Dollar Rising After Deluge Of Economic Reports

21 Décembre 2018 - 3:57PM

RTTF2

After recovering from a weak start, the dollar is gaining ground

against all of its major rivals Friday afternoon. Traders were

confronted with a large number of U.S. economic reports this

morning. In addition, traders are keeping an eye on developments on

Capitol Hill amid the threat of a looming government shutdown.

Reflecting downward revisions to consumer spending and exports,

the Commerce Department released a report on Friday showing

slightly slower than previously estimated U.S. economic growth in

the third quarter.

The report said real gross domestic product surged up by 3.4

percent in the third quarter compared to the previously estimated

3.5 percent jump. The pace of GDP growth had been expected to be

unrevised.

After reporting a steep drop in new orders for U.S. manufactured

durable goods in the previous month, the Commerce Department

released a report on Friday showing a rebound in durable goods

orders in the month of November.

The Commerce Department said durable goods orders climbed by 0.8

percent in November after plunging by 4.3 percent in October.

Economists had expected durable goods orders to jump by 1.6

percent.

Personal income in the U.S. increased by slightly less than

expected in the month of November, according to a report released

by the Commerce Department on Friday, although the report also

showed slightly stronger than expected personal spending

growth.

The Commerce Department said personal spending edged up by 0.2

percent in November after climbing by 0.5 percent in October.

Economists had expected personal income to rise by 0.3 percent.

Meanwhile, the report said personal spending climbed by 0.4

percent in November after jumping by an upwardly revised 0.8

percent in October.

Personal spending had been expected to rise by 0.3 percent

compared to the 0.6 percent increase originally reported for the

previous month.

Revised data released by the University of Michigan on Friday

unexpectedly showed an improvement in U.S. consumer sentiment in

the month of December. The report said the consumer sentiment index

for December was upwardly revised to 98.3 from a preliminary

reading of 97.5. Economists had expected the index to be

unrevised.

The dollar has climbed to around $1.1375 against the Euro Friday

afternoon, from an early low of $1.1474.

Germany's consumer confidence is set to remain steady at the

start of next year as households as the divide between expectations

on overall economic situation and personal finances widened

further.

The forward-looking consumer confidence indicator is set to show

a reading of 10.4 in January, unchanged from December, the market

research group GfK said Friday. Economists had forecast a score of

10.3 for January.

Germany's import price growth slowed to its lowest level in six

months in November, after an acceleration in the previous month,

data from the Federal Statistical Office showed on Friday.

The import price index rose 3.1 percent annually in November

following a 4.8 percent increase in October. The latest gain was

fastest since May, when import prices rose 2.9 percent from a year

ago

Export prices increased 1.7 percent year-on year in November,

but fell 0.1 percent from the previous month.

The buck slid to an early low of $1.2697 against the pound

sterling Friday, but has since bounced back to around $1.2635.

British business investment fell for three consecutive quarters,

marking its weakest period since the 2008-09 global financial

crisis, as businesses reduced spending due to the Brexit chaos.

Business investment decreased 1.1 percent sequentially in the

third quarter, falling for a third consecutive quarter.

Investment declined for such a long duration for the first time

since the economic downturn of 2008-2009, the Office for National

Statistics said.

The greenback fell to a low of Y110.932 against the Japanese Yen

Friday, but has since rebounded to around Y111.300.

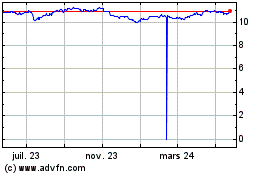

US Dollar vs SEK (FX:USDSEK)

Graphique Historique de la Devise

De Fév 2025 à Mar 2025

US Dollar vs SEK (FX:USDSEK)

Graphique Historique de la Devise

De Mar 2024 à Mar 2025