RUBIS: Rubis Énergie signs a master shelf facility subscription agreement for USD 265 million

17 Juillet 2024 - 5:45PM

UK Regulatory

RUBIS: Rubis Énergie signs a master shelf facility subscription

agreement for USD 265 million

Paris, 17 July 2024, 5:45pm CET

Rubis announces today that its subsidiary Rubis

Énergie SAS has signed its first-ever US Private Placement (USPP)

financing under French law, with PGIM Private Capital (“PPC”) the

private capital arm of PGIM Inc., the global investment management

business of Prudential Financial Inc. amounting to US$265 million.

Rubis Énergie SAS will start issuing three series of €70 million

each of Senior Unsecured Notes with a 8-, 10-, and 12-year bullet

maturities.

Rubis Énergie has kept nearly US$40 million

available under the shelf agreement for future issuances during the

next two years.

This new USPP financing enables Rubis to

diversify its funding sources while extending the current average

maturity of its debt from 3 to 5 years and paves the way to

potential further USPP operations.

The teams advising Rubis Énergie SAS on this

consist of:

- BRED Banque Populaire, Advisor.

- Norton Rose Fulbright LLP Paris and

London offices, Lawyers.

- Forex Finance, Advisor.

Upcoming events

Q2 & H1 2024 results: 5 September 2024 (after market

close)

Photosol Day: 17 September 2024

About Rubis

Rubis is an independent French group that has

been operating at the heart of energy for over 30 years, driven by

its mission to give as many people as possible access to reliable

and sustainable energy. The Group meets the essential needs of

individual customers in terms of mobility, cooking and heating, and

supplies the energy required for the operation of industry and

professionals. Aware of the energy sector’s key role in combating

climate change, Rubis is currently diversifying its business and

offering towards less carbon-intensive solutions.

With around 4,500 employees across three regions

(Africa, the Caribbean and Europe), the Group relies on a

decentralised structure and operates its Energy Distribution,

Renewable Electricity Production and Bulk Liquid Storage (joint

venture) activities in close harmony with local requirements.

Rubis is a signatory of the United Nations

Global Compact.

For more information

This announcement shall not constitute an

offer to sell or a solicitation of an offer to buy the notes or any

other securities, and shall not constitute an offer, solicitation

or sale in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful.

The notes have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “Securities Act”) and may not be offered, sold,

tendered, bought or delivered within the United States or to or for

the account or benefit of “U.S. Persons” (as defined in the

Securities Act) absent registration or an applicable exemption from

registration requirements. No public offering of the notes will be

made in the United States.

|

Press Contact |

Analyst Contact |

|

RUBIS - Communication department |

RUBIS - Clémence Mignot-Dupeyrot, Head of IR |

Tel: +33 (0)1 44 17 95 95

presse@rubis.fr |

Tel: +33 (0)1 45 01 87 44

investors@rubis.fr |

- RUBIS: Rubis Énergie signs a master shelf facility subscription

agreement for USD 265 million

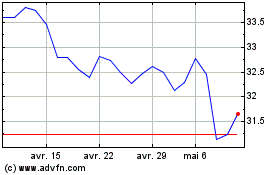

Rubis (EU:RUI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Rubis (EU:RUI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025