With EBITA up by 144% and a faster pace of

deleveraging

Regulatory News:

Today, Elior Group (Paris:ELIOR) (Euronext Paris – ISIN: FR

0011950732), a world leader in catering and multiservices, is

releasing its unaudited results for the first half of the 2023-2024

fiscal year (six months ended March 31, 2024).

- Initial benefits from our strategy implemented since April

2023

- A more agile and efficient Group

- A return to profitability and growth momentum back on

track

- Robust business development, led by strong customer relations

and contract performance

- Costs streamlined

- Ongoing deleveraging

- Solid results for the first half of fiscal 2023-2024

- €3,123 million in consolidated revenue, representing 5.9%

organic growth

- A more-than twofold increase in adjusted EBITA to €100 million

from €41 million a year earlier; adjusted EBITA margin up 150 basis

points to 3.2%

- A positive €169 million in free cash flow versus a negative €15

million a year earlier

- A €137 million reduction in net debt during the period

- Leverage ratio (net debt/adjusted EBITDA) of 4.1x, i.e., below

the 5.25x set for the covenant test

Outlook for full-year 2023-2024

- Organic revenue growth between 4% and 5%

- Adjusted EBITA margin of at least 2.5%

- Leverage ratio (net debt/adjusted EBITDA) around 4.0x at

September 30, 2024

Commenting on these results, Daniel Derichebourg, Elior

Group’s Chairman and CEO, said:

“Against a backdrop of market uncertainty, Elior delivered a

solid performance in the first half of fiscal 2023-2024. We’ve

returned to operating profitability and have removed sources of

losses within several strategic contracts. Our business development

was robust and we won and renewed major contracts during the

period. We also continued to deleverage the Group. Our revenue and

organic growth are trending upwards, both overall and for our

businesses individually, as are our EBITDA and profit margin. These

are all signs that our recovery is continuing at a good pace, even

though there's still some way to go.

Our first-half 2023-2024 results are the outcome of the

structural changes we’ve been putting in place since April 2023

following the alliance between Elior and Derichebourg

Multiservices. The intense efforts we’ve made are beginning to pay

off and we plan to steadily and rigorously pursue them going

forward. In view of all of these factors, I have every confidence

in our ability to carry on down the path of profitable and

sustainable growth. I’d like to take this opportunity to thank all

of our teams for their hard work and all of our stakeholders – both

internal and external – for their unwavering support.”

Business Development

Several major contracts were won or renewed in the first half of

2023-2024, including with the following:

- In Contract Catering

- France: Dassault Aviation’s head office, the municipality of

Aubervilliers, l’École Nationale de Police de Oissel, and the

Sainte Croix Sainte Euverte Orléans group of schools

- United Kingdom: Leeds-Bradford international airport passenger

lounges and Leicestershire County Cricket Club

- Italy: BNL Aldobrandeschi

- Spain: Fundación La Caixa

- United States: The Thomas Jefferson Foundation Inc. and Pine

Bluff School

- India: Boeing India Private Limited and Autodesk India PVT.

Limited

- In Multiservices

- Facility: Disney Hotel and Edvance (EDF group)

- Health: Hôpital Ambroise Paré and Centre René Gauducheau

- Temporary Staffing: Le Saint group

- Aeronautics: new contracts with Airbus

- Energy & Urban: Batipart Immo and the municipality of

Argenteuil

Revenue

Consolidated revenue from continuing operations amounted to

€3,123 million in the first half of fiscal 2023-2024, compared

with €2,478 million for the year-earlier period. This 26.0%

increase reflects organic growth of 5.9%, a 0.7% negative currency

effect and a 20.8% positive impact from changes in scope of

consolidation, mainly due to the consolidation of Derichebourg

Multiservices (DMS) as from April 18, 2023.

On a like-for-like basis, revenue rose by 4.6%, including a

positive 1.0% volume effect and a favorable 3.6% price effect.

Business development remained robust in the first half of

2023-2024, driving up revenue by 9%, having already added 10.3% to

the first-half 2022-2023 revenue figure.

Contract losses, excluding voluntary contract exits, reduced

revenue by 6.4%. On this basis, the revenue retention rate was

93.6% at March 31, 2024. Voluntary contract exits trimmed a further

1.3% from revenue. The overall revenue retention rate was therefore

92.3%, up 1 point on the 91.3% recorded at March 31, 2023.

Revenue by business segment

Contract Catering revenue totaled €2,293 million in the

first half of 2023-2024 versus €2,169 million in the same period of

2022-2023, representing year-on-year growth of 5.7%. This increase

breaks down as follows: 5.9% organic growth, a positive 0.6% impact

from changes in scope of consolidation stemming from the

acquisition of Cater to You in the United States, and a negative

0.8% currency effect.

Multiservices revenue jumped to €823 million from €302

million in the year-earlier period. This €521 million increase

reflects organic growth of 6.0% and a positive €503 million impact

from changes in scope of consolidation, arising on the first-time

consolidation of DMS.

The Corporate & Other segment, which includes the

Group’s “Ciel de Paris” and “Maison de l’Amérique Latine”

concession catering activities, generated €7 million in revenue in

first-half 2023-2024.

Pro forma revenue

On a pro forma basis, consolidated revenue was 5.3% higher than

the €2,965 million recorded for the first half of 2022-2023. Pro

forma revenue growth for Multiservices was 4.3%.

Adjusted EBITA and Other Income Statement Items

Consolidated adjusted EBITA from continuing operations came to

€100 million in the first half of 2023-2024, compared with €41

million for the same period of 2022-2023. Adjusted EBITA margin

widened by 150 basis points to 3.2% from 1.7%. The effect of price

increases more than offset the impact of inflation. Operational

efficiency gains – which amounted to €29 million, including €9

million in synergies achieved – also contributed to the improvement

in operating profitability.

In Contract Catering, adjusted EBITA came in at €91

million, versus €49 million a year earlier. Adjusted EBITA margin

was 4.0%, up 170 basis points from 2.3% in the same period of

2022-2023.

In Multiservices, adjusted EBITA was €16 million,

compared with a €2 million loss in the first half of 2022-2023.

Adjusted EBITA margin was 1.9%, representing a 270 basis-point

positive swing versus the negative 0.8% reported a year earlier,

before the consolidation of DMS.

For the Corporate & Other segment, adjusted EBITA

represented a €7 million loss, against a €6 million loss in the

same period of 2022-2023, reflecting the first-time consolidation

of DMS’ corporate structures.

Pro forma EBITA

On a pro forma basis, EBITA margin for the Group as a whole also

increased by 150 basis points from the 1.7% EBITA margin posted for

the first half of 2022-2023. The pro forma EBITA margin for

Multiservices widened by 70 basis point from 1.2% in the first half

of 2022-2023. The Corporate & Other segment saw a €2 million

improvement in pro forma adjusted EBITA compared with the first

half of 2022-2023, reflecting the cost savings already achieved for

the corporate structures.

Recurring operating profit from continuing operations

totaled €88 million in the first half of 2023-2024, compared with

€30 million a year earlier.

Non-recurring income and expenses represented a net

expense of €15 million, versus a net expense of €17 million in

first-half 2022-2023, and included €12 million in restructuring

costs.

The Group recorded a net financial expense of €52 million

for the six months ended March 31, 2024 compared with €35 million

in first-half 2022-2023, reflecting the increase in average debt

and interest rates, and, to a lesser extent, the interest expense

on DMS’ factoring program.

Income tax represented a €20 million charge versus a €3

million charge a year earlier. Current income tax expense amounted

to €14 million (including the CVAE tax charge in France) and

deferred tax expense was €6 million, mainly due to the profit

generated in France during the period.

In view of the above factors, the Group ended first-half

2023-2024 with €1 million in net profit for the period

attributable to owners of the parent, compared with a €23

million attributable net loss for the same period of 2022-2023.

Cash Flows, Debt and Liquidity

Free cash flow amounted to a positive €169 million, up

sharply on the negative €15 million recorded for first-half

2022-2023.

The net change in operating working capital represented a

strong cash inflow of €83 million, including a reversal of the €38

million temporary negative movement related to outstanding

securitized and factored receivables recorded at the end of the

2022-2023 fiscal year. On a normalized basis, i.e., after

neutralizing this €38 million positive reversal effect, free

cash flow would have totaled €131 million.

EBITDA rose sharply from €107 million in first-half

2022-2023 to €189 million in the first six months of 2023-2024.

Net capital expenditure increased by €11 million year on

year to €43 million from €32 million, reflecting the first-time

consolidation of DMS. As a percentage of revenue it represented

1.4%, up slightly on the 1.3% for first-half 2022-2023.

Net debt stood at €1,256 million at March 31, 2024,

versus €1,393 million at September 30, 2023.

The leverage ratio (net debt/adjusted EBITDA), as

calculated for the purpose of the test carried out by the Group’s

lenders, was 4.1x at March 31, 2024, i.e., below the 5.25x set in

the covenant.

The Group’s available liquidity totaled €342 million at

March 31, 2024, against €313 million at September 30, 2023, and

included €81 million in cash and cash equivalents, an undrawn €190

million under its €350 million revolving credit facility and €71

million in other available credit facilities.

Corporate Social Responsibility (CSR)

Highly aware of Elior's footprint and our responsibilities

towards our stakeholders, in the first half of 2023-2024 we

continued to work on defining the Group's new social and

environmental commitments with a view to publishing our

sustainability roadmap by the end of the fiscal year.

We completed our double materiality analysis during the period,

which enabled us to identify the Group’s strategic goals and

challenges regarding the social and environmental impacts that its

activities have on its stakeholders and the financial impacts that

social and environmental issues have on the Group.

This analysis will also enable the Group to comply with the EU

Corporate Sustainability Reporting Directive (CSRD) and therefore

publish its first sustainability report as early as the end of

fiscal 2023-2024.

Events After the Reporting Date

On April 30, 2024, the Group signed an agreement to acquire DCK

Catering, a school catering company based and operating in Hong

Kong. This acquisition will strengthen the Group’s positions in the

contract catering market in Asia.

With an operating presence in India since 2017, in 2023 when

Daniel Derichebourg arrived, the Group decided to accelerate its

expansion there through robust organic growth and bolt-on

acquisitions.

Outlook

The Group's activity remains well oriented in each of its two

businesses, and the upward trend in prices is expected to continue

to boost revenue for the rest of fiscal 2023-2024. During the

remainder of the year we intend to continue to win new business

while at the same time streamlining our portfolio of existing

contracts whose profitability levels are still considered

insufficient.

In view of the above factors and our solid results for the first

half of 2023-2024, we are standing by our previously announced

guidance for the full fiscal year, namely:

- Organic revenue growth between 4% and 5%

- Adjusted EBITA margin of at least 2.5%.

- Net debt/EBITDA ratio around 4.0x at September 30, 2024

We have set the following mid-term financial targets:

- €56 million in run-rate synergies by 2026 (compared with the

initially targeted €30 million)

- Net debt/adjusted EBITDA ratio below 3.0x at September 30,

2026

Presentation

The Group’s presentation of its results for the first half of

2023-2024 will take place on May 16, 2024, at 9:00 a.m. Paris

time and will be accessible by webcast and telephone.

Participants will be able to ask questions over the phone only.

The webcast will be accessible via the following link:

https://channel.royalcast.com/landingpage/eliorgroup/20240516_1/

The dial-in numbers for the conference call are as follows:

France: +33 (0) 1 7037 7166

United Kingdom: +44 (0) 33 0551 0200

United States: +1 786 697 3501

Access code: Elior Group; please log in at least 10 minutes

before the start of the presentation.

Financial calendar

November 20, 2024: full-year results for fiscal 2023-2024 –

pre-market press release and conference call

Appendices

Appendix 1: Revenue by business segment

Appendix 2: Revenue by geographic area

Appendix 3: Pro forma revenue by business segment

Appendix 4: Adjusted EBITA and adjusted EBITA margin by business

segment

Appendix 5: Pro forma adjusted EBITA and adjusted EBITA margin

by business segment

Appendix 6: Simplified cash flow statement

Appendix 7: Consolidated financial statements

Appendix 8: Definitions of alternative performance

indicators

About Elior Group

Founded in 1991, Elior Group is a world leader in contract

catering and multiservices, and a benchmark player in the business

& industry, local authority, education and health & welfare

markets. With strong positions in ten countries, the Group

generated €5.8 billion in pro forma revenue in fiscal 2022-2023.

Our 133,000 employees cater for 3.1 million people every day at

20,200 restaurants and points of sale on three continents.

The Group’s business model is built on both innovation and

social responsibility. Elior Group has been a member of the United

Nations Global Compact since 2004, reaching advanced level in

2015.

To find out more, visit www.eliorgroup.com/Follow Elior Group on

Twitter: @Elior_Group

Appendix 1: Revenue by business

segment

H1

2023-24

H1

2022-23

Organic

growth

Changes in

scope of consolidation

Currency

effect

Total year-on-year

change

(in € millions)

Contract Catering

2,293

2,169

5.9%

+0.6%

-0.8%

+5.7%

Multiservices

823

302

6.0%

+166.9%

0.0%

+172.9%

Sub-total

3,116

2,471

5.9%

+20.9%

-0.7%

+26.1%

Corporate & Other

7

7

1.9%

NM

NM

+1.9%

GROUP TOTAL

3,123

2,478

5.9%

+20.8%

-0.7%

+26.0%

NM: not material

Appendix 2: Revenue by geographic

area

H1

(in € millions)

2023-24

France

1,607

Europe (including the UK)

841

Rest of the world

675

GROUP TOTAL

3,123

H1

H2

12 months

(in € millions)

2022-23

2022-23

2022-23

France

1,112

1,428

2,540

Europe (including the UK)

719

704

1,423

Rest of the world

647

613

1,260

GROUP TOTAL

2,478

2,745

5,223

Appendix 3: Pro forma revenue by

business segment

Pro forma 2022-23

H1

H2

12 months

(in € millions)

2022-23

2022-23

2022-23

Contract Catering

2,169

1,982

4,151

Multiservices

789

804

1,593

Sub-total

2,958

2,786

5,744

Corporate & Other

7

9

16

GROUP TOTAL

2,965

2,795

5,760

Appendix 4: Adjusted EBITA and adjusted

EBITA margin by business segment

H1

Change in

adjusted EBITA

Adjusted EBITA margin

(in € millions)

2023-24

2022-23

2023-24

2022-23

Contract Catering

91

49

+42

4.0%

2.3%

Multiservices

16

(2)

+18

1.9%

-0.8%

Sub-total

107

47

+60

3.4%

1.9%

Corporate & Other

(7)

(6)

-1

NM

NM

GROUP TOTAL

100

41

+59

3.2%

1.7%

NM: not material

Appendix 5: Pro forma adjusted EBITA

and adjusted EBITA margin by business segment

Pro forma 2022-23

H1

H2

12 months

(in € millions)

Adjusted EBITA

Adjusted EBITA margin

Adjusted

EBITA

Adjusted EBITA margin

Adjusted EBITA

Adjusted EBITA margin

Contract Catering

49

2.3%

(2)

-0.1%

47

1.1%

Multiservices

9

1.2%

29

3.5%

38

2.3%

Sub-total

58

2.0%

27

1.0%

85

1.5%

Corporate & Other

(9)

NM

(8)

NM

(17)

NM

GROUP TOTAL

49

1.7%

19

0.7%

68

1.2%

NM: not material

Appendix 6: Simplified cash flow

statement

Six months ended

March 31

(in € millions)

2024

2023

EBITDA

189

107

Purchases of and proceeds from sale of

property, plant and equipment and intangible assets

(43)

(32)

Change in operating working capital

83

(45)

Share of profit of equity-accounted

investees

-

-

Non-recurring income and expenses

impacting cash

(13)

(15)

Other non-cash movements

(1)

2

Repayments of lease liabilities (IFRS

16)

(41)

(33)

Operating free cash flow

174

(16)

Tax recovered (paid)

(5)

1

Free cash flow

169

(15)

Appendix 7: Consolidated financial

statements

Consolidated income statement

Six months ended

March 31

(in € millions)

2024

2023

Revenue

3,123

2,478

Purchase of raw materials and

consumables

(907)

(845)

Personnel costs

(1,675)

(1,255)

Share-based compensation expense

1

(3)

Other operating expenses

(293)

(223)

Taxes other than on income

(60)

(46)

Depreciation, amortization and provisions

for recurring operating items

(88)

(68)

Net amortization of intangible assets

recognized on consolidation

(13)

(8)

Recurring operating profit from

continuing operations

88

30

Share of profit of equity-accounted

investees

-

-

Recurring operating profit from

continuing operations including share of profit of equity-accounted

investees

88

30

Non-recurring income and expenses, net

(15)

(17)

Operating profit from continuing

operations including share of profit of equity-accounted

investees

73

13

Financial expenses

(61)

(39)

Financial income

9

4

Profit/(loss) from continuing

operations before income tax

21

(22)

Income tax

(20)

(3)

Net profit/(loss) for the period from

continuing operations

1

(25)

Net profit for the period from

discontinued operations

-

-

Net profit/(loss) for the

period

1

(25)

Attributable to:

Owners of the parent

1

(23)

Non-controlling interests

-

(2)

Six months ended

March 31,

(in €)

2024

2023

Earnings/(loss) per share

Earnings/(loss) per share – continuing

operations

Basic

-

(0.14)

Diluted

-

(0.14)

Earnings per share – discontinued

operations

Basic

-

-

Diluted

-

-

Total earnings/(loss) per share

Basic

-

(0.14)

Diluted

-

(0.14)

Consolidated balance sheet –

Assets

(in € millions)

At March 31, 2024

At September 30, 2023

Goodwill

1,670

1,680

Intangible assets

247

257

Property, plant and equipment

256

258

Right-of-use assets

196

216

Non-current financial assets

129

127

Fair value of derivative financial

instruments (*)

2

5

Deferred tax assets

82

84

Total non-current assets

2,582

2,627

Inventories

101

107

Trade and other receivables

953

975

Current income tax assets

13

12

Other current assets

75

67

Cash and cash equivalents (*)

81

45

Assets classified as held for sale

-

-

Total current assets

1,223

1,206

Total assets

3,805

3,833

(*) Included in the calculation of net

debt

Consolidated balance sheet – Equity and

liabilities

(in € millions)

At March 31, 2024

At September 30, 2023

Share capital

3

3

Reserves and retained earnings(1)

822

833

Translation reserve

2

11

Equity attributable to owners of the

parent

827

847

Non-controlling interests

-

(1)

Total equity

827

846

Long-term debt (*)

1,023

1,074

Long-term lease liabilities (*)

137

155

Fair value of derivative financial

instruments (*)

6

-

Provisions for pension and other

post-employment benefit obligations

80

74

Other long-term provisions

28

28

Other non-current liabilities

6

6

Total non-current liabilities

1,280

1,337

Trade and other payables

687

646

Due to suppliers of non-current assets

12

14

Accrued taxes and payroll costs

667

639

Current income tax liabilities

17

8

Short-term debt (*)

103

135

Short-term lease liabilities (*)

68

67

Short-term provisions

54

56

Contract liabilities

51

53

Other current liabilities

39

32

Liabilities classified as held for

sale

-

-

Total current liabilities

1,698

1,650

Total liabilities

2,978

2,987

Total equity and liabilities

3,805

3,833

Net debt

1,254

1,381

Net debt excluding fair value of

derivative financial instruments and debt issuance costs

1,256

1,393

(*) Included in the calculation of net

debt

Consolidated cash flow

statement

Six months ended

March 31

(in € millions)

2024

2023

Recurring operating profit including share

of profit of equity-accounted investees

88

30

Amortization and depreciation(1)

90

76

Provisions

11

1

EBITDA

189

107

Share of profit of equity-accounted

investees

-

-

Change in operating working capital

83

(45)

Non-recurring income and expenses

impacting cash

(13)

(15)

Interest and other financial expenses

paid

(48)

(32)

Tax recovered (paid)

(5)

1

Other non-cash movements

(1)

2

Net cash from operating activities –

continuing operations

205

18

Purchases of property, plant and equipment

and intangible assets

(46)

(35)

Proceeds from sale of property, plant and

equipment and intangible assets

3

3

Purchases of financial assets

(2)

(3)

Proceeds from sale of financial assets

1

-

Acquisitions of shares in consolidated

companies, net of cash acquired

(2)

-

Other cash flows from investing

activities

(1)

(1)

Net cash from/(used in) investing

activities – continuing operations

(47)

(36)

Proceeds from borrowings

14

51

Repayments of borrowings

(86)

(73)

Repayments of lease liabilities

(37)

(30)

Net cash from/(used in) financing

activities – continuing operations

(109)

(52)

Effect of exchange rate changes

3

(4)

Increase/(decrease) in net cash and

cash equivalents – continuing operations

52

(74)

Increase/(decrease) in net cash and

cash equivalents – discontinued operations

(1)

-

Net cash and cash equivalents at

beginning of period

(2)

59

Net cash and cash equivalents at end of

period

49

(15)

(1) Including amortization of advances on customer contracts

corresponding to €1 million in the six months ended March 31, 2023

and a non-material amount in the six months ended March 31, 2024

Appendix 8: Definitions of alternative performance

indicators

Organic growth in consolidated revenue: Growth in

consolidated revenue expressed as a percentage and adjusted for the

impact of (i) changes in exchange rates, using the calculation

method described in Chapter 4, Section 4.2 of the 2022-2023

Universal Registration Document, (ii) changes in accounting

policies, and (iii) changes in scope of consolidation.

Revenue retention rate: Based on the percentage of

revenue from the previous fiscal year, adjusted for the cumulative

year-on-year change in revenue attributable to contracts or sites

lost since the beginning of the previous fiscal year.

Adjusted EBITA: Recurring operating profit, including

share of profit of equity-accounted investees, adjusted for

share-based compensation (stock options and performance shares

granted by Group companies) and net amortization of intangible

assets recognized on consolidation.

The Group considers that this indicator best reflects the

operating performance of its businesses as it includes the

depreciation and amortization arising as a result of the capex

inherent to its business model. It is also the most commonly used

indicator in the industry and therefore enables meaningful

comparisons between the Group and its peers.

Adjusted EBITA margin: Adjusted EBITA as a percentage of

consolidated revenue.

Operating free cash flow: The sum of the following items

as defined in the 2022-2023 Universal Registration Document and

recorded either as individual line items or as the sum of several

individual line items in the consolidated cash flow statement:

- EBITDA;

- net capital expenditure (i.e., amounts paid as consideration

for property, plant and equipment and intangible assets used in

operations less the proceeds received from sales of these types of

assets);

- repayments of lease liabilities (IFRS 16);

- change in net operating working capital;

- share of profit of equity-accounted investees;

- non-recurring income and expenses impacting cash;

- other non-cash movements.

This indicator reflects cash generated by operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515851628/en/

Press contact Silvine Thoma –

silvine.thoma@eliorgroup.com / +33 (0)6 80 87 05 54

Investor contact investor@eliorgroup.com

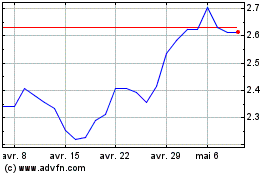

Elior (EU:ELIOR)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Elior (EU:ELIOR)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024