Valeo Q3 2024 Sales

PARIS

October 24, 2024

In a worsening automotive market in the

second half, Valeo is confirming its margin and free cash flow

guidance for full-year 2024.

Valeo records third-quarter sales of 5.0

billion euros. Original equipment sales outperform automotive

production by 3 percentage points.

- Sales of 5.0 billion euros,

down 2% on a like-for-like basis (LFL)

- Original equipment sales outperform automotive

production by 3 percentage points (down 2% LFL). Outperformance

across all Divisions versus automotive production

- Aftermarket

sales up 3% LFL

- 2024 objectives: Valeo is

maintaining its margin and free cash flow guidance with margins

significantly higher in the second half of the year versus the

first half thanks to the rigorous management of its activities and

the implementation of cost adjustment measures amid adverse market

conditions. Valeo is adjusting its sales objective to around 21.3

billion euros

- 2025 objectives: given the

worsening economic environment and the significant uncertainty

surrounding automotive production volumes, Valeo will publish

guidance adapted to these new market conditions when it publishes

its 2024 results. For 2025, Valeo remains fully focused on

generating free cash flow and reducing its debt. The year 2025

therefore represents a further step in which Valeo aims to deliver

an original equipment sales outperformance versus

automotive production and significantly improve its profitability

and cash generation (in absolute terms) compared with

2024

“In the third quarter, Valeo outperformed

automotive production by 3 percentage points, representing an

improvement on the first half of 2024. The BRAIN Division

outperformed the market (5 percentage points), thanks in particular

to the strong momentum of its Interior Experience (displays,

Phone-as-a-Key and telematics) business. In the LIGHT Division, a

significant number of production launches in the Division's main

regions across the world contributed to this improved

outperformance (4 percentage points). The POWER Division continues

to contend with an unfavorable environment, in particular due to

much lower than expected volumes in high-voltage electrification.

Thanks to the sound performance of its traditional activities, the

Division outperformed automotive production by 1 percentage point

over the quarter.

Given the worsening market environment, we

are adjusting our sales objectives for full-year 2024 to around

21.3 billion euros1. We remain fully

focused on continuing to improve our financial performance in line

with the margin and cash generation objectives we set

ourselves for 2024. The significant improvement in our

earnings in the second half of the year compared with the first

half will enable us to achieve these objectives. This performance

is driven by the remarkable commitment of Valeo’s teams in

rigorously managing our activities and implementing significant

cost adjustment measures.

Given the worsening economic environment and

the significant uncertainty surrounding automotive production

volumes, we will publish new 2025 guidance adapted to these new

market conditions when we publish our 2024 results. We remain

focused on cash generation and confirm our aim of taking a further

step in significantly improving our profitability and

reducing our debt in 2025.”

Christophe Périllat, Valeo’s Chief Executive

Officer

Sales of 4,967 million

euros in third-quarter 2024, down 2%

like for like

Sales

(in millions of euros) |

As a % of sales |

|

Q3 2024 |

|

Q3 2023 |

Change |

FX |

Scope |

LFL* change |

|

Original equipment |

84% |

|

4,197 |

|

4,433 |

-5% |

-1% |

-2% |

-2% |

|

Aftermarket |

11% |

|

538 |

|

569 |

-5% |

-4% |

-4% |

+3% |

|

Miscellaneous |

5% |

|

232 |

|

222 |

+5% |

—% |

+2% |

+2% |

|

Total |

100% |

|

4,967 |

|

5,224 |

-5% |

-2% |

-2% |

-2% |

* Like for like

(2).

S&P Global Mobility automotive production

estimates are down 5% on the third quarter of 2023. This decrease

reflects both the postponement of production launches by customers

and the impact on demand of uncertainty surrounding the adoption of

electric vehicles.

Total sales for third-quarter

2024 came in at 4,967 million euros, down 5% compared with the same

period in 2023.

Changes in Group structure had a negative 1.6%

impact, mainly linked to the sale of the Thermal Commercial

Vehicles activity towards the end of the first half of the

year.

Changes in exchange rates had a negative 1.8%

impact, primarily due to the appreciation of the euro against the

Japanese yen and the South Korean won.

On a like-for-like basis, sales fell by 2%.

Original equipment

sales were down by 2% like for like, outperforming

automotive production by 3 percentage points.

Aftermarket sales rose by 3% on

a like-for-like basis compared with the prior-year period, fueled

by the increased number and age of vehicles on the road, and an

increasingly attractive offering of value-added products.

“Miscellaneous” sales (tooling and customer

contributions to R&D) increased by 2% like for like.

Original equipment sales deliver 3

percentage point outperformance in the third quarter

Original equipment sales***

(in millions of euros) |

As a % of sales |

|

Q3 2024 |

|

Q3 2023 |

Change |

LFL* change |

Perf. ** |

|

Europe & Africa |

46% |

|

1,916 |

|

1,966 |

-3% |

—% |

+6 pts |

|

Asia, Middle East & Oceania |

32% |

|

1,349 |

|

1,446 |

-7% |

-4% |

+1 pt |

| o/w Asia

(excluding China) |

17% |

|

717 |

|

724 |

-1% |

+3% |

+10 pts |

|

o/w China |

15% |

|

632 |

|

722 |

-12% |

-12% |

-9 pts |

|

North America |

20% |

|

844 |

|

918 |

-8% |

-6% |

-1 pt |

|

South America |

2% |

|

88 |

|

103 |

-15% |

+14% |

+5 pts |

|

Total |

100% |

|

4,197 |

|

4,433 |

-5% |

-2% |

+3 pts |

* Like for like.

** Based on S&P Global Mobility automotive production

estimates released on October 15, 2024.

*** Original equipment sales by destination

region.

In the third quarter of 2024, original equipment

sales fell by 2% like for like, outperforming automotive production

by 3 percentage points.

In Europe and Africa, the Group

outperformed automotive production by 6 percentage points: the

POWER Division benefited from growth in its activities, excluding

the high-voltage electric powertrain business (thermal systems,

transmission systems and 48V), thanks to the ramp-up of production

for European automakers. This momentum more than offset the impact

of the sharp drop in activity on certain electric vehicle

platforms. The BRAIN division reported robust growth in its ADAS

business (particularly for front cameras and computer-vision

cameras) and its Interior Experience business (particularly

displays, Phone-as-a-Key and telematics), while the LIGHT division

was lifted by a significant number of production launches for

several European automakers.

In Asia, the Group outperformed

automotive production by 1 percentage point:

-

in China, the Group underperformed automotive

production by 9 percentage points. It continued the repositioning

of its customer portfolio (around 50% of original equipment sales

and 60% of order intake recorded with automakers (excluding joint

ventures) in China since the beginning of 2024). The LIGHT Division

is fully benefiting from recent production launches for a North

American automaker and several Chinese automakers, particularly in

the area of electrification;

-

in Asia excluding China, Valeo outperformed

automotive production by 10 percentage points, thanks to good

momentum for the BRAIN Division in ADAS. The LIGHT Division was

penalized by production stoppages at several Japanese automakers,

linked in part to the typhoon at the end of August.

In North America, Valeo

underperformed automotive production by 1 percentage point, despite

the LIGHT Division enjoying the full effects of the ramp-up in

production of a new contract in electrification for a North

American automaker.

In South America, the Group

outperformed automotive production by 5 percentage points.

Segment reporting

In the third quarter of 2024, all three Divisions

outperformed automotive production, POWER impacted by weak

high-voltage activity

Sales by Division

(in millions of euros) |

Q3 2024 |

|

Q3 2023 |

Change in sales |

Change in OE sales* |

Perf. ** |

|

POWER |

2,470 |

|

2,694 |

-8 % |

-4% |

+1 pt |

|

High-voltage electrification |

189 |

|

220 |

-14 % |

-15% |

-10 pts |

|

Traditional activities |

2,281 |

|

2,474 |

-8 % |

-3% |

+2 pts |

|

BRAIN*** |

1,214 |

|

1,210 |

— % |

—% |

+5 pts |

|

ADAS |

776 |

|

793 |

-2 % |

-3% |

+2 pts |

|

Interior Experience |

438 |

|

404 |

+9 % |

+7% |

+12 pts |

|

LIGHT |

1,270 |

|

1,280 |

-1 % |

-1% |

+4 pts |

|

Other |

13 |

|

40 |

N/A |

N/A |

N/A |

|

Group |

4,967 |

|

5,224 |

-9 % |

-2% |

+3 pts |

* Like for like.

** Based on S&P Global Mobility automotive production

estimates released on October 15, 2024. (Q3 2024 global

production growth: -5%).

*** Including the Top Column Module business.

The sales performance for the Divisions reflects

the specific product, geographic and customer mix and the relative

weighting of the aftermarket in their activity as a whole.

In the third quarter, the POWER

division posted a 1 percentage point outperformance (excluding the

high-voltage electrification business, the POWER Division's

outperformance was 2 percentage points). The POWER Division's

traditional activities (thermal systems, transmission systems and

48V) outperformed automotive production by 2 percentage points.

This more than offset the decline in the high-voltage electric

powertrain activity (189 million euros in the third quarter of 2024

versus 220 million euros in the same period in 2023, i.e., an

underperformance of 10 percentage points compared with automotive

production), which was heavily penalized by the decline in activity

on certain electric vehicle platforms in Europe.

The BRAIN Division posted an

outperformance of 5 percentage points, thanks to the outperformance

of its Interior Experience (in particular displays, Phone-as-a-Key

and telematics) and ADAS (front cameras and computer-vision

cameras) activities, particularly in Europe and Asia excluding

China. The Interior Experience and ADAS activities' original

equipment sales delivered a 12 percentage point and 2 percentage

point outperformance, respectively.

The LIGHT Division outperformed

automotive production by 4 percentage points, driven by a

significant number of production launches in Europe, and China,

including for several Chinese automakers in electrification. The

Division's performance was also fueled by recent production

launches for a North American automaker in the field of

electrification. In Japan, the Division's activity was penalized by

production stoppages at several Japanese automakers, linked in part

to the typhoon at the end of August.

2024 and 2025 objectives

2024 objectives:

Valeo is maintaining its margin and free cash

flow guidance with margins significantly higher in the second half

of the year versus the first half thanks to the rigorous management

of its activities and the implementation of cost adjustment

measures amid adverse market conditions. Valeo is adjusting its

sales objective to around 21.3 billion euros.

|

|

2024 guidance (a) (b) |

Previous 2024 guidance (a) (b) |

|

Sales

(in billions of euros) |

~21.3 |

~22.0 |

|

EBITDA (as a % of sales)

|

12.1% to 13.1% |

12.1% to 13.1% |

|

Operating margin (as a % of sales) |

4.0% to 5.0% |

4.0% to 5.0% |

Free cash flow

before one-off exceptional cost adjustment measures (c)

(in millions of euros) |

~500 |

~500 |

Free cash flow

after one-off exceptional cost adjustment measures

(c)

(in millions of euros) |

~350 |

~350 |

(a) Second-half free cash

flow generation higher than in the first half.

(b) For greater comfort, figures are based on (i) light vehicle

production 3% below the S&P Global Mobility scenario released

on February 16, 2024, and

(ii) sales in high-voltage electrification of around 0.85

billion euros in 2024.

(c) Includes, but is not limited to,

potential restructuring measures.

2025 objectives:

The outlook for 2025 currently shows a worsening

economic environment and significant uncertainty surrounding

production volumes at Valeo’s customers, due in particular to a

slowdown in the Chinese economy, the application of new or

potential environmental standards in Europe, China and North

America, as well as to delays in customer programs and inventory

management impacts.

Valeo will publish its 2025 guidance adapted to

these new market conditions when it publishes its 2024 results. For

2025, Valeo remains fully focused on generating free cash flow and

reducing its debt: the year 2025 therefore represents a further

step in which Valeo aims to deliver an original equipment sales

outperformance versus automotive production and significantly

improve its profitability and cash generation (in absolute terms)

compared with 2024.

Upcoming events

2024 annual results: February 27, 2025

Highlights

ESG

On January 2, Christophe

Perillat, CEO of Valeo, nominated Édouard de Pirey as Chief

Financial Officer. He takes over from Robert Charvier who, after 24

years with the Group, has retired. Click here

On March 27, Valeo informed its

shareholders that its Combined (ordinary and extraordinary) General

Shareholders' Meeting would be held on May 23, 2024. Click here

On April 3, Valeo announced

that it had published its 2023 Universal Registration Document.

Click here

On April 22, Valeo took a new

step towards electric mobility and announced the creation of its

new Valeo POWER division. Click here

On May 23, Valeo announced that

its 2024 Shareholders' Meeting had taken place. Click here

Industrial partnerships

Valeo took part in CES 2024 from January

8 to 12, during which it announced several

partnerships:

- On January 4,

Valeo and Teledyne FLIR announced that they had signed an agreement

and first contract for thermal imaging for automotive safety

systems. Click here

- On January 4,

Valeo and Sennheiser presented ImagIn: an immersive sound and light

experience in your car. Click here

- On January 4,

Valeo and Applied Intuition announced their partnership to provide

digital twin technology for ADAS simulation. Click here

- On January 8,

ZutaCore® and Valeo announced their first contract for innovative

data center cooling. Click here

On February 8, Dawex, Schneider

Electric, Valeo, CEA and Prosyst joined forces to create

Data4Industry-X, the trusted data exchange solution for industry.

Click here

On May 7, Valeo and ICAP GROUP,

the owner of Tecnobus, announced they had signed an agreement to

prepare the future of mobility in Ferentino. Click here

On May 23, Valeo and Smovengo

committed to circular maintenance of Vélib’ electric bike motors

and batteries. Click here

On June 11, Valeo partnered

with Dassault Systèmes to accelerate the digitalization of its

R&D. Click here

On July 8, Valeo and Seeing

Machines announced a strategic collaboration to offer advanced

driver and occupant monitoring solutions. Click here

On October 14, Valeo and MAHLE

announced the extension of their range of magnet free electric

motors to upper segment applications through a Joint Development of

iBEE (Inner Brushless Electrical Excitation). Click here

On October 14, Valeo and HERE

Technologies presented Valeo Smart Safety 360 with Navigation on

Pilot at the Paris Motor Show 2024. Click here

On October 18, Valeo and

TotalEnergies announced the strengthening of their partnership for

the next generation of EVs. Click here

Products/technologies and patents

On January 4, Valeo announced

expanded software capabilities in North America to support

increased demand. Click here

On January 8, Valeo announced

its acceleration in artificial intelligence thanks to Google Cloud

tools. Click here

From January 8 to 12, Valeo

took part in CES 2024, where it presented groundbreaking

innovations from its booth and from its live demonstration area

paving the way for affordable, greener, safer and more connected

mobility:

- On January 4,

Valeo presented the latest update of its Valeo Cyclee™ Mid-Drive

Unit solution with a new HMI and reduced noise and vibration at CES

2024. Click here

- On January 4, Valeo presented Ineez™ Air

Charging, its solution for wireless charging for electric vehicles.

Click here

On January 10, Valeo's Vsevolod

Vovkushevsky announced that he had been named a MotorTrend Software

Defined Vehicle Innovator Awards Winner. Click here

On January 18, Mister-Auto integrated the Valeo

Canopy low-carbon-footprint wiper blade range. Click here

On January 23, Valeo announced

that it had once again ranked first among French patent applicants

worldwide. Click here

On January 25, Smart #3

equipped with Valeo Smart Safety 360 received 5 stars at Euro NCAP

Click here

On February 1, Valeo was

certified ISO/SAE21434, the benchmark for automotive cybersecurity,

by UTAC. Click here

On February 21, Valeo announced

its participation in SXSW 2024. Click here

On February 26, Valeo announced

its participation at the Taipei Cycle Show 2024. Click here

On March 4, Valeo presented

Valeo Racer, a new extended reality in-car gaming experience

developed with Unity, at South by Southwest 2024. Click here

On March 6, Valeo announced

that it is Launch Partner for SDVerse, a new Automotive Software

Marketplace Click here

On March 28, Valeo announced

that it is taking the driver's seat on generative AI with Google

Cloud. Click here

On March 29, Valeo announced

the opening of a new plant in Daegu (South Korea) for the

production of Advanced Driver Assistance Systems. Click here

On April 17, Valeo announced it

was celebrating 30 years in China and showcased its latest

technologies at Auto China – Beijing 2024. Click here

On April 25, Valeo was named

the number 1 French patent filer in Europe and the number 3 patent

filer in France. Click here

On April 30, Valeo won an

automotive News PACE award for its SCALA™ 3 LiDAR. Click here

On May 16, Valeo announced that

its Valeo eAccess solution would power the Toyota APM electric

shuttles for a major summer 2024 sporting event. Click here

On June 24, Valeo received the

Frost & Sullivan 2024 Global Company of the Year award for its

market-leading position on software-defined vehicles. Click

here

On June 26, Valeo announced it

would be taking part in the Eurobike 2024 trade show, held from

July 3 to 7, 2024. Click here

On September 9, Valeo showcased

its technologies dedicated to commercial vehicles at IAA

Transportation 2024. Click here

From October 14 to 20, Valeo

took part in the Paris Motor Show 2024. Click here

On October 16, Valeo leveled up

the expertise of its mechanics thanks to the launch of Valeo Tech

Academy. Click here

Financing activities and financial ratings

On March 11, Valeo announced

the implementation of its share buyback program. Click here

On March 22, Moody's affirmed

Valeo’s “Baa3” long-term issuer rating, negative outlook, and “P3”

short-term issuer rating. Click here

On April 3, Standard &

Poor’s affirmed Valeo’s “BB+” long-term issuer rating, revising its

outlook from “stable” to “negative”. Click here

On April 4, Valeo announced a

green bond issue for an amount of 850 million euros with maturity

April 2030. Click here

On May 15, Valeo announced the

completion of its share buyback program. Click here

On September 26, Moody’s

Ratings (Moody’s) agency revised its long-term issuer rating of

Valeo from “Baa3” to “Ba1” and its short-term commercial paper

rating from “Prime-3” to “Non-Prime”. The outlook is negative.

Click here

Financial glossary

Like for like (or LFL): the

currency impact is calculated by multiplying sales for the current

period by the exchange rate for the previous period. The Group

structure impact is calculated by adjusting sales by elimination

(or by addition in the event of a change in consolidation method)

to ensure that the prior period is comparable with the current

period.

Operating margin corresponds to

operating income before other income and expenses before share in

net earnings of equity-accounted companies.

EBITDA corresponds to (i)

operating margin before depreciation, amortization and impairment

losses (included in the operating margin) and the impact of

government subsidies and grants on non-current assets, and (ii) net

dividends from equity-accounted companies.

Free cash flow corresponds to

net cash from operating activities (excluding changes in

non-recurring sales of receivables and net payments for the

principal portion of lease liabilities) after taking into account

acquisitions and disposals of property, plant and equipment and

intangible assets.

Appendices

Year-to-date figures

Sales

YTD sales

(in millions of euros)

|

As a % of sales |

|

YTD 2024 |

|

YTD 2023 |

Change |

LFL* change |

|

FX |

Scope |

|

Original equipment |

84% |

|

13,492 |

|

13,977 |

-3% |

-1% |

|

-1% |

-1% |

|

Aftermarket |

11% |

|

1,728 |

|

1,736 |

—% |

+4% |

|

-3% |

-2% |

|

Miscellaneous |

5% |

|

864 |

|

723 |

+20% |

+21% |

|

-1% |

-1% |

|

Total |

100% |

|

16,084 |

|

16,436 |

-2% |

—% |

|

-1% |

-1% |

* Like for like.

Sales by destination region

Original equipment sales

(in millions of euros)

|

As a % of sales |

|

YTD 2024 |

|

YTD 2023 |

LFL* change |

Perf.** |

|

Europe & Africa |

48% |

|

6,517 |

|

6,657 |

-2 % |

+1 pt |

|

Asia, Middle East & Oceania |

30% |

|

4,036 |

|

4,331 |

-2% |

-1 pt |

| o/w Asia

(excluding China) |

16% |

|

2,138 |

|

2,254 |

+2% |

+7 pts |

|

o/w China |

14% |

|

1,898 |

|

2,077 |

-5% |

-7 pts |

|

North America |

20% |

|

2,678 |

|

2,702 |

—% |

+1 pt |

|

South America |

2% |

|

261 |

|

287 |

—% |

+2 pts |

|

Total |

100% |

|

13,492 |

|

13,977 |

-1% |

+1 pt |

* Like for like.

** Based on S&P Global Mobility

automotive production estimates released on October 15,

2024.

Sales by Division

Sales by Division

(in millions of euros)

|

YTD 2024 |

|

YTD 2023 |

Change in sales |

Change in OE

sales* |

Perf.** |

|

POWER |

8,162 |

|

8,645 |

-6% |

-5% |

-3 pts |

|

High-voltage electrification |

702 |

|

1,067 |

-34% |

-37% |

-35 pts |

|

Traditional activities |

7,460 |

|

7,578 |

-2% |

—% |

+2 pts |

|

BRAIN*** |

3,783 |

|

3,658 |

+3% |

+4% |

+6 pts |

|

ADAS |

2,436 |

|

2,356 |

+3% |

+3% |

+5 pts |

|

Interior Experience |

1,349 |

|

1,284 |

+5% |

+5% |

+7 pts |

|

LIGHT |

4,123 |

|

4,096 |

+1% |

+1% |

+3 pts |

|

Other |

16 |

|

37 |

N/A |

N/A |

N/A |

|

Group |

16,084 |

|

16,436 |

-2% |

-1% |

+1 pt |

* Like for like.

** Based on S&P Global Mobility automotive production

estimates released on October 15, 2024. (YTD global production

growth: -2%).

*** Including the Top Column Module business.

2023 segment information

|

Segment information |

POWER |

BRAIN* |

LIGHT |

Other* |

Group |

|

Sales |

11,571 |

4,878 |

5,541 |

54 |

22,044 |

|

EBITDA |

1,171 |

690 |

736 |

50 |

2,647 |

|

Net R&D expenditure |

(895) |

(728) |

(396) |

(10) |

(2,029) |

|

Investments in property, plant & equipment & intangible

assets |

715 |

869 |

563 |

66 |

2,213 |

|

Segment assets |

6,948 |

3,519 |

2,967 |

275 |

13,709 |

*In line with the Group’s new organizational structure

effective as from June 30, 2024, the Top Column Module activity is

presented as part of the BRAIN Division.

Safe Harbor Statement

Statements contained in this document which,

when they are not historical fact, constitute “forward-looking

statements”. These statements include projections and estimates and

their underlying assumptions, statements regarding projects,

objectives, intentions and expectations with respect to future

financial results, events, operations, services, and product

development and potential and future performance. Even though

Valeo’s Management feels that the forward-looking statements are

reasonable as at the date of this document, investors are put on

notice that the forward-looking statements are subject to numerous

factors, risks and uncertainties that are difficult to predict and

generally beyond Valeo’s control, which could cause actual results

and events to differ materially from those expressed or projected

in the forward-looking statements. Such factors include, among

others, the Company’s ability to generate cost savings or

manufacturing efficiencies to offset negotiated or imposed price

reductions. The risks and uncertainties to which Valeo is exposed

mainly comprise the risks resulting from the investigations

currently being carried out by the antitrust authorities as

identified in the Universal Registration Document, risks related to

the automotive equipment industry and to the development and launch

of new products and risks due to certain global and regional

economic conditions, environmental and industrial risks as well as

risks and uncertainties described or identified in the public

documents submitted by Valeo to the French financial markets

authority (Autorité des marchés financiers – AMF),

including those set out in the “Risk Factors” section of the 2023

Universal Registration Document registered with the AMF on March

29, 2024 (under number D.24-0218).

In addition, other risks which are currently

unidentified or considered to be non-material by the Group, could

have the same adverse impact and investors could lose all or part

of their investment. Forward-looking statements are given only as

at the date of this document and Valeo does not undertake to update

the forward-looking statements to reflect events or circumstances

which occur subsequent to the publication of this document. Valeo

assumes no responsibility for any analyses issued by analysts and

any other information prepared by third parties which may be used

in this document. Valeo neither intends to review, nor will it

confirm, any estimates issued by analysts.

About Valeo

As a technology company and partner to all automakers and new

mobility players, Valeo is innovating to make mobility cleaner,

safer and smarter. Valeo enjoys technological and industrial

leadership in electrification, driving assistance systems,

reinvention of the interior experience and lighting everywhere.

These four areas, vital to the transformation of mobility, are the

Group's growth drivers.

Valeo in figures: 22 billion euros in sales in

2023 | 109,600 employees, 28 countries, 159 plants, 64 research and

development centers, 19 distribution platforms at June 30,

2024.

Valeo is listed on the Paris Stock Exchange.

Media Relations

Dora Khosrof | +33 7 61 52 82 75

Caroline De Gezelle | +33 7 62 44 17 85

press-contact.mailbox@valeo.com

Investor Relations

+33 1 40 55 37 93

valeo.corporateaccess.mailbox@valeo.com

1 Previous guidance for full-year 2024 sales of around 22

billion euros.

(2) See

financial glossary, page 9.

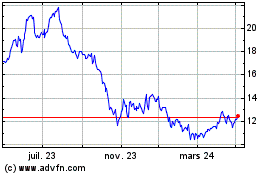

Valeo (EU:FR)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

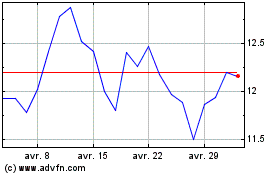

Valeo (EU:FR)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024