Pound Climbs Against Majors

01 Décembre 2023 - 9:53AM

RTTF2

The pound firmed against its major counterparts in the European

session on Friday, as Bank of England policy maker Megan Greene

pushed back against market bets on interest rate cuts in 2024.

In her first speech as an MPC member on Thursday, Greene said

the central bank will keep restrictive monetary policy stance for

an extended period to achieve the inflation target.

The data on output remains mixed but inflation persistence is a

concern, Greene added.

Final data from S&P Global and the Chartered Institute of

Procurement & Supply showed that U.K. manufacturing PMI

advanced to 47.2 from 44.8 in October. The flash reading was

46.6.

Data from the mortgage lender Nationwide Building Society showed

that UK house prices declined at the slowest pace in nine months in

November as expectations of interest rate cuts in future eased

affordability pressures.

House prices registered an annual decline of 2.0 percent after

easing 3.3 percent in October. Prices marked the slowest fall since

February 2023. They were forecast to drop 2.3 percent. The pound

advanced to 1.2675 against the greenback, 187.51 against the yen

and 1.1081 against the franc, off its early lows of 1.2609, 186.67

and 1.1032, respectively. The pound may find resistance around 1.31

against the greenback, 190.00 against the yen and 1.13 against the

franc.

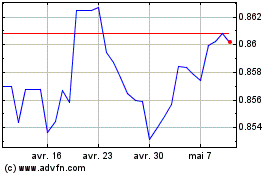

The pound moved up to 0.8599 against the euro, its highest level

since September 18. The pound is seen finding resistance around the

0.84 level.

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Juin 2024 à Juil 2024

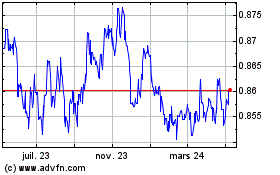

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Juil 2023 à Juil 2024