UCB SA/NV : Convening notice to the general meeting of shareholders

*** Unofficial English translation – For

convenience purposes only *** UCB SA/NV

- Public Limited Liability CompanyAllée de la Recherche 60, 1070

BrusselsEnterprise nr. 0403.053.608 (RLE

Brussels)www.ucb.com("UCB SA/NV" or the

“Company”)

|

CONVENING NOTICE TO THE GENERAL MEETING OF

SHAREHOLDERS |

The Board of Directors invites the shareholders

for the Ordinary and Extraordinary General Meeting of Shareholders

(the “General Meeting”) which will be held on Thursday, 30

April 2020, at 11:00 am CEST, at the registered

office of UCB SA/NV, Allée de la

Recherche 60 - 1070 Brussels, for the

purpose of considering and voting on the items shown on the agenda

set out below.

|

Due to the evolution of the crisis of the Corona virus

(Covid-19) and the measures taken by our governments and public

authorities, it is likely that UCB SA/NV will not be able to allow

physical access to its General Meeting of 30 April 2020. Subject to

any other measure or terms and conditions that we could communicate

later with respect to the holding and organization of and

participation in our General Meeting, we are already recommending

now to our shareholders, wishing to participate in our General

Meeting, to cast their vote by proxy, by mandating the independent

person mentioned in our proxy form and specifying their precise

voting instructions. |

ORDINARY PART

1. Report of the Board of Directors on the annual

accounts for the financial year ended 31 December 2019

2. Report of the statutory auditor on the annual

accounts for the financial year ended 31 December 2019

3. Communication of the consolidated annual accounts of

the UCB Group relating to the financial year ended 31 December

2019

4. Approval of the annual accounts of

UCB SA/NV for the financial year ended 31 December 2019 and

appropriation of the results

Proposed resolution:

The General Meeting approves the annual accounts

of UCB SA/NV for the financial year ended 31 December 2019 and

the appropriation of the results reflected therein, including the

approval of a gross dividend of € 1.24 per share(*).

(*) The UCB shares held by UCB SA/NV

(own shares) are not entitled to a dividend. Therefore, the

aggregate amount to be distributed to the shareholders may

fluctuate depending on the number of UCB shares held by

UCB SA/NV (own shares) on the dividend approval

date.

5. Approval of the remuneration report for the financial

year ended 31 December 2019

The Belgian Code of Companies and

Associations requires the General Meeting to approve the

remuneration report each year by separate vote. This report

includes a description of the remuneration policy that was

applicable in 2019 and information on remuneration of the members

of the Board of Directors and of the Executive

Committee.

Proposed resolution:

The General Meeting approves the remuneration

report for the financial year ended 31 December 2019.

6. Approval of the remuneration policy

2020

The new Belgian 2020 Corporate

Governance Code requires UCB SA/NV to establish a remuneration

policy and to submit such policy to the approval of the General

Meeting. As explained in the remuneration report, changes to UCB’s

remuneration policy announced last year (mainly replacing free

stock awards by performance shares in grants to top executives and

the remuneration of directors) were implemented in the course of

2019 and are now reflected in the remuneration policy submitted to

your approval.

Proposed resolution:

The General Meeting approves the remuneration

policy 2020.

7. Discharge in favour of the

directors

Pursuant to the Belgian Code of

Companies and Associations, the General Meeting must, after

approval of the annual accounts, vote on the discharge of liability

of the directors.

Proposed resolution:

The General Meeting grants discharge to the

directors for the performance of their duties during the financial

year ended 31 December 2019.

8. Discharge in favour of the statutory

auditor

Pursuant to the Belgian Code of

Companies and Associations, the General Meeting must, after

approval of the annual accounts, vote on the discharge of liability

of the statutory auditor.

Proposed resolution:

The General Meeting grants discharge to the

statutory auditor for the performance of his duties during the

financial year ended 31 December 2019.

9. Directors: renewal of mandates of (independent)

directors

The mandates of Mr. Pierre Gurdjian, Mr.

Ulf Wiinberg and Mr. Charles-Antoine Janssen will expire at this

General Meeting. Upon recommendation of the Governance, Nomination

and Compensation Committee (“GNCC”), the Board of Directors

proposes: (i) the renewal of the mandate of Mr. Pierre Gurdjian and

Mr. Ulf Wiinberg as independent directors for the statutory term of

4 years and (ii) the renewal of the mandate of Mr. Charles-Antoine

Janssen as director for the statutory term of 4 years. If

re-elected, Mr. Pierre Gurdjian will continue to be the Vice-Chair

of the Board of Directors and member of the GNCC and Mr.

Charles-Antoine Janssen and Mr. Ulf Wiinberg will both continue to

be members of the Audit Committee. Mr. Pierre Gurdjian and Mr. Ulf

Wiinberg each meet the independence criteria stipulated by article

7:87 of the Belgian Code of Companies and Associations, by

provision 3.5 of the 2020 Belgian Corporate Governance Code and by

the Board. The curriculum vitae of these directors are available on

the internet site of UCB

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2020.

Subject to the abovementioned renewals by the General

Meeting, the Board will continue to be composed of a majority of

independent directors.

Proposed resolutions:

9.1.

A) The General Meeting renews the

appointment of Mr. Pierre Gurdjian(*) as director

for the statutory term of four years until the close of the annual

General Meeting of 2024.

B) The General Meeting

acknowledges that, from the information made available to the

Company, Mr. Pierre Gurdjian qualifies as an

independent director according to the independence criteria

provided for by article 7:87 of the Belgian Code of Companies and

Associations, by provision 3.5 of the 2020 Belgian Corporate

Governance Code and by the Board, and appoints him as independent

director.

9.2.

A) The General Meeting renews the

appointment of Mr. Ulf Wiinberg(*) as director for

the statutory term of four years until the close of the annual

General Meeting of 2024.

B) The General Meeting

acknowledges that, from the information made available to the

Company, Mr. Ulf Wiinberg qualifies as an

independent director according to the independence criteria

provided for by article 7:87 of the Belgian Code of Companies and

Associations, by provision 3.5 of the 2020 Belgian Corporate

Governance Code and by the Board, and appoints him as independent

director.

9.3. The

General Meeting renews the appointment of Mr.

Charles-Antoine Janssen(*) as director for the

statutory term of four years until the close of the annual General

Meeting of 2024.

(*) Curriculum vitae and details are

available at

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2020.

SPECIAL PART

10. Long-Term Incentive Plans -

Program of free allocation of shares

This approval requested from the General

Meeting is not as such required by Belgian law but is sought in

order to ensure transparency and, as the case may be, compliance

with foreign law for certain jurisdictions where our Long-Term

Incentive Plans (LTI plans) are offered to our employees. For more

information on UCB’s LTI plans, please refer to the 2019

remuneration report. For the avoidance of doubt, UCB confirms that

it covers all its obligations under the LTI Plans with existing

shares, i.e. through share buybacks, so there is no dilution for

existing shareholders of UCB SA/NV.

Proposed resolution:

The General Meeting approves the decision of the

Board of Directors to allocate an estimated number of 1 361 000

free shares:a) of which an estimated number of 802

000 shares to eligible employees under the Long-Term Inventive

policy (LTI policy), namely to about 1 961 individuals, according

to the applicable allocation criteria. These free shares will only

vest if and when the eligible employees are still employed within

the UCB Group three years after the grant of the awards; b)

of which an estimated number of 204 000 shares to eligible

employees under the Performance Share Plan, namely

to about 139 individuals, according to the applicable allocation

criteria. These free shares will be delivered after a three-year

vesting period and the number of shares actually allocated will

vary from 0% to 150% of the number of shares initially granted

depending on the level of achievement of the performance conditions

set by the Board of UCB SA/NV at the moment of grant; andc)

of which exceptionally for 2020 an estimated transition grant of

355 000 shares to be granted to certain employees, due to a market

re-alignment of the LTI policy. This one-time grant is to be made

to employees who experience a reduction in grant value when

comparing the previous and new Long-Term Incentive policy. These

additional free shares are to be granted in 2020 and will vest in 3

tranches, on a diminishing basis, between 2023 and 2025, if the

eligible employees are still employed within the UCB Group on the

respective annual vesting dates. The estimated figures under

a) and b) do not take into account employees hired or promoted to

eligible levels between 1 January 2020 and 1 April 2020.

11. Change of control

provisions - art. 7:151 of the Belgian Code of

Companies and Associations

Pursuant to article 7:151 of the Belgian

Code of Companies and Associations, the General Meeting is solely

competent to approve change of control clauses whereby third

parties are granted rights having a substantial influence on the

assets of the Company or causing a substantial debt or undertaking

for the Company, if the exercise of such rights depends on the

launch of a public takeover bid on the shares of the Company or a

change of control thereof.

11.1 EMTN Program –

renewal

UCB SA/NV has entered

into a Euro Medium Term Note Program dated 6 March 2013 for an

amount of € 3 000 000 000, with last update of the Base

Prospectus on 22 October 2019, as this program may be further

amended, extended or updated from time to time, (the “EMTN

Program”). The terms of the EMTN Program provide for a change of

control clause - condition 5 (e) (i) - under which, for any of the

Notes issued under the EMTN Program where a change of control put

is included in the relevant final terms, any and all of the holders

of such notes can, in certain circumstances, require UCB SA/NV to

redeem that Note, following a change of control at the level of UCB

SA/NV, upon exercise of the change of control put, for a value

equal to the put redemption amount increased with, if appropriate,

interest accrued until the date of exercise of the change of

control put (all as more particularly described in the Base

Prospectus of the EMTN Program). In accordance with said article

7:151 of the Belgian Code of Companies and Associations, this

clause must be approved by the General Meeting and it is hereby

proposed to renew this approval for any series of notes issued

under the EMTN Program including such clause during the next 12

months.

Proposed resolution:

Pursuant to article 7:151 of the Belgian Code of

Companies and Associations, the General Meeting renews its

approval: (i) of condition 5 (e) (i) of the Terms and

Conditions of the EMTN Program (Redemption at the Option of

Noteholders – Upon a Change of Control (Change of Control Put)), in

respect of any series of notes to which such condition is made

applicable being issued under the Program from 30 April 2020 until

29 April 2021, under which any and all of the holders of the

relevant notes can, in certain circumstances when a change of

control at the level of UCB SA/NV occurs, require UCB SA/NV to

redeem that note on the change of control put date at the put

redemption amount together, if appropriate, with interest accrued

to such change of control put date, following a change of control

of UCB SA/NV; and (ii) of any other provision of the EMTN Program

or notes issued under the EMTN Program granting rights to third

parties which could affect an obligation on UCB SA/NV where in each

case the exercise of these rights is dependent on the occurrence of

a change of control.

11.2 Term Facility Agreement of USD 2

070 million entered on 10 October 2019

UCB SA/NV has entered a Term Facility

Agreement in the amount of USD 2 070 million between, amongst

others, UCB SA/NV and UCB Biopharma SRL, as borrowers, and BNP

Paribas Fortis SA/NV and Bank of America Merrill Lynch

International Designated Activity Company as bookrunners dated 10

October 2019, providing for a change of control clause, according

to which any and all of the lenders can, in certain circumstances,

cancel their commitments and require repayment of their

participations in the loan, together with accrued interests and all

other amounts accrued and outstanding thereunder, following a

change of control of UCB SA/NV.

Proposed resolution:

Pursuant to article 7:151 of the Belgian Code of

the Companies and Associations, the General Meeting approves

Condition 8.2 (b) (iv) of the Terms and Conditions of the USD 2 070

million Term Facility Agreement between, amongst others, UCB SA/NV

and UCB Biopharma SRL, as borrowers, and BNP Paribas Fortis SA/NV

and Bank of America Merrill Lynch International Designated Activity

Company as bookrunners dated 10 October 2019, which includes a

change of control clause, under which any and all of the lenders

can, in certain circumstances, cancel their commitments and require

repayment of their participations in the loan, together with

accrued interests and all other amounts accrued and outstanding

thereunder, following a change of control of UCB SA/NV.

11.3 EUR 1 billion Revolving Facility

Agreement as last amended and restated by the Amendment and

Restatement Agreement dated 5 December 2019

UCB SA/NV has entered into an amendment

and restatement agreement dated 5 December 2019 pursuant to which

the EUR 1 billion multicurrency revolving facility agreement,

originally dated 14 December 2009 and made between, amongst others,

UCB SA/NV and BNP Paribas Fortis SA/NV as agent, was amended and

restated (hereafter abbreviated, as amended and restated, the

“Revolving Facility Agreement”). The terms of the Revolving

Facility Agreement include a change of control clause under which

any and all of the lenders can, in certain circumstances, cancel

their commitments and require repayment of their participations in

the loans, together with accrued interest and all other amounts

accrued and outstanding thereunder, following a change of control

of UCB SA/NV (as more particularly described in the Revolving

Facility Agreement).

Proposed resolution:

Pursuant to article 7:151 of the Belgian Code of

the Companies and Associations, the General Meeting approves clause

10.2 (Change of control) of the Revolving Facility Agreement, as

last amended and restated on 5 December 2019, under which any and

all of the lenders can, in certain circumstances, cancel their

commitments and require repayment of their participations in the

loans, together with accrued interest and all other amounts accrued

and outstanding thereunder, following a change of control UCB

SA/NV.

EXTRAORDINARY PART (Extraordinary General

Meeting)

The Extraordinary General Meeting will only

validly deliberate on the items on its agenda if at least half of

the capital is present or represented. If this condition is not

met, a new Extraordinary General Meeting with the same agenda will

be convened for 25 May 2020 at 11:00 am CEST. This

second Extraordinary General Meeting will validly deliberate

irrespective of the number of shares present or

represented.

1. Implementation of

the Belgian Code of Companies and Associations

On 4 April 2019, the law of 23 March

2019 introducing the Belgian Code of Companies and Associations

(‘BCCA’) was published in the Official Belgian State Gazette,

replacing the Belgian Companies Code of 1999 and of which the

mandatory provisions entered into force for existing

companies on 1 January 2020. As a result, UCB SA/NV is required by

law to adapt and align its Articles of Association to the new

provisions of the BCCA and is therefore submitting the following

changes to the approval of this Extraordinary Shareholders Meeting.

These changes are required to align our Articles of Association

either to the new terminology or the new mandatory rules of the

BCCA or to refer to the appropriate section of the new BCCA or

other applicable legislation. Notably, the last sentence of article

32 of the Articles of Association must be amended to reflect the

new rule of the article 7:126 of the BCCA according to which a

shareholders meeting can be convened at the request of

shareholder(s) holding at least 10% of the capital (instead of 20%

previously). The Board confirms that there is no change to the “one

share one vote” principle included in article 38 of the Articles of

Association. The full coordinated version of the articles of

association is available on the internet site of the

Company

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2020.

Proposed resolution:The General Meeting resolves

to amend the Articles of Association of the Company to implement

the new Belgian Code of Companies and Associations and, in

particular, to implement the mandatory provisions, and linguistic

or technical adjustments required by the BCCA, as

follows:

- Removal of the second paragraph in article 1.

- Replacement of the first paragraph of article 2 by following

text: “The registered office is located in the Brussels Capital

Region, at Anderlecht (1070 Brussels), Allée de la Recherche,

60.”, replacement of the second paragraph of article 2 by following

text: “The registered office can be transferred to any other place

in Belgium by decision of the Board of Directors, in accordance

with applicable legal provisions.”

- Replace the word “doel” by “voorwerp” in the title of chapter I

and in the first sentence of article 3 (only in Dutch version of

the bylaws).

- Removal of the words “of the company” in article 5.

- Replacement of article 7 by following text: “When the increase

in capital approved by the Board of Directors includes a share

premium, the amount of such premium, after any deduction of costs,

shall be allocated in full to a reserve account designated "Share

premium account."

- Add the following words in fine of second paragraph of article

8 and in fine of first paragraph of article 10: “..., in accordance

with applicable legal provisions of the Belgian Code of Companies

and Associations.”

- Replacement of article 12 by following text: “The rights and

obligations attached to a share shall remain attached to such share

no matter who holds it. Possession of a share implies adhesion

tHolderso the Articles of Association of the company and to the

decisions of the General Meeting and of the Board of Directors, or

in general to those taken in compliance with these Articles of

Association. The Company and its direct subsidiaries may acquire

the Company’s shares if the General Meeting has authorized such

acquisition in accordance with the Belgian Code of Companies and

Association or, without such an authorization in the specific

instances set out in the aforementioned Code. The indirect

subsidiaries of the Company may acquire the Company’s shares under

the conditions of the Belgian Code of Companies and Associations.

The Company and its direct and indirect subsidiaries may dispose of

the Company’s shares under the conditions of the Belgian Code of

Companies and Associations.”

- Replacement of the second sentence of article 13 by the

following text: “If several persons have rights to the same share,

the company can suspend the exercise of the voting rights

appertaining to it, until such time as one person only shall be

designated as the holder of the voting rights of the share

vis-à-vis the company.”

- Removal of the words “cash vouchers or” in the first paragraph

of article 14 and replacement of the second and third paragraph of

article 14 by following text: “The Company can issue either

convertible bonds or rights of subscription, attached or

non-attached to other shares, in accordance with applicable legal

provisions of the Belgian Code of Companies and Associations.” and

“The registered share register or registered bond register(s) of

the Company may be held either on paper or via electronic means as

legally permissible at any given point in time.”

- Replacement of the first paragraph of article 15 as follows:

“The Company shall be managed by a Board of Directors having at

least three members, whether shareholders or not, appointed by the

general meeting for a term ending at the latest at the end of the

fourth annual shareholders’ meeting following the date their

appointment has become effective. The general meeting can, at all

times, end the mandate of each director without any reason and with

immediate effect.”

- Insertion of a new sentence in fine last paragraph of article

17 as follows: “Board meetings can also validly be held using

video, telephone, internet or any other electronic based means,

which allow a jointly deliberation.”

- Replacement the words “Companies code” by “Belgian Code of

Companies and Associations” in the second sentence of the second

paragraph of article 18, the words “registered letter” by “ordinary

letter, email or other electronic document” in the third sentence

of the second paragraph of article 18 and the words “a simple

letter, telegram, telex of telefax” by “ordinary letter, email or

other electronic document” in the first sentence of the third

paragraph of article 18.

- Replacement of the fourth paragraph of article 18 by following

text: “The decisions of the Board of Directors may be taken by the

unanimous consent of the Directors expressed in writing, except for

decisions requiring a notarial deed, in accordance with applicable

legal provisions of the Belgian Code of Companies and

Associations.”

- Replacement of the second paragraph of article 19 by following

text: “Copies of the minutes to be produced in court or elsewhere

shall be signed either by the Chair of the Board of Directors or

by one or several Directors having representation powers. The

extracts are signed either by the Chair of the Board of Directors,

or by one or several Directors, or by the Secretary General, or by

the General Counsel.”

- Replacement of the first paragraph of article 20 by following

text: “The Board of Directors creates within the Board consultative

committees, including:

- An Audit Committee in accordance with article 7:99 of the

Belgian Code of Companies and Associations, with at least the

missions set out in there; and,

- A Governance, Nomination & Compensation Committee which

includes the Remuneration Committee as required pursuant to article

7:100 of the Belgian Code of Companies and Associations.

The Board of Directors can create other

consultative committees within the Board and determines their

composition and powers.”

- Replacement of the words “of the objectives” by “the object” in

the second paragraph of article 20 and deletion of the third

paragraph of article 20.

- Replacement of the second paragraph of article 21 by following

text: “The Board of Directors may also set up an executive

committee, of which it determines the composition, mission and

powers.”

- Insertion of the words “…, subject to the applicable legal

dispositions of the Belgian Code of Companies and Associations.” in

fine the second sentence of article 24.

- Insertion of the words “…, in accordance with applicable legal

provisions of the Belgian Code of Companies and Associations.” in

fine first sentence of article 26 and deletion of the second

paragraph of article 26.

- Deletion of the word “company’s” in the first paragraph of

article 32, replacement of third paragraph of article 32 by

following text: “The meeting shall hear the reports of the Board of

Directors and the auditor(s), shall discuss the annual accounts and

take all decisions appertaining thereto, shall decide by a special

vote on the remuneration report, on the discharge to be given to

the Directors and auditors and, if applicable, on any other item

required under the Belgian Code of Companies and Associations. The

meeting shall also, if need be, re-elect or replace the retiring

Directors and auditors.”, insertion in the fourth paragraph of

article 32 after the words “… annual accounts,” of the following

words “the discussion of the remuneration report,”, insertion

in fine the fourth paragraph of article 32 of “… and, if

applicable, any other item required under the Belgian Code of

Companies and Associations or any applicable law or regulation.”

and replacement of the words “one-fifth” by “one-tenth” in the last

paragraph of article 32.

- Replacement of article 34 by following text: “The convening

notices for every general meeting include at least the information

required by the Belgian Code of Companies and Associations and

shall be announced in accordance with the requirements of the

aforementioned Code. For a continuous period beginning on the date

of the publication of the notice of a meeting and until 5 years

after the day of such General Meeting, the company shall make

available for its shareholders, on its website, at least the

information required by the Belgian Code of Companies and

Associations.”

- Replacement of article 36 by following text:

“Any shareholder can be represented at the

General Meeting by a proxy holder of his choice. The Board of

Directors may determine the form of proxies and the manner in which

they are sent to the Company (possibly also in electronic form) in

accordance with the Belgian Code of Companies and Associations. If

the convening notice so provides, shareholders may vote remotely in

advance of the general meeting, by letter or by any other

electronic means, using the form provided by the Company, and in

accordance with the conditions set out in the convening notice and

by article 7:146 of the Belgian Code of Companies and Associations.

If the convening notice so provides, shareholders (and, if

applicable, holders of convertible bonds and subscription rights)

may participate remotely at a general meeting by means of an

electronic communication made available by the Company, and in

accordance with the conditions set out in the convening notice and

by article 7:137 of the Code of Companies and Associations. If the

convening notice implements this paragraph, such convening notice

(or a document that can be consulted by the shareholders and to

which the convening notice refers) will detail the manner to

determine that a shareholder (and, if applicable, a holder of

convertible bonds or subscription rights) participates at the

general meeting by means of an electronic communication and

therefore can be considered as being present.”

- Replacement the words “by article 516 of the Companies Code.”

by “in the applicable articles of the law of 2 May 2007 on the

disclosure of shareholdings in issuers whose securities are

admitted to trading on a regulated market.” in fine the second

paragraph of article 38.

- Replacement of the last paragraph of article 39 by following

text: “Copies of these minutes shall be signed either by the Chair

of the Board of Directors, or by one or several Directors having

representation powers. The extracts are signed either by the Chair

of the Board of Directors, or by one or several Directors, or by

the Secretary General, or by the General Counsel.”

- Replacement of the third and fourth paragraph of article 42 by

following text: “The Board of Directors shall prepare an annual

report in respect of the annual accounts and consolidated annual

accounts in accordance with the Belgian Code of Companies and

Associations. The annual accounts and the other documents required

by the Belgian Code of Companies and Associations shall be made

available to the shareholders at the registered office, where they

can be consulted and copied for at least thirty (30) days before

the general meeting.”

- Deletion of the words “of the company” in the second paragraph

of article 43 and insertion in the last paragraph of article 43

after the words “… and debts” of the following words “and in

exceptional cases, the non-amortized formation expenses and

research and development costs.”

- Replace in article 44 the words “as stipulated in articles 98

and following of the Companies Code.” by “in accordance with

applicable legal provisions of the Belgian Code of Companies and

Associations.”

- Replacement of the second, third and fourth paragraph of

article 45 by the following text: “The Board of Directors can

decide to pay interim dividend in accordance with article 7:213 of

the Belgian Code of Companies and Associations.”

- Deletion of the words “of the company” in the second paragraph

of article 46, insertion in the second paragraph of article 46

between the words “in the agenda” and “, as the case may be.”

of the following words “to ensure the continuity of the company”,

insertion in the fourth paragraph of article 46 in fine of the

following words “, without taking into account the abstentions in

the nominator and denominator.”, deletion in the last paragraph of

article 46 of the word “Commercial” and replacement of the words “a

period of time” by “a binding period of time”.

- Deletion in article 49 of the word “company’s”.

- Replace in the first paragraph of article 50 the words “the

Companies Code” by “the Belgian Code of Companies and

Associations”.

2. Special Report of

the Board of Directors

Submission of the special report

prepared by the Board of Directors in accordance with article 7:199

of the Belgian Code of Companies and Associations in which the

Board requests the renewal of its powers in relation to the

authorized capital and indicates the special circumstances where it

may use its powers under the authorized capital and the purposes

that it shall pursue.

3. Renewal of the powers of

the Board of Directors under the authorized capital and amendment

to article 6 of the Articles of Association

It is proposed to the General Meeting to

renew the two (2) year authorization granted by the General Meeting

of 26 April 2018 to the Board of Directors for another two (2)

years, to decide, under the authorized capital, to increase the

capital of the Company, within the limits of article 7:198 of the

Belgian Code of Companies and Associations, with an amount of up to

5% of the share capital (calculated at the time of use of this

authorization) in case of cancellation or limitation of the

preferential subscription rights of the shareholders, or with an

amount of up to 10% of the capital in case there is no limitation

nor cancellation of the preferential subscription rights of

existing shareholders. This authorization is for general purposes.

For further information on the use and purposes of the authorized

capital, please refer to the special report of the Board of

Directors prepared in accordance with article 7:199 of the Belgian

Code of Companies and Associations.

Proposed resolution:

The General Meeting resolves to renew the

authorization to the Board of Directors to increase the capital of

the Company within the framework of the authorized capital for

another two (2) years, and to amend article 6 of the Articles of

Association accordingly to reflect this renewal and the changes

required as a result of the implementation of the new

BCCA.

Subject to the approval of this resolution, the

text of article 6 of the Articles of Association of the Company

will be amended as follows:

“Article 6

The capital can be increased one or more times

by a decision of a General Meeting of shareholders constituted

under the conditions required to modify the Articles of

Association.

The Board of Directors is authorized to increase

the share capital amongst other by way of the issuance of shares,

convertible bonds or subscription rights, in one or more

transactions, within the limits set by law,

- with up to 5% of the share capital at the time of the

decision of the Board of Directors to make use of this

authorization, in the event of a capital increase with cancellation

or limitation of the preferential subscription rights of the

shareholders (whether or not for the benefit of one or more

specific persons who are not part of the personnel of the Company

or of its subsidiaries, as defined in the Belgian Code of Companies

and Associations),

- with up to 10% of the share capital at the time of the decision

of the Board of Directors to make use of this authorization, in the

event of a capital increase without cancellation or limitation of

the preferential subscription rights of the existing

shareholders.

In any event, the total amount by which the

Board of Directors may increase the share capital by a combination

of the authorizations set forth in (i) and (ii) above, is limited

to 10% of the share capital at the time of the decision of the

Board of Directors to make use of this authorization.

The Board of Directors is moreover expressly

authorized to make use of this authorization, within the limits as

set out under (i) and (ii) of the second paragraph above, for the

following operations:

- a capital increase or the issuance of convertible bonds or

subscription rights with cancellation or limitation of the

preferential subscription rights of the existing shareholders,

- a capital increase or the issuance of convertible bonds or

subscription rights with cancellation or limitation of the

preferential subscription rights of the existing shareholders for

the benefit of one or more specific persons who are not part of the

personnel of the Company or of its subsidiaries, as defined in the

Belgian Code of Companies and Associations, and

- a capital increase by incorporation of reserves.

Any such capital increase may take any and all

forms, including, but not limited to, contributions in cash or in

kind, with or without share premium, with issuance of shares below,

above or at par value, the incorporation of reserves and/or share

premiums and/or profits carried forward, to the maximum extent

permitted by the law.

Any decision of the Board of Directors to use

this authorization requires a 75% majority within the Board of

Directors.

This authorization is granted for a period of

two (2) years as from the date of the publication in the appendices

to the Belgian Official Gazette of the resolution of the

Extraordinary Shareholders Meeting held on 30 April 2020.

The Board of Directors is empowered, with full

power of substitution, to amend the Articles of Association to

reflect the capital increase(s) resulting from the exercise of its

powers pursuant to this article.” 4.

Acquisition of own shares – renewal of

authorization

In accordance with article 7:215 of the

BCCA, it is proposed to the General Meeting to renew the

authorization granted to the Board of Directors by the

extraordinary general meeting of 26 April 2018 to acquire own

shares for up to 10% of the total number of shares of the Company,

for two (2) years expiring on 30 June 2022. The previous

authorization of 26 April 2018 will remain valid until it expires

on 30 June 2020. As per previous years, this is a general-purpose

authorization for share buybacks. The Board of Directors may for

example (and without being limited thereto) use this authorization

to service the Long-Term Incentive Plans of the UCB Group for

employees and management.

Proposed resolution:

The Board of Directors is authorized to acquire,

directly or indirectly, whether on or outside of the stock

exchange, by way of purchase, exchange, contribution or any other

way, up to 10% of the total number of the Company’s shares, as

calculated on the date of each acquisition, for a price or an

exchange value per share which will not be (i) higher than the

highest price of the Company’s shares on Euronext Brussels on the

day of the acquisition and (ii) lower than one (1) euro, without

prejudice to article 8:5 of the royal decree of 29 April 2019

implementing the Belgian Code of Companies and Associations. As a

result of such acquisition(s), the Company, together with its

direct or indirect subsidiaries, as well as persons acting on their

own behalf but for the account of the Company or its direct or

indirect subsidiaries, may not hold more than 10% of the total

number of shares issued by the Company at the moment of the

acquisition concerned. This authorization is granted for a period

of two years starting on 1 July 2020 and expiring on 30 June 2022.

This authorization extends to any acquisitions of the Company’s

shares, directly or indirectly, by the Company’s direct

subsidiaries in accordance with article 7:221 of the Belgian Code

of Companies and Associations. The authorization granted by the

Extraordinary General Meeting of the Company on 26 April 2018

remains valid until 30 June 2020.

***

ATTENDANCE FORMALITIES

In order to attend the General Meeting, holders of securities

must comply with the following formalities:

- Kindly note that all due dates and times mentioned herein are

the final deadlines and that these will not be extended due to a

weekend, holiday or for any other reason.

- Registration Date: the

registration date is 16 April 2020, at 24:00 CEST.

- Owners of registered shares must be registered

as a shareholder in UCB SA/NV’s share register, held by Euroclear,

on 16 April 2020, at 24:00 CEST.

- Owners of dematerialized shares must be

registered as a shareholder on an account with a recognized account

holder or settlement institution on 16 April 2020, at 24:00

CEST.

- Intention to participate in the General

Meeting: the shareholder who intends to

participate in the General Meeting must also declare his/her intent

to participate (in person or by proxy) in the General Meeting, as

follows:

- Owners of registered shares must declare their

intention to participate in the General Meeting to UCB SA/NV (c/o

Mrs. Muriel Le Grelle) or via e-mail to

shareholders.meeting@ucb.com at the latest by 24 April

2020, 15:00 CEST, mentioning the number of shares with

which they want to participate in the General Meeting. The Company

will verify the number of shares held on the registration date

based on the registration in the share register held by

Euroclear.

- Owners of dematerialized shares must declare

their intent to participate in the General Meeting at the latest by

24 April 2020, 15:00 CEST to one of the agencies

of KBC Bank NV, together with a certificate of dematerialized

shares issued by their relevant account holder or settlement

institution mentioning the number of dematerialized shares in their

account on the registration date and for which they want to

participate in the General Meeting. KBC Bank NV will notify the

Company thereof.

Only persons having notified their intent to participate

(in person or by proxy) at the General Meeting at the latest by 24

April 2020, 15:00 CEST and in accordance with the aforementioned

formalities will be allowed to attend and vote at the General

Meeting.

- Proxies: shareholders who have

complied with the above attendance formalities are permitted to be

represented by a proxy holder at the General Meeting. The proxy

forms approved by UCB SA/NV, which must be used to be represented

at the General Meeting, can be downloaded from

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2020.

Shareholders must deposit or send these proxies, duly filled out

and signed, to UCB SA/NV’s registered office (c/o Mrs. Muriel Le

Grelle) or send them via e-mail to shareholders.meeting@ucb.com, in

such a way that they arrive at UCB at the very latest by 24

April 2020, 15:00 CEST. Scans by e-mail are allowed

provided the proxy holder produces the original proxy at the latest

immediately prior to the General Meeting. Failure to comply with

these requirements may result in UCB SA/NV not acknowledging the

powers of the proxy holder.

- In accordance with article 7:130 of the Belgian Code

of Companies and Associations and under certain conditions, one or

more shareholder(s) holding (together) at least 3% of the share

capital of the Company may request to add items to the agenda and

may file resolution proposals relating to the items on the agenda

or to be added to the agenda.

Such request will only be valid if it is duly

notified to UCB SA/NV in writing or via

shareholders.meeting@ucb.com at the latest by 8 April 2020,

15:00 CEST. An updated agenda will, if applicable, be

published on 15 April 2020. In such case, the Company will make an

updated proxy form available in order to allow shareholders to give

specific voting instructions thereon. The additional items on the

agenda and the proposed resolutions will only be discussed at the

General Meeting if this/these shareholder(s) holding (together) at

least 3% of the share capital of the Company has/have fulfilled the

admission formalities as detailed under point 3 above.

- In accordance with article 7:139 of the Belgian Code

of Companies and Associations and under certain conditions,

shareholders are entitled to submit questions in writing prior to

the General Meeting to the Board of Directors or the statutory

auditor regarding their reports or items on the agenda. The

questions will be answered during the General Meeting provided (i)

the shareholders concerned have complied with all required

admission formalities and (ii) any communication of information or

fact in response to such question does not prejudice the Company’s

business interests or the confidentiality undertaking of UCB SA/NV,

its directors and statutory auditor.

Questions can be sent in writing to UCB SA/NV’s registered

office or by e-mail to shareholders.meeting@ucb.com in a way that

they arrive at UCB by 24 April 2020, 15:00 CEST at

the latest.

- Holders of bonds issued by the

Company may attend the General Meeting in an advisory capacity and

are subject to the same attendance formalities as those applicable

to shareholders.

- In order to attend the General Meeting, individuals

holding securities and proxy holders must prove their identity and

representatives of legal entities must hand over documents

establishing their identity and their representation power, at the

latest, immediately prior to the beginning of the General Meeting.

Persons attending the General Meeting are requested to arrive

at least 45 minutes before the

time set for the General Meeting in order to complete the

registration formalities.

- As of the date of publication of this notice, the

documents to be presented at the General Meeting, the (amended)

agenda, and the (amended) proxy forms are available on

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2020.

The shareholders and bondholders will also be able to access and

consult the documents during working hours on business days at UCB

NV/SA’s registered office and/or can receive a free copy of these

documents.

- The Company is responsible for the processing of the

personal data it receives from shareholders, holders of other

securities issued by the Company (as, for example, bonds) and proxy

holders in the context of the general shareholder’s meeting in

accordance with the applicable data protection legislation. The

processing of such personal data will in particular take place for

the analysis and management of the attendance and voting procedure

in relation to the general shareholders’ meeting, in accordance

with the applicable legislation and the Company’s Privacy Policy.

These personal data will be transferred to third parties for the

purpose of providing assistance in the management of attendance and

voting procedures, and for analyzing the composition of the

shareholder base of the Company. The personal data will not be

stored any longer than necessary in light of the aforementioned

objectives. Shareholders, holders of other securities issued by the

Company and proxy holders can find the Company’s Privacy Policy on

the Company’s website. This Privacy Police contains detailed

information regarding the processing of the personal data of, among

others, shareholders, holders of other securities issued by the

Company and proxy holders, including the rights that they can

assert towards the Company in accordance with the applicable data

protection legislation. The aforementioned can exercise their

rights with regard to their personal data provided to the Company

by contacting the Company’s Data Protection Officer via

‘dataprivacy@ucb.com’.

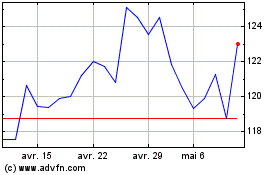

UCB (EU:UCB)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

UCB (EU:UCB)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025