Euro In Positive Territory After Lagarde's Remarks

19 Janvier 2023 - 11:44AM

RTTF2

The euro was higher against its major counterparts in the

European session on Thursday, as European Central Bank President

Christine Lagarde affirmed that the central bank will keep raising

interest rates to rein in inflation.

Speaking at a panel at the World Economic Forum in Davos,

Switzerland, Lagarde reiterated that the ECB is determined to bring

down inflation to 2 percent target and would move ahead with more

interest rate hikes.

"We shall stay the course until such time when we have moved

into restrictive territory for long enough so that we can return

inflation to 2% in a timely manner," Lagarde said.

Data from the European Central Bank showed that euro area

current account balance turned to a surplus for the first time in

nine months in November, underpinned by the improvement in foreign

trade.

The current account surplus for November was EUR 14 billion,

versus a EUR 1.0 billion shortfall in October.

The euro rose to 1.0838 against the greenback around 5:30 am ET,

but it has since eased to 1.0796. At yesterday's trading close, the

pair was quoted at 1.0794.

The euro advanced to 139.43 against the yen, off an early fresh

2-week low of 137.91. Against the franc, it edged up to 0.9932. The

euro is seen finding resistance around 141.00 against the yen and

1.05 against the franc.

The euro climbed to 0.8787 against the pound, from an early

multi-week low of 0.8733. Next key resistance for the currency is

seen around the 0.89 level.

The euro touched 1.4640 against the loonie, its highest level in

more than a year. The currency is likely to find resistance around

the 1.48 level.

Extending its previous session's rally, the euro appreciated to

a 3-day high of 1.6984 against the kiwi and near a 3-week high of

1.5750 against the aussie. The currency is poised to find

resistance around 1.73 against the kiwi and 1.61 against the

aussie.

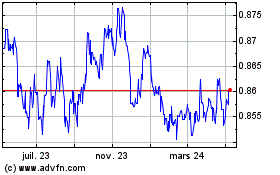

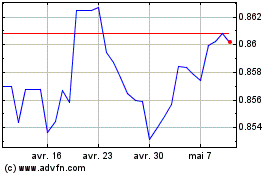

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024