BoE Chief Bailey Says Markets Underestimating Persistence Of Inflation

21 Novembre 2023 - 9:51AM

RTTF2

Bank of England Governor Andrew Bailey said that financial

markets are putting too much weight on the current data releases

and underestimates the persistence of inflation. At the Treasury

Select Committee hearing on Tuesday, Bailey said the decline in

inflation was good news.

Inflation will end the year a bit lower than the central bank

estimated, the BoE Governor told lawmakers.

However, Bailey said the central bank is concerned about the

potential persistence of inflation in the course of its journey

down to the 2 percent target.

Regarding suggestions on raising the inflation target to 3

percent, Bailey said it is a very bad argument. He asserted that

the target should remain at 2 percent.

At the November policy meeting, the Monetary Policy Committee

decided to maintain the bank rate at 5.25 percent in a split vote.

Policymakers Jonathan Haskel, Catherine Mann and Megan Greene had

called for a quarter point rate hike.

At the hearing, MPC external member Catherine Mann said tighter

monetary policy will be needed both to reduce inflation itself as

well as to align inflation expectations with the remit.

"While I acknowledge that the monetary policy stance has started

becoming restrictive, it is so only recently and not by so much,"

Mann added.

MPC member Dave Ramsden said, "Given my assessment of the

outlook and the risks I would not rule out having to raise bank

rate further in the future but I will continue to make my decisions

on a meeting to meeting basis."

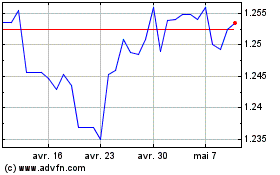

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Juin 2024 à Juil 2024

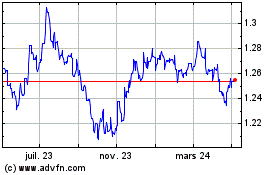

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Juil 2023 à Juil 2024