be able to issue a proxy

to vote after Thursday 25 July 2024, 17:00 CEST.

If you intend to instruct your Intermediary for

any of the above, please be aware that their deadlines could be a

number of days before those mentioned above. Please check with the

individual Intermediaries as to their cut-off dates.

VIRTUAL VOTING

The Company wishes to assist its shareholders to

attend the meeting virtually by providing an adequate opportunity

to follow the proceedings of the meeting and to vote electronically

and real time during the meeting. Shareholders can attend and vote

at the meeting on all resolutions via the internet, therefore

online and remote with their own smartphone, tablet or personal

computer, unless the relevant Intermediary does not accommodate

online voting. Shareholders attending the meeting virtually will

also be able to ask written questions during the meeting.

Upon registration to vote virtually, a

shareholder will receive an email with a link via

www.abnamro.com/evoting to login to the Company’s online voting

platform. After successful login and confirmation of the login via

two factor authentication (by SMS verification), the shareholder is

automatically logged into the meeting. Further instructions may be

provided via www.abnamro.com/evoting and/or the Company’s online

voting platform.

You will be able to log in for virtual admission

to the meeting on Thursday 1 August 2024 via

www.abnamro.com/evoting from 13:00 CEST until the commencement of

the meeting at 14:00 CEST. You must log in and complete the

admission procedure for the meeting before 14:00 CEST. After this

time registration is no longer possible. Shareholders who log in

afterwards will only have access to the live stream to follow the

meeting, but will not be able to vote.

Minimum requirements to the devices and systems

that can be used for virtual participation as well as an overview

of Q&A’s regarding online voting and the Company’s Policy

regarding the Hybrid General Meeting of Shareholders can be found

at

https://investors.cabka.com/corporate-governance/shareholder-meetings

(together with the meeting documents).

Virtual participation entails risks, as

described in the Company’s Policy regarding the Hybrid General

Meeting of Shareholders. If you wish to avoid such risks you should

choose to attend the meeting in person or by proxy.

REGISTRATION AND IDENTIFICATION AT THE

MEETING

Registration for admission to the meeting will

take place from 13:00 CEST until the commencement of the meeting at

14:00 CEST. After this time registration is no longer possible.

Persons entitled to attend the meeting may be asked for

identification prior to being admitted by means of a valid identity

document, such as a passport or driver’s license.

WEBCAST

The meeting will be broadcasted live and in full

online. The participants will receive a personal invite by email 1

hour before the meeting. This email will contain instructions on

how to attend the meeting online.

ISSUED CAPITAL AND VOTING RIGHTS

At the start of trading on Euronext Amsterdam on

the date of this notice, the Company's total issued share capital

amounted to 40,802,756 shares, which shares comprise a total number

of voting rights of 40,802,756. Of these shares an amount of

15,994,378 shares are held in treasury.

For further information, please see the

Company's website https://cabka.com/newsroom/ or contact us by

email at IR@cabka.com.

The supervisory boardThe management board

Amsterdam, 20 June 2024

Financial Calendar 2024

|

|

Ex-Dividend* Date |

|

|

Dividend* Record Date |

|

|

Half-Year Results and Half-Year Report 2024 |

|

|

Dividend* Payment Date |

|

|

Trading Update Q3 2024 |

* Reference to ‘dividend’ refers to proposed

distribution

For more information, please

contact:Nadia Lubbe, Investor & Press

contactIR@cabka.com, or n.lubbe@cabka.com;+49 152 243 254

79www.investors.cabka.comCommercial contact: info@cabka.com

www.cabka.com

About CabkaCabka is in the

business of recycling plastics from post-consumer and

post-industrial waste into innovative reusable transport packaging

(RTP), like pallets- and large container solutions enhancing

logistics chain sustainability. ECO product are mainly construction

and road safety products produced exclusively out of post-consumer

waste.

Cabka is leading the industry in its integrated

approach closing the loop from waste, to recycling, to

manufacturing. Backed by its own innovation center it has the rare

industry knowledge, capability, and capacity of making maximum use

bringing recycled plastics back in the production loop at

attractive returns. Cabka is fully equipped to exploit the full

value chain from waste to end-products.

Cabka is listed at Euronext Amsterdam as of 1

March 2022 under the CABKA ticker with international securities

identification number NL00150000S7.

DisclaimerThe content of this

press release may include statements that are, or may be deemed to

be, ‘’forward-looking statements’’. These forward-looking

statements may be identified by the use of forward-looking

terminology, including the terms ‘’believes’’, ‘’estimates’’,

‘’plans’’, ‘’projects’’, ‘’anticipates’’, ‘’expects’’, ‘’intends’’,

‘’may’’, ‘’will’’ or ‘’should’’ or, in each case, their negative or

other variations or comparable terminology, or by discussions of

strategy, plans, objectives, goals, future events or intentions.

Forward-looking statements may and often do differ materially from

actual results. Any forward-looking statements reflect the

Company’s current view with respect to future events and are

subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Company’s business,

results of operations, financial position, liquidity, prospects,

growth, or strategies.

Readers are cautioned that any forward-looking

statements are not guarantees of future performance. Given these

uncertainties, the reader is advised not to place any undue

reliance on such forward-looking statements. These forward-looking

statements speak only as of the date of publication of this press

release. The Company undertakes no obligation to publicly update or

revise the information in this press release, including any

forward-looking statements, except as may be required by law.

This document contains information that may

qualify as inside information within the meaning of Article 7(1) of

Regulation (EU) No 596/2014 on market abuse.

- 20240620_Cabka announces 1 August 2024 EGM agenda

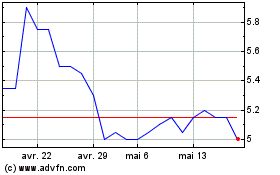

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025