Maisons du Monde: Q3 sales at -9.4% consistent with

pre-announcement and FY23 guidance adjustment on October 9. 3C Plan

further strengthened to address changing consumer dynamics

PRESS

RELEASENantes, 26 October 2023

THIRD-QUARTER AND NINE-MONTH 2023

ACTIVITY

Q3 sales at -9.4% consistent with

pre-announcementand FY23 guidance adjustment on

October 9

3C Plan further strengthened to address

changing consumer dynamics

- Group GMV: Q3 at €285.2m

(-6.3% yoy), 9M at €896.0m (-5.5% yoy)

- Marketplace GMV: Q3

at €42.6m (+30.1% yoy), 9M at €127.6m (+56.1% yoy)

- France GMV: Q3 at

€161.9m (-3.3% yoy), 9M at €504.3m (-2.2% yoy)

- Group sales:

Q3 at €252.3m (-9.4% yoy), 9M at €795.7m (-9.8% yoy)

-

3C Plan: Reinforcing and accelerating all actions

- Customers:

Strengthening the Q4 commercial action plan to adapt to consumer

behavior, introducing new and distinctive initiatives.

- Costs: Further

increasing selectivity of spending and ensuring a significant

outperformance of 2023 cost savings plan, increased from €25

million to €35 million.

-

Cash: Optimizing working capital through payment

terms and inventory management, and further streamlining of

projects to limit 2023 Capex to c.€40 million.

François-Melchior de Polignac, CEO,

commented:“The change in the consumption environment that

Maisons du Monde has faced since August led us to adjust our

full-year 2023 objectives a few weeks ago.In this context, all

teams are engaged in leveraging our 3C Plan and intensifying our

focus across its three dimensions: Customers, Costs, and Cash.I am

also expecting the Group to benefit from the arrival of Christophe

Lapotre as Head of Retail and Guillaume Lesouef as Head of

Marketing, Merchandise and Sustainability, who will contribute to

take our commercial efficiency to the next level.Turning Maisons du

Monde into a more customer-centric and profitability-driven

organization will lay the foundation for our broader transformation

plan to be shared in Q1 2024.”

Conference call

for investors

and analysts

Date: 26 October 2023 at 9:00 am CET

Speakers: François-Melchior de Polignac, CEO and Gilles Lemaire,

Acting CFO Connection details:

- Webcast:

https://edge.media-server.com/mmc/p/qn27in5t

- Conference call:

https://register.vevent.com/register/BIee9bbee94bb44ff1a52ce447281eb010

MARKET TREND AND BUSINESS

OVERVIEW

Since August, Maisons du Monde has been dealing

with deteriorating macro-economic trends and declining consumer

confidence across Europe.After a positive month of July that

benefited from summer sales, non-food consumption trends

deteriorated sharply across many sectors. Consumer confidence in

Europe started to decline again from August after a year of

continuous recovery, as rising energy and food prices fueled

inflation concerns. In France, inflation rose in August and

September compared to July, affecting consumer purchasing power. In

this context, the Home & Furniture sector felt the full effect

of reduced discretionary consumer spending, resulting in lower

traffic both in stores and online.

FY23 GUIDANCE ADJUSTED ON OCTOBER

9

Given this context, Maisons du Monde adjusted

its 2023 financial objectives on October 9:

|

|

Adjusted guidance |

Previous guidance |

|

Top line |

Decline by c. -10% |

Decline in the low-to-mid single digit range, with a sequential

improvement in H2 vs H1 |

|

EBIT |

€40m-€50m |

€65m-€75m |

|

FCF |

€20m-€30m |

€40m-€50m |

|

Dividend pay-out ratio |

30% to 40% |

CANCELLATION OF SHARES PURCHASED UNDER THE SHARE BUYBACK

PROGRAM COMPLETED END OF JUNE 2023

On June 30, 2023, Maisons du Monde fully

completed its second share buyback program, which was launched on

July 29, 2022. The Group has repurchased 4,098,809 shares at an

average market price of €10.17.A first cancellation of 2,300,000

shares was carried out in March 2023 followed by a capital

reduction.The Board of Directors meeting on October 25, 2023,

approved the cancellation of 1,798,809 remaining shares. The

capital reduction will be executed on October 27, 2023.The share

capital of Maisons du Monde S.A. will then be divided into

39,189,288 shares.

UPCOMING REPAYMENT OF CONVERTIBLE

BONDS

Maisons du Monde will proceed to the repayment

of €200m convertible bonds issued in 2017 coming to maturity on

December 6, 2023 with a mix of Group’s Senior credit facilities and

cash.

As a reminder, Maisons du Monde successfully

secured with its banks around €250 million credit facilities in

April 2022, and in June 2023, further increased the amount to reach

nearly €300 million and extended the maturity profile to April

2028. The cash and cash equivalents position of the Group as of

June 30, 2023 was €100 million.

Q3 and 9M 2023

SALES PERFORMANCE

|

Summary of

sales |

Q3 23 |

Q3 22 |

%Change |

9M 2023 |

9M 2022 |

%Change |

|

(in EUR million) |

|

|

Group GMV |

285.2 |

304.3 |

-6.3% |

896.0 |

948.0 |

-5.5% |

|

Sales |

252.3 |

278.5 |

-9.4% |

795.7 |

882.4 |

-9.8% |

|

Like-for-like |

-10.6% |

-10.1% |

|

-11.2% |

-8.1% |

|

|

Sales by product

category |

|

|

|

|

|

|

|

Decoration |

143.7 |

159.0 |

-9.6% |

433.1 |

479.5 |

-9.7% |

|

% of sales |

57.0% |

57.1% |

|

54.4% |

54.3% |

|

|

Furniture |

108.6 |

119.5 |

-9.1% |

362.7 |

402.9 |

-10.0% |

|

% of sales |

43.0% |

42.9% |

|

45.6% |

45.7% |

|

|

Sales by

distribution channel |

|

|

|

|

|

|

Stores |

182.7 |

198.9 |

-8.2% |

564.9 |

606.0 |

-6.8% |

|

% of sales |

72.4% |

71.4% |

|

71.0% |

68.7% |

|

|

Online |

69.7 |

79.6 |

-12.4% |

230.8 |

276.4 |

-16.5% |

|

% of sales |

27.6% |

28.6% |

|

29.0% |

31.3% |

|

|

Sales by

geography |

|

|

|

|

|

|

|

France |

138.6 |

146.8 |

-5.6% |

430.2 |

459.4 |

-6.4% |

|

% of sales |

54.9% |

52.7% |

|

54.1% |

52.1% |

|

|

International |

113.8 |

131.7 |

-13.6% |

365.5 |

423.0 |

-13.6% |

|

% of sales |

45.1% |

47.3% |

|

45.9% |

47.9% |

|

Q3 GMV and Sales

Group GMV was €285.2 million,

down 6.3% yoy, including online GMV representing 35.0% at €99.8

million. Marketplace GMV amounted to €42.6

million, up +30.1%, of which €3.7 million in-stores and €38.9

million online.

Third-quarter

sales amounted to €252.3 million, declining by

-9.4% yoy, showing an acceleration of the consumption deterioration

in Q3 2023.

Q3 2023 sales details

Sales by

channel

Online sales were €69.7

million, representing a yoy decrease of -12.4%. Online sales in

France showed some resilience compared to other countries, notably

supported by the ongoing growth of the marketplace. Indeed,

marketplace continued to grow consistently in its three countries,

France, Spain and Italy, allowing us to better serve the needs of

our customers while increasing the profitability of our online

operations.

On the other hand, Germany strongly contributed

to online sales decline, as a result of ROI-driven approach to

digital marketing investments across our markets. In this market,

the launch of the marketplace in August and the progressive ramp up

of local brands are expected to improve Maisons du Monde website’s

overall attractivity, traffic and sales resilience.

Store sales amounted to €182.7

million, down -8.2% yoy.This decline was less pronounced in France,

which proved more resilient than other geographies. Continuing its

active store network management, the Group closed 6 stores and

transferred one to an affiliate partner. At the end of Q3 2023, the

Group operated 344 own stores and 3 affiliated in France.

The uniqueness of our hybrid online and offline

marketplace model is also further evidenced in Q3 by the growing

part of marketplace GMV generated in store.

Sales by

category

Furniture and Decoration categories experienced

similar trends in Q3.

Decoration sales amounted to

€143.7 million, down -9.6% yoy, representing 57.0% of sales. The

decoration category benefited from price adjustments on 400

references among the most attractive products. However, textile

items were adversely affected by unusual weather conditions in

Europe.

Furniture sales reached €108.6

million, down -9.1% yoy, representing 43.0% of sales.The furniture

category benefitted from record-high availability of products

displayed in-store and online and was sustained by initiatives such

as free shipping for online orders and free installment

payments.

Sales by

geography

Sales in France reached €138.6

million, marking a yoy decline of -5.6%. This relative resilience

compared to other geographies can be explained by the successful

implementation of the Appshop, Maisons du Monde’s innovative

digital platform in-store, reaching 95% of orders, and an optimized

merchandising with improved availability of products displayed.

International sales totaled

€113.8 million, down -13.6% yoy, with Switzerland particularly

contributing to this decline. As a result, Maisons du Monde will

start implementing a more favorable Swiss for Euro conversion rate

for its pricing policy in Q4 on a large part of the assortment. The

discontinuation of non-profitable online activities in the UK

resulted in an impact of €-2.2million in sales.

Financial calendar

25 January

2024 Q4

and FY 2023 sales

Disclaimer:

Forward Looking

Statement

This press release contains certain statements

that constitute "forward-looking statements," including but not

limited to statements that are predictions of or indicate future

events, trends, plans or objectives, based on certain assumptions

or which do not directly relate to historical or current facts.

Such forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted or implied by such

forward-looking statements. Accordingly, no representation is made

that any of these statements or forecasts will come to pass or that

any forecast results will be achieved. Any forward-looking

statements included in this press release speak only as of the date

hereof and will not give rise to updates or revision. For a more

complete list and description of such risks and uncertainties,

refer to Maisons du Monde’s filings with the French Autorité des

marchés financiers.

About Maisons du Monde

Maisons du Monde, a uniquely positioned and

beloved brand across Europe, stands as the European leader in

inspirational and affordable home & living. It offers a wide

and constantly renewed range of furniture and home accessories

across multiple styles. Creativity, inspiration and engagement are

the brand’s core pillars. Leveraging its distinctive

direct-to-consumer omnichannel model, the company generates over

50% of its sales digitally, through its online platform and

in-store digital sales and operates stores in 9 European

countries.”

corporate.maisonsdumonde.com

Contacts

|

Investor Relations |

Press Relations |

|

Carole Alexandre Tel: (+33) 6 30 85 12 78 |

Pierre Barbe Tel: (+33) 6 23 23 08 51 |

|

calexandre@maisonsdumonde.com |

pbarbe@maisonsdumonde.com |

- 2023 10 26 Q3-9M 23 Sales_EN_FOR RELEASE

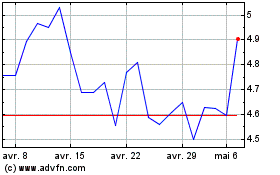

Maisons du Monde (EU:MDM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Maisons du Monde (EU:MDM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024