TIDMAIE

RNS Number : 9065R

Ashoka India Equity Investment Tst

06 March 2023

ASHOKA INDIA EQUITY INVESTMENT TRUST PLC

HALF-YEARLY FINANCIAL REPORT FOR THE SIX MONTHSED 31 DECEMBER

2022

INVESTMENT OBJECTIVE, FINANCIAL INFORMATION AND PERFORMANCE

SUMMARY

Investment Objective

The investment objective of the Ashoka India Equity Investment

Trust PLC (the "Company") is to achieve long-term capital

appreciation, mainly through investment in securities listed in

India and listed securities of companies with a significant

presence in India.

Financial information

As at As at

31 December 30 June 2022

2022 (unaudited) (audited)

Net asset value ("NAV") per Ordinary

Share (cum income) 191.6p 174.2p

Ordinary Share price 192.0p 175.0p

Ordinary Share price premium to NAV

(1) 0.2% 0.5%

Net assets GBP215.9 million GBP187.4 million

--------------------------------------- ------------------- ------------------

For the For the

six months six months

ended 31 December ended

2022 (unaudited) 31 December

Performance summary 2021 (unaudited)

% change (2,3) % change (2,3)

Share price total return per Ordinary

Share (1) 9.7% 26.2%

NAV total return per Ordinary Share

(1) 10.0% 25.2%

MSCI India IMI Index (sterling terms) 9.9% 15.4%

--------------------------------------- ------------------- ------------------

1 Alternative Performance measures.

2 Total returns in Sterling for the six month period.

3 Source: Bloomberg.

Alternative Performance Measures ("APMs")

The items in the Financial information and the Performance

summary indicated in the footnote above, are considered to

represent APMs of the Company. Definitions of these APMs together

with how these measures have been calculated can be found in the

half-yearly report.

Chairman's Statement

Global difficulties have continued to make life challenging for

economic growth with Russia's illegal invasion of Ukraine creating

daily headlines. This has caused supply chain issues to reverberate

around the world leading to energy insecurity, inflationary

pressures and unnecessary loss of life. It is a tragedy unfolding

before our eyes but, regardless, our lives must go on.

I am pleased to present the Company's half-year financial report

for the period 1 July 2022 to 31 December 2022 and, given this

backdrop, it is all the more remarkable that the Company continued

to make headway and achieve a positive return, just ahead of its

benchmark index, the MSCI India IMI.

Performance

In the period under review, the Company's share price and NAV

have recorded total returns in sterling terms of 9.7% and 10.0%

respectively, compared to 9.9% for the benchmark index. The

Investment Managers and Investment Adviser have used the authority

granted to them by shareholders to broaden the investment portfolio

into an increased number of positions which, given the growing

opportunities presented by entrepreneurial companies in the small

and mid-cap sectors and those newly coming to market, allows them

greater flexibility to identify and invest in India's best

companies. As ever, the Investment Manager's report that follows

goes into more detail.

The Company's shares traded at a premium to NAV (cum income) of

0.2% at the end of the period.

Performance fee

No accrual for a performance fee has been made for the period,

nor since the start of the measurement period on 1 July 2021. The

Company's positive performance during the period does not yet

exceed the starting net asset value per share adjusted by the

percentage total return of the MSCI India IMI Index (in Sterling)

over the performance period. If a performance fee liability

crystallises, it will be duly reflected and accrued in the

Company's daily net asset value announcement.

Share Issuance

The Company again issued new shares during the period under

review reflecting continued confidence from existing shareholders

and growing belief from new investors both in the Indian economy as

a whole and the Investment Team's ability to outperform over the

longer term. This resulted in the issuance of 5.08 million new

shares raising gross proceeds of GBP10.4 million. New Ordinary

Shares are issued at a small premium to the prevailing net asset

value to ensure no dilution to existing shareholders. The Company's

net asset value and market capitalization at the calendar year-end

were GBP215.9 million and GBP216.3 million respectively. As at the

date of this report the Company's total assets stood at GBP220

million.

Revenue and Dividends

The Company's principal objective is to provide returns through

long-term capital appreciation, with income being a secondary

consideration. Therefore, shareholders should not expect that the

Company will pay an annual dividend, under normal circumstances.

Whilst the portfolio does generate a small amount of income, this

is used to defray running costs. However, the Company may declare

an annual dividend to maintain UK investment trust status if there

is a sufficient surplus. In the period under review, no interim

dividend has been declared.

Redemption Facility

The Company has a redemption facility through which shareholders

are entitled to request the redemption of all or part of their

holding of Ordinary Shares on an annual basis. The fourth

Redemption Point for the Ordinary Shares was on 30 September 2022.

I am pleased to report that redemption requests for just 124,374

shares were received and that these redeemed shares were matched

with demand from other shareholders in the stock market by the

Company's corporate broker, Peel Hunt. The Board has absolute

discretion to operate the annual redemption facility on any given

Redemption Point and to accept or decline in whole or in part any

redemption request.

Shareholders are reminded that investment in a Company of this

nature should only be considered if it is understood that the

significant growth potential of the Indian equity market is likely

to be achieved over the medium to longer term, a minimum of five

years.

Outlook

If one truly believed the daily press, investors could be

forgiven for feeling gloomy. High inflation, rising interest rates,

cost of living pressures and low growth forecasts enable editors to

feature depressing headlines. However, the signs are becoming

clearer that interest rates and inflation may be at or near their

peaks in Europe and the US, energy prices are a fraction of their

previous highs and the jobs market remains strong. India, whilst

not having been immune from these global pressures, is particularly

well placed to benefit from an upturn in global activity.

Domestic demand in India remains strong and the economy is being

bolstered by recovering export growth. The shift of manufacturing

from China to India is occurring even faster than anticipated and

it is predicted that this trend will accelerate thus creating

greatly increased job opportunities and prosperity. In addition,

India is adopting a number of green initiatives that will not only

create a large number of jobs and help wean the country off

dependence on imported oil but greatly assist its commendable

ambition of achieving net zero by 2070. India's GDP growth in 2023

is forecast to be the highest in the world and if the economy

continues to grow apace, it will overtake countries such as

Germany, Japan, France and the UK to become the third largest

within 10 years.

As I repeat almost ad nauseum, your Investment Manager and

Investment Adviser remain focused on strong corporate governance

applied before each stock is selected for the portfolio, an

approach strongly supported by the Board and one that, judging by

recent events, continues to pay dividends. The portfolio's

constituents are selected for their superior future growth

prospects and avoidance of misgovernance, wherever possible, is

highly desirable.

Both Acorn and White Oak remain focused on delivering

outstanding returns from a diversified portfolio of investments

from across the market cap spectrum. Your Board has great

confidence in their abilities to outperform and produce superior

returns from one of the world's most dynamic and fastest-growing

markets.

As ever, I thank you for your continued support as a shareholder

of this Company.

Andrew Watkins

Chairman

6 March 2023

Investment Manager's Report

During the latter half of 2022, the Company's total NAV return

outperformed the index by 0.1% delivering 10.0%, compared to 9.9%

for the MSCI India IMI (in sterling terms). Since 31 July 2018 (the

date post IPO when the Company was fully invested), the Company has

delivered 45.8% of net cumulative outperformance, with a 93.0%

absolute return compared to the benchmark return of 47.2%, both in sterling terms.

Key contributors

ICICI Bank is one of the leading private sector banks in India.

Given the under-penetration of credit, the Indian banking sector

offers a long runway for growth. Well-run private sector banks like

ICICI Bank, are gaining market share from state-owned banks, which

account for two- thirds of the loan market. The management team has

been leveraging ICICI's wide distribution franchise, a new

risk-based pricing approach, and digital offerings to accelerate

market share and enhance return ratios. The bank's asset quality

has also remained robust. The stock outperformed as a result of

continued strong business performance.

Titan is the leading jewelry company in India which also has a

presence in other segments such as watches, eyewear, fragrances,

precision engineering, and women's ethnic wear. Titan is a luxury

lifestyle retailer which commands premium brand positioning across

segments. The company's well-tuned operating model allows it to

generate industry-leading return ratios, whilst maintaining robust

growth. Titan's jewelry market share is still in the mid-single

digits, with significant scope for sustained expansion. Recent

outperformance likely reflects continued strength in discretionary

consumption within Titan's core target group - middle and

high-income urban households.

Cholamandalam Investment and Finance (CIFC) is a non-banking

financial company (NBFC) belonging to the Chennai-based Murugappa

Group. It primarily operates in vehicle finance (including

Commercial Vehicles, Passenger Vehicles, Two and Three-Wheelers),

home equity, and the affordable home loans category. In terms of

customer profile, it caters predominantly to single truck and small

fleet owners, self-employed non-professionals and Micro, Small and

Medium Enterprise (MSME) businesses in semi-urban and rural India.

CIFC's strength lies in its ability to reach such customers in

rural and semi-urban markets and its ability to underwrite and

collect from customers whose income streams are less predictable.

While the concerns regarding asset quality due to Covid have been

allayed, the vehicle finance business is likely entering an upcycle

given demand has been weak in the last couple of years. Apart from

briskly scaling up its housing finance business, which from a low

base could grow upwards of 25% in the coming years, the company has

also made progress in three new segments: Consumer & Small

Enterprise Loan; Secured Business & Personal Loan; and Small

Medium Enterprises Loan business. These reasons contributed to the

outperformance of the stock.

Key Detractors

PB Fintech operates Policybazaar.com, India's largest Insurance

Web Aggregator, and Paisabazaar.com, one of India's leading

financial products marketplaces. Policybazaar.com facilitates

online comparison and the purchase of insurance policies and has a

dominant 90% market share in the insurance web aggregator segment.

Over the last five years, revenues and underlying premiums have

grown multi-fold. In addition, Paisabazaar.com is one of the

leading players in the personal loan and credit card business.

Though this business will take time to break even, it has a long

runway for growth and represents a significant future business

value for the company. Recently, the competition faced by both

Policybazaar.com and Paisabazaar.com has increased substantially

and the sentiment towards new-age technology companies has slightly

weakened. These reasons have contributed to the underperformance of

the stock in the second half of 2022.

Intellect Design Arena is a financial services software company

and is regarded as one of the leading solution providers in

transaction banking software, which accounts for 45% of its

revenues. It has also made significant inroads in other product

suites including payments, retail banking, digital banking and

insurance. Intellect has cumulatively invested over US$200 million

in product R&D over the last decade and has built a strong

reputation in developed and emerging markets on the back of a

marquee client list which includes JP Morgan, HSBC and Barclays.

Its profitability has improved significantly over the last few

years from single-digit operating margins to over 20%, due to scale

and operational efficiencies. The stock underperformed due to lower

than expected near-term performance.

Dodla Dairy is a leading dairy company in South India with

strong brands, a well-developed direct procurement network and a

healthy portfolio of value- added products. Premiumization is

likely to be a key driver of the organized dairy sector's growth

and well- run companies in the private sector (such as Dodla Dairy)

will benefit from this long-term tailwind. The company's

underperformance is directly attributed to rising concerns about

raw material supply, following the spread of lumpy skin disease in

cows in parts of India.

Investment Outlook

Indian equity markets delivered a resilient performance in 2022,

despite a challenging global macroeconomic environment. This was

underpinned by strong fundamentals, healthy domestic demand, and

the government's continued push on capital expenditure. Whilst most

major economies expect to experience a slowdown in GDP growth in

2023, India remains one of the fastest-growing major economies in

the world. As per consensus estimates, India is poised to become

the third-largest economy (by nominal GDP) within the next 10

years.

Post COVID-19, the revival of export growth has been a key

contributor to India's economic recovery. India's merchandise

exports touched a record US$420 billion in the financial year

2021-22, after stagnating in the US$300 billion range for the last

decade. Supply chain disruptions have accelerated the relocation of

manufacturing out of China, with India emerging as a credible

alternative. Policy supports in the form of Product Linked

Incentive ("PLI") schemes for key sectors, and measures to improve

the 'ease of doing business' have emerged as critical enablers.

India has a marginal market share in many manufacturing industries,

and even a 1-2% incremental market share gain from China could

result in high-teens growth rates.

From a services perspective, Indian IT companies benefit from

the accelerated digital transformation of global enterprises and

cloud adoption. Enhanced by the business continuity showcased

during COVID-19 lockdowns, global customers have preferred Indian

IT & engineering services providers due to their exceptional

talent pool and depth of competencies across service lines. The

country's services export is expected to reach an all-time high of

US$325 billion during the financial year 2022-23. This favourable

dynamic is helping India boost its foreign exchange reserves,

thereby increasing the cushion against external shocks.

On the domestic front, the government is supporting the economy

through various supply-side measures. Infrastructure Capital

Expenditure ("CapEx") continues its strong momentum with spending

in sectors such as roads and railways the key focus areas for the

government. As a proportion of GDP, capital expenditure edged

closer to the levels witnessed between 2003 and 2006, which

coincided with strong private sector CapEx and corporate earnings

growth. The green shoots of private sector CapEx in asset-heavy

sectors, such as cement and steel, are also visible. This is due to

significantly deleveraged balance sheets and improved operating

performance supported by an uptick in demand for housing and real

estate.

Corporate earnings are predicted to remain resilient in 2023.

MSCI India's consensus earnings growth for 2023 to 2024 is

approximately 15%, compared with approximately 13% for China and

approximately 9% for the APAC (ex-Japan) region - with financials,

CapEx- sensitive, and consumer sectors driving most of the earnings

growth. The underlying multi-decadal trend of market share

consolidation in favour of stronger, well- run businesses

continues. The unbranded segment of the market has found it

challenging to deal with higher input costs and frequent supply

chain disruptions. However, the businesses in the portfolio have

shown immense resilience due to their industry leadership and

strong execution capabilities, supported by robust balance

sheets.

The recently announced Union Budget for the financial year

2023-24 builds on the foundation of sustainable growth laid out in

previous budgets while signalling policy continuity with a focus on

public CapEx, enhancing the ease of doing business and boosting

exports and manufacturing. There is also an added emphasis on

inclusive growth and green energy. The key announcements

included:

-- development of physical infrastructure, with the overall

public sector CapEx projected to increase by 33% year-on-year to

3.3% of GDP;

-- measures for further improving the ease of doing business

with proposals to reduce compliance burdens, faster dispute

resolution, continuous digitalization of public infrastructure and

decriminalizing numerous legal provisions;

-- managing the environment and climate (details covered below); and

-- boosting manufacturing and exports through cuts and

exemptions in customs/excise duties and investing in skills

development.

From a 6.4% fiscal deficit in financial fear 2023, the

government intends to follow the fiscal consolidation roadmap,

prudently reducing the deficit to 5.9% of GDP in financial year

2024 and reaching below 4.5% by financial year 2026. To summarise,

the government has resisted the temptation to be populist, despite

this being a pre-election year budget.

At the 2021 United Nations Climate Change Conference (COP-26),

India pledged to achieve net-zero carbon emissions by 2070. The

government continues its focus on reducing the dependence on fossil

fuels with its recent budget. It has allocated US$4.3 billion for

energy transition expenditure by 2030. This includes the national

green hydrogen mission, enhancing development and the use of

renewables. The National Green Hydrogen Mission alone aims to

develop a green hydrogen production capacity of at least five

million metric tonnes per annum, with an associated renewable

energy capacity addition of about 125 gigawatts in the country.

This would result in total investments of over US$98 billion and

would generate over 600,000 jobs. Based on past achievements, we

believe India could become a global leader in green hydrogen and

significantly reduce its reliance on imported fuel.

From a potential risk perspective, private investments have

remained subdued in the last decade, thereby holding back a

domestic cyclical earnings recovery. An absence of any consistent

improvement in external demand, escalation in geo-political

tensions, or the onset of another COVID-19 wave weighing on

domestic demand could pose risks to near-term growth. However, we

believe the ingredients of an investment cycle revival remain

skewed towards the positive, given the strong position of

corporates and the financial sector and the government's push for

infrastructure.

General elections in India are likely to be held in April or May

2024. Though the current Prime Minister's popularity remains strong

and the risk of regime change appears low, such an event or a weak

coalition central government could be a negative surprise for the

markets, which would like to see policy continuity. Of course, any

sustained weakness in global growth could weigh on market

performance. On the other hand, a sharp reversal in anticipated

global risk factors such as inflation, recession, or geopolitical

tensions could boost investor sentiments.

The Investment Manager believes that the most attractive aspect

of investing in India is the outsized alpha opportunity that the

market presents compared to any other equity market globally given

that the Indian market is still relatively under-researched and

under- brokered. Such alpha opportunities are present across the

large, mid, and small cap spectrum. In particular, the SMID (small

& mid) cap segment of the Indian equity market has a large, and

expanding, number of listed businesses to choose from. Besides the

large number of listings, the SMID-cap segment also tends to have

very heterogeneous business models which makes it fertile hunting

ground for bottom-up stock pickers.

The SMID-cap segment also tends to have lower liquidity compared

to the large cap peers. Hence, from a risk management and liquidity

management perspective, the Investment Manager believes it is

desirable to have smaller position sizes in SMID-cap names. Thus,

having a higher number of names in the portfolio optimises alpha

extraction from a larger universe of SMID-cap names, while being

prudent on risk and liquidity considerations.

We believe India is at the cusp of realising its true economic

potential, while benefitting from several secular tailwinds. The

most important are its favourable demographics and rising income

levels, thereby allowing domestic consumption to flourish - with

demand for discretionary goods, travel & leisure, financial and

healthcare services on the rise. Additionally, the country is

experiencing rapid digitalisation of services, supported by

increasing Internet penetration, and formalisation on the back of

crucial on-going structural reforms. The government is undertaking

steps to manufacture imported goods domestically while developing

the country's infrastructure like never before. We believe that all

these factors place India as one of the most promising economies

for years to come and makes for a highly compelling investment

proposition.

Acorn Asset Management Ltd

6 March 2023

TOP TEN HOLDINGS

Top Ten Holdings

As at 31 December 2022 % of

net assets

-------------------------------------------- ------------

ICICI Bank Ltd 6.8

Infosys Ltd 5.0

Ambuja Cements Ltd 3.4

Cholamandalam Investment and Finance Co Ltd 3.4

Titan Co Ltd 3.3

Kaynes Technology India Limited 2.8

HDFC Bank Ltd 2.7

Maruti Suzuki India Ltd 2.6

Asian Paints Ltd 2.6

Nestle India Ltd 2.5

Top 10 35.1

Other holdings 64.4

Total Holdings 99.5

Cash/Others 0.5

Total Net assets 100

INTERIM MANAGEMENT REPORT

The Directors are required to provide an Interim Management

Report in accordance with the Financial Conduct Authority's ("FCA")

Disclosure Guidance and Transparency Rules ("DTR"). The Directors

consider that the Chairman's Statement and the Investment Manager's

Report in the Half-Yearly Report provide details of the important

events which have occurred during the period and their impact on

the financial statements. The following statement on related party

transactions and the Directors' Responsibility Statement below, the

Chairman's Statement and Investment Manager's Report together

constitute the Interim Management Report of the Company for the six

months ended 31 December 2022. The outlook for the Company for the

remaining six months of the year ending 30 June 2023 is discussed

in the Chairman's Statement and the Investment Manager's

Report.

Principal and emerging risks and uncertainties

The principal and emerging risks and uncertainties to the

Company are detailed on pages 14 to 17 of the Company's most recent

Annual Report and Audited Financial Statements for the year ended

30 June 2022 which can be found on the Company's website at

https://www. ashokaindiaequity.com. The principal and emerging

risks and uncertainties facing the Company remain unchanged from

those disclosed in the Annual Report for the year ended 30 June

2022 and the Board are of the opinion that they will continue to

remain unchanged for the forthcoming six-month period. The

principal and emerging risks and uncertainties facing the Company

are as follows:

(i) market risks (economic conditions and sectorial diversification);

(ii) corporate governance and internal control risks (including cyber security);

(iii) regulatory risks; and

(iv) financial risks.

Related party transactions

Details of the amounts paid to the Company's Investment Adviser

and the Directors during the period are detailed in the notes to

the Half-Yearly report and unaudited condensed financial statements

(the "Financial Statements").

Going concern

The Half-Yearly Report has been prepared on a going concern

basis. The Board considers this the appropriate basis as they have

a reasonable expectation that the Company has adequate resources to

continue in operational existence for at least the following

twelve- month period from the date of this report. In reaching this

conclusion, the Directors have considered the liquidity of the

Company's portfolio of investments as well as its cash position,

income and expense flows. As at 31 December 2022 the Company held

GBP212.1 million (30 June 2022: GBP178.1 million) in quoted

investments and had cash of GBP6.1 million (30 June 2022: GBP7.0

million).

Unaudited

These Financial Statements have not been audited or reviewed by

auditors pursuant to the Financial Reporting Council guidance on

the Review of Interim Financial Information.

DIRECTORS' STATEMENT OF RESPONSIBILITY FOR THE HALF-YEARLY

REPORT

The Directors confirm to the best of their knowledge that:

-- these condensed set of financial statements contained within

the Half-Yearly Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting; and

-- the Interim Management Report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the FCA's DTR.

Signed on behalf of the Board by

Andrew Watkins

Chairman

6 March 2023

FINANCIAL STATEMENTS

Condensed Unaudited Statement of

Comprehensive Income

For the six months ended 31 December 2022

Six months ended Six months ended

31 December 2022 (unaudited) 31 December 2021 (unaudited)

Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----- ---------- ---------- ---------- ---------- ---------- ----------

Gains on investments 3 - 21,460 21,460 - 41,272 41,272

Losses on currency movements - (346) (346) - (28) (28)

Net investment gains - 21,114 21,114 - 41,244 41,244

Income 5 799 - 799 559 - 559

------------------------------ ----- ---------- ---------- ---------- ---------- ---------- ----------

Total income 799 21,114 21,913 559 41,244 41,803

Performance fees 7 - - - - (2,437) (2,437)

Operating expenses 8 (376) - (376) (312) - (312)

------------------------------ ----- ---------- ---------- ---------- ---------- ---------- ----------

Operating profit before

taxation 423 21,114 21,537 247 38,807 39,054

Taxation 9 (88) (3,255) (3,343) (125) (3,880) (4,005)

------------------------------ ----- ---------- ---------- ---------- ---------- ---------- ----------

Profit for the period 335 17,859 18,194 122 34,927 35,049

------------------------------ ----- ---------- ---------- ---------- ---------- ---------- ----------

Earnings per Ordinary Share 10 0.31p 16.31p 16.62p 0.13p 38.55p 38.68p

------------------------------ ----- ---------- ---------- ---------- ---------- ---------- ----------

There is no other comprehensive income and therefore the 'Profit

for the period' is the total comprehensive income for the

period.

The total column of the above statement is the statement of

comprehensive income of the Company. The supplementary revenue and

capital columns, including the earnings per Ordinary Share, are

prepared under guidance from the Association of Investment

Companies ("AIC").

All revenue and capital items in the above statement derive from

continuing operations.

Condensed Unaudited Statement of Financial Position

As at 31 December 2022

31 December 2022 30 June 2022

(unaudited) (audited)

Note GBP'000 GBP'000

---------------------------------------- ----- ----------------- -------------

Non-current assets

Investments held at fair value through

profit or loss 3 214,661 183,361

---------------------------------------- ----- ----------------- -------------

Current assets

Cash and cash equivalents 6,052 7,027

Dividend receivable - 188

Other receivables 156 42

-------------

6,208 7,257

---------------------------------------- ----- ----------------- -------------

Total assets 220,869 190,618

---------------------------------------- ----- ----------------- -------------

Current liabilities

Other payables 6 (165) (203)

Non-Current liabilities

Capital gains tax provision (4,848) (3,029)

-------------

Total liabilities (5,013) (3,232)

---------------------------------------- ----- ----------------- -------------

Net assets 215,856 187,386

---------------------------------------- ----- ----------------- -------------

Equity

Share capital 12 1,126 1,076

Share premium account 100,696 90,470

Special distributable reserve 13 44,276 44,276

Capital reserve 69,543 51,684

Revenue reserve 215 (120)

-------------

Total equity 215,856 187,386

---------------------------------------- ----- ----------------- -------------

Net asset value per Ordinary Share 14 191.6p 174.2p

---------------------------------------- ----- ----------------- -------------

Condensed Unaudited Statement of Changes in Equity

For the six months ended 31 December 2022 (Unaudited)

Share Special

Share premium distributable Capital Revenue

Capital account reserve reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ------ -------- -------- -------------- -------- -------- --------

Opening balance as at 1

July 2022 1,076 90,470 44,276 51,684 (120) 187,386

Profit for the period - - - 17,859 335 18,194

Issue of Ordinary Shares

* 12 50 10,349 - - - 10,399

Share issue cost - (123) - - - (123)

Closing balance as at 31 December

2022 1,126 100,696 44,276 69,543 215 215,856

------------------------------------- -------- -------- -------------- -------- -------- --------

For the six months ended 31 December 2021

(Unaudited)

Share Special

Share premium distributable Capital Revenue

Capital account reserve reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ------ -------- -------- -------------- -------- -------- --------

Opening balance as at 1

July 2021 860 49,099 44,276 42,466 (126) 136,575

Profit for the period - - - 34,927 122 35,049

Issue of Ordinary Shares 12 131 25,581 - - - 25,712

Share issue costs - (329) - - - (329)

Closing balance as at 31 December

2021 991 74,351 44,276 77,393 (4) 197,007

------------------------------------- -------- -------- -------------- -------- -------- --------

* During the period, the Company issued 5,076,184 new Ordinary

Shares with gross aggregate proceeds of GBP10.4 million.

The Company's distributable reserves consist of the special

distributable reserve, capital reserve and revenue reserve.

Condensed Unaudited Statement of Cash Flows

For the six months ended 31 December 2022

For Six Months For Six Months

ended 31 December ended 31 December

2022 2021

(unaudited) (unaudited)

Note GBP'000 GBP'000

---------------------------------------- ----- ------------------- -------------------

Cash flows from operating activities

Operating profit before taxation 21,537 39,054

Taxation paid (1,524) (1,859)

Decrease in receivables 75 579

(Decrease)/increase in payables (38) 2,436

Gains on investments 3 (21,460) (41,272)

Net cash flow used in operating

activities (1,410) (1,062)

---------------------------------------- ----- ------------------- -------------------

Cash flows from investing activities

Purchase of investments (52,018) (59,908)

Sale of investments 42,177 51,852

Net cash flow used in investing

activities (9,841) (8,056)

---------------------------------------- ----- ------------------- -------------------

Cash flows from financing activities

Proceeds from issue of shares 12 10,399 17,719

Share issue costs (123) (329)

Net cash flow generated from financing

activities 10,276 17,390

---------------------------------------- ----- ------------------- -------------------

(Decrease)/Increase in cash and

cash equivalents (975) 8,272

---------------------------------------- ----- ------------------- -------------------

Cash and cash equivalents at start

of period 7,027 7,447

---------------------------------------- ----- ------------------- -------------------

Cash and cash equivalents at end

of period 6,052 15,719

---------------------------------------- ----- ------------------- -------------------

NOTES TO THE FINANCIAL STATEMENTS

1. Reporting entity

Ashoka India Equity Investment Trust plc is a closed-ended

investment company, registered in England and Wales on 11 May 2018.

The Company's registered office is 6th Floor 125 London Wall,

London, England, EC2Y 5AS. Business operations commenced on 6 July

2018 when the Company's Ordinary Shares were admitted to trading on

the London Stock Exchange ("LSE"). The financial statements of the

Company are presented for the period from 1 July 2022 to 31

December 2022.

The Company primarily invests in securities listed on any stock

exchange in India and can invest in the securities of companies

with a significant presence in India that are listed on stock

exchanges outside India.

2. Basis of preparation and statement of compliance

These Condensed Unaudited Financial Statements have been

prepared in accordance with International Accounting Standard

("IAS") 34 as required by DTR 4.2.4R, the Listing Rules of the LSE

and applicable legal and regulatory requirements. They do not

include all the information and disclosures required in Annual

Financial Statements and should be read in conjunction with the

Company's last Annual Audited Financial Statements for the year

ended 30 June 2022.

The accounting policies applied in these Financial Statements

are consistent with those applied in the last Annual Audited

Financial Statements for the year ended 30 June 2022, which were

prepared in accordance with UK-adopted international accounting

standards. Having reassessed the principal risks, the Directors

considered it appropriate to adopt the going concern basis of

accounting in preparing these Financial Statements.

Going concern

The Directors have adopted the going concern basis in preparing

the financial statements.

Details of the Directors' assessment of the going concern status

of the Company, which considered the adequacy of the Company's

resources, are given in the half-yearly report . The Directors have

a reasonable expectation that the Company has adequate operational

resources to continue in operational existence for at least twelve

months from the date of approval of these financial statements.

Significant judgements and estimates

There have been no changes to the significant accounting

judgements, estimates and assumptions from those applied in the

Company's Audited Annual Financial Statements for the year ended 30

June 2022.

The Indian capital gains tax provision represents an estimate of

the amount of tax payable by the Company. Tax amounts payable may

differ from this provision depending when the Company disposes of

investments. The current provision on Indian capital gains tax is

calculated based on the long-term or short-term nature of the

investments and the applicable tax rate at the period end. The

short-term tax rates are 15% and the long-term tax rates are 10%.

The estimated tax charge is subject to regular review including a

consideration of the likely period of ownership, tax rates and

market valuation movements.

As disclosed in the statement of financial position, the Company

made a capital gains tax provision of GBP4,848,000 (30 June 2022:

GBP3,029,000) in respect of unrealised gains on investments

held.

Adoption of new IFRS standards

A number of new standards, amendments to standards and

interpretations are effective for the annual periods beginning

after 1 January 2022. None of these are expected to have a material

impact on the measurement of the amounts recognised in the

financial statements of the Company.

3. Investment held at fair value through profit or loss

(a) Investments held at fair value through profit or loss

As at As at

31 December 30 June

2022 2022

(unaudited) (audited)

------------------------------- ------------- -----------

GBP'000 GBP'000

Quoted investments in India 212,067 177,998

Unquoted investments in India 2,594 5,363

------------------------------- ------------- -----------

Closing valuation 214,661 183,361

------------------------------- ------------- -----------

(b) Movements in valuation

For the For the

six months ended year ended

31 December

2022 30 June

(unaudited) 2022

(audited)

GBP'000 GBP'000

----------------------------- ---- ------------------- -------------

Opening valuation 183,361 147,399

Opening unrealised gains on

investments 29,059 46,121

----------------------------------- ------------------- -------------

Opening book cost 154,302 101,278

Additions, at cost 51,928 121,568

Disposals, at cost (31,727) (68,544)

----------------------------------- ------------------- -------------

Closing book cost 174,503 154,302

Revaluation of investments 40,158 29,059

----------------------------------- ------------------- -------------

Closing valuation 214,661 183,361

----------------------------------- ------------------- -------------

Transaction costs on investment purchases for the six months

ended 31 December 2022 amounted to GBP89,000 (31 December 2021:

GBP43,000) and on investment sales for the six months to 31

December 2022 amounted to GBP86,000 (31 December 2021:

GBP81,000).

(c) Gains on investments

For the

For the year ended

six months ended 30 June

31 December

2022 2022

(unaudited) (audited)

GBP'000 GBP'000

------------------------------------------- ---- ------------------ -------------

Realised gains on disposal of investments 10,536 25,241

Transaction costs (175) (331)

Movement in unrealised gains/(losses)

on investments held 11,099 (17,062)

------------------------------------------------- ------------------ -------------

Total gains on investments 21,460 7,848

------------------------------------------------- ------------------ -------------

Under IFRS 13 'Fair Value Measurement', an entity is required to

classify investments using a fair value hierarchy that reflects the

significance of the inputs used in making the measurement

decision.

The following shows the analysis of financial assets recognised

at fair value based on:

- Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities that the entity can access at the

measurement date;

- Level 2: inputs other than quoted prices included within level

1 that are observable for the asset or liability, either directly

or indirectly; and

- Level 3: inputs other than quoted prices included within level

1 that are observable for the asset or liability, either directly

or indirectly.

The classification of the Company's investments held at fair

value is detailed in the table below:

As at 31 December 2022 (unaudited)

Level Level

1 Level 2 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- ---------- --------- --------

Investments at fair value through

profit and loss:

Quoted investments in India 212,067 - - 212,067

Unquoted investments in India - - 2,594 2,594

----------------------------------- --------- ---------- --------- --------

212,067 - 2,594 214,661

----------------------------------- --------- ---------- --------- --------

As at 30 June 2022 (audited)

Level Level

1 Level 2 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- -------- --------- -------- --------

Investments at fair value through

profit and loss:

Quoted investments in India 177,998 - - 177,998

Unquoted investments in India - - 5,363 5,363

----------------------------------- -------- --------- -------- --------

177,998 - 5,363 183,361

----------------------------------- -------- --------- -------- --------

The movement on the Level 3 unquoted investments during the

period is shown below:

As at As at

31 December 30 June

2022 2022

(unaudited) (audited)

GBP'000 GBP'000

---------------------------------- --------------- -------------

Opening balance 5,363 6,323

Additions during the period/year 210 5,416

Disposals during the period/year (2,861) (6,323)

Valuation adjustments (118) (53)

Closing balance 2,594 5,363

---------------------------------- --------------- -------------

4. Financial risk management

At 31 December 2022, the Company's financial risk management

objectives and policies are consistent with those disclosed in the

Company's last Annual Report and Audited Financial Statements for

the year ended 30 June 2022.

5. Income

For the For the

six months ended six months ended

31 December 31 December

2022 2021

(unaudited) (unaudited)

GBP'000 GBP'000

------------------------- ------------------ ------------------

Income from investments

Overseas dividends 799 559

Total income 799 559

------------------------- ------------------ ------------------

6. Other payables

As at As at

31 December 30 June

2022 2022

(unaudited) (audited)

GBP'000 GBP'000

---------------------- ------------- -----------

Accrued expenses 165 203

Total other payables 165 203

---------------------- ------------- -----------

7. Performance fees

The Investment Manager does not receive a fixed management fee

in respect of its portfolio management services to the Company. The

Investment Manager will become entitled to a performance fee

subject to the Company delivering excess returns versus the MSCI

India IMI Index in the medium term. The performance fee is measured

over periods of three years (Performance Period). The first

Performance Period ended on 30 June 2021 (approximately three years

from the Company's IPO). The Investment Manager's second

Performance Period commenced on 1 July 2021 and will end in June

2024. The performance fee in any Performance Period shall be capped

at 12% of the time weighted average adjusted net assets during the

relevant Performance Period.

The performance fee is calculated at a rate of 30% of the excess

returns between adjusted NAV per share on the last day of the

performance period and the MSCI India IMI Index (sterling) over the

performance period, adjusted for the weighted average number of

Ordinary Shares in issue during the performance period. The

Performance Fee in respect of each Performance Period will be paid

at the end of the three year period.

As at 31 December 2022, there was no performance fee payable to

the Investment Manager (30 June 2022: Nil).

8. Operating expenses

For the For the

six months ended six months ended

31 December 2022 31 December 2021

(unaudited) (unaudited)

GBP'000 GBP'000

----------------------------------- ------------------ ------------------

Administration & secretarial fees 73 73

Auditor's remuneration *

- Statutory audit fee 24 20

Broker fees 17 16

Custody services 14 11

Directors' fees 64 64

Board trip to India costs 5 3

Tax compliance and advice 14 15

Printing and public relations 83 25

Registrar fees 15 9

Legal Fees 15 20

UKLA and other regulatory fees 6 5

Other expenses 46 51

-----------------------------------

Total 376 312

----------------------------------- ------------------ ------------------

* Auditor's remuneration excludes VAT.

9. Taxation

a) Analysis of charge in the period

For the six months ended For the six months ended

31 December 2022 (unaudited) 31 December 2021 (unaudited)

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- ---------- ---------- ---------- ----------

Capital gains tax provision - - - - 1,475 1,475

Capital gains expense - 3,255 3,255 - 2,405 2,405

Indian withholding tax 88 - 88 125 - 125

Total tax charge for the

six months 88 3,255 3,343 125 3,880 4,005

----------------------------- ---------- ---------- ---------- ---------- ---------- ----------

The Company is liable to Indian capital gains tax under Section

115 AD of the Indian Income Tax Act 1961. A tax provision on Indian

capital gains is calculated based on the long term (securities held

more than one year) or short term (securities held less than one

year) nature of the investments and the applicable tax rate at the

period end. The short-term tax rates are 15% and the long-term tax

rates are 10%.

The Company's dividends are received net of 20% withholding tax.

Of this 20% withholding tax charge, 10% is irrecoverable with the

remainder being shown in the Statement of Financial Position as an

asset due for reclaim.

b) Factors affecting the tax charge for the period

The effective UK corporation tax rate for the period is 19%. The

tax charge differs from the charge resulting from applying the

standard rate of UK corporation tax for an investment trust

company. The differences are explained below:

For the For the

six months ended six months ended

31 December 31 December 2021

2022 (unaudited) (unaudited)

GBP'000 GBP'000

------------------------------------------ ------------------- ------------------

Operating profit before taxation 21,537 39,054

UK Corporation tax at 19% (2022: 19.00%) 4,092 7,420

Effects of:

Indian capital gains tax provision

not taxable 3,255 3,880

Gains on investments not taxable (4,012) (7,836)

Overseas dividends not taxable (152) (106)

Unutilised management expenses 72 522

Indian withholding tax 88 125

Total tax charge for the six months 3,343 4,005

------------------------------------------ ------------------- ------------------

10. Earnings per Ordinary Share

For the six months For the six months

ended ended

31 December 2022 (unaudited) 31 December 2021 (unaudited)

Revenue Capital Total Revenue Capital Total

--------------------------------- ------------ ----------- -------- ------------ ----------- --------

Profit for the period (GBP'000) 335 17,859 18,194 122 34,927 35,049

------------

Return per Ordinary Share 0.31p 16.31p 16.62p 0.13p 38.55p 38.68p

--------------------------------- ------------ ----------- -------- ------------ ----------- --------

Earnings per Ordinary Share is based on the profit for the

period of GBP18,194,000 (31 December 2021: GBP35,049,000)

attributable to the weighted average number of Ordinary Shares in

issue during the six months ended 31 December 2022 of 109,501,337

(31 December 2021: 90,592,560).

11. Dividend

The Company's objective is to provide shareholder returns

through capital growth with income being a secondary consideration.

Therefore, it is unlikely that the Company will pay a dividend

under normal circumstances.

12. Share capital

As at 31 December As at 30 June

2022 2022

(unaudited) (audited)

No. No.

of shares GBP'000 of shares GBP'000

--------------------------------------- ------------ -------- ------------ --------

Allotted, issued and fully paid:

Redeemable Ordinary Shares of 1p each

('Ordinary Shares') 112,643,856 1,126 107,567,672 1,076

Total 112,643,856 1,126 107,567,672 1,076

--------------------------------------- ------------ -------- ------------ --------

Ordinary Shares

The Ordinary Shares have attached to them full voting, dividend

and capital distribution rights and confer rights of

redemption.

Between 1 July 2022 and 31 December 2022, 5,076,184 Ordinary

Shares (30 June 2022: 22,590,042 Ordinary Shares issued) have been

issued; raising aggregate gross proceeds of GBP10,339,000 (30 June

2022: GBP42,102,000).

Since 31 December 2022, there have been no shares issued. As at

the date of this Annual Report, the total number of Ordinary Shares

in issue is 112,643,856.

The Ordinary Shares have attached to them full voting, dividend

and capital distribution rights. They confer rights of redemption.

The Company's special distributable reserve may also be used for

share repurchases, both into treasury or for cancellation.

Management shares

In addition to the above, on incorporation the Company issued

50,000 Management Shares of nominal value of GBP1.00 each.

The holder of the Management Shares undertook to pay or procure

payment of one quarter of the nominal value of each Management

share on or before the fifth anniversary of the date of issue of

the Management Shares. The Management Shares are held by an

associate of the Investment Manager.

The Management Shares do not carry a right to attend or vote at

general meetings of the Company unless no other shares are in issue

at that time. The Management Shares have been treated as equity in

accordance with IFRS.

13. Special distributable reserve

As indicated in the Company's prospectus dated 19 June 2018,

following admission of the Company's Ordinary Shares to trading on

the LSE, the Directors applied to the Court and obtained a

judgement on 4 December 2018 to cancel the amount standing to the

credit of the share premium account of the Company. The amount of

the share premium account cancelled and credited to a special

distributable reserve was GBP44,275,898. This reserve may also be

used to fund dividend payments.

14. Net asset value ("NAV") per Ordinary Share

Net assets per ordinary share as at 31 December 2022 is based on

GBP215,856,000 (30 June 2022: GBP187,386,000) of net assets of the

Company attributable to the 112,643,856 (30 June 2022: 107,567,672)

Ordinary Shares in issue as at 31 December 2022.

15. Related party transactions

There were no fees payable to the Investment Manager.

White Oak Capital Partners provides investment advisory services

to the Investment Manager and no fees are paid to them from the

Company.

The annual remuneration of the Board is GBP40,000 to the

Chairman, GBP32,500 to the Chair of the Audit Committee, and

GBP27,500 to the other Directors. The Directors have the option to

receive their fees in cash or in shares in the Company.

The Directors had the following shareholdings in the Company,

all of which are beneficially owned.

As at As at

31 December 30 June

2022 2022

(unaudited) (audited)

------------------ -------------- ------------

Andrew Watkins 94,425 94,425

Jamie Skinner 86,806 84,733

Rita Dhut 81,733 81,733

Dr. Jerome Booth 68,957 66,202

------------------ -------------- ------------

16. Subsequent events

There have been no significant events since the period end which

would require revision of the figures or disclosure in the

Financial Statements.

OTHER INFORMATION

Alternative Performance Measures

Ordinary share price to NAV premium

The amount, expressed as a percentage, by which the share price

is more than the Net Asset Value per share.

As at As at

31 December 30 June

2022 2022

(unaudited) (audited)

NAV per Ordinary Share (pence) a 191.6 174.2

Share price (pence) b 192.0 175.0

=============================== ============= ============= ===========

Premium (b÷a)-1 0.2% 0.5%

=============================== ============= ============= ===========

Share price/NAV total return

A measure of performance that includes both income and capital

returns.

For the six months ended 31 December Share price NAV

2022

(unaudited)

Opening at 1 July 2022 (p) a 175.0 174.2

Closing at 31 December 2022 (p) b 192.0 191.6

===================================== ============= =========== =====

Total return (b÷a)-1 9.7% 10.0%

===================================== ============= =========== =====

For the six months ended 31 December Share price NAV

2021

(unaudited)

Opening at 1 July 2021 (p) a 162.5 158.9

Closing at 31 December 2021 (p) b 205.0 198.9

===================================== ============= =========== =====

Total return (b÷a)-1 26.2% 25.2%

===================================== ============= =========== =====

n/a = not applicable.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QXLFBXXLZBBK

(END) Dow Jones Newswires

March 06, 2023 02:00 ET (07:00 GMT)

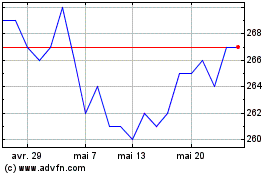

Ashoka India Equity Inve... (LSE:AIE)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Ashoka India Equity Inve... (LSE:AIE)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024