Moody's Gives FDJ a Long-Term Credit Rating of Baa1 - Stable Outlook

07 Novembre 2024 - 6:45PM

Business Wire

Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ), one of Europe's leading

betting and gaming operators, today announced that Moody's has

given the Group a long-term credit rating of Baa1 - stable

outlook.

This long-term investment grade rating will enable the FDJ Group

to diversify its financing sources and gain access to the bond

market, especially as part of its aim to refinance most of the €2

billion bridging loan arranged on 7 October to finance the

acquisition of Kindred shares for nearly €2.5 billion.

About FDJ Group

FDJ Group is one of Europe's leading betting and gaming

operators, with a vast portfolio of iconic brands and a reputation

for technological excellence. With almost 6,000 employees and a

presence in around 15 regulated markets in Europe, the Group offers

a diversified, responsible range of games, both under exclusive

rights and open to competition: lottery games in France and

Ireland, via an extensive point-of-sale network and online; sports

betting at points of sale in France; and online games open to

competition (sports and horse-race betting, poker and online casino

games, in markets where these activities are authorised). The FDJ

Group has placed responsibility at the heart of its strategy and

promotes recreational betting. FDJ Group is listed on the regulated

market of Euronext Paris (Compartment A – FDJ.PA) and is part of

the SBF 120, Euronext 100, Euronext Vigeo 20, EN EZ ESG L 80, STOXX

Europe 600, MSCI Europe and FTSE Euro indices.

For more information, visit www.groupefdj.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107238746/en/

Media Contact 01 41 10 33 82 |

servicedepresse@lfdj.com

Investor Relations Contact 01 41 04 19 74 |

invest@lfdj.com

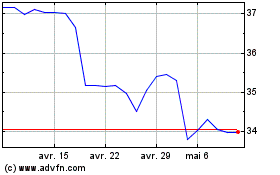

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

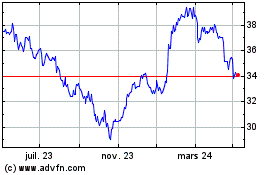

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024