U.S. Dollar Falls As Business Activity Slows

23 Avril 2024 - 2:56PM

RTTF2

The U.S. dollar weakened against its major counterparts in the

New York session on Tuesday, after the release of

weaker-than-expected flash PMI data for the month of April.

Survey from S&P Global showed that the flash composite

output index dropped to 50.9 in April from 52.1 in March.

The services PMI declined to 50.9 from 51.7 in the previous

month. The reading was seen at 52.

The manufacturing PMI decreased to 49.9 in April from 51.9 in

March. Economists had forecast the index to climb to 52.

Investors also await the release of first-quarter U.S. GDP data

as well as the core personal-consumption expenditures (PCE) price

index, which is the Fed's preferred measure of inflation, this week

for clues about the timing and pace of interest-rate cuts this

year.

The greenback touched 0.5948 against the kiwi and 0.6490 against

the aussie, setting 8-day lows. The currency may locate support

around 0.62 against the kiwi and 0.67 against the aussie.

The greenback dropped to near a 2-week low of 1.0711 against the

euro and a 4-day low of 1.2458 against the pound, off its early

highs of 1.0638 and 1.2331, respectively. The greenback is seen

finding support around 1.10 against the euro and 1.27 against the

pound.

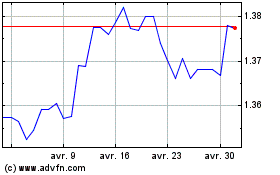

The greenback touched 1.3656 against the loonie, its lowest

level since April 10. If the currency falls further, it is likely

to test support around the 1.33 region.

The greenback declined to a 4-day low of 0.9086 against the

franc, from an early 4-day high of 0.9130. The greenback is likely

to find support around the 0.89 level.

The greenback eased to 154.56 against the yen, from an early

multi-year high of 154.87. On the downside, 144.00 is likely seen

as its next support level.

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2024 à Mai 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mai 2023 à Mai 2024