Ease2pay launches rights offering of 1,539,999 new shares at an

issue price of EUR 1.50 per share

Rotterdam, the Netherlands – 4 December 2018 –

Ease2pay N.V. (“Ease2pay”, or the

“Company”), a mobile payment transaction platform,

announces the launch of a rights offering of 1,539,999 new ordinary

shares with a nominal value of EUR 0.10 each (the Offer

Shares), at an issue price of EUR 1.50 per Offer Share

(the Issue Price). These Offer Shares will be

admitted to listing and trading under the symbol "EAS2P" on

Euronext Amsterdam N.V. (Euronext Amsterdam).

Subject to applicable securities laws, the holders of ordinary

shares in the share capital of the Company with a nominal value of

EUR 0.10 (the Shares and the

Shareholders) at the Record Date (as defined

below) will be granted subscription rights to subscribe for the

Offer Shares (the Rights), provided that in each

case they are a Shareholder or any other person that lawfully

acquired the Rights directly or indirectly from a Shareholder or

from a person that subsequently acquired the Rights who is able to

give the representations and warranties as set out below in Annex A

(an Eligible Person). The Rights will not be

admitted to listing and trading on any regulated market.

Highlights

- Shareholders will be granted one Right per Share held, exercise

of five (5) Rights entitles an Eligible Person to subscribe for one

(1) Offer Share at the Issue Price, raising up to EUR 2.3m gross

proceeds in case of full subscription

- The Issue Price is EUR 1.50 per Offer Share. This represents a

discount of 20.4% to the theoretical ex-rights price (TERP) of EUR

1.88, based on the closing price of the Shares on Euronext

Amsterdam on 3 December 2018 and a discount of 23.5% versus the

10-day volume weighted average price on Euronext Amsterdam

- Record date and record time for allocation of Rights is set at

17:40 Central European Time (CET) on 6 December

2018, immediately after the closing of trading of Ease2pay's

ordinary shares on Euronext Amsterdam

- Subscription period for Offer Shares starts on 7 December 2018

and ends on 18 December 2018

- Rights will be credited to clearing systems and to the accounts

of Shareholders on 7 December 2018

- Results of the transaction will be announced on or about 19

December 2018

- Any Rights not exercised by Eligible Persons will be offered to

institutional investors in the Netherlands and in selected

geographies in the European Economic Area, and outside the United

States of America in reliance of Regulation S under the Securities

Act by the Sole Bookrunner (as defined below) in the Rump Offering

(as defined below)

- The Rump Offering (as defined below), if any, is expected to

take place on or about 18 December 2018, after the closing of

trading on Euronext Amsterdam

The proceeds from the Offering will be used for

i) working capital to enable growth of the Company’s services and

platform, ii) to repay EUR 1,471,000 nominal shareholder loans to

strengthen the balance sheet and prevent the related burdensome

accounting treatment of these shareholder loans in the future.

Members of the Company's management board have committed to

exercise all rights from their shareholding held through The

Internet of Cars v.o.f. (TIOC) representing 56.5%

of the outstanding share capital, of which the full proceeds will

be used to repay outstanding shareholder loans. To ensure minimal

useable gross proceeds for working capital, NIBC Bank N.V. has

committed to subscribe for new shares from non-exercised rights in

the Offering for the difference, if any, between gross proceeds

raised in the Offering, excluding gross proceeds from rights

exercised by TIOC, and EUR 500,000.

In connection with Offering (as defined below),

the Company has published a Dutch information document. Pursuant to

the requirements of this Dutch information document, the Company

has included quarterly financials on Q3 2018 on p. 8-10 of the

Dutch information document, which are only available in Dutch. A

copy of the Dutch information document can be downloaded from the

Website (as defined below).

The ratio between equity and debt of Ease2pay is

14/86 as of 30 September 2018. Following the Offering, this ratio

is at least 20/80. As a result of the repayment of the subordinated

shareholder loans, the company has an additional interest charge of

EUR 42,098 with which the shareholder loan is repaid at nominal

value. The additional interest expense is due to the fact that the

shareholder loan was recognized at 30 September 2018 at an

amortized cost price, which is EUR 42,098 lower at 30 September

2018 than the nominal value at which the shareholder loan will be

repaid. In October 2018 and November 2018 this shareholder loan was

further increased towards the redemption value and in December 2018

the last part will be recognized as a charge in the income

statement for Ease2pay, this will result in a higher debt of EUR

42,098, and a lower equity and result of EUR 42,098 for the full

year 2018.

Certain post-closing lock-ups have been agreed

for Mr Borghuis and Mr van Lookeren Campagne as directors of the

Company and indirect shareholders through TIOC, for a period of 180

days from the settlement date which are subject to certain

customary carve-outs and possible waiver by the Sole

Bookrunner.

NIBC Bank N.V. is acting as (i) subscription

agent of the Company in relation to the Offering (the

Subscription Agent), (ii) issuing

and settlement agent for Offer Shares (the Issuing

Agent, the Settlement Agent), (iii) the

listing agent for Offer Shares, and (iv) sole bookrunner in

relation to the Rump Offering, if any, (the Sole

Bookrunner).

The Offering DetailsSubject to

the terms and conditions set out in any press release of the

Company in relation to the Offering (each a Press

Release), the offering comprises: (i) the rights offering

in which Shareholders as of 17:40 CET on 6 December 2018 (the

Record Date) will be granted one (1) Right for

each Share held on that date to subscribe for Offer Shares against

payment of the Issue Price (the Rights Offering),

and (ii) if any, the rump offering in which Offer Shares for which

Rights have not been validly exercised during the Rights Offering

Period (as defined below) (the Rump Shares) may be

placed via a private placement with certain qualified investors in

the Netherlands and in selected geographies in the European

Economic Area, and outside the United States of America in reliance

of Regulation S under the Securities Act by means of an accelerated

bookbuild offering at the Issue Price (the Rump

Offering and together with the Rights Offering referred to

as the Offering).

The Rights Offering is expected to commence at

09:00 CET on 7 December 2018, and to end no later than 15:00 CET on

18 December 2018 (the Rights Offering Period),

subject to acceleration or extension on the timetable or the

withdrawal of the Rights Offering. The Rump Offering, if any, is

expected to commence immediately after the closing of trading on

Euronext Amsterdam 18 December 2018, and to end no later than 9:00

CET on 19 December 2018 (the Rump Offering Period,

together with the Rights Offering Period the Offering

Period), subject to acceleration or extension on the

timetable or the withdrawal of the Rump Offering. Subject to

acceleration or extension of the timetable or withdrawal of the

Offering, listing and trading of the Offer Shares and Rump Shares

is expected to commence on or about 21 December 2018. Payment (in

euro) for, and issue and delivery of, the Offer Shares and the Rump

Shares (the Settlement) is expected to take place

on or about 21 December 2018 (the Settlement

Date). The Offer Shares and Rump Shares will be delivered

in book-entry form through the facilities of the Centraal Instituut

voor Giraal Effectenverkeer B.V. (Euroclear

Nederland).

The Issue Price per Offer Share is EUR 1.50.

Subject to certain exceptions and applicable securities laws, and

provided the Company has established to its satisfaction that such

action would not result in the contravention of any registration

requirement or other legal regulations in any jurisdiction, the

Shareholders as of the Record Date will be granted Rights that

entitle Eligible Persons to subscribe for Offer Shares at the Issue

Price. Each Share held by a Shareholder, immediately after the

closing of trading on Euronext Amsterdam at 17:40 CET on 6 December

2018, will entitle such Shareholder to one (1) Right. In accordance

to the subscription ratio, every five (5) Rights will entitle a

Shareholder who is an Eligible Person to subscribe for one (1)

Offer Share at the Issue Price (the Subscription

Ratio). A holding of less than five (5) Rights will not

give the holder thereof any rights in connection with the Rights

Offering and such Rights will, if not transferred, automatically

lapse without value. The Rights will not be admitted to listing and

trading on any regulated market. The statutory pre-emption rights

(wettelijke voorkeursrechten) of the Shareholders in respect of the

Offering have been excluded.

Subject to the restrictions set out below, any

Shareholder who is an Eligible Person may subscribe for Offer

Shares by exercising its Rights from 09:00 CET on 7 December 2018,

which is the beginning of the Rights Offering Period, up to 15:00

CET on 18 December 2018, which is the end of the Rights Offering

Period. The last date and/or time before which notification of

exercise instructions may be validly given may be earlier,

depending on the financial institution through which the Rights are

held. Any extension of the timetable for the Offering will be

published in a Press Release at least three (3) hours before the

end of the original Offering Period, which will be placed on

www.ease2paynv.com (the Website), provided that

any extension will be for a minimum of one (1) full business

day.

To qualify for allocation of Offer Shares,

investors must place their subscriptions for Offer Shares during

the Offering Period through financial intermediaries. Different

financial intermediaries may apply different deadlines before the

closing time of the Rights Offering Period. NIBC Bank N.V., through

Euroclear, will communicate to the financial intermediaries, the

aggregate number of Offer Shares allocated to their respective

investors. It is up to the financial intermediaries to notify

investors of their individual allocations of Offer Shares.

Investors participating in the Offering will be

deemed to have checked each Press Release and any Additional

Information Document (as defined below) and confirmed whether they

meet the requirements laid down in the Selling and Transfer

Restrictions as set out in Annex B and as stated in any other Press

Release and any Additional Information Document (as defined below).

If in doubt, investors should consult their professional advisor,

their financial institution or broker.

The Rights Offering Period will end at 15:00 CET

on 18 December 2018. In case there are unexercised Rights, the

Company may decide to offer the Rump Shares from the unexercised

Rights via a private placement to certain qualified investors in

the Netherlands and in selected geographies in the European

Economic Area, and outside the United States of America in reliance

of Regulation S under the Securities Act, by means of an

accelerated bookbuild offering at the Issue Price. NIBC Bank N.V.

will act as Sole Bookrunner for such Rump Offering, if any, which

is expected to commence immediately after the closing of the

trading on Euronext Amsterdam on 18 December 2018. Any qualified

investors who are interested in any Rump Shares may place the

orders for such Rump Shares directly with the Sole Bookrunner

during the accelerated bookbuild offering in the Rump Offering. The

Sole Bookrunner cannot guarantee that the Rump Offering, if any,

will be successfully completed.

The allocation of Rump Shares, if any, is

expected to take place shortly after the end of the Rump Offering

Period, on or about 19 December 2018. Allocation to qualified

investors who subscribed for Rump Shares in the Rump Offering will

be made on a systematic basis (pro rata) and full discretion will

be exercised by the Company as to whether or not and how to allot

the Rump Shares. The Company may, at its own discretion and without

stating the grounds, reject any subscriptions by qualified

investors wholly or partly. During the Rump Offering, no minimum or

maximum subscription amount for Rump Shares will apply.

The results of the Offering will be communicated

through a Press Release on the Website.

Any acceleration of the timetable for the

Offering will be published in a Press Release at least three (3)

hours before the proposed end of the accelerated Offering Period,

which will be placed on the Website. In any event, the Offering

Period will be at least six (6) business days. If and when the

Offering should be withdrawn, which can be done at the sole

discretion of the Company, notice thereof will be given as soon as

possible by the Company through a Press Release, which will be

placed on the Website. Any entitlements in relation to a withdrawal

of the Offering, will be deemed to have expired without

compensation.

If the Offering is withdrawn and Settlement does

not take place, all subscriptions for Offer Shares and Rump Shares

will be disregarded, any allotments made will be deemed not to have

been made and any subscription payments made will be returned

without interest or other compensation. Any transfers of Rights or

trades in Offer Shares or Rump Shares prior to Settlement are at

the sole risk of the parties concerned. Neither the Company, the

Subscription, Issuing, and Settlement Agent nor Euronext Amsterdam

accept any responsibility or liability for any loss incurred by any

person as a result of a withdrawal of the Offering or the related

annulment of any transactions in Shares on Euronext Amsterdam.

The Offer Shares and Rump Shares will be

delivered in book-entry from through the facilities of Euroclear

Nederland. Payment for and delivery of the Offer Shares and Rump

Shares and trading on Euronext Amsterdam under the symbol "EAS2P"

is expected to take place on 21 December 2018, in accordance with

their normal settlement procedures applicable to equity securities

and against payment (in euro) for the Offer Shares and Rump Shares

in immediately available funds.

The closing of the Offering may not take place

on the Settlement Date or at all if certain conditions or events

referred to in the underwriting agreement entered into by the

Company and the Sole Bookrunner on 3 December 2018 are not

satisfied or waived or occur on or prior to such date. Such

conditions include, among others (i) agreement upon the Offer Price

and the exact number of Rights, Offer Shares and Rump Shares and

entering into a pricing agreement and, (ii) the representations and

warranties made by the Company being true and accurate at the date

of the underwriting agreement.

Timetable The Company has

confirmed the following timetable for the Offering:

|

Event |

Time |

Date |

|

Record Date |

17:40 CET |

Immediately after the closing of trading on Euronext Amsterdam at

17:40 CET on 6 December 2018 |

|

Crediting of rights to Shareholders’ securities account, start of

Rights Offering Period |

09:00 CET |

7 December2018 |

|

End of Rights Offering Period |

15:00 CET |

18 December 2018 |

|

Rump Offering (if any) |

|

18 December 2018 |

|

Results of the Offering, allocation of the Offer Shares and Rump

Shares (if any) |

|

19 December 2018 |

|

Issue of, payment for and delivery of the Offer Shares and Rump

Shares |

|

21 December 2018 |

|

Listing of Offer Shares and Rump Shares on Euronext Amsterdam

|

09:00 CET |

21 December 2018 |

For further information on the Offering and the

Company, we refer to the Press Releases as published on the

website, all information and documents (including a Dutch

information document) (each an Additional Information

Document) as well as any (future) messages from Euronext

Amsterdam and/or Euroclear Nederland.

Contact detailsNIBC Bank

N.V.NIBC Equity Agency ServicesT: +31 20 550 8415E:

eas@nibc.com

About Ease2payEase2pay is a

payment and loyalty transaction platform with which you can turn

every smartphone into a cash register and a pin terminal. The app

allows consumers to order, pay and save in one operation without

using cash registers or pin terminals.

Ease2pay B.V., a subsidiary of the Company, is

registered with the Dutch Central Bank (De Nederlandsche Bank)

(DNB) as an exempted electronic money institution

(elektronischgeldinstelling) and as an exempted payment service

provider (betaaldienstverlener). Due to the applicable exemptions,

Ease2pay B.V. is not under the supervision of DNB. Ease2pay B.V. is

accredited for Mandate Service Provider and is a certificate holder

Collecting Payment Service Provider (CPSP) iDEAL.

The information communicated through

this press release constitutes inside information (voorwetenschap)

within the meaning of Article 7 of Regulation (EU) No 596/2014

(market abuse regulation).

For more information, please contact:

Jan Borghuis Director

T: +31 (0)10 3074619

Annex A - Eligible

Persons

Subject to applicable securities laws, and

provided the Company is satisfied that such action would not result

in the contravention of any registration or other legal requirement

in any jurisdiction, Rights will be granted to Shareholders as at

the Record Date. Rights credited to the account of a person who is

not an Eligible Person shall not constitute an offer of Offer

Shares to such person. A financial institution may not acknowledge

the receipt of any Rights, and the Company reserves the right to

treat as invalid the exercise, purported exercise or transfer of

any Rights, which may involve a breach of the laws or regulations

of any jurisdiction or if the Company believes, or any of the

Company’s agents believe, that the same may violate applicable

legal or regulatory requirements or may be inconsistent with the

procedures and terms set out in each Press Release or any

Additional Information Document or in breach of the representations

and warranties to be made by an accepting holder, as described

herein.

In accordance with the terms and subject to

certain exceptions:

- the Rights being granted in the Offering may be exercised only

by an Eligible Person, subject to applicable securities laws;

- the Rights being granted or Offer Shares being offered in the

Offering may not be offered, sold, resold, exercised, transferred

or delivered, directly or indirectly, in or into jurisdictions

other than the Netherlands where the Rights may not be granted and

Offer Shares may not be offered pursuant to applicable law,

including, but not limited to, the United States, Australia,

Canada, Hong Kong, Singapore, South Africa and Japan, subject to

certain limited exceptions (the Ineligible

Jurisdictions); and

- any Press Release or any Additional Information Document may

not be sent to:

- any person residing in an Ineligible Jurisdiction or with a

citizenship from an Ineligible Jurisdiction such that he or she

cannot lawfully receive the Rights or participate in the Offering;

or

- any Shareholder or any other person residing in a jurisdiction

other than the Netherlands where the Rights may be granted and

Offer Shares may be offered, but to whom certain restrictions

apply, as set out in Annex B to this Press Release, as a result of

which he or she cannot receive the Rights or lawfully participate

in the Offering (such a person being an Ineligible

Person).

Persons who are not Ineligible Persons are

referred to as Eligible Persons.

The Rights will initially be credited to

financial intermediaries for the accounts of all Shareholders who

hold Shares in custody through such financial intermediary on the

Record Date. A financial intermediary may not exercise any Right on

behalf of any Ineligible Person and will be required in connection

with any exercise of the Rights to certify to such effect.

Exercise instructions or certifications sent

from or postmarked in any Ineligible Jurisdiction will be deemed to

be invalid and the Rights and Offer Shares will not be delivered to

addresses inside any Ineligible Jurisdictions.

Representations and warranties by

Eligible PersonsSubject to certain exceptions, if a person

(i) accepts, takes up, delivers or otherwise transfers Rights, (ii)

exercises Rights to subscribe for Offer Shares, or (iii) purchases,

subscribes for, trades or otherwise deals in Offer Shares being

granted or offered, respectively, in the Offering, will be deemed

to have given, made, and in some case be required to explicitly

confirm, each of the following representations and warranties to

the Company, to the Subscription, Issuing and Settlement Agent and

to any person acting on behalf of either the Company or the

Subscription, Issuing and Settlement Agent, unless in the Company’s

or NIBC Bank N.V.'s discretion the Company waives such

requirement:

- It is not located inside an Ineligible Jurisdiction;

- It is not an Ineligible Person;

- It is not acting, and has not acted, for the account or benefit

of an Ineligible Person;

- It will not offer, sell or otherwise transfer either a Right or

an Offer Share to any person located in an Ineligible Jurisdiction

(which will be deemed to be satisfied when trading Offer Shares in

the marketplace through Euronext Amsterdam); and

- It was a Shareholder as at 17:40 CET on the Record Date, or

such person lawfully acquired or may lawfully acquire Rights,

directly or indirectly, from such a Shareholder or from a person

that subsequently lawfully acquired Rights.

The Company, the Subscription Agent, Issuing

Agent and Settlement Agent and any persons acting on behalf of the

Company will rely upon the truth and accuracy of this person’s

representations and warranties. Any provision of false information

or subsequent breach of these representations and warranties may

subject that person to liability.

A person acting on behalf of another person

exercising its Rights or purchasing Offer Shares (including,

without limitation, as a nominee, custodian or trustee), will be

required to provide the foregoing representations and warranties to

the Company and the Subscription, Issuing and Settlement Agent with

respect to the exercise of Rights or purchase of Offer Shares on

behalf of such person. If such person does not provide the

foregoing representations and warranties, neither the Company, nor

the Subscription, Issuing and Settlement Agent nor any persons

acting on behalf of either the Company or the Subscription, Issuing

and Settlement Agent, will be bound to authorise the allocation of

any Shares to such person or the person whose behalf is acted for;

neither will they be liable for any damages incurred as a result

thereof.

Annex B - Selling and Transfer

Restrictions

GeneralNo action has been or

will be taken to permit a public offering of the Rights or the

Offer Shares in any jurisdiction other than the Netherlands.

Receipt of a Press Release or any Additional Information Document

will not constitute an offer in those jurisdictions in which it

would be illegal to make an offer and, in those circumstances, all

Press Releases are for information purposes only and should not be

copied nor redistributed. If an investor receives a copy of a Press

Release or any Additional Information Document, such documents may

not be treated as constituting an invitation or offer to the

recipient, nor should the recipient in any event deal in Offer

Shares, unless, in the relevant territory, such an invitation or

offer could lawfully be made to the recipient and Offer Shares can

lawfully be dealt in without contravention of any unfulfilled

registration or other legal requirements. Accordingly, if a

recipient receives a copy of a Press Release, the recipient should

not, in connection with the Offering, distribute or send the Press

Release, or transfer Offer Shares to any person in or into any

jurisdiction where to do so would or might contravene local

securities laws or regulations.

Subject to certain exceptions, financial

intermediaries, including brokers, custodians and nominees, are not

permitted to send or otherwise distribute any Press Release, or any

other Additional Information Document to any Ineligible Person.

Persons and/or companies such as financial

intermediaries, including brokers, custodians and nominees into

whose hands this Press Release comes, are required by the Company

and NIBC Bank N.V. to comply with all applicable laws and

regulations in each country or jurisdiction in or from which they

purchase, offer, sell or deliver the Offer Shares or have in their

possession or distribute this Press Release, in all cases at their

own expense.

Subject to the specific restrictions described

below, if a recipient of a copy of the Press Release, or any

Additional Information Document (including, without limitation, his

or her nominees, custodians and trustees) is outside the

Netherlands and wishes to sell, transfer or exercise Rights or

subscribe for or purchase Offer Shares, the recipient must

reasonably believe to comply with the applicable laws of any

relevant territory including obtaining any requisite governmental

or other consents, observing any other requisite formalities and

paying any issue, transfer or other taxes due in such territories.

Neither the Company, the Subscription Agent, Issuing Agent,

Settlement Agent nor Euronext Amsterdam accept (i) any legal

responsibility for any violation by any person, whether or not an

Admitted Institution, prospective subscriber or purchaser of any of

the Offer Shares, of any such restriction, (ii) any legal

responsibility or liability for any loss incurred by any person as

a result of a withdrawal of the Offering or the related annulment

of any transactions in Shares on Euronext Amsterdam.

The information set out in this section is

intended as a general guide only. If a recipient of a Press

Release, or any Additional Information Document is in any doubt as

to its position, he or she should consult his or her professional

advisor without delay.

Selling Restrictions

United StatesThe Rights, Offer Shares and Rump

Shares have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (Securities

Act) and may not be offered, granted, sold, taken up,

delivered, renounced or transferred in or into the United States.

In addition, until 40 days following the commencement of the

Offering, an offer or sale of the Rights, the Offer Shares and Rump

Shares within the United States by any financial institution

(whether or not participating in the Rights Offering) may violate

the registration requirements of the Securities Act. The Company

has no intention to register any part of the Offering in the United

States or make a public offering of the Rights, Offer Shares or

Rump Shares in the United States. The Rights, Offer Shares and Rump

Shares are being offered and sold in the Netherlands in selected

geographies in the European Economic Area, and outside the United

States of America in reliance of Regulation S under the Securities

Act.

European Economic AreaIn relation to each member

state of the European Economic Area which has implemented the

Prospectus Directive, other than the Netherlands (each, a

Relevant Member State), an offer of Offer Shares

may not be made to the public in that Relevant Member State, except

that an offer of Offer Shares may be made to the public in that

Relevant Member State at any time under the following exemption

under the Prospectus Directive, if and only to the extent it is

implemented in that Relevant Member State, namely to any legal

entity which is a qualified investor as defined in the Prospectus

Directive; provided that no such offer of Offer Shares shall result

in a requirement for the publication by the Company or any initial

purchaser of a prospectus pursuant to Article 3 of the Prospectus

Directive.

For the purposes hereof, the expression an

offer to the public in relation to any Offer

Shares in any Relevant Member State means the communication in any

form and by any means of sufficient information on the terms of the

Offering and any Offer Shares to be offered so as to enable an

investor to decide to purchase or subscribe to any Offer Shares, as

that expression may be varied in the Relevant Member State by any

measure implementing the Prospectus Directive in that Relevant

Member State.

The expression Prospectus

Directive means Directive 2003/71/EC (and any supplements

and/or changes, including Directive 2010/73, if and in so far

implemented in any Relevant Member State), including any

relevant implementing measure in each Relevant Member State. The

Sole Bookrunner has not and will not offer any Rump Shares in the

Netherlands and in selected geographies in the European Economic

Area, other than exclusively to qualified investors

(gekwalificeerde beleggers) as defined in Section 1:1 of the Dutch

Financial Supervision Act (Wet op het Financieel Toezicht) or to

legal entities which are 'qualified investors' as defined in the

Prospectus Directive.

United KingdomIn addition to the restrictions

identified above, any invitation or inducement to engage in

investment activity (within the meaning of Article 21 FSMA) in

connection with the issue or sale of the Offer Shares may only be

communicated or caused to be communicated in the United Kingdom in

circumstances in which Article 21(1) FSMA does not apply or if an

exemption (as set out in the FSMA (Financial Promotion Order 2005)

applies.

Annex C - Disclaimer

These materials are not for release,

distribution or publication, whether directly or indirectly and

whether in whole or in part, in or into the United States, Canada,

Australia or Japan or any other jurisdiction where to do so would

constitute a violation of the relevant laws of such

jurisdiction.

These materials are for information purposes

only and are not intended to constitute, and should not be

construed as, an offer to sell or a solicitation of any offer to

buy the securities of Ease2pay N.V. (the Company,

and such securities, the Securities) in the United

States, Canada, Australia or Japan or in any other jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration, exemption from registration or qualification under

the securities laws of such jurisdiction.

The Securities have not and will not be

registered under the U.S. Securities Act of 1933, as amended (the

Securities Act) and may not be offered or sold in

the United States absent registration or an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Company has no intention to register any part

of the offering in the United States or make a public offering of

Securities in the United States.

No communication or information relating to any

offer or sale of the Securities of the Company may be disseminated

to the public in jurisdictions, other than The Netherlands, where

prior registration or approval is required for that purpose. No

action has been taken that would permit an offer of the Securities

of the Company in any jurisdiction where action for that purpose is

required, other than in The Netherlands.

The Company has not authorised any offer to the

public of the Securities in any Member State of the European

Economic Area (other than the Netherlands). With respect to any

Member State of the European Economic Area (other than the

Netherlands), and which has implemented the Prospectus Directive

(each a Relevant Member State), no action has been

undertaken or will be undertaken to make an offer to the public of

Securities requiring publication of a prospectus in any Relevant

Member State. As a result, the Securities may only be offered in

Relevant Member States to any legal entity which is a qualified

investor as defined in the Prospectus Directive. For the purpose of

this paragraph, the expression "offer of securities to the public"

means the communication in any form and by any means of sufficient

information on the terms of the offer and the Securities to be

offered so as to enable the investor to decide to exercise,

purchase or subscribe for the Securities, as the same may be varied

in that Member State by any measure implementing the Prospectus

Directive in that Member State and the expression "Prospectus

Directive" means Directive 2003/71/EC (and amendments thereto,

including Directive 2010/73/EU, to the extent implemented in the

Relevant Member State), and includes any relevant implementing

measure in the Relevant Member State.

No action has been taken by the Company that

would permit an offer of Securities or the possession or

distribution of these materials or any other offering or publicity

material relating to such Securities in any jurisdiction where

action for that purpose is required.

The release, publication or distribution of

these materials in certain jurisdictions may be restricted by law

and therefore persons in such jurisdictions into which they are

released, published or distributed, should inform themselves about,

and observe, such restrictions.

This announcement does not constitute a

prospectus.

- Press Release Launch Ease2pay

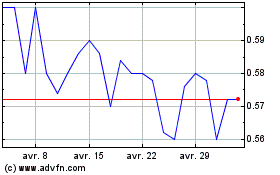

Docdata Nv (EU:EAS2P)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Docdata Nv (EU:EAS2P)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025