Strong revenue growth, margin expansion and FCF delivery in 2024,

while investing significantly and reaching key transformation

milestones

Regulated information

- Portfolio refocus nearly complete and major steps

taken in transforming European and North American

footprint;

- Innovation and operating efficiencies strengthened

competitiveness, leading to 6% volume & mix growth and 28% adj.

EBITDA increase;

- Solid operational result facilitated step up of

investments in transformation and growth, while raising FCF to €48

million;

- 2025 outlook for revenue to grow by 3% to 5% LFL,

adj. EBITDA by 4% to 7%, and FCF to remain

strong;

CEO quote

Gustavo Calvo Paz, Ontex’s CEO, said: “We achieved

key strategic milestones last year, thanks to the dedication of

Ontex’s teams. With all planned strategic divestments finalized or

agreed, we will be fully focused on retailer and healthcare brands

by end 2025. We also achieved a major step to make our European

footprint leaner, with the transformation of our Belgian operations

to be finalized early 2026. These measures are necessary to

continue driving our competitiveness and profitability, as we did

in the last two years. We achieved strong volume growth in 2024, in

North America, and in selected categories in Europe. Our biggest

category has now become adult care, positioning us well to serve

the needs of a growing and more active elderly population. Our

margins expanded back to our historic levels, and while we continue

to invest in our transformation, our free cash flow delivery has

strengthened further. I have confidence that we will drive our free

cash flow up over time, as we execute our growth and efficiency

plans, and as the step-up investment phase of our transformation

journey will fade down after 2025.”

FY 2024 results

- Revenue [1] was €1,860 million, up 3.5% like

for like. Volumes were up 5.7% including mix effects, growing in

all categories, and by double digits in baby care in North America,

as well as in adult care and baby pants in Europe. Sales prices

were 2.2% lower, reflecting the decrease of raw material indices

and investments in increased competitiveness. Forex fluctuations

were positive, adding 0.2%, bringing total growth at 3.7%.

- Adjusted EBITDA [1] was €223 million, up 28%.

Sustained delivery of the cost transformation program added €70

million, driving competitiveness and profitability. Volume and mix

growth contributed €21 million and lower prices had a €(39) million

effect. While lower raw material prices, in line with indices,

added €39 million, continued inflation drove other operating and

SG&A costs up by €(28) million and €(10) million respectively.

Forex fluctuations had an adverse effect of €(3) million. The

adjusted EBITDA margin [1] rose to 12.0%, up 2.3pp

year on year. The operating profit [1] was €76

million, including one-time restructuring expenses of €(73)

million, primarily related to the restructuring of the Belgian

operations.

- Adjusted profit from continuing operations doubled to €76

million, and including the one-time restructuring charges, profit

from continuing operations was €21 million. The loss from

discontinued operations was €(11) million, reflecting lower adj.

EBITDA due to the scope reduction, and divestment-related one-time

costs. The profit for the period for the Total Group was thereby

€10 million.

- Free cash flow amounted to €48 million, a significant increase

compared to €9 million in 2023. Strong operational delivery and

working capital management, more than offset the temporary step-up

in investments to transform the Group in an accelerated way.

Capital expenditure rose to €(112) million, reaching close to 6% of

revenue in Core Markets, and €(39) million one-time spent was

related mostly to the transformation of the Belgian

operations.

- Net financial debt for the Total Group dropped €53 million to

€612 million over the year. Combined with the adjusted EBITDA

improvement, the leverage ratio was brought down from 3.25x at the

start of the year to 2.46x at the end.

Q4 2024 results

- Revenue [1] was €476 million, up 6.6% like for

like versus 2023. Volumes were up 9.0% including mix effects, and

grew in all categories. The increase was driven primarily by the

growth acceleration in North America as well as sustained growth in

selected categories in Europe. As anticipated, sales prices were

largely stable sequentially, and 2.4% lower year on year,

reflecting the past raw material index decreases and investments in

increased competitiveness. Forex fluctuations were supportive,

adding 0.2%, bringing total growth at 6.8% year on year.

- Adjusted EBITDA [1] was €57 million, up 22%

year on year. The cost transformation program delivered €17

million, driving stronger profitability and competitiveness. Volume

and mix growth contributed €7 million. Sales prices had a €(11)

million adverse impact. While raw material prices were stable

overall year on year, continued inflation drove other operating

costs up by €(6) million. SG&A costs were stable sequentially,

but €4 million lower than in 2023. Forex fluctuations had an

adverse effect of €(1) million. The adjusted EBITDA margin rose to

11.9%, up 1.5pp year on year. The operating

profit [1] was €36 million, versus €23 million in

2023, reflecting the strong operational improvement.

- Discontinued operations generated an operating loss of €(5)

million, compared to a profit of €13 million in 2023. Revenue was

8.4% lower like for like and the adjusted EBITDA margin dropped to

5.6%, reflecting more challenging market conditions in Brazil. The

operating result also includes an impairment of €(6) million on the

Turkish assets, triggered by the divestment process.

Strategic developments since Q4 2024

- In November, Ontex entered into a new syndicated facilities

agreement, encompassing a new revolving credit facility with a

maximum drawable amount of €270 million and a five-year maturity.

The new facility replaces the previous one, which had maximum

drawable amount of €242 million, and similarly holds a floating

interest rate based on EURIBOR plus a margin, subject to certain

conditions including the leverage ratio.

- In December, Ontex launched a share buyback program to acquire

a maximum of 1.8% of its issued shares by June 2025. The acquired

shares are to contribute to meeting Ontex’s obligations under its

current and future long-term incentive plans.

- In January 2025, Ontex reached a binding agreement to sell its

Turkish business activities to Dilek Grup for an enterprise value

of approximately €24 million, net of cash disposed, and prior to

taxes and transaction costs. The closing is expected during the

third quarter of 2025 subject to customary conditions. With this

agreement, Ontex will conclude its strategic refocus on retailer

and healthcare brands in Europe and North America in 2025.

Including the previously announced divestment of the Brazilian

business, about €100 million net proceeds are expected to be

received in the year.

2025 outlook

Based on solid delivery in the last two years, Ontex is well

positioned to successfully complete its intensive three-year

transformation journey, and thereby expects the following for

2025:

- Revenue to grow by 3% to 5% like for like, supported by

double-digit volume growth in North America;

- Adjusted EBITDA to grow by 4% to 7%, supported by revenue

growth and further improvement of operational efficiencies;

- Free cash flow to remain strong, while continuing the step-up

of investments in Ontex’s transformation. This step-up will be

nearing completion by the end of 2025.

Key business indicators

| Business

results |

Q4 |

Year |

|

in € million |

2024 |

2023 |

% |

% LFL |

2024 |

2023 |

% |

% LFL |

| Core Markets

(continuing operations) |

|

Revenue |

476.5 |

446.0 |

+6.8% |

+6.6% |

1,860.5 |

1,794.7 |

+3.7% |

+3.5% |

|

Adult Care |

205.7 |

191.5 |

+7.4% |

+7.5% |

800.5 |

736.4 |

+8.7% |

+9% |

|

Baby Care |

201.4 |

191.2 |

+5.4% |

+5.1% |

793.4 |

790.0 |

+0.4% |

-0.1% |

|

Feminine Care |

59.5 |

57.3 |

+3.7% |

+3.2% |

236.6 |

241.3 |

-1.9% |

-2.5% |

| Adj.

EBITDA |

56.8 |

46.5 |

+22% |

|

222.6 |

173.9 |

+28% |

|

|

Adj. EBITDA margin |

11.9% |

10.4% |

+1.5pp |

|

12.0% |

9.7% |

+2.3pp |

|

| Operating

profit |

36.3 |

23.5 |

+55% |

|

75.8 |

88.3 |

-14% |

|

| Emerging Markets

(discontinued operations) [2] |

|

Revenue |

72.7 |

98.7 |

|

-8.4% |

306.9 |

546.8 |

|

-5.5% |

| Adj.

EBITDA |

4.1 |

11.8 |

|

|

29.2 |

49.4 |

|

|

|

Adj. EBITDA margin |

5.6% |

12.0% |

-6.4pp |

|

9.5% |

9.0% |

+0.5pp |

|

| Operating

profit/(loss) |

( 4.6) |

12.8 |

|

|

2.1 |

22.3 |

|

|

| Total Group

[2] |

|

Revenue |

549.2 |

544.7 |

|

+4.3% |

2,167.4 |

2,341.5 |

|

+2.0% |

| Adj.

EBITDA |

60.8 |

58.3 |

|

|

251.9 |

223.3 |

|

|

|

Adj. EBITDA margin |

11.1% |

10.7% |

+0.4pp |

|

11.6% |

9.5% |

+2.1pp |

|

| Operating

profit |

31.8 |

36.2 |

|

|

77.9 |

110.6 |

|

|

|

Core Markets revenue |

|

2023 |

Vol/mix |

Sales |

2024 |

Forex |

2024 |

| in € million |

|

|

|

price |

LFL |

|

|

|

Q4 |

446.0 |

+40.2 |

-10.7 |

475.5 |

+1.0 |

476.5 |

| Year |

1,794.7 |

+101.8 |

-39.2 |

1,857.2 |

+3.3 |

1,860.5 |

| |

|

|

|

|

|

|

|

|

|

|

Core Markets adj. EBITDA [3] |

2023 |

Vol/mix |

Raw |

Operat. |

Operat. |

SG&A/ |

Forex |

2024 |

| in € million |

|

/price |

mat'ls |

costs |

savings |

Other |

|

|

|

Q4 |

46.5 |

-3.7 |

-0.1 |

-5.6 |

+17.0 |

+3.9 |

-1.1 |

56.8 |

| Year |

173.9 |

-18.4 |

+38.8 |

-28.2 |

+69.8 |

-9.8 |

-3.5 |

222.6 |

[1] Reported P&L figures, represent

continuing operations, i.e. Core Markets, only. As from 2022,

Emerging Markets are reported as assets held for sale and

discontinued operations, following the strategic decision to divest

these businesses.

[2] The Emerging Markets and Total Group

year-on-year comparison is affected by divestments, i.e. the

Mexican business activities in 2023 and the Algeria and Pakistan

ones in 2024. The LFL comparison is corrected for this scope

reduction.

[3] The adjusted EBITDA bridge

methodology was changed in order to only present currency

translation effects separately, whereas before all foreign exchange

and hedge effects were presented separately.

Unless otherwise indicated, all comments in this document

are on a year-on-year basis and for revenue specifically on a

like-for-like (LFL) basis (at constant currencies and scope and

excluding hyperinflation effects). Definitions of Alternative

Performance Measures (APMs) in this document can be found on page

10.

Full year 2024 business review of Core Markets (continuing

operations)

Revenue

Revenue was €1,860 million, up 3.5% like for like, driven by

strong volume and mix growth, which more than offset the

anticipated lower prices. Including slightly supportive forex,

revenue was up 3.7%.

Volumes grew in all categories, and were up 5.7% overall

including mix effects, outperforming the market in Europe and

especially in North America, which remained overall stable. Market

demand for adult care products in European retail was up by

mid-to-high single digits, supported by societal trends with an

increasing and more active elderly population, and with retailer

brands gaining market share. Ontex’s volume/mix grew by double

digits, mainly thanks to market share gains in the institutional

channel. While market demand for feminine care products in Europe

was largely stable, retailer brands gained share, and Ontex’s sales

volumes grew in line. Market demand for baby care products in

Europe decreased by low single digit, reflecting the decreasing

birth rate. Retailer brands consolidated their market share gains

made in 2023, when consumers switched to better value-for-money

alternatives. Ontex’s baby care volumes in Europe were lower,

largely in line with the market, albeit with a switch in the

portfolio to more premium products, like baby pants, where volumes

grew by double digits. Demand for baby care products in North

America was largely stable, albeit that A-brands lost some market

share to retailer and lifestyle brands. Ontex volumes were up by

strong double digit growth in the region, boosted by contract gains

with retailers, which started in the second half of 2023 and

throughout 2024.

Sales prices were lower across categories, down 2.2% overall.

This was expected, reflecting planned investments in

competitiveness, and adjustments for the decrease of raw material

price indices since end 2023.

Forex fluctuations were supportive, adding 0.2%, mainly thanks

to the appreciation of the British pound and the Polish zloty,

which compensated for the depreciation of the Russian ruble.

Adjusted EBITDA

Adjusted EBITDA was €223 million, up 28%. Volume and mix growth

contributed €21 million, and strong delivery of the cost

transformation program €70 million. Lower sales prices for €(39)

million, were offset by index-driven raw material tailwinds. Other

operating and SG&A costs rose with inflation, however.

The cost transformation program delivered €70 million net

operating savings, leading to a reduction of the operating cost

base by 4.6% year on year, based on purchasing, supply chain,

product innovation and manufacturing initiatives.

Raw material prices had a €39 million positive impact, in

particular for super-absorbent polymers and for fluff. Raw material

indices started to rise sequentially again in the second half of

2023 and first quarter of 2024, but largely stabilized since.

Other operating costs were up by €(28) million, largely due to

inflation of salaries, as well as energy and distribution costs.

These were exacerbated by temporary inefficiencies resulting from

the North American production ramp-up and the footprint adjustments

in Europe.

SG&A expenditure was up by €(10) million, mainly due to

salary inflation. SG&A over revenue remained largely stable at

10.1%.

Forex fluctuations had a €(3) million net negative impact,

mainly linked to the depreciation of the Mexican peso affecting the

contribution from the Tijuana plant.

The adjusted EBITDA margin rose to 12.0%, up 2.3pp year on

year.

Q4 2024 business review of Core Markets (continuing

operations)

Revenue

Revenue was €476 million, up 6.6% like for like versus 2023,

driven by a substantial volume increase, including mix, which more

than offset the anticipated lower sales prices. Including slightly

supportive forex, revenue was up 6.8% overall versus the prior year

and 1.8% versus the prior quarter.

Volumes were up 9.0% year on year including mix effects, and

grew in all categories. Volumes were up by double digits in North

America, versus the previous quarter and especially versus the

fourth quarter of 2023, mainly as orders from new contracts ramped

up. In Europe volumes were up in all categories, especially in

adult care and in baby pants, where Ontex’s is leveraging its

expertise in service and innovation.

Sales prices were largely stable quarter on quarter, as

anticipated, and 2.4% lower year on year, reflecting the past raw

material index decreases and investments in increased

competitiveness.

Forex fluctuations were supportive, adding 0.2%, mainly thanks

to the appreciation of the British pound and the Polish zloty,

which compensated for the depreciation of the Russian ruble.

Adjusted EBITDA

Adjusted EBITDA was €57 million, up 22% year on year and largely

in line sequentially versus the previous quarter. Volume and mix

growth contributed €7 million. Sales prices had a €(11) million

adverse impact. The cost transformation program continued to

deliver solid results. While raw material prices were stable

overall year on year and SG&A costs came out lower, continued

inflation drove other operating costs up.

The cost transformation program delivered €17 million net

operating savings, leading to a reduction of the operating cost

base by 4.4% year on year, with purchasing, supply chain, product

innovation and manufacturing initiatives.

Raw material prices were largely stable year on year, and

slightly up versus the previous quarter, reflecting a slight

increase in fluff prices.

Other operating costs were up by €(6) million year on year,

largely due to inflation of salaries, and temporary inefficiencies

resulting from the North American production ramp-up and the

footprint adjustments in Europe.

SG&A expenditure was stable sequentially,

but down by €4 million year on year. Inflation drove salaries up,

but the fourth quarter of 2023 it compares to, was exceptionally

high due to cost phasing over that year.

Forex fluctuations had a €(1) million net negative impact,

mainly linked to the depreciation of the Mexican peso affecting the

contribution from the Tijuana plant.

The adjusted EBITDA margin was 11.9%, up 1.5pp year on year

compared to the fourth quarter of 2023, and slightly down by 0.1pp

sequentially versus the third quarter of 2024.

Full year 2024 operational review

Supply chain

The cost transformation program delivered €70 million savings

after netting with implementation costs. This represents an

increase of about 25% versus 2023. These initiatives allowed to

reduce raw materials and operating costs, prior to volume and

inflation effects, by 4.6%. While the bulk of the savings were

realized on procurement, the continuous implementation of the

program allowed to further improve operational efficiencies and

lower scrap rates. Service levels also improved from the 2023

level.

To further support these initiatives in the coming years, Ontex

is transforming its operating footprint in Belgium, with the

closure of its Eeklo plant in December of last year, and the

transformation of its Buggenhout plant over the next two years into

a center of excellence for research, development and production of

medium and heavy incontinence care products. A total amount of €62

million was provisioned, covering the redundancy cost according to

the Belgian legal requirements and the supplementary social

plan.

Besides the optimization of the manufacturing footprint, Ontex

continues to invest in its operations, ramping up in the year to

€112 million for the Total Group, or 5.2% of revenue, and close to

6% for Core Markets only. As anticipated this is a step-up compared

to 4.1% in 2023 and approximately double Ontex’s

depreciation [4] level. The vast majority was

invested in Core Markets, with about half in business expansion,

with new production lines for baby pants and adult care, and adding

capacity in North America and about a quarter in operational

efficiency improvement projects, mostly in Europe.

Innovation

Innovation in Core Markets represented €18 million in

operational and capital expenditure, a 5% increase compared to

2023, with 13 major product innovations launched in the year. All

Ontex’s innovation is thoroughly tested with consumers, to

guarantee that new solutions offered to customers are comparable to

leading A-brand standards.

Baby care focus in 2024 was to boost leak prevention, with the

launch of baby diapers with front and back barriers, as well as

baby pants with back barrier. The year also saw the introduction of

larger pants sizes and bags with mechanical post-consumer recycled

content. In adult care overnight extra -protection pads were

brought to market. In feminine care the focus was on boosting

recently introduced product concepts being the first follower of

the A-brand equivalent, with ConfiDaily ™ pantyliners and

SatinSense® tampons.

Ontex also secured its place in the top 10 of Belgian applicants

at the European Patent Office, for the second year in a row. Ontex

currently holds more than 800 patents grouped in 160 patent

families.

Sustainability [5]

Ontex takes the safety of its employees to heart. In 2024 the

accident frequency rate was 3.20, decreasing 9% versus 3.52 lost

workday cases per million worked hours in 2023, and 41% compared to

the base year 2020, by focusing on machine risk reduction,

behaviors and leadership awareness. Ontex strives to reduce the

number of accidents further down year after year to eventually

reach its ultimate ambition to be a zero harm workplace.

Ontex is also committed to reducing its environmental footprint.

Also in 2024, actions were undertaken to support Ontex’s long-term

climate strategy, investing in energy efficiency initiatives,

increasing renewable energy sourcing and working closely with

suppliers. Despite these initiatives, scope 1 & 2 emissions

went up by 5.2% compared to 2023, reflecting higher electricity

consumption in one of the plants. Scope 3 emissions also increased,

by 1.4%, as supplier engagement efforts and more efficient product

design were offset by the growing production volumes.

Ontex's sustainability efforts continue to be externally

recognized, including recently by the global environmental

non-profit organization Carbon Disclosure Project (CDP), with an

“A” score for leadership in corporate transparency and performance

on climate change and an “A-“ score on forestry, bringing Ontex in

the leadership segment. Earlier in 2024, Ontex received a gold

medal from sustainability rating agency EcoVadis for transparency

in sustainable initiatives throughout the supply chain and

operations. This recognition places Ontex in the top 5% of

companies assessed worldwide.

[4] Depreciation adjusted for

depreciation of right-of-use assets, as lease payments are not

included in capex either.

[5] Preliminary unaudited figures for

2024

Key financial indicators

| Financial

results |

Year |

|

|

in € million |

2024 |

2023 |

% |

|

| Adj.

EBITDA |

222.6 |

173.9 |

+28% |

|

|

Depreciation & amortization |

(74.1) |

(70.7) |

-4.8% |

|

| Net

finance cost |

(51.4) |

(45.1) |

-14% |

|

| Adj. income tax expense [6] |

(21.3) |

(19.5) |

-9% |

|

|

Adj. profit from continuing operations |

75.8 |

38.6 |

+97% |

|

| EBITDA

adjustments [7] |

(72.7) |

(14.9) |

-387% |

|

| Impact of EBITDA adjustments on income

tax [6] [7] |

17.9 |

3.3 |

+448% |

|

|

Profit from continuing operations |

20.9 |

26.9 |

-22% |

|

| Profit/(loss) from discontinued

operations |

(10.7) |

7.9 |

-236% |

|

|

Profit for the period |

10.3 |

34.8 |

-70% |

|

| Basic EPS (in €) |

0.13 |

0.43 |

-71% |

|

|

Capex |

(112.4) |

(96.5) |

-17% |

|

| Free

cash flow |

47.9 |

9.1 |

+427% |

|

| Net

working capital [8] |

117.5 |

166.5 |

-29% |

|

|

Working capital / revenue [8] |

5.3% |

7.6% |

-2.3pp |

|

|

Gross financial debt [8] |

736.3 |

833.5 |

-12% |

|

| Net

financial debt [8] |

612.0 |

665.3 |

-8% |

|

|

Leverage ratio [8] |

2.46x |

3.25x |

-0.79x |

|

| |

|

|

|

|

|

[6] The Adjusted income tax expense

consists of the income tax expense, as presented in the income

statement, adjusted for the impact of EBITDA adjustments.

[7] EBITDA adjustments and their impact

on income tax are subtracted from adjusted profit to obtain

profit.

[8] Balance sheet data reflect the end of

the period and compare to the start of the period, i.c. December

2023.

FY 2024 financial review of Total Group

P&L

Depreciation & amortization from continuing operations was

slightly up at €(74) million, reflecting the higher investment

level.

EBITDA adjustments of €73 million were made in continuing

operations. These adjust for €(62) million restructuring

provisions, and consist primarily of the provision taken to

restructure the Belgian operating footprint. This amount reflects

the redundancy cost for the employees concerned according to the

Belgian legal requirements and the agreed social plan. EBITDA

adjustments were also made for €(11) million impairments on

redundant assets linked to the footprint transformation.

Net finance cost from continuing operations was €(51) million,

higher than €(45) million in 2023. Net interest charges decreased,

as a result of the lower indebtedness, following the repayment of

the €220 million term loan mid-2023. Forex fluctuations had a

negative impact on financing activities, compared to a positive

impact in 2023.

Income taxes from continuing operations were €(3) million,

compared to a €(16) million in 2023. The decrease is attributable

to the impact of the restructuring charges on profit before income

tax, and the lower effective tax rate, following the

recognition of deferred tax assets in the period in view of the

improving underlying profitability.

Discontinued operations, consisting of the Emerging Markets

division, generated revenue of €307 million, a 5% like for like

decrease, excluding forex and scope effects. The adjusted EBITDA

margin was slightly up at 9.5%, versus 9.0% in 2023. The adjusted

EBITDA was €29 million, lower than €49 million in 2023, due to the

scope reduction, following the divestment of the Mexican business

in the second quarter of 2023 and the Algeria and Pakistan

businesses in the second quarter of 2024. The operating profit was

€2 million and includes €(27) million divestment-related costs. The

divestment of the Algeria and Pakistan businesses led to €(7)

million costs and the non-cash recycling of €(20) million currency

translation adjustments. The planned Brazilian divestment led to a

€7 million impact, consisting of a capital gain and impairment

reversal, netted with upfront divestment costs. In anticipation of

the Turkish divestment a non-cash impairment of €(6) million was

taken. The loss from discontinued operations was thereby €(11)

million.

Profit of the period for the Total Group was €10 million,

compared to €35 million the year before, and consists of the €(11)

million loss from discontinued operations and a €21 million profit

from continuing operations. The latter compares to €27 million in

2023, and includes the impact of restructuring and impairment

related costs. Excluding these, the adjusted profit from continuing

operations was €76 million, well up versus €39 million the year

before. Basic earnings per share of the Total Group were €0.13,

compared to €0.43 in 2023.

Cash flow

Capital expenditure was €(112) million, representing 5.2% of the

Total Group revenue, a significant increase versus €(96) million or

4.1% of revenue in 2023. Combined with lease payments of €(25)

million, it represented 1.9x the depreciation. The

intensification of capital investments was planned, and is foreseen

to remain at a high level in 2025 to support the business expansion

in North America and the further implementation of the cost

transformation program.

Free cash flow amounted to €48 million, well up compared to €9

million in 2023. Strong operational delivery, more than compensated

for the higher capital expenditure and one-time restructuring and

divestment-related cash-out. These accounted for €(39) million, of

which €(29) million relates to the restructuring of the Belgian

operations. Solid working capital management contributed €9

million. Cash taxes were €(10) million and net financing cash-out

totaled €(31) million, substantially lower than in 2023, as the

interest payments decreased.

M&A proceeds totaled €10 million net. Ontex completed the

divestment of its Algeria and Pakistan business in the second

quarter of 2024, for which it received net cash proceeds of €17

million, net of cash disposed, taxes and transaction costs.

The deferred receivable, linked to the divestment of the Mexican

business in 2023, was partly collected. €15 million were

received from the acquirer and €11 million remains outstanding.

Prior to the finalization of the divestment of the Brazilian

business, expected in the second quarter of 2025, €(21) million

transaction-related costs were paid in 2024.

The on-going share buy-back program, launched in December, led

to the acquisition of 146,338 shares for €(1) million. By June 2025

Ontex foresees to buy back 1.5 million shares in total for the

program.

Balance sheet

Net working capital for the Total Group at the end of the period

was €118 million, a €49 million decrease versus the end of 2023,

linked to the scope reduction following the divestment of the

Algeria and Pakistan businesses, as well as good working capital

management. Net working capital decreased from 7.6% end 2023 to

5.3% end 2024 relative to revenue. Trade receivables remained

stable, with increased needs for the growing business offset by

slightly higher factoring activity. Factoring increased by €12

million to €176 million over the year. Inventories were up to

support the ramp-up in revenue in North America and the footprint

adjustments in Europe. These were more than offset by higher trade

payables, reflecting the growing business and better payment terms

as a result of the cost transformation program.

Net financial debt for the Total Group dropped €53 million, from

€665 million to €612 million over the year, thanks to the solid

free cash flow and the net proceeds on divestments. The leverage

ratio decreased from 3.25x at the start of the year to 2.46x at the

end, as a combination of the net financial debt reduction and

especially the further increase of the adjusted EBITDA of the Total

Group of the last twelve months.

Gross financial debt of the Total Group reduced even more, by

€97 million, from €834 million to €736 million, thanks to cash

optimization. It consists primarily of the €580 million bond at

fixed 3.5% rate maturing in July 2026, of €123 million of short-

and long-term lease liabilities, and of €24 million drawn on the

new floating rate revolving credit facility with a maximum capacity

of €270 million maturing in November 2029. The available liquidity

of the Total Group increased from €322 million to €370 million,

consisting of the €124 million cash and cash equivalents and the

undrawn part of the revolving credit facility.

Assets-held-for-sale at the end of the period, i.e. mainly the

Brazilian and Turkish businesses, have a net assets value of €155

million at the end of the year, including a €51 million net cash

position. The balance sheet also includes €(211) million of

cumulative translation reserves in equity related to these assets,

that will be recycled through the P&L once the divestments are

finalized.

Practical information

Disclaimer

This report may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, Ontex’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein. Forward-looking statements contained in this

report regarding trends or current activities should not be taken

as a report that such trends or activities will continue in the

future. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. You should not place undue reliance on

any such forward-looking statements, which speak only as of the

date of this report.

The information contained in this report is subject to change

without notice. No re-report or warranty, express or implied, is

made as to the fairness, accuracy, reasonableness or completeness

of the information contained herein and no reliance should be

placed on it. In most of the tables of this report, amounts are

shown in € million for reasons of transparency. This may give rise

to rounding differences in the tables presented in the report.

Corporate information

The financial information in this document of Ontex Group NV for

the twelve months ended December 31, 2024 was authorized for issue

in accordance with a resolution of the Board on February 18,

2025.

Audio webcast

Management will host an audio webcast for investors and analysts

on February 19, 2025 at 12:00 CET / 11:00 BT. To attend,

click on

https://channel.royalcast.com/landingpage/ontexgroup/20250219_1. A

replay will be available on the same link shortly after the live

presentation. A copy of the presentation slides will be available

on ontex.com.

Financial calendar

- April 30,

2025

Q1 2025 results

- May 5,

2025

2025 Annual general meeting of shareholders

- July 31,

2025

Q2 & H1 2025 results

- October 30, 2025 Q3 2025 results

Enquiries

-

Investors

Geoffroy

Raskin

+32 53 33 37

30

investor.relations@ontexglobal.com

-

Media

Catherine

Weyne

+32 53 33 36

22

corporate.communications@ontexglobal.com

About Ontex

Ontex is a leading international developer and producer of baby

care, feminine care and adult care products, both for retailers and

healthcare. Ontex’s innovative products are distributed in around

100 countries through retailers and healthcare providers. Employing

some 7,000 people, Ontex has a presence in 14 countries, with its

headquarters in Aalst, Belgium. Ontex is listed on Euronext Brussel

and is a constituent of the Bel Mid® index. To keep up

with the latest news, visit ontex.com or follow Ontex on

LinkedIn.

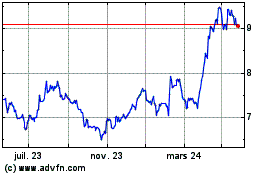

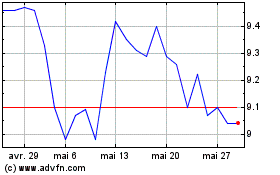

Ontex Group NV (EU:ONTEX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Ontex Group NV (EU:ONTEX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025