Quarterly financial information as of September

30, 2024 IFRS - Regulated information - Not audited

Cegedim: Revenue growth continued in the

third quarter of 2024

- Revenue of €156.8 million in Q3 2024, up 5.7%

- Marketing, BPO, HR, and cloud businesses led the way

- Revenue for the first nine months of 2024 grew 5.9% to €475.8

million

Boulogne-Billancourt, France, October 24,

2024, after the market close.Revenue

|

|

Third quarter |

Change Q3 2024 / 2023 |

|

in millions of euros |

2024 |

2023reclassified(1) |

Reclassification(1) |

2023Reported |

Reportedvs.

reclassified(1) |

Like for

like(2)(3)vs.

reclassified(1) |

|

Software & Services |

75.6 |

76.0 |

-4.8 |

80.8 |

-0.5% |

-4.2% |

|

Flow |

23.7 |

22.4 |

-0.4 |

22.8 |

5.5% |

5.4% |

|

Data & Marketing |

28.2 |

24.1 |

0.0 |

24.1 |

17.0% |

17.1% |

|

BPO |

21.6 |

19.0 |

0.0 |

19.0 |

13.9% |

13.9% |

|

Cloud & Support |

7.7 |

6.8 |

+5.2 |

1.6 |

12.5% |

12.5% |

|

Cegedim |

156.8 |

148.3 |

0.0 |

148.3 |

5.7% |

3.8% |

|

|

First 9 months |

Change 9M 2023 / 2022 |

|

in millions of euros |

2024 |

2023reclassified(1) |

Reclassification(1) |

2023Reported |

Reportedvs.

reclassified(1) |

Like for

like(2)(4)vs.

reclassified(1) |

|

Software & Services |

227.7 |

226.6 |

-15.7 |

242.3 |

0.5% |

-2.6% |

|

Flow |

73.2 |

69.2 |

-1.8 |

71.0 |

5.7% |

5.6% |

|

Data & Marketing |

87.5 |

79.0 |

0.0 |

79.0 |

10.8% |

10.8% |

|

BPO |

61.5 |

51.8 |

0.0 |

51.8 |

18.8% |

18.8% |

|

Cloud & Support |

25.8 |

22.6 |

+17.5 |

5.1 |

13.9% |

13.9% |

|

Cegedim |

475.8 |

449.3 |

0.0 |

449.3 |

5.9% |

4.3% |

Cegedim posted consolidated third quarter revenues

up 5.7% as reported and 3.8% like for like(2) compared with the

same period in 2023. Revenues to end-September rose 5.9% as

reported and 4.3% like for like compared with 9M 2023. Marketing,

BPO, HR, and cloud businesses all delivered solid growth in the

third quarter. As expected, the Software & Services division

felt the impact of comparisons with Ségur public health investment

spending in 2023 and a slowdown in international sales owing to the

decision to refocus the Group’s UK doctor software activities on

Scotland.Analysis of business trends by

division

Software & Services

|

Software & Services |

Third quarter |

Change Q3 2024 / 2023 |

First 9 months |

Change 9M 2024 / 2023 |

|

in millions of euros |

2024 |

2023

reclassified(3) |

Reported vs. reclassified(1) |

Like for

like(2)vs.

reclassified(1) |

2024 |

2023reclassified(1) |

Reported vs. reclassified(1) |

Like for

like(2)vs.

reclassified(1) |

|

Cegedim Santé |

20.1 |

18.6 |

8.0% |

-6.2% |

58.9 |

58.4 |

0.9% |

-9.8% |

|

Insurance, HR, Pharmacies, and other services |

42.7 |

43.9 |

-2.7% |

-2.7% |

129.5 |

128.4 |

0.9% |

0.8% |

|

International businesses |

12.8 |

13.5 |

-5.0% |

-6.1% |

39.3 |

39.8 |

-1.3% |

-2.8% |

|

Software & Services |

75.6 |

76.0 |

-0.5% |

-4.2% |

227.7 |

226.6 |

0.5% |

-2.6% |

Revenues at Cegedim Santé grew 8.0% as reported in

the third quarter but fell 6.2% like for like. We did not fully

meet our 2024 goal of offsetting last year’s Ségur impact and

keeping like-for-like sales stable, but we are closing the gap with

each quarter. Reported growth figures include Visiodent as of March

1, 2024. Visiodent’s gradual transition to Cegedim Group products

for scheduling, databases, and so on is generating internal sales,

which do not appear in the consolidated scope.

Other French subsidiaries had a challenging

quarter, with revenues down 2.7%. We saw positive growth at our

insurance businesses, thanks to robust project-based sales, and in

HR, which is still getting a boost from its client diversification

strategy. Conversely, the €2 million in Ségur public health

investment subsidies we recorded in Q3 2023 made for a demanding

comparison in the pharmacy business, where equipment sales also

flagged after accelerating last year.

Internationally, revenues from software sales to

UK doctors declined, as expected, following the decision to refocus

the activity on Scotland.

Flow

|

Flow |

Third quarter |

Change Q3 2024 / 2023 |

First 9 months |

Change 9M 2024 / 2023 |

|

in millions of euros |

2024 |

2023

reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)vs.

reclassified(1) |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)vs.

reclassified(1) |

|

e-business |

13.5 |

13.5 |

-0.2% |

-0.4% |

43.5 |

41.3 |

5.1% |

4.8% |

|

Third-party payer |

10.2 |

8.9 |

14.3% |

14.3% |

29.7 |

27.9 |

6.7% |

6.7% |

|

Flow |

23.7 |

22.4 |

5.5% |

5.4% |

73.2 |

69.2 |

5.7% |

5.6% |

Third-quarter growth in e-business, e-invoicing,

and digitized data exchanges was nearly flat, at -0.2%. Healthcare

flows offset a relative slowdown in the Invoicing & Procurement

segment, which last year enjoyed sustained growth in France ahead

of the e-invoicing reform scheduled to take effect July 1, 2024,

but which has since been postponed to September 2026.

The digital data flow business dealing with

reimbursement of healthcare payments in France (Third-party payer)

experienced 14.3% yoy growth in Q3. It was boosted by strong growth

in demand for its fraud and long-term illness detection

offerings.

Data & Marketing

|

Data & Marketing |

Third quarter |

Change Q3 2024 / 2023 |

First 9 months |

Change 9M 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)vs.

reclassified(1) |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)vs.

reclassified(1) |

|

Data |

15.1 |

14.6 |

3.4% |

3.4% |

43.1 |

43.4 |

-0.7% |

-0.7% |

|

Marketing |

13.1 |

9.5 |

38.0% |

38.0% |

44.4 |

35.6 |

24.8% |

24.8% |

|

Data & Marketing |

28.2 |

24.1 |

17.0% |

17.1% |

87.5 |

79.0 |

10.8% |

10.8% |

Data business posted 3.4% yoy growth in the third

quarter, resulting in nearly stable growth over nine months. Growth

was led by French sales, which were more dynamic than international

sales.

The Marketing segment had a record third quarter,

up 38% owing to special ad campaigns during the Olympics. The

rising popularity of our phygital media offerings in pharmacies

helped the segment post 24.8% growth over the first nine

months.

BPO

|

BPO |

Third quarter |

Change Q3 2024 / 2023 |

First 9 months |

Change 9M 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)vs.

reclassified(1) |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)vs.

reclassified |

|

Insurance BPO |

15.9 |

13.8 |

15.7% |

15.7% |

44.6 |

35.9 |

24.2% |

24.2% |

|

Business Services BPO |

5.7 |

5.2 |

+9.2% |

+9.2% |

16.9 |

15.9 |

6.5% |

6.5% |

|

BPO |

21.6 |

19.0 |

13.9% |

13.9% |

61.5 |

51.8 |

18.8% |

18.8% |

The Insurance BPO business grew by more than 15.7%

over the third quarter, chiefly owing to its overflow business,

which has been flourishing since the start of the year. Growth over

nine months amounted to 24.2%, partly thanks to a favorable

comparison stemming from the April 1, 2023, launch of the Allianz

contract.

Business Services BPO (HR and digitalization)

continues to report strong growth, up 9.2% yoy over the quarter on

the back of a popular compliance offering and new clients.

Cloud & Support

|

Cloud & Support |

Third quarter |

Change Q3 2024 / 2023 |

First 9 months |

Change 9M 2024 / 2023 |

|

in millions of euros |

2024 |

2023reclassified(4) |

Reported vs. reclassified(1) |

Like for

like(2)vs.

reclassified(1) |

2024 |

2023

reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2)

vs.

reclassified(1) |

|

Cloud & Support |

7.7 |

6.8 |

12.5% |

12.5% |

25.8 |

22.6 |

13.9% |

13.9% |

The Cloud & Support division’s trajectory

continued over the third quarter, with growth of 12.5% reflecting

our expanded range of sovereign cloud-backed products and

services.

Highlights

Apart from the items cited below, to the best of

the company’s knowledge, there were no events or changes during Q3

2024 that would materially alter the Group’s financial

situation.

• New financing

arrangement

On July 31, 2024, Cegedim

announced that it had secured a new financing arrangement

consisting of a €230 million syndicated loan. The arrangement is

split into €180 million of lines drawn upon closing to refinance

the Group’s existing debt (RCF and Euro PP, which were to mature in

October 2024 and October 2025 respectively) and an additional,

undrawn revolving credit facility (RCF) of €50 million. This new

financing arrangement will bolster the Group’s liquidity and extend

the maturity of its debt to, respectively, 5 years (€30 million,

payments every six months); 6 years (€60 million, repayable upon

maturity); and 7 years (€90 million, repayable upon maturity).

Significant transactions and events post

September 30, 2024

To the best of the company’s knowledge, there

were no post-closing events or changes after September 30, 2024,

that would materially alter the Group’s financial situation.

Outlook

Based on the currently available information,

the Group expects 2024 like-for-like revenue(1) growth to be

towards the lower end of the 5-8% range relative to 2023. That

said, we still expect recurring operating income to continue to

improve. These targets are not forecasts and may need to be revised

if there is a significant worsening of geopolitical, macroeconomic,

or currency risks.

---------------

|

Webcast on October 24, 2024, at 6:15 pm (Paris

time) |

|

The webcast is available at:

www.cegedim.fr/webcast |

|

The Q3 2024 revenue presentation is available here:

https://www.cegedim.fr/documentation/Pages/presentation.aspx |

Financial calendar:

|

2025 |

January 29 after the closeMarch

27 after the closeMarch 28 at 10:00

amApril 24 after the closeJune 13

at 9:30July 24 after the closeSeptember

25 after the closeSeptember 26 at 10:00

amOctober 23 after the close |

2024 revenue2024 resultsSFAF meetingQ1 2025 revenueShareholders’

general meetingH1 2025 revenueH1 2025 resultsSFAF meetingQ3 2025

revenue |

Financial calendar:

https://www.cegedim.fr/finance/agenda/Pages/default.aspx

DisclaimerThis press

release is available in French and in English. In the event of any

difference between the two versions, the original French version

takes precedence. This press release may contain inside

information. It was sent to Cegedim’s authorized distributor on

October 24, 2024, no earlier than 5:45 pm Paris

time.The figures cited in this press release

include guidance on Cegedim's future financial performance targets.

This forward-looking information is based on the opinions and

assumptions of the Group’s senior management at the time this press

release is issued and naturally entails risks and uncertainty. For

more information on the risks facing Cegedim, please refer to

Chapter 7, “Risk management”, section 7.2, “Risk factors and

insurance”, and Chapter 3, “Overview of the financial year”,

section 3.6, “Outlook”, of the 2023 Universal Registration Document

filled with the AMF on April 3, 2024, under number

D.24-0233.

About Cegedim:Founded in 1969, Cegedim is an

innovative technology and services group in the field of digital

data flow management for healthcare ecosystems and B2B, and a

business software publisher for healthcare and insurance

professionals. Cegedim employs more than 6,500 people in more than

10 countries and generated revenue of €616 million in 2023. Cegedim

SA is listed in Paris (EURONEXT: CGM).To learn more please visit:

www.cegedim.frAnd follow Cegedim on X: @CegedimGroup, LinkedIn, and

Facebook.

|

Aude BalleydierCegedim Media

Relationsand Communications ManagerTel.: +33 (0)1 49 09 68

81aude.balleydier@cegedim.fr |

Damien BuffetCegedim Head of

Financial CommunicationTel.: +33 (0)7 64 63 55

73damien.buffet@cegedim.com |

Céline Pardo Becoming RP

AgencyMedia Relations Consultant

Tel.: +33 (0)6 52 08

13 66cegedim@becoming-group.com |

|

Annexes

Breakdown of revenue by quarter and

division

Year 2024

|

In € million |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Software & Services |

|

74.3 |

77.8 |

75.6 |

|

227.7 |

|

Flow |

|

25.3 |

24.2 |

23.7 |

|

73.2 |

| Data

& Marketing |

|

27.0 |

32.3 |

28.2 |

|

87.5 |

|

BPO |

|

20.2 |

19.7 |

21.6 |

|

61.5 |

| Cloud

& Support |

|

9.0 |

9.1 |

7.7 |

|

25.8 |

|

Group revenue |

|

155.9 |

163.1 |

156.8 |

|

475.8 |

Year 2023

|

In € million |

|

Q1reclassified |

Q2reclassified |

Q3reclassified |

Q4reclassified |

Totalreclassified |

|

Software & Services |

|

74.4 |

76.2 |

76.0 |

|

226.6 |

|

Flow |

|

24.0 |

22.8 |

22.4 |

|

69.2 |

| Data

& Marketing |

|

24.6 |

30.3 |

24.1 |

|

79.0 |

|

BPO |

|

14.4 |

18.4 |

19.0 |

|

51.8 |

| Cloud

& Support |

|

8.4 |

7.4 |

6.8 |

|

22.6 |

|

Group revenue |

|

145.9 |

155.1 |

148.3 |

|

449.4 |

Breakdown of revenue by geographic zone,

currency and division at September 30, 2024

|

as a % of consolidated revenues |

|

Geographic zone |

|

Currency |

| |

France |

EMEA ex. France |

Americas |

|

Euro |

GBP |

Other |

|

Software & Services |

|

82.8% |

17.1% |

0.1% |

|

86.2% |

12.0% |

1.7% |

|

Flow |

|

91.9% |

8.1% |

0.0% |

|

94.5% |

5.5% |

0.0% |

| Data

& Marketing |

|

97.9% |

2.1% |

0.0% |

|

98.0% |

0.0% |

2.0% |

|

BPO |

|

100.0% |

0.0% |

0.0% |

|

100.0% |

0.0% |

0.0% |

| Cloud

& Support |

|

99.9% |

0.1% |

0.0% |

|

100.0% |

0.0% |

0.0% |

|

Cegedim |

|

90.1% |

9.8% |

0.1% |

|

92.2% |

6.6% |

1.2% |

1 As of January 1, 2024, our Cegedim Outsourcing and Audiprint

subsidiaries—which were previously housed in the Software &

Services division—as well as BSV—formerly of the Flow division—have

been moved to the Cloud & Support division in order to

capitalize on operating synergies between cloud activities and IT

solutions integration. 2 At constant scope and exchange rates. The

positive currency impact of 0.2% was mainly due to the pound

sterling. The positive scope effect of 1.8% was attributable to the

first-time consolidation in Cegedim’s accounts of Visiodent

starting March 1, 2024.The positive currency impact of 0.1% was

mainly due to the pound sterling. The positive scope effect of 1.4%

was attributable to the first-time consolidation in Cegedim’s

accounts of Visiodent starting March 1, 2024. 3 To take advantage

of synergies, Cegedim Outsourcing, Audiprint, and BSV have been

reassigned to the Cloud & Support division.At constant

scope and exchange rates. 4 To take advantage of synergies, Cegedim

Outsourcing, Audiprint, and BSV have been reassigned to the Cloud

& Support division.At constant scope and exchange

rates.

- Cegedim_Revenue_3Q2024_ENG

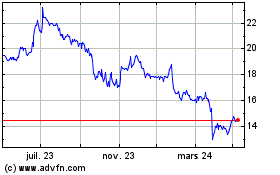

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

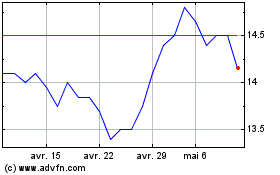

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025