TIDMADA

RNS Number : 2700E

Adams PLC

03 July 2019

3 July 2019

Adams Plc

("Adams" or the "Company")

ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEARED 31 MARCH

2019

Adams Plc presents its annual report and audited financial

results for the year ended 31 March 2019.

Highlights:

- Net assets at 31 March 2019 of GBP2.37 million (2018: GBP2.11 million).

- Net assets per share 2.87 pence at 31 March 2019 (2018: 2.55 pence).

- Profit after tax of GBP0.26 million (2018: profit of GBP0.18 million).

- Investments at 31 March 2019 valued at GBP2.08 million (2018: GBP2.08 million).

- Spend on new investments of GBP0.21 million (2018: GBP1.59 million).

- Investment realisation proceeds of GBP0.53 million (2018: GBP0.73 million).

- Secured GBP3.00 million loan facility of which no part drawn down to date.

Michael Bretherton, Chairman, said:

"The Board continues to seek attractive investment opportunities

coupled with a focus on financial discipline as the strategy to

best navigate challenging markets and the uncertain global climate.

We remain committed to delivering additional value for our

shareholders going forward."

The Company's 2019 Annual Report will shortly be posted to

shareholders together with a Notice of Annual General Meeting,

copies of which will be made available on the Company's website at

www.adamsplc.co.uk under the Investor Relations / Company &

Shareholder Documents section. The Annual General Meeting is to be

held at 11.00 a.m. on Friday 9 August 2019 at IOMA House, Hope

Street, Douglas, Isle of Man, IM1 1AP.

Enquiries:

Adams Plc Michael Bretherton Tel: +44 1534 719 761

Nomad Cairn Financial Advisers LLP. Sandy Jamieson, James

Caithie Tel: +44 207 213 0880

Broker Peterhouse Capital Limited. Heena Karani Tel: +44 207 469

3393

Chairman's Statement

Adams Plc ("Adams" or the "Company") reported a profit after tax

of GBP257,000 for the year ended 31 March 2019 compared to a profit

of GBP180,000 in the prior year. The increase in profitability is

principally due to higher reported gains on the valuation of

investments.

During the year, the Company spent GBP0.21 million on the

purchase of additional investments and realised proceeds of GBP0.53

million from investment disposals. The carrying value of

investments at 31 March 2019 was GBP2.08 million, represented by 3

listed and 1 un-listed investment holding, which was in line with

the prior year end carrying value of GBP2.08 million as represented

by 3 listed and 3 un-listed investment holdings at 31 March

2018.

Net assets increased to GBP2.37 million (equivalent to 2.87

pence per share) at the 31 March 2019 balance sheet date, compared

with GBP2.11 million (equivalent to 2.55 pence per share) at the

previous year end. The increase in net assets fully reflects the

profit reported for the year.

Cash and cash equivalent balances were GBP315,000 at 31 March

2019 compared to cash balances of GBP52,000 at 31 March 2018.

Business model and investing policy

Adams is an investing company with an investing policy under

which the Board is seeking to acquire interests in special

situation investment opportunities that have an element of

distress, dislocation, dysfunction or other special situation

attributes and that the Board perceives to be undervalued. The

principal focus is in the small to middle-market capitalisation

sectors in the UK or Europe, but the directors will also consider

possible special situation opportunities anywhere in the world if

they believe there is an opportunity to generate added value for

shareholders.

Loan Facility

On 29 January 2019, Adams announced that, in support of its

investment strategy, the Company had entered into an agreement with

Adams's largest shareholder, Richard Griffiths, and his controlled

company, Blake Holdings Limited, for the provision of an unsecured

loan facility of up to GBP3 million in total. The Company believes

there is potential to yield increased investment returns if Adams

has access to such further cash resources to finance additional

special situation investment opportunities.

This loan facility may be drawn down by the Company in minimum

tranches of GBP500,000 and has no fixed term but is repayable in

full or in part six months after any repayment notice issued by

either the lender or the Company. Interest accrues daily based on a

rate of 7 per cent. per annum and is paid six monthly in arrears.

No arrangement, commitment or exit fees have or will be

charged.

No part of this loan facility has been drawn down to date.

Investment Portfolio

The listed investments held by the Company at 31 March 2019

comprised Petrofac Limited ("Petrofac"), Eland Oil & Gas Plc

("Eland"), and Midatech Pharma Plc ("Midatech"). In addition, the

Company holds shares and loan notes in unquoted Sherwood Holdings

Limited which has Source Bioscience Limited ("Source Bioscience")

as its principal subsidiary company asset.

Petrofac is listed on the Main Market of the London Stock

Exchange and is a multinational service provider to the oil and gas

production and processing industry. The company, which has 31

offices and approximately 13,500 staff worldwide, designs, builds,

operates and maintains oil and gas facilities with a focus on

delivering first class project execution, cost control and

effective risk management. For the year ended 31 December 2018,

Petrofac reported a profit of US $350 million after tax before

exceptional items, on revenue of US $5.83 billion. During that

period, the company incurred exceptional costs of US $289 million

on mainly the write down of an installation vessel following the

decision to exit the deep-water market, together with a further

write down of its interests in Mexico and the Greater Stella Area

development, both of which are in the process of disposal, and

which resulted in a reported overall profit after tax for the year

of US $61 million.

Eland is an AIM listed independent oil and gas company focused

on production and development in principally the Niger Delta in

West Africa where, through its joint venture company Elcrest

Exploration and Production Nigeria Ltd, it has acquired a number of

oil field licenses. Since acquiring its Opuama oil field, Eland has

successfully redeveloped this asset with first production oil

commencing in February 2014 from the recommissioning of two

existing wells. The company subsequently brought two further wells

onstream, resulting in an all-time production high in 2018. Eland's

increasing production has led to growing revenues of US $169.2

million for the year to 31 December 2018 and a resultant US $148.0

million post-tax profit in that period.

Midatech is an AIM listed company focussed on improved

bio-delivery and bio-distribution of medicines or agents to areas

of the body where they are most needed and can exert their actions

in an effective, safe and precise manner in order to extend the

lives of patients with rare and serious cancers.

Source Bioscience is a private company that is an international

provider of state-of-the art laboratory services and products and

has an expertise in clinical diagnostics, genomics, proteomics,

drug discovery & development research and analytical testing

services.

Post year end investment transactions. Subsequent to the

Company's 31 March 2019 year end, Adams realised its investment in

Midatech in full, generating investment disposal proceeds amounting

to GBP580,000. Adams also made a new investment of GBP233,000 in a

UK-based AIM listed specialty pharmaceutical company dedicated to

developing high-quality hormone therapeutics to aid lifelong

treatment for rare and chronic endocrine conditions, as well as a

new investment of GBP195,000 in an AIM listed mining company with

principal interests in China. Together with other cash flows, Adams

currently has cash balances of approximately GBP479,000, in

addition to an unused loan facility of GBP3.0 million, available

for further investment as and when the directors identify

appropriate attractive opportunities to exploit.

Outlook

Expansion of the world economy is continuing to lose momentum

and growth forecasts have been revised downwards in almost all G20

economies, with particularly large revisions in the euro area for

both 2019 and 2020. Ongoing trade tensions between the US and

China, Brexit uncertainties and a further erosion of business and

consumer confidence are all contributing to the slowdown.

Consequently, your Board will continue to maintain a rigorous and

highly selective investment approach, coupled with a focus on

financial discipline, as the best strategy to navigate these

challenging markets and the uncertain global climate.

We remain confident in the underlying fundamentals, technologies

and long-term potential for growth at the companies within our

investment portfolio and are committed to delivering additional

value for shareholders going forward.

Michael Bretherton

Chairman

2 July 2019

Statement of Comprehensive Income Year ended Year ended

31 March 2019 31 March 2018

GBP'000 GBP'000

---------------------------------------------------- ---- --------------- ----------------

Dividend income 87 45

Gain on investments 317 280

---------------------------------------------------------- --------------- ----------------

Investment return 404 325

Expenses and other income

Administrative expenses

Other income (172) (155)

14 -

--------------------------------------------------------- --------------- ----------------

Operating profit 246 170

Interest income 11 10

---------------------------------------------------------- --------------- ----------------

Profit before income tax 257 180

Income tax expense - -

---------------------------------------------------- ---- --------------- ----------------

Profit and total comprehensive profit for the year 257 180

---------------------------------------------------------- --------------- ----------------

Basic and diluted earnings per share 0.31p 0.25p

---------------------------------------------------------- --------------- ----------------

Statement of Financial Position at 31 March 2019

31 March

31 March 2019 2018

GBP'000 GBP'000

--------------------------------------- --------------- -----------

Assets

Non-current assets

Investments 2,075 2,076

----------------------------------------- -------------- -----------

Current assets

Prepayments 2 2

Cash and cash equivalents 315 52

----------------------------------------- -------------- -----------

Current assets 317 54

----------------------------------------- -------------- -----------

Total assets 2,392 2,130

----------------------------------------- -------------- -----------

Liabilities

Current liabilities

Trade and other payables (26) (21)

----------------------------------------- -------------- -----------

Total liabilities (26) (21)

----------------------------------------- -------------- -----------

Net current assets 291 33

----------------------------------------- -------------- -----------

Net assets 2,366 2,109

----------------------------------------- -------------- -----------

Equity

--------------------------------------- -------------- -----------

Called up share capital 826 1,001

Share premium - 1,401

Foreign currency translation reserve - (244)

Retained earnings / (deficit) reserve 1,540 (49)

----------------------------------------- -------------- -----------

Total shareholder equity 2,366 2,109

----------------------------------------- -------------- -----------

Statement of Changes in Equity as at 31 March 2019

Share Foreign currency Retained earnings /

Share Capital Premium translation reserve (deficit) reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2017 636 783 (244) (229) 946

Changes in equity

Issue of shares 365 618 - - 983

Total comprehensive gain - - - 180 180

-------------------------- -------------- --------- -------------------------- ------------------------- --------

At 31 March 2018 1,001 1,401 (244) (49) 2,109

-------------------------- -------------- --------- -------------------------- ------------------------- --------

Changes in equity

Redenomination of share

capital (175) 175 - - -

Elimination of foreign

currency reserve - (244) 244 - -

Reclassification of share

premium - (1,332) - 1,332 -

Total comprehensive gain - - - 257 257

-------------------------- -------------- --------- -------------------------- ------------------------- --------

At 31 March 2019 826 - - 1,540 2,366

-------------------------- -------------- --------- -------------------------- ------------------------- --------

Statement of Cash Flows for the year ended 31 March 2019

Year ended Year ended

31 March 2018

31 March 2019 *Restated

GBP'000 GBP'000

Profit for the year 257 180

Unrealised gain on revaluation of portfolio investments (174) (237)

Realised gain on disposal of portfolio investments (143) (43)

Increase / (decrease) in trade and other payables 5 (5)

-------------------------------------------------------------------- -------------- --------------

Net cash outflow from operating activities (55) (105)

-------------------------------------------------------------------- -------------- --------------

Cash flows from investing activities

Purchase of portfolio investments (211) (1,591)

Proceeds from sales of investments 529 730

-------------------------------------------------------------------- -------------- --------------

Net cash generated / (used) in investing activities 318 (861)

-------------------------------------------------------------------- -------------- --------------

Cash flows from financing activities

Issue of ordinary share capital - 983

Net cash generated from financing activities - 983

-------------------------------------------------------------------- -------------- --------------

Net increase in cash and cash equivalents 263 17

Cash and cash equivalents at beginning of year 52 35

-------------------------------------------------------------------- -------------- --------------

Cash and cash equivalents at end of year 315 52

-------------------------------------------------------------------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR CKBDBABKDFOK

(END) Dow Jones Newswires

July 03, 2019 02:00 ET (06:00 GMT)

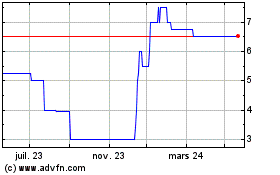

Adams (LSE:ADA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Adams (LSE:ADA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025