Pound Falls As BoE Governor Bailey Signals Four Rate Cuts Next Year

04 Décembre 2024 - 8:20AM

RTTF2

The British pound weakened against most major currencies in the

European session on Wednesday, after the Bank of England (BoE)

Governor Baily predicted four interest rate cuts in 2025.

While speaking at an interview at the Global Boardroom Digital

Conference hosted by the Financial Times (FT), the BoE Governor

Andrew Bailey said that the policymakers expect four UK rate cuts

next year as inflation eases.

"We always condition what we publish in terms of the projection

on market rates, and so as you rightly say, that was effectively

the view the market had," Bailey said.

When asked how U.S. President-elect Donald Trump's tariffs will

affect inflation in the United Kingdom (UK), Bailey responded that

these effects "are not straightforward to predict".

In the European trading now, the pound fell to a 2-day low of

1.2630 against the U.S. dollar, from an early 2-day high of 1.2702.

If the pound extends its downtrend, it is likely to find support

around the 1.25 region.

Against the euro and the Swiss franc, the pound edged down to

0.8302 and 1.1206 from an early 2-day highs of 0.8277 and 1.1257,

respectively. The pound may test support near 0.84 against the euro

and 1.11 against the franc.

Meanwhile, the pound advanced to a 5-day high of 191.43 against

the yen, from a slight fall of 190.07. The pound is likely to find

resistance around the 194.00 region.

Looking ahead, U.S. MBA weekly mortgage approvals data, U.S. and

Canada services PMI data for November, U.S. EIA weekly crude oil

data and U.S. Fed Beige report are slated for release in the New

York session.

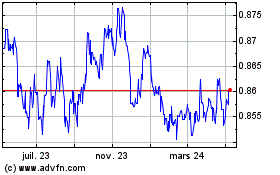

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Nov 2024 à Déc 2024

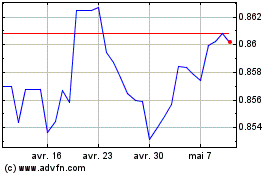

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Déc 2023 à Déc 2024