Heineken Holding N.V. reports 2024 full year results

Heineken Holding N.V. reports 2024 full

year results

Amsterdam, 12 February 2025 – Heineken Holding

N.V. [(EURONEXT: HEIO; OTCQX: HKHHY)] announces:

Solid results with broad-based growth and

profit expansion in 2024

- The net result of

Heineken Holding N.V.'s participating interest in Heineken N.V. for

2024 amounts to €498 million

- Revenue €35,955

million

- Net revenue (beia)

5.0% organic growth, per hectolitre 3.5%

- Beer volume 1.6%

organic growth; Heineken® volume up 8.8%

- Operating profit

€3,517 million; operating profit (beia) 8.3% organic growth

- Operating profit

(beia) margin 15.1%, up 40 bps

- Net profit €978

million; net profit (beia) 7.3% organic growth

- Diluted EPS (beia)

€4.89

- Free Operating Cash

Flow €3,058 million

- Heineken Holding

N.V. to launch two-year share buyback programme for up to circa

€750 million

- Heineken Holding N.V

to participate pro rata to its shareholding in Heineken N.V.’s €1.5

billion share buyback programme

- Full year 2025

outlook: 4% to 8% operating profit (beia) organic growth

|

IFRS Measures |

€ million |

Total

growth |

|

BEIA Measures |

€ million |

Organic

growth2 |

|

Revenue |

35,955 |

-1.2% |

|

Revenue (beia) |

36,077 |

5.0% |

| Net revenue |

29,821 |

-1.8% |

|

Net revenue

(beia) |

29,964 |

5.0% |

| Operating

profit |

3,517 |

8.9% |

|

Operating profit

(beia) |

4,512 |

8.3% |

| |

|

|

|

Operating profit

(beia) margin (%) |

15.1% |

|

| Net profit of

Heineken Holding N.V. |

498 |

|

|

Net profit

(beia) |

2,739 |

7.3% |

| Diluted EPS (in

€) |

1.76 |

|

|

Diluted EPS

(beia) (in €) |

4.89 |

4.7% |

| |

|

|

|

Free operating

cash flow |

3,058 |

|

|

|

|

|

|

Net debt / EBITDA (beia)3 |

2.2x |

|

1 Consolidated figures are used throughout this

report, unless otherwise stated. Tables will not always cast due to

rounding. Please refer to the Glossary for an explanation of

non-GAAP measures and other terms. Page 14 includes a

reconciliation versus IFRS metrics. These non-GAAP measures are

included in internal management reports that are reviewed by the

Executive Board of HEINEKEN, as management believes that this

measurement is the most relevant in evaluating the results and in

performance management. Full year numbers are audited.

2 Organic growth shown, except for Diluted EPS (beia),

which is total growth.

3 Includes acquisitions and excludes disposals on a

12-month pro-forma basis.

HEINEKEN continued executing its EverGreen strategy,

successfully returning to balanced growth. To be in a strong

position to seize future opportunities, HEINEKEN invests in

becoming the best digitally connected brewer, raise the bar on

sustainability and responsibility, and evolve its capabilities and

culture. To fund HEINEKEN's growth, and deliver on the EverGreen

ambitions, HEINEKEN drives productivity and capital efficiency in

the pursuit of sustainable, long-term value creation.

Revenue for the full year was €36.0 billion

(2023: €36.4 billion) a total decrease of 1.2%.

Net revenue (beia) increased organically by a

solid 5.0% to €30.0 billion, supported in particular by the strong

growth of our largest operating companies in Brazil, Mexico,

Nigeria, South Africa, Vietnam and India. Total consolidated volume

increased by 1.4% with net revenue (beia) per hectolitre up 3.5%.

The underlying price-mix on a constant geographic basis was up

4.1%, with a positive contribution from all regions.

Net revenue (beia) was dampened by a negative

translation impact of €1,656 million, or 5.5%, mainly due to the

devaluation of the Nigerian Naira, and depreciation of the

Brazilian Real and Mexican Peso. The consolidation effect,

primarily HEINEKEN's exit from Russia and the sale of Vrumona more

than offsetting the acquisition benefit of Distell and Namibian

Breweries, had a net negative impact of €193 million, or 0.6%.

Beer volume increased organically 1.6% for the

full year. All regions contributed to HEINEKEN's growth, with

notable increases in India, Nigeria, Vietnam, Brazil and Mexico.

HEINEKEN gained or held volume market share in more than half of

its markets in 2024.

| Beer

volume |

|

|

4Q24 |

|

Organic

growth |

|

|

|

FY24 |

|

Organic

growth |

|

(in mhl) |

4Q23 |

|

|

|

FY23 |

|

|

|

Heineken N.V. |

59.4 |

|

60.5 |

|

1.8% |

|

242.6 |

|

240.7 |

|

1.6% |

In the fourth quarter, net revenue (beia) grew organically by

4.7%. Total consolidated volume increased by 1.5%, improving

relative to the third quarter. Beer volume increased organically by

1.8%. Net revenue (beia) per hectolitre was up organically 3.1%

with a positive price-mix on a constant geographic basis of 3.6%,

supported by strong inflation-led pricing in AME and moderate

pricing in the other regions.

Premium beer volume increased organically by

5.2%, supported in particular by Brazil, Vietnam, India, South

Africa, and the UK. This growth is led by

Heineken®,

complemented by HEINEKEN's international and local premium brands

including Kingfisher Ultra, Desperados, and Birra Moretti.

Heineken® led

HEINEKEN's premium portfolio with a volume growth of 8.8% versus

last year. Growth was broad-based across 53 markets, most notably

in HEINEKEN's key markets Brazil, China, Vietnam, and Nigeria.

Heineken®

Silver volume grew in the mid thirties, led by

China and Vietnam.

|

Heineken®

volume |

|

|

4Q24 |

|

Organic

growth |

|

FY23 |

|

FY24 |

|

Organic

growth |

|

(in mhl) |

4Q23 |

|

|

|

|

|

|

Total |

15.4 |

|

16.6 |

|

8.1% |

|

56.3 |

|

61.1 |

|

8.8% |

As HEINEKEN advances on its EverGreen journey, HEINEKEN remains

committed to its medium-term ambition to deliver superior growth,

balanced between volume and value, and continuous productivity

improvements to fund investments and enable operating profit (beia)

to grow ahead of net revenue (beia) over time.

HEINEKEN anticipates ongoing macro-economic challenges that may

affect its consumers, including weak consumer sentiment in Europe,

volatility, inflationary pressures and currency devaluations across

developing markets, and broader geopolitical fluctuations.

HEINEKEN's 2025 outlook reflects HEINEKEN's current assessment of

these factors as HEINEKEN sees them today.

For the full year 2025, HEINEKEN anticipates continued

volume and revenue growth. However, the first

quarter will face a high comparison base and be impacted by

technical factors such as fewer selling days and the timing of

Easter and Tết.

HEINEKEN expects its variable costs to rise by

a mid-single-digit per hectolitre. Excluding Africa & Middle

East, where higher local input cost inflation and currency

devaluations persist, variable costs are expected to increase by a

low-single-digit per hectolitre.

HEINEKEN's continuous productivity programme aims to deliver at

least €400 million of gross savings in 2025,

funding growth, digital transformation, and sustainability

initiatives. As it did this year, HEINEKEN intends to further

increase in support of its brands and for marketing and

selling investments to grow ahead of revenue.

Overall, HEINEKEN expects to grow operating profit

(beia) organically in the range of 4% to 8%, with:

- An average

effective interest rate (beia) of around 3.5% (2024:

3.5%)

- Other net

finance expenses (beia) to be in the range of €225 to €275

million (2024: €271 million)

- An effective

tax rate (beia) in the range of 27% to 28% (2024:

27.9%)

HEINEKEN expects net profit (beia) organic

growth to be broadly in line with the operating profit

(beia) organic growth.

Lastly, HEINEKEN anticipates maintaining a similar level of

capital expenditure this year (2024: 8.2% of net

revenue (beia)).

|

|

Share buyback programme Heineken Holding N.V. and Heineken

N.V. |

Heineken Holding N.V. intends to implement a two-year programme

to repurchase own shares for an aggregate amount up to circa €750

million.

Heineken N.V. intends to simultaneously execute a share buyback

programme for an aggregate amount of €1.5 billion. Heineken Holding

N.V. intends to participate pro rata to its shareholding in

Heineken N.V.’s share buyback programme.

Heineken Holding N.V. intends to use the proceeds of its pro

rata participation in the Heineken N.V. share buyback programme to

purchase a number of Heineken Holding N.V. shares equal to the

number of Heineken N.V. shares that Heineken Holding N.V. will sell

to Heineken N.V. All shares that are repurchased by Heineken

Holding N.V. under the programme will be cancelled. Heineken

Holding N.V. intends to distribute any excess proceeds after the

repurchase of its own shares to Heineken Holding N.V. shareholders

on regular final dividend dates. The share buyback programme may be

suspended, modified, or discontinued at any time.

The programme will be executed within the existing authority

granted in the 25 April 2024 Heineken Holding N.V. Annual General

Meeting of Shareholders and the authority granted by future

Heineken Holding N.V. general meetings.

L'Arche Green N.V., Heineken Holding N.V.'s majority

shareholder, is supportive of the share buyback programme and as

such has irrevocably undertaken to vote in favour of any requested

share buyback and share cancellation mandates in relation to the

announced programme at future general meetings of Heineken Holding

N.V. L'Arche Green N.V. remains strongly committed as Heineken

Holding’s long-term majority shareholder and will not participate

in the programme.

Both the Heineken Holding N.V. and Heineken N.V. share buyback

programmes will be conducted in accordance with the Market Abuse

Regulation 596/2014 and Commission Delegated Regulation (EU)

2016/1052 (each as amended), including compliance with safe harbour

provisions for such programmes. All transactions under the

respective programmes will be published on Heineken Holding N.V.'s

or Heineken N.V.'s website, as applicable, through regular press

releases and updates.

The Heineken N.V. dividend policy is to pay a ratio of 30% to

40% of full year net profit (beia). For 2024, a total cash dividend

of €1.86 per share, a 7.5% increase to last year

(2023: €1.73), for an aggregate amount of €1,042 million. This

represents a payout ratio of 38.0%, within the

range of Heineken N.V.'s policy, and will be proposed to the

Heineken N.V. Annual General Meeting on 17 April 2025. If approved,

a final dividend of €1.17 per share will be paid on 2 May 2025, as

an interim dividend of €0.69 per share was paid on 8 August

2024.

If Heineken N.V. shareholders approve the proposed dividend,

Heineken Holding N.V. will, according to its Articles of

Association, pay an identical dividend per share. A final dividend

of €1.17 per share of €1.60 nominal value will be payable as of 2

May 2025.

Both the Heineken Holding N.V. shares and the Heineken N.V.

shares will trade ex-dividend on 23 April 2025. The dividend

payment will be subject to a 15% Dutch withholding tax.

|

|

Translational Calculated Currency Impact |

The translational currency impact for 2024 was negative on net

revenue (beia) by €1,656 million, on operating profit (beia)

by €236 million and on net profit beia by €54 million.

Applying spot rates of 10 February 2025 to the 2024 financial

results as a base, the calculated negative currency translational

impact for the full year would be approximately €180 million in net

revenue (beia), €80 million at operating profit (beia), and €40

million at net profit (beia).

|

|

Board of Directors Composition |

The Board of Directors of Heineken Holding N.V. announced on 13

December 2024 that it will propose at the Annual General Meeting of

Shareholders (AGM) in April 2025 to appoint Jean-Marc Huët as

non-executive member of the Board of Directors of Heineken Holding

N.V., for the maximum period of four years, i.e. until the AGM in

2029. The Board of Directors has appointed Mr Huët as Chair of the

Board of Directors, conditional upon his appointment as

non-executive member of the Board of Directors.

Jean-Marc Huët (1969) is a Dutch national. Mr Huët holds an MBA

from INSEAD (Fontainebleau, France) and a bachelor's degree from

Dartmouth College (New Hampshire, USA). Mr Huët is Chairman of the

Board of Directors of Lonza Group. Mr Huët also serves as Chair of

the Supervisory Board of Vermaat Groep. Mr Huët will step down as

member and Chair of the Supervisory Board of Heineken N.V. at the

AGM of Heineken N.V. in April 2025.

Maarten Das will retire as non-executive member and Chair of the

Board of Directors when his current term ends at the AGM in April

2025. Mr Das was first appointed to the Board of Directors in 1994

and held the role of Chair since 2002.

Furthermore, the Board of Directors of Heineken Holding N.V.

announced that it will propose at the AGM in April 2025 to

reappoint Alexander de Carvalho as non-executive member of the

Board of Directors of Heineken Holding N.V., for a next four-year

term.

|

Media Heineken Holding N.V. |

|

|

|

Kees Jongsma |

|

|

| tel. +31 6 54 79

82 53 |

|

|

| E-mail:

cjongsma@spj.nl |

|

|

| |

|

|

|

Media |

|

Investors |

|

Christiaan Prins |

|

Tristan van Strien |

| Director of

Global Communication |

|

Global Director

of Investor Relations |

| Marlie

Paauw |

|

Lennart

Scholtus / Chris Steyn |

| Corporate

Communications Lead |

|

Investor

Relations Manager / Senior Analyst |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

|

Tel:

+31-20-5239590 |

|

|

Investor Calendar HEINEKEN |

|

Annual report publication |

20 February 2025 |

| Trading Update for Q1

2025 |

16 April 2025 |

| Annual General Meeting of

Shareholders |

17 April 2025 |

| Quotation ex-final dividend

2024 |

23 April 2025 |

| Final dividend 2024

payable |

2 May 2025 |

| Half Year 2025 Results |

28 July 2025 |

| Quotation ex-interim dividend

2025 |

30 July 2025 |

| Interim dividend payable |

31 July 2025 |

| Trading Update for Q3

2025 |

22 October 2025 |

| Capital Markets Event in

Seville, Spain |

23-24 October 2025 |

HEINEKEN will host an analyst and investor video webcast about

its 2024 FY results today, 12 February, at 14:00 CET/ 13:00 GMT/

08.00 EST. This call will also be accessible for

Heineken Holding N.V. shareholders. The live video webcast

will be accessible via the Heineken N.V.’s website:

https://www.theheinekencompany.com/investors/results-reports-webcasts-and-presentations.

An audio replay service will also be made available after the

webcast at the above web address. Analysts and investors can

dial-in using the following telephone numbers:

| United Kingdom

(local): +44 20 3936 2999 |

| Netherlands

(local): +31 85 888 7233 |

| United States: +1

646 787 9445 |

| All other

locations: +44 20 3936 2999 |

| For the full list

of dial in numbers, please refer to the following link: Global

Dial-In Numbers |

| Participation

password for all countries: 962302 |

Editorial information:

Heineken Holding N.V. engages in no activities other than its

participating interest in Heineken N.V. and the management or

supervision of and provision of services to that company. HEINEKEN

is the world's most international brewer. It is the leading

developer and marketer of premium and non-alcoholic beer and cider

brands. Led by the Heineken® brand, the Group has a portfolio of

more than 340 international, regional, local and specialty beers

and ciders. With HEINEKEN’s over 85,000 employees, we brew the joy

of true togetherness to inspire a better world. HEINEKEN's dream is

to shape the future of beer and beyond to win the hearts of

consumers. HEINEKEN is committed to innovation, long-term brand

investment, disciplined sales execution and focused cost

management. Through "Brew a Better World", sustainability is

embedded in the business. HEINEKEN has a well-balanced geographic

footprint with leadership positions in both developed and

developing markets. HEINEKEN operates breweries, malteries, cider

plants and other production facilities in more than 70 countries.

Most recent information is available on www.heinekenholding.com and

www.theheinekencompany.com and follow HEINEKEN on LinkedIn, Twitter

and Instagram.

Market Abuse Regulation:

This press release may contain price-sensitive information within

the meaning of Article 7(1) of the EU Market Abuse Regulation.

Disclaimer:

This press release contains forward-looking statements based on

current expectations and assumptions with regards to the financial

position and results of HEINEKEN’s activities, anticipated

developments and other factors. All statements other than

statements of historical facts are, or may be deemed to be,

forward-looking statements. Forward-looking statements also

include, but are not limited to, statements and information in

HEINEKEN’s non-financial reporting, such as HEINEKEN’s emissions

reduction and other climate change related matters (including

actions, potential impacts and risks associated therewith). These

forward-looking statements are identified by their use of terms and

phrases such as “aim”, “ambition”, “anticipate”, “believe”,

“could”, “estimate”, “expect”, “goals”, “intend”, “may”,

“milestones”, “objectives”, “outlook”, “plan”, “probably”,

“project”, “risks”, “schedule”, “seek”, “should”, “target”, “will”

and similar terms and phrases. These forward-looking statements,

while based on management's current expectations and assumptions,

are not guarantees of future performance since they are subject to

numerous assumptions, known and unknown risks and uncertainties,

which may change over time, that could cause actual results to

differ materially from those expressed or implied in the

forward-looking statements. Many of these risks and uncertainties

relate to factors that are beyond HEINEKEN’s ability to control or

estimate precisely, such as but not limited to future market and

economic conditions, the behaviour of other market participants,

changes in consumer preferences, the ability to successfully

integrate acquired businesses and achieve anticipated synergies,

costs of raw materials and other goods and services, interest-rate

and exchange-rate fluctuations, changes in tax rates, changes in

law, environmental and physical risks, change in pension costs, the

actions of government regulators and weather conditions. These and

other risk factors are detailed in HEINEKEN’s publicly filed annual

reports. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only of the date of this

press release. HEINEKEN assumes no duty to and does not undertake

any obligation to update these forward-looking statements contained

in this press release. Market share estimates contained in this

press release are based on outside sources, such as specialised

research institutes, in combination with management estimates.

- Heineken Holding NV FYPR2024 FINAL

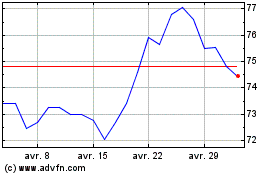

Heineken (EU:HEIO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Heineken (EU:HEIO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025