Regulatory News:

Ikonisys SA (Euronext Growth Paris: ALIKO), a company

specializing in the early and accurate detection of cancers through

a unique, fully automated solution for medical analysis

laboratories (the “Issuer”), today announces the completion

of a capital increase of €500k by way of a private placement with a

specialized investor.

This transaction is part of the Company strategy to strengthen

its net financial position while expanding its shareholder base

with specialized investors, following the path highlighted during

the presentation of the ALIKO SCIENTIFIC brand on December 4,

2024.

The funds raised will be primarily used to accelerate the

Group’s global commercial expansion and its transformation into a

global hub for next-generation oncology diagnostics solutions.

Legal terms of the Capital Increase

The implementation of this capital increase, conducted with

cancellation of shareholders' subscription rights through a private

placement, was approved by the Board of Directors of the Issuer at

its meeting held on February 10, 2025 (the "Capital

Increase").

The new shares will be issued under the 17th resolution of the

Issuer's shareholders' meeting held on September 30, 2024. The

settlement-delivery of the new shares is expected to take place on

March 3, 2025.

In accordance with applicable regulations, the Capital Increase

did not require the approval of a notice (le “prospectus”)

by the Autorité des marchés financiers (the “AMF”).

Main terms of the Capital Increase

The Issuer has issued a total of 333,333 new ordinary shares,

with a par value of €0.5 each, to the investor, pursuant to article

L. 225-129, 225-129-2 and 225-138 of the French Commercial Code, in

accordance with the 17th resolution passed by its Annual General

Meeting on September 30, 2024.

The issuance price of the new shares issued under the Capital

Increase, equal to €1.50 per share, represents a premium of

approximately 3% on the Ikonisys share price at the close of

February 26, 2025.

Impact of the transaction in terms of liquidity risk

management and financing horizon

As of June 30, 2024, and as mentioned in the half-year financial

report published on October 31, 2024, the Issuer's consolidated

cash position amounted to €23k.

In order to strengthen its financial resources, Ikonisys

completed in H2 2024 capital increases for a total cumulative sum

of €1m.

Taking into account the previously secured financing facility,

the Company considers that it is now in a position to meet its

financing needs for more than 12 months.

Impact of the Capital Increase on a shareholder holding 1% of

the capital

On the basis of the 13,457,565 shares outstanding, the impact on

the shareholding of a shareholder holding 1% of the Issuer's

capital prior to the transaction is as follows:

On a non-diluted

basis

On a diluted

basis1

Before completion of the Capital

Increase

1.00%

0.97 %

After issuance of the 333,333 shares

resulting from the Capital Increase

0.98 %

0.95 %

1 Dilution takes into account the exercise of all outstanding

dilutive instruments likely to result in the issuance of a maximum

indicative number of 397,043 new shares.

Capital breakdown before and after completion of the Capital

Increase

Before the Capital Increase:

Shareholder

Number of shares

% of share capital

% of voting rights

Cambria Co-Investment Fund

5,268,989

39.15%

48.97%

Cambria Equity Partners

1,796,919

13.35%

16.49%

MC Consulting*

351,464

2.61%

3.63%

Redfish 4 listing Srl

233,333

1.73%

1.20%

CC Holding Srl

166,666

1.24%

0.86%

ETH Scientific Srl

2,000,000

14.86%

10.33%

Free float

3,640,194

27.05%

18.52%

Total

13,457,565

100%

100%

Treasury shares

54,138

*Holding company of the CEO, Mario Crovetto

After the Capital Increase:

Shareholder

Number of shares

% of share capital

% of voting rights

Cambria Co-Investment Fund

5,268,989

38.21%

48.14%

Cambria Equity Partners

1,796,919

13.03%

16.21%

MC Consulting*

351,464

2.55%

3.57%

Redfish 4 listing Srl

233,333

1.69%

1.18%

CC Holding Srl

166,666

1.21%

0.85%

ETH Scientific

2,000,000

14.50%

10.15%

Free float

3,973,527

28.81%

19.90%

Total

13,790,898

100%

100%

Treasury shares

54,138

*Holding company of the CEO, Mario Crovetto

Risk factors related to the Issuer

Detailed information about the Issuer, including its business,

financial information, results, outlook and related risk factors,

is contained in the 2023 annual financial report for the financial

year ended December 31, 2023, published on July 8, 2024. This

document, together with other regulated information and all the

Issuer's press releases, is available on the Issuer's website

(https://alikoscientific.com).

-----------------------

About ALIKO SCIENTIFIC (Ikonisys SA)

Headquartered in Paris, ALIKO SCIENTIFIC is the parent company

of an international ecosystem of businesses dedicated to advancing

oncology diagnostics. Listed on Euronext Growth Paris under the

ticker ALIKO, the company coordinates industrial, financial and

research activities through its subsidiaries: Ikonisys Inc. (USA)

and Hospitex International (Italy). ALIKO SCIENTIFIC's mission is

to innovate cancer diagnosis by uniting cutting-edge technologies,

resources, and strategic investments to create a global center of

excellence in oncology.

For more information, visit: www.alikoscientific.com

About IKONISYS

Ikonisys is a global leader in automated diagnostics,

specializing in fluorescence in situ hybridization (FISH) and

circulating tumor cell (CTC) detection. Leveraging advanced

artificial intelligence (AI) and a fully automated microscopy

platform, Ikonisys provides unmatched precision, scalability, and

efficiency in cancer diagnostics and treatment monitoring.

Recognized as pioneer in automation for rare cell detection,

Ikonisys is at the forefront of personalized medicine, empowering

clinicians to deliver targeted therapies and improve patient

outcomes.

For more information, visit: www.ikonisys.com

About HOSPITEX

Hospitex, based in Florence, Italy, is a global leader in

cytology innovation. The company conducts in-house research,

development, and production, thus ensuring the highest standards of

quality. Hospitex offers the world's most advanced Liquid-Based

Cytology (LBC) technology, capable of processing any cytological

sample with unmatched precision. Hospitex is uniquely positioned as

the only company fully prepared for seamless digital integration,

paving the way for a transformative future in cytology

diagnostics.

For more information, visit: www.hospitex.com

Contacts

Disclaimer

This press release contains forward-looking statements about the

Company's prospects and development. These statements are sometimes

identified by the use of the future tense, the conditional tense

and forward-looking words such as "believe", "aim to", "expect",

"intend", "estimate", "believe", "should", "could", "would" or

"will" or, where appropriate, the negative of these terms or any

other similar variants or expressions. This information is not

historical data and should not be construed as a guarantee that the

facts and data set forth will occur. This information is based on

data, assumptions and estimates considered reasonable by the

Company. It is subject to change or modification due to

uncertainties relating to the economic, financial, competitive and

regulatory environment. This information contains data relating to

the Company's intentions, estimates and objectives concerning, in

particular, the market, strategy, growth, results, financial

situation and cash flow of the Company. The forward-looking

information contained in this press release is made only as of the

date of this press release. The Company does not undertake to

update any forward-looking information contained in this press

release, except as required by applicable law or regulation. The

Company operates in a competitive and rapidly changing environment

and therefore cannot anticipate all of the risks, uncertainties or

other factors that may affect its business, their potential impact

on its business or the extent to which the materialization of any

one risk or combination of risks could cause results to differ

materially from those expressed in any forward-looking information,

it being recalled that none of this forward-looking information

constitutes a guarantee of actual results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227707866/en/

Ikonisys Alessandro Mauri CFO investors@ikonisys.com

NewCap Louis-Victor Delouvrier/Aurélie Manavarere Investor

Relations ikonisys@newcap.eu Tel.: +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations ikonisys@newcap.eu

Tel.: +33 (0)1 44 71 94 98

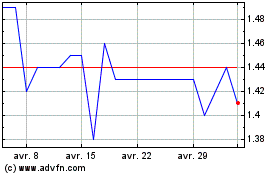

Ikonisys (EU:ALIKO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Ikonisys (EU:ALIKO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025