THESE VERY GOOD RESULTS CONFIRM THE

EFFECTIVENESS OF OUR VALUE-CREATION MODEL AND THE STRONG

CONTRIBUTION OF THE INTEGRATION OF SUEZ

2023 TARGETS FULLY CONFIRMED, WITH EBITDA

GROWTH NOW EXPECTED TO BE AT THE TOP END OF THE RANGE OF +5% to

+7%

- REVENUE OF €22 755 M , SHARPLY UP BY+14.2 %1 DRIVEN BY

COMMERCIAL MOMENTUM AND PRICE INCREASES

- GROWTH OF +5.2%1 EXCLUDING ENERGY PRICES

- EBITDA OF €3 162 M , A STRONG ORGANIC GROWTH OF +8.2 %1

- €84 M OF SYNERGIES (€230 M CUMULATED) , AHEAD OF THE ANNUAL

TARGET OF MORE THAN €280 M CUMULATED, AND CONTINUED EFFICIENCY

GAINS, WITH €187 M DELIVERED IN H1, AHEAD OF THE ANNUAL OBJECTIVE

OF €350 M

- CURRENT EBIT STRONGLY UP, BY +13.3 %1, TO €1 674 M2

- VERY STRONG GROWTH OF +18.7 %3 OF CURRENT NET INCOME, TO

€662 M2

- STRONG IMPROVEMENT OF NET FREE CASH FLOW AND NET FINANCIAL

DEBT UNDER CONTROL, AT €19.2 BN2

- 2023 TARGETS FULLY CONFIRMED, AND EBITDA ORGANIC GROWTH NOW

EXPECTED AT THE TOP END OF THE +5% TO +7% RANGE

1 at constant scope and forex 2 Excluding purchase price

allocation (PPA) of Suez. 3 At constant forex

Regulatory News:

Veolia Environnement (Paris:VIE):

Estelle Brachlianoff, CEO of the Group, commented : “I am

very pleased to announce another set of excellent results for

Veolia, with strong growth and a new all-time high, despite the

unfavorable macroeconomic context. This very good performance, with

revenue up 14.2% and current net income up 19%, reflects our

commercial dynamism and our operational excellence, and confirms

our low sensitivity to economic cycles. These results demonstrate

the relevance of our value-creation model and of our strategic

positioning, based on the complementary nature of our three

businesses (Water, Waste and Energy), our diversified global

footprint, with 40% of our activities outside Europe, and our

leadership position in strategic markets. They also reflect the

Group's new profile and the success of the merger with Suez. In

just under 18 months, we have already generated €230 million in

synergies and are ahead of schedule. 2023 has therefore got off to

a perfect start for Veolia, and the second half of the year should

also follow a favorable trend, which means that I can confirm our

objectives for the year as a whole and now aim for the top end of

the EBITDA growth range. Our ideal positioning as a leader in

ecological transformation, a growth market as illustrated, for

example, by the many contracts we have won since the beginning of

the year to help our clients cope with the scarcity of water

resources, puts Veolia on a sustainable growth trajectory.”

Detailed results at 30 June 2023

- Revenues for the first half of 2023 amounted to €22,755

million, compared with €20,196 million for the first half of 2022,

up 14.2% on a like-for-like basis, and up 5.2% excluding the impact

of energy prices.

Revenue growth by effect breaks down as follows:

The currency effect was a negative

€293 million (-1.4% of revenue), mainly reflecting the depreciation

of the Argentinean, British, Australian and Chinese currencies,

partially offset by the appreciation of the US dollar, the Czech

koruna and the Chilean peso.

The scope effect was almost neutral,

at -€20 million (-0.1% of revenues), and was due to the combination

of the anti-trust disposals linked to the acquisition of Suez and

the full-year consolidation of Suez assets (17 more days)

The Commerce/Volumes/Works effect

amounted to +564 million euros (+2.8% of revenue) thanks to the

good performance of the energy business and growth in the Water

Technology business.

The climate effect was slightly

negative, at -54 million euros (-0.3% of revenue), reflecting the

mild winter in Central and Eastern Europe.

The impact of energy prices, net of

recyclate prices, amounted to €1,584 million (7.8% on

revenues), reflecting the sharp rise in heat and electricity

tariffs for €1,821 million notably in Central and Eastern Europe,

partially offset by the effect of the fall in recycled materials

prices (-€237 million).

The price effect in Water and Waste

was a positive €779 million (+3.9% on revenue). This reflects price

indexation mechanisms and increases in the price of the Group's

services of +4.4% on average in Water and +4.9% in Waste.

- Revenue at 30 June 2023 progressed across all operating

segments compared to 30 June 2022.

- Revenue in France and Special Waste

Europe reached 4 795 million euros, an organic growth of +1.5 %

compared with 30 June 2022 :

- Water France revenue increased by +0.8 % This was mainly

due to tariff increases, which compensated for the return of the

Lyon contract to public service management. Billed volumes were

down by 2.8% due to generally unfavorable weather conditions in the

second quarter.

- Waste France revenue decreased by -0.6 % mainly as a

result of lower prices for recycled materials, partially offset by

higher prices for services and energy sold, commercial selectivity

and lower volumes.

- The Hazardous Waste business in Europe grew slightly,

with prices for waste treatment services continuing to trend

upwards, offset by a fall in the price of recycled oils.

- SADE grew by +4.0%, thanks to continued strong sales

activity.

- Revenues in Europe excluding France

grew to €9,883 million at 30 June 2023, up 23.2% organically,

thanks mainly to higher energy prices in Central and Eastern

Europe..

- In Central and Eastern Europe, revenue rose by a strong

+41.5% to €6,130 million. Business in the region was driven by the

favorable impact of price rises in heat and electricity. The Energy

climate effect was slightly unfavorable (-30 million euros).

- In Northern Europe, revenue rose by 5.2% to €1,989

million. In the United Kingdom, sales rose by 5.9% on a

like-for-like basis, thanks in particular to the good performance

of municipal waste collection activities, higher selling prices for

electricity generated by incinerators, and the start-up of

contracts linked to the UK government's decarbonisation plan.

Organic growth in Belux was +4.7%.

- In Italy, revenues were down 11.4% at €500 million, due

to the fall in energy prices, which had no impact on

profitability.

- In Spain and Portugal, revenue was up 10.8% at €1,263

million, both in Energy and Water, with water volumes up 1.3% and

tariff increases.

- Sales in the Rest of the World

reached €5,883 million, up 12.1% on a like-for-like basis..

- Revenue in Latin America rose by 28.1% to €955 million,

thanks to strong tariff indexation, particularly in Argentina,

where revenue more than doubled, and to strong Water in Chile.

- In Africa Middle East, business grew by +15.8% to €1,029

million thanks to new Water contracts and growth in energy services

in the Middle East.

- In North America, revenue totalled €1,631 million, up

+9% thanks to continued buoyant activity, a very favorable mix

effect and continued price rises for hazardous waste services, as

well as the effect of higher tariffs and volumes increases (+5.2%)

in Water.

- Revenues in Asia returned to a healthy growth path,

rising by +7.0% to €1,280 million. Sales in China rose by 2.8%,

while South Korea, Japan, Taiwan and Hong Kong continued to enjoy

sustained growth.

- In the Pacific region, revenue rose by 7.5% to €988

million, thanks to a good commercial performance in the Australian

waste business and the industrial maintenance business..

- Water Technologies recorded solid

growth of +9.0% to € 2,183 million. Veolia Water Technologies grew

by 4.6% to € 731 million thanks to services and technologies, and

WTS by 11.4% to €1,452 million, mainly in engineering systems and

chemical sales.

- Revenue growth by business. The 14.2% growth in revenue was

driven primarily by strong growth in Energy, due to the sharp rise

in the price of energy sold. Excluding the impact of energy prices,

organic growth was 5.2%.

- Water revenue rose by +8.4% to €8,834 million, with

volumes up +4.3% (+0.6% in Central and Eastern Europe, -2.8% in

France, +1.3% in Spain, +1.4% in Chile and +5.2% in the United

States), the full effect of tariff indexation in all geographies

(+4.4% overall) and good growth in the Water Technologies

business.

- Revenue from the Waste business showed the same trends

as in the first quarter. Like-for-like sales rose by 3.3% to €7,344

million. The volume effect was -0.2%, more than offset by the

commerce effect (+0.7%), and the effect of price increases was

+4.9%, partly offset by the fall in prices for recyclates (paper,

cardboard and plastics), which had a negative impact of -3.0% on

revenue growth.

- Energy revenues totalled €6,578 million, a very strong

increase (+41.3% on a like-for-like basis), mainly due to higher

prices for heat and electricity sold, reflecting the very sharp

rise in the cost of purchased energy (gas, coal, biomass). The

weather effect was slightly unfavorable at -0.7%, due to a mild

winter.

- Strong growth in EBITDA, to €3,162m from €2,953m at 30 June

2022, representing like-for-like growth of 8.2%.

- Exchange rate fluctuations had a negative impact of €21m, and

scope a negative impact of €12m.

- The strong growth in EBITDA breaks down into a volume effect of

+€56 million (+1.9%), a slightly negative climate effect of -€22

million (-0.8%), an energy and recyclates price effect of +€52

million (+1.8%), the impact of efficiency gains net of contract

renegotiations and of the gradual passing on of cost increases into

prices and indexes of +73 million euros (+2.5%) and the effect of

synergies of +84 million euros (+2.8%), ahead of the annual

target.

- Very strong growth in recurring EBIT(1) , up 13.3% on a

like-for-like basis, to €1,674 million from €1,515 million at 30

June 2022. Changes in exchange rates had a negative impact of

€11 million on current EBIT. The increase in current EBIT on a

like-for-like basis (+€202m) breaks down as follows:

- A sharp rise in EBITDA (up €243 million on a like-for-like

basis).

- Depreciation and amortization stable at €1,377 million,

compared with €1,386 million (excluding repayments of operating

financial assets).

- A significant drop of €46 million (and -€57 million at constant

scope and forex) in the positive balance of capital gains on

industrial disposals net of impairment, from €139 million in the

first half of 2022 to €93 million in the first half of 2023. In the

first half of 2022, the Group recorded capital gains on the

disposal of industrial assets in connection with the acquisition of

Suez (antitrust divestitures).

- Contribution from joint ventures and associates of €53 million,

up €5 million at constant scope and forex

- Net current income Group share (before PPA of -16 million

euros) reached 662 million euros at 30 June 2023, compared with 550

million euros at 30 June 2022 (+18.7% at constant exchange

rates).

- The cost of net financial debt was €312m. It fell by €8m thanks

to active management of financing costs. The Group's borrowing rate

was stable at 3.67%.

- Other financial income and expenses (including gains and losses

on disposals of financial assets) amounted to €123m, compared with

€207m at 30 June 2022, an improvement of €84m due to the lower

revaluation of Chilean inflation-linked debt and the non-recurrence

of negative one off effects linked to the Suez transaction.

- Tax totalled €332m, reflecting the increase in profit before

tax on ordinary activities. The tax rate was 28%, compared with

28.6% in the first half of 2022.

- Minority interests amounted to €245m, compared with €172m at 30

June 2022, mainly due to higher earnings in Chile and Central

Europe.

- Reported net profit Group share came to €523 million,

compared with €236 million at 30 June 2022, an increase of 117.9%

at constant forex.

- The very sharp improvement in reported net profit is due to the

strong growth in current net income and the sharp reduction in

costs relating to the acquisition and integration of Suez, which

amounted to €55m compared with €154m.

- Net financial debt under control (1), at €19,233 million at

30 June 2023, compared with €18,138 million at 31 December

2022.

- Compared with 31 December 2022, the change in net financial

debt is mainly due to the following factors: - Strong improvement

in net free cash flow for the year to -78 million euros compared

with -304 million euros in the first half of 2022, with gross

capital expenditure of 1,820 million euros compared with 1,624

million in the first half of 2022(2) due to the increase in

decarbonisation investments in Central and Eastern Europe and

investments in hazardous waste, and an improvement(2) in Working

Capital Requirement of 35 million euros despite the strong increase

in revenue. - Net financial debt was also impacted by an

unfavorable exchange rate effect and fair value adjustments of

€189m at 30 June 2023.

(1)

Excluding PPA Suez

(2)

Including the 17 days in 2022

**************

In view of the very good first-half performance, our 2023

targets have been fully confirmed, with organic EBITDA growth now

expected to be at the upper end of the +5% to +7% range.

- Objectives 2023 (1)(2)

- Solid organic growth of revenue

- Efficiency gains above €350m complemented by additional

synergies for a cumulated amount of €280m end-2023, in line with

the €500m cumulated objective.

- Organic growth of EBITDA between +5% and +7%

- Current net income group share around €1.3bn(2)

- Confirmation of the EPS accretion(3) of around 40% in 2024

- Leverage ratio around 3x

- Dividend growth in line with current EPS growth

(1)

At constant forex and without extension of

the conflict beyond the Ukrainian territory and without significant

change in the energy supply conditions in Europe

(2)

Before Suez PPA

(3)

Current net income per share after hybrid

costs and before PPA

ESG, at the heart of the multi-faceted performance of

Veolia

New Multifaceted performance progress Report 2023:

https://www.veolia.com/sites/g/files/dvc4206/files/document/2023/08/veolia-esg-multifaceted-performance-progress-report-2023.pdf

About Veolia

Veolia Group aims to become the benchmark company for ecological

transformation. Present on five continents with nearly 220,000

employees, the Group designs and deploys useful, practical

solutions for the management of water, waste and energy that are

contributing to a radical turnaround of the current situation.

Through its three complementary activities, Veolia helps to develop

access to resources, to preserve available resources and to renew

them. In 2022, the Veolia group provided 111 million inhabitants

with drinking water and 97 million with sanitation, produced 44

terawatt hours of energy and recovered 61 million tonnes of waste.

Veolia Environnement (Paris Euronext: VIE) achieved consolidated

revenue of 42 885 million euros in 2022. www.veolia.com

Important disclaimer

As the changes in the health crisis are difficult to estimate,

we draw your attention to the “forward-looking statements” that may

appear in this press release and relating to the consequences of

this crisis which may affect the future performance of the

Company.

Veolia Environnement is a corporation listed on the Euronext

Paris. This press release contains “forward-looking statements''

within the meaning of the provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including but not limited to: the risk of suffering

reduced profits or losses as a result of intense competition, the

risk that changes in energy prices and taxes may reduce Veolia

Environnement’s profits, the risk that governmental authorities

could terminate or modify some of Veolia Environnement’s contracts,

the risk that acquisitions may not provide the benefits that Veolia

Environnement hopes to achieve, the risks related to customary

provisions of divestiture transactions, the risk that Veolia

Environnement’s compliance with environmental laws may become more

costly in the future, the risk that currency exchange rate

fluctuations may negatively affect Veolia Environnement’s financial

results and the price of its shares, the risk that Veolia

Environnement may incur environmental liability in connection with

its past, present and future operations, as well as the other risks

described in the documents Veolia Environnement has filed with the

Autorité des Marchés Financiers (French securities regulator).

Veolia Environnement does not undertake, nor does it have, any

obligation to provide updates or to revise any forward-looking

statements. Investors and security holders may obtain from Veolia

Environnement a free copy of documents it filed (www.veolia.com)

with the Autorités des marchés financiers.

This document contains "non‐GAAP financial measures". These

"non‐GAAP financial measures" might be defined differently from

similar financial measures made public by other groups and should

not replace GAAP financial measures prepared pursuant to IFRS

standards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230802366571/en/

Media Relations Laurent Obadia Evgeniya Mazalova Tél : +

33 (0)1 85 57 86 25

Investor Relations Ronald Wasylec - Ariane de Lamaze Tél.

: + 33 (0)1 85 57 84 76 / 84 80

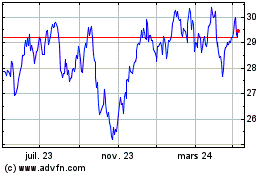

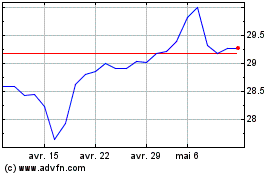

Veolia Environnement (EU:VIE)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Veolia Environnement (EU:VIE)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024