Australia Cuts Key Interest Rate For First Time Since 2020

18 Février 2025 - 3:26AM

RTTF2

The Reserve Bank of Australia lowered its benchmark rate for the

first time since 2020 as upside risks to inflation eased but

policymakers remained cautious about further easing.

The policy board of the RBA governed by Michele Bullock decided

to reduce the cash rate target by 25 basis points to 4.10 percent.

The decision came in line with expectations.

This was the first reduction since November 2020 and follows 13

rate hikes since May 2022.

Today, the interest rate paid on Exchange Settlement balances

was also cut to 4 percent.

The board assessed that the monetary policy has been restrictive

and will remain so after the reduction in the cash rate, the bank

said.

"Some of the upside risks to inflation appear to have eased and

there are signs that disinflation might be occurring a little more

quickly than earlier expected," the bank added.

However, policymakers observed that if the policy is eased too

much too soon, then disinflation could stall and inflation would

settle above the midpoint of the target range.

"In removing a little of the policy restrictiveness in its

decision today, the Board acknowledges that progress has been made

but is cautious about the outlook," RBA said.

The bank forecast underlying inflation to return to the 2-3

percent range a little sooner than earlier estimated. The bank

noted that inflation is moving sustainably towards the mid-point of

the target range.

The board cautioned that geopolitical and policy uncertainties

are pronounced and may themselves bear down on activity in many

countries.

Capital Economics' economist Abhijit Surya said the ongoing

easing cycle will prove short-lived. The economist expects only two

more cuts in the current easing cycle.

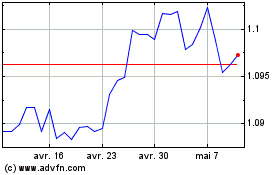

AUD vs NZD (FX:AUDNZD)

Graphique Historique de la Devise

De Jan 2025 à Fév 2025

AUD vs NZD (FX:AUDNZD)

Graphique Historique de la Devise

De Fév 2024 à Fév 2025