Pound Slides On Disappointing U.K. GDP Data

15 Novembre 2024 - 6:51AM

RTTF2

The British pound weakened against other major currencies in the

European session on Friday, after data showed a sharp slowdown in

the third quarter growth.

Data from the Office for National Statistics showed that the

U.K. economy grew only marginally in the third quarter on weak

services output.

Gross domestic product grew 0.1 percent sequentially, following

growth of 0.5 percent in the second quarter and was also weaker

than the forecast of 0.2 percent.

On a yearly basis, economic growth improved to 1.0 percent in

the third quarter from 0.7 percent in the preceding period.

In September, GDP edged down 0.1 percent, in contrast to the 0.2

percent expansion in August, data showed. The economy was expected

to grow again by 0.2 percent.

Earlier this month, the Bank of England had reduced its

benchmark rate by a quarter-point and signaled a gradual easing as

the Autumn Budget is forecast to boost inflation.

Month-on-month, industrial production slid unexpectedly by 0.5

percent in September but slower than the 0.7 percent drop in

August. Output was expected to rise 0.1 percent. Manufacturing

contracted 1.0 percent, partially offsetting the 1.3 percent rise

in August. Economists had forecast nil growth.

In a separate communiqué, the ONS today said the deficit on

goods trade widened in September due to a sharp 12.6 percent

decline in exports. At the same time, imports were down 6.3

percent.

The visible trade deficit rose to GBP 16.3 billion from GBP 15.2

billion in the previous month.

The total trade balance, covering both goods and services,

registered a deficit of GBP 3.47 billion compared to a GBP 2.02

billion shortfall a month ago.

European stocks declined as Federal Reserve Chair Jerome Powell

signaled a cautious approach on rate cuts and mixed Chinese data

stoked concerns about slowing demand in the country.

Powell said the U.S. central bank does not need to rush to lower

interest rates and can approach decisions carefully, given

persistent inflationary pressures.

Data showed earlier today that China's industrial output

expanded at a slower-than-anticipated 5.3 percent in October, while

retail sales jumped an annual 4.8 percent to surpass expectations

boosted by a week-long holiday and the annual Singles' Day shopping

festival.

Property investment fell 10.3 percent year-on-year in

January-October and fixed asset investment growth in the first ten

months of 2024 came in below expectations, keeping alive calls for

Beijing to unveil more stimulus.

In the European trading today, the pound fell to a 9-day low of

0.8350 against the euro and a 2-day low of 1.1229 against the Swiss

franc, from early high of 0.8312 and 1.1281, respectively. If the

pound extends its downtrend, it is likely to find support around

0.84 against the euro and 1.11 against the franc.

Against the yen, the pound slid to a 2-week low of 196.47 from

an early 4-day high of 198.45. On the downside, 193.00 is seen as

the next support level for the pound.

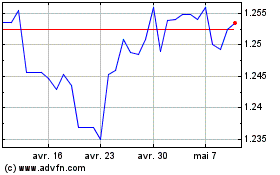

The pound edged down to 1.2649 against the U.S. dollar, from an

early high of 1.2691. The next possible downside target for the

pound is seen around the 1.22 region.

Looking ahead, Canada manufacturing sales, new motor vehicle

sales and wholesale sales data, all for September, U.S. retail

sales data for October, import and export prices for October, U.S.

NY Empire State manufacturing index for November, U.S. industrial

and manufacturing production for October, business inventories for

September and U.S. Baker Hughes oil rig count data are slated for

release in the New York session.

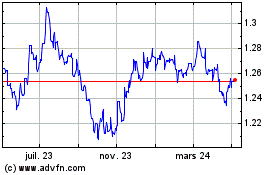

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Oct 2024 à Nov 2024

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Nov 2023 à Nov 2024