Equasens: 2024 nine-month revenue: €158.2 million - Return to growth in Q3 (+0.3%)

07 Novembre 2024 - 6:00PM

UK Regulatory

Equasens: 2024 nine-month revenue: €158.2 million - Return to

growth in Q3 (+0.3%)

Villers-lès-Nancy, 7 November 2024 - 6:00 p.m.

(CET)

PRESS RELEASE

2024 nine-month revenue:

€158.2 million

Return to growth

in Q3 (+0.3%)

|

Revenue (€m) |

2023

Reported basis |

2024

Reported basis |

Change /

Reported basis |

- Ségur

2024 |

+Ségur

2023 |

- External Growth

|

Change /

Like-for-like basis |

|

Q1 |

56.2 |

53.3 |

-2.9 |

-5.2% |

0.3 |

1.4 |

2.0 |

-3.8 |

-6.7% |

|

Q2 |

56.4 |

54.7 |

-1.7 |

-3.0% |

0.3 |

1.2 |

1.7 |

-2.6 |

-4.6% |

|

Q3 |

50.1 |

50.2 |

0.1 |

0.3% |

0.2 |

0.3 |

1.8 |

-1.5 |

-3.0% |

|

Total |

162.7 |

158.2 |

-4.5 |

-2.8% |

0.9 |

2.9 |

5.5 |

-7.9 |

-4.9% |

At September 30, 2024, Equasens

Group reported year-to-date revenue of €158.2m, down 2.8%

on a reported basis from one year earlier and 4.9%

like-for-like.

- Improved momentum

in Q3 both on a reported and like-for-like basis, with renewed

growth by all divisions except AXIGATE LINK which has been growing

since the beginning of the year.

- Stable

contributions from acquisitions, up 3.5% in the quarter.

Operating highlights:

|

Year-to-date revenue at 30 September by business

(€m) |

2023

Reported basis |

2024

Reported basis |

Change / Reported basis |

|

Sale of configurations and hardware |

70.3 |

62.7 |

-7.5 |

-10.7% |

|

Scalable maintenance and professional training services |

58.3 |

60.5 |

2.2 |

3.8% |

|

Software solutions and subscriptions |

32.2 |

33.0 |

0.8 |

2.6% |

|

Other services (including intermediation) |

1.9 |

1.9 |

0.0 |

-0.7% |

|

TOTAL |

162.7 |

158.2 |

-4.5 |

-2.8% |

- A smaller decline

in configuration and hardware sales (-5.0% in Q3

alone, compared with -12.9% in H1) in the Pharmagest and e-Connect

Divisions.

- Scalable

maintenance services and business training continue to

grow, albeit at a slower pace (+0.5% in Q3 2024), while e-learning

sales are down.

- The

software solutions and subscriptions business

registered strong growth (+11.4% in Q3 compared with -0.9% in H1),

with a significantly smaller Ségur base effect (€0.1m).

Acquisitions in 2024 also significantly contributed to the

segment's growth.

|

Year-to-date revenue at 30/09 / Division (€m) |

2023

Reported basis |

2024

Reported basis |

Change /

Reported basis |

- Ségur

2024 |

+Ségur

2023 |

- External Growth |

Change /

Like-for-like basis |

|

Pharmagest |

120.5 |

120.1 |

-0.4 |

-0.4% |

0.4 |

1.4 |

5.4 |

-4.9 |

-4.0% |

|

Axigate Link |

22.3 |

22.6 |

0.3 |

1.5% |

0.2 |

0.9 |

|

1.0 |

4.7% |

|

e-Connect |

11.7 |

8.3 |

-3.5 |

-29.5% |

|

|

|

-3.5 |

-29.5% |

|

Medical Solutions |

6.7 |

5.8 |

-1.0 |

-14.2% |

0.2 |

0.6 |

0.1 |

-0.7 |

-10.0% |

|

Fintech |

1.5 |

1.5 |

0.0 |

1.6% |

|

|

|

0.0 |

1.6% |

|

Total |

162.7 |

158.2 |

-4.5 |

-2.8% |

0.9 |

2.9 |

5.5 |

-7.9 |

-4.9% |

- The PHARMAGEST

Division ended Q3 2024 with revenue of €38.0m, up 3.2% on

Q3 2023 and marginally down year-to-date (-0.4% to

€120.1m).

- In France, with

revenue up 0.9% over the quarter and 2.7% year-to-date

respectively, business was notably driven by software solutions and

subscriptions (+62.6% in Q3), with acquisitions in 2024

contributing €1.0m in the quarter.

- Configuration and

hardware sales remain down (-1.6% in Q3) with the electronic label

market remaining sluggish (-€0.7m).

- In the rest of

Europe, growth remained strong, gaining 24.0% in the quarter and

19.8% year-to-date. Italy contributed significantly to this good

performance (+7.5% in Q3) while PHARMAGEST Germany added €0.7m to

revenue for the quarter and €2.2m year-to-date.

This Division accounts for 75.9% of total

revenue.

- The AXIGATE LINK

Division recorded revenue in Q3 of €7.2m, down

2.7% compared with Q3 2023. For the first nine months, the Division

reported growth in revenue of 1.5% to €22.6m. The

Division now equips 4,381 health and medico-social establishments

with a net increase of 51 new customers since the beginning of

2024.

- Continuing growth

of the nursing home sector, which accounts for 53% of the

Division's sales, has been driven by the deployment of TITAN LINK

in France (558 establishments out of 2,500 customer sites) and

Belgium (73 establishments out of 919 customer sites). Its launch

in the UK is scheduled for the end of 2024 and is expected to

contribute to accelerating the division's future growth.

- Growth momentum of

the Homecare sector (21% of the Division's revenue) also remains on

track, as DICSIT expand its coverage to Territorial Resource

Centres, regional entities that help the elderly remain in their

homes as long as possible, with the upcoming launch of a specially

designed, innovative solution.

- The Hospital sector

(12% of the Division's revenue) remains buoyant, with the signature

of two major contracts with large psychiatric establishments for

orders totalling nearly €1m to be deployed mainly in 2025. In

addition, the customer portfolio was strengthened in Q3 by the

addition of two new medium-sized hospitals.

This Division accounts for 14.3% of total

revenue.

- The E-CONNECT

Division had Q3 revenue of €2.8m, down 23.2% from Q3 2023

and bringing the decline for the first nine months to

29.5%, compared with 32.3% in H1 2024.

- As a reminder: the

Division experienced exceptional growth in 2023 driven by a

regulatory windfall (i.e. the announcement of the discontinuation

of Application Reader Terminal sales).

- Against the

backdrop of a persistently difficult market, the Division

integrated new software publishers for its Kap-inSide and eS-Kap+

solutions which address all mobility needs of healthcare

professionals (billing at the patient's bedside), thereby

significantly expanding its potential customer base.

- Marketing of the

KAP-eCV (the electronic French health insurance card reader) has

begun in the test departments. In this initial phase, the KAP-eCV

was selected by more than 25 major software publishers covering

more than half of France's healthcare professionals, confirming the

strong potential linked to the nationwide roll-out plan of the

French National Health Insurance administration to begin in January

2025.

- The NOVIAcare offer

is being adopted by new tele-care providers in France and is

continuing to be rolled out in the Netherlands.

This Division accounts for 5.2% of total

revenue.

- The MEDICAL SOLUTIONS

Division had Q3 revenue of €1.8m, down slightly (-1.2%) on

Q3 2023, bringing the decline for the first 9 months

to -14.2% compared with -19.1% in H1 2024.

- Q3 was marked by

the finalisation of investments to develop new offerings due to be

launched over the next 6 months. These include LOQuii, the

consultation voice assistant, MS.SAFE, the online backup solution,

and the Agenda, enabling patients to book appointments online from

early 2025. In this way, the Division is strengthening its upsell

strategy to provide growth drivers and recurring revenues.

- In addition, the

successful deployment in September of an intermediation offer with

a major pharmaceutical player confirms MédiStory's potential as a

software solution for prevention and patient support, opening up

new growth prospects for this activity in 2025.

The Division accounts for 3.6% of total

revenue.

- The FINTECH

Division reported revenue of €0.4m for Q3 2024 and

€1.5m for the first nine months, in line with the performances for

the same periods in 2023.

- A highlight of Q3

included the launch of the new Dispay bankcard payment service,

integrated into the healthcare professional's management

software.

- While the

contribution to revenue is still marginal at this stage, the

Division remains confident that will be able to generate additional

revenue as its customer base expands.

2024 outlook

- Equasens Group

remains confident that growth will be back on track in Q4

2024.

- The Group is

continuing to actively explore opportunities for external growth in

France and Europe, in order to strengthen its position in its

markets.

Financial

calendar:

- Q4 2023 revenue: 6 February

2025

About

Group Equasens

With more than 1,300 employees, Equasens

Group is today a key player in the European healthcare sector,

providing software and hardware solutions to all healthcare

professionals (pharmacists, primary care practitioners, hospitals,

hospital-at-home programmes, retirement homes, health centres) in

both primary and secondary care sectors.

With operations in in France, Germany, Great

Britain, Belgium, Ireland, Italy, and Luxembourg, Equasens Group

today brings together healthcare professionals within a unique

ecosystem in France and Europe benefiting people by making

available the very best of technology.

Listed on Euronext Paris™ - Compartment

B

Indexes: MSCI GLOBAL SMALL CAP - GAÏA Index

2020 - CAC® SMALL and

CAC® All-Tradable

Included in the Euronext Tech Leaders segment and the European

Rising Tech label

Eligible for the Deferred Settlement Service (“Service à

Règlement Différé” - SRD) and equity savings accounts invested in

small and mid-caps (PEA-PME).

ISIN: FR 0012882389 – Ticker Code:

EQS

Get all the news about Equasens

Group www.equasens.com

and on

LinkedIn

CONTACTS

Analyst and Investor

Relations:

Chief Administrative and Financial Officer: Frédérique Schmidt

Tel: +33 (0)3 83 15 90 67 - frederique.schmidt@equasens.com

Financial communications

agency:

FIN’EXTENSO - Isabelle Aprile

Tel.: +33 (0)6 17 38

61 78 - i.aprile@finextenso.fr

- EQUASENS_PRESS RELEASE_20241107_Sales Q3_2024_V2_EN_GB

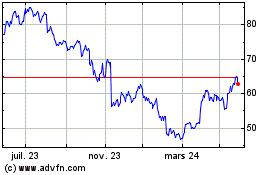

Equasens (EU:EQS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

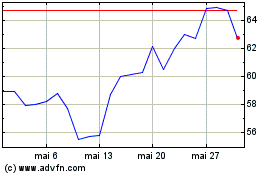

Equasens (EU:EQS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024