U.S. Dollar Extends Gains As Solid PMI Data Reduces Prospects Of Aggressive Rate Cut

03 Octobre 2024 - 3:08PM

RTTF2

The U.S. dollar extended gains against its major counterparts in

the New York session on Thursday, as the nation's service sector

activity climbed more than expected in September, reducing the

likelihood of a 50 basis point rate cut by the Federal Reserve at

the meeting in November.

Data from the Institute for Supply Management showed that the

services PMI shot up to 54.9 in September from 51.5 in August, with

a reading above 50 indicating growth. Economists had expected the

index to inch up to 51.7.

With the much bigger than expected increase, the services PMI

reached its highest level since hitting 55.0 in February 2023.

Traders are now pricing in a 63.7 percent chance of a 25 basis

point rate cut in November.

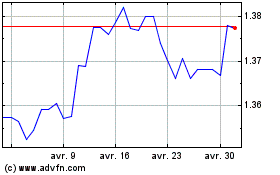

The greenback strengthened to 3-week highs of 1.1009 against the

euro, 1.3089 against the pound and 0.8543 against the franc, off

its early lows of 1.1048, 1.3269 and 0.8491, respectively.

The greenback climbed to a 1-week high of 0.6829 against the

aussie, near 2-week high of 0.6211 against the kiwi and a 10-day

high of 1.3553 against the loonie, from its early lows of 0.6888,

0.6268 and 1.3496, respectively.

The greenback appreciated to a 1-1/2-month high of 147.24

against the yen.

The currency is seen finding resistance around 1.08 against the

euro, 1.28 against the pound, 0.90 against the franc, 0.64 against

the aussie, 0.60 against the kiwi, 1.38 against the loonie and

149.00 against the yen.

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Nov 2024 à Déc 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Déc 2023 à Déc 2024