NZ Dollar Rises After Risk Appetite

20 Janvier 2025 - 4:19AM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Monday amid risk appetite among

traders, following the broadly positive cues from Wall Street on

Friday, on renewed optimism about the outlook for interest rates.

Traders are also cautious and reluctant to make more significant

moves ahead of the inauguration of U.S. President-elect Donald

Trump amid speculations on the potential impact of his

policies.

Adding to the interest rate optimism, U.S. Fed Governor

Christopher Waller told CNBC the central bank could lower interest

rates multiple times this year if inflation eases as he is

expecting. Waller added that the number of rate cuts would be

driven by the data, suggesting the Fed could cut rates three or

four times if there is a lot of progress on inflation or cut rates

twice or only once if inflation remains sticky.

Gains across most sectors led by iron ore miners and technology

stocks, also led to the upturn of commodity linked NZD.

In economic news, the People's Bank of China maintained its

interest rates for the third straight session, as policymakers

await the stance of new US administration.

The PBoC left its one-year loan prime rate at 3.10 percent.

Similarly, the five-year LPR, the benchmark for mortgage rates, was

held at 3.60 percent. The decision matched expectations.

In the Asian trading today, the NZ dollar rose to 4-day highs of

1.8355 against the euro and 87.65 against the yen, from last week's

closing quotes of 1.8387 and 87.22, respectively. If the kiwi

extends its uptrend, it is likely to find resistance around 1.80

against the euro and 89.00 against the yen.

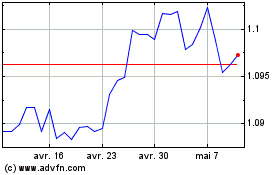

Against the U.S. and the Australian dollars, the kiwi edged up

to 0.5615 and 1.1071 from Friday's closing quotes of 0.5580 and

1.1081, respectively. On the upside, 0.58 against the greenback and

1.09 against the aussie are seen as the next resistance levels for

the kiwi.

Looking ahead, Eurostat publishes euro area construction output

data for November at 5:00 am ET in the European session.

In the New York session, Bank of Canada Business Outlook Survey

result is slated for release.

AUD vs NZD (FX:AUDNZD)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

AUD vs NZD (FX:AUDNZD)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025