TIDMAQSG

RNS Number : 6620U

Aquila Services Group PLC

27 November 2023

For immediate release

27 November 2023

Aquila Services Group plc

Unaudited Interim Results for the six months ended 30 September

2023

Aquila Services Group plc ("the Company"), is the holding

company for Altair Consultancy and Advisory Services Ltd

("Altair"), Aquila Treasury and Finance Solutions Ltd ("ATFS") and

Oaks Consultancy Ltd ("Oaks") which form the Group ("the

Group").

The Group works in the UK and internationally. Its expertise is

in the provision, financing and management of affordable housing by

housing associations, local authorities, government agencies and

other non-profit organisations, high level business advice to the

property sector and support for organisations including

multi-academy education trusts and sports foundations working in

communities to improve health and well-being opportunities.

Results Highlights

6 Months 6 months to Year ended

to 30 Sept 2022 31 March

30 Sept 2023 (unaudited) 2023 (audited)

(unaudited)

GBP'000 GBP'000 GBP'000

Revenue 5,923 5,874 12,249

Gross profit 1,039 1,078 2,605

Underlying Operating profit* 99 308 806

Profit after tax 68 244 518

Earnings per share 0.17p 0.61p 1.29p

Cash balances 1,649 1,718 2,405

Total dividend payable 0.25p 0.25p 0.75p

* Underlying operating profit is calculated by adjusting the

reported pre-tax profit for share-based payment charges and

impairment of goodwill.

Dividend

The directors propose an interim dividend of 0.25p (2022:

0.25p). This will be paid on 20 December 2023 to shareholders on

the register at 8 December 2023.

A copy of the interim results will be available from the

Company's website:

https://aquilaservicesgroup.co.uk/investor-information

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 as it forms

part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018 ("UK MAR").

For further information please visit

www.aquilaservicesgroup.co.uk or contact:

Aquila Services Group plc

Claire Banks

Claire.banks@aquilaservicesgrp.co.uk

Group Finance Director and Company Secretary

Tel: 020 7934 0175

Beaumont Cornish Limited, Financial Adviser

Roland Cornish / Asia Szusciak

corpfin@b-cornish.co.uk

Tel: 020 7628 3396

Chair's statement

Dear Shareholder,

I am pleased to present the half-yearly report and the interim

results for the six months to 30 September 2023.

Aquila Services Group plc ("the Company") is the holding company

for Altair Consultancy & Advisory Services Ltd ("Altair"),

Aquila Treasury and Financial Solutions Ltd ("ATFS") and Oaks

Consultancy Ltd ("Oaks") which form the Group ("the Group").

The group is an independent consultancy specializing in the

provision, financing, and management of affordable housing by

housing associations, local authorities, government agencies and

other non-profit organisations. The Group also provides high level

business advice to the commercial property sector and support for

organisations including multi-academy education trusts, charities

and sports foundations, working in communities to improve health

and well-being opportunities.

The prospect for the half year was for the business to continue

the growth achieved in the second half of the financial year ended

31 March 2023. Demand for the majority of our services in many of

the sectors in which we operate has continued at a high level

although the wait for government to set effective procedures for

education to access capital allocations continues.

However, a number of factors have impacted on the profitability

and to a lesser extent turnover in the first six months.

As mentioned at the year end, 'wage inflation and skills

shortages are still a significant upward pressure on our cost

base'. We have, like the majority of businesses, had to respond to

these pressures and with the cost of living crisis continuing, the

pressure on salaries has increased and these additional costs, as

well as costs of recruitment and training, have reduced

profitability in the first 6 months of this financial year.

Our consultants, particularly those with specific skills, are in

high demand in the sector. This has led to pressures on retention

and additional costs of recruitment and training. There is an

interregnum before the new recruits are able to support the level

of expertise required by our clients. We are beginning to see these

pressures ease as the general recruitment market as well as the

cost of living become less challenging. It is our expectation that

it will be the next financial year before we can return to a

position where there is stability between demand for our services

and the resources that we have available.

The pressures on the property market and in particular the

cross-subsidy provided to new affordable housing has impacted on

our clients. To compensate, our development team have changed

emphasis with consultants assisting with investment in existing

housing stock with both turnover and profitability being affected

during this transition.

The planned restructuring and investment in Oaks has taken

longer than expected partially due to the difficulties experienced

in the recruitment market. The restructuring is now largely

completed but represented a significant additional cost in the

first six months.

Looking forward we are now better positioned and resourced to

meet the demands of a challenging market. New opportunities for the

Group's services are emerging, particularly with our international

work, and proposals for more diverse growth in both social and

affordable housing. We do not expect that profitability in the

second half will compensate for the shortfall in the first half but

we confidently expect an improving position.

We are still conscious of the impact of the costs of having a

full market quote on the London Stock Exchange and are continuing

to examine ways the impact can be reduced with benefit to

shareholders.

Turnover for the 6 months was GBP5,923k (GBP5,874k 6 months to

September 2022; GBP12,249k 12 months to March 2023) and profit

before tax, share option charges and impairment of goodwill of

GBP99k (GBP308k September 2022, GBP806k March 2023).

The Group continues to have a strong balance sheet with no debt.

As at 30 September 2023 net current assets were GBP2,856k (30

September 2022 GBP2,715k and 31 March 2023 GBP3,036k).

We are confident of achieving a significant profit for the full

year and will therefore maintain the interim dividend at the

previous level. The final dividend will be reviewed once we know

the outcome for the full year. The interim dividend for the 6

months ended 30 September 2023 to be paid on 20 December 2023 to

those shareholders on the register at 8 December 2023 will be

0.25p, (30 September 2022: 0.25p, 31 March 2023 0.5p).

We remain committed to the services that the Group offers to

organisations and agencies working to provide the essential

services that enhance the life opportunities of their communities.

In an increasingly troubled world, finding the resources to

maintain these objectives is the challenge, both to government and

the many different sectors that make up our civil society. Our role

in helping clients construct funding and delivery mechanisms to

achieve these objectives is important. As always it is only from

the commitment and expertise of all our staff that we can achieve

these objectives. On behalf of the board we thank them for their

efforts.

I look forward to reporting progress at the year end.

Derek Joseph - Chair

24 November 2023

The Management of the Group are pleased to present their report

for the period ended 30 September 2023.

Aquila at a Glance

The Group continues to implement its business strategy to

encompass all the professional consultancy services that the

Group's client base demands. The Group now provides advice and

support across the affordable housing, regeneration, sport, charity

and education sectors. Its purpose is to assist organisations that

benefit local communities such as housing associations, local

authorities, government agencies, multi-academy trusts, charities,

other non-profit organisations and those set up for community

benefit, as well as providing related high-level business advice to

the commercial property sector.

Business performance and position

Altair Consultancy and Advisory Services Ltd ("Altair")

Altair is a specialist management consultancy company that works

with organisations that govern, manage, regulate or build housing.

Operating within the UK and Europe, its international client base

is increasing with continuing and new contracts in Africa and

investment in expansion into Asia.

The services that Altair offers cover housing development and

regeneration, property asset management, health and safety

compliance and building safety advice, strategic financial advice,

governance and risk management, executive and non-executive

recruitment. Our digital, transformation and people services and

our technical asset team are areas of continued significant

investment and growth.

Clients contract with Altair on a fixed-fee basis, through

retained contracts in our finance, governance and transformation

business streams, and placements for members of the property team,

and increasingly for our transformation team, at client sites.

Both the consulting and property businesses have seen income

remain in-line with expectations this half year. Profitability has

been affected by the cost-of-living crisis, recruitment and

retention and the investment in our new service lines, Commercial

and Procurement and Sustainability.

The impact of the macro-economic environment was most keenly

felt within our property business, clients have begun to reduce

their investment in new housing development and increase investment

in their current housing stock. To mitigate this, where possible,

colleagues are being redeployed into the technical and asset

management teams which have an increasing workload.

The business is seeing opportunity on the work clients are

undertaking in preparation for the implementation of the various

new Bills that have gained Royal Assent in the last six months,

specifically the new consumer regulations due to come into force in

April 2024.

Management report

Aquila Treasury and Financial Solutions Ltd ("ATFS")

ATFS is a specialist treasury management consultancy authorised

and regulated by the Financial Conduct Authority that operates

across the UK and Europe. It provides advice on treasury policy and

strategy, debt and capital market finance, banking and card

merchant services, value for money, and financial market

information services to local authorities, charities, housing

associations, education bodies, private sector housing providers

and government bodies.

Work is delivered through fixed price contracts as retained

general treasury advisers and information subscription agreements.

Specific advisory project contracts are on a fixed fee basis, won

through competitive procurement tenders, payable on agreed project

milestones.

The changes in personnel within ATFS last year has meant that

the business has stabilised and, although the issues within

education procurement continues, the treasury advice into the

housing and international markets has seen an increase in the half

year. This is expected to improve in the next half.

Oaks Consultancy Limited ("Oaks")

Oaks is a specialist sports, charity, statutory and education

consultancy operating within the UK and Europe with an increasing

international presence. Oaks' clients include national and

international sports teams and governing bodies, national and

international charities, statutory organisations and local

authorities, multi academy trusts and teaching school alliances,

housing associations and corporate businesses.

Oaks provides consultancy advice and guidance on strategy and

business planning, organisational and cultural change programmes,

impact measurement, together with implementation support in

relation to income generation and diversification. Contracts are

delivered through a mix of fixed-fee projects and retained

contracts for general advisory services.

The agreed investment in Oaks was slower than anticipated and

this has affected the results this half year. With two of the three

planned sector leads now in-place the expectations are that the

results in the second half will recover, although not to budgeted

levels.

Investments

The Group continues to hold a 5.3% equity stake in AssetCore, a

company building a financial debt management platform for the

affordable housing sector.

Group-wide initiatives

ESG Group

The purpose of the ESG Group is to focus on the Environment,

Social and Governance (ESG) agenda and to drive the agenda across

the Group and its subsidiaries. This includes driving Aquila's

approach to being a climate conscious organisation. During the year

the Group retained its Carbon Neutral Plus status and to ensure all

employees are treated fairly. The Group commit to training all

employees on the importance of having an inclusive workforce.

Further information about, and activities within the groups, is

available on the website.

Outlook

The outlook for the second half is positive. The housing and

international markets continue to provide opportunities for the

Group and the investment in the Sports, Chairty and Education

sector should see an increase in contracts in the next period.

Retention and recruitment continue to be one of the major risks

and there is a sharp focus on this by the leadership teams of each

business within the Group. In addition, the Group remains focused

on improving margins whilst retaining turnover growth.

Going concern basis

The Board updates its three-year business plan annually. This

includes a review of the Company's cash flows and other key

financial ratios over the period. These metrics are subject to

sensitivity analysis which involves flexing a number of the main

assumptions underlying the forecast, both individually and in

unison. Where appropriate, this analysis is carried out to evaluate

the potential impact of the Company's principal risks. The

three-year review also makes certain assumptions about the normal

level of capital investment likely to occur and considers whether

additional financing facilities will be required.

The Group does not have any bank debt and remains in a strong

cash position with balances at the end of September 2023 at

GBP1.65m and net current assets at GBP2.86m.

The Directors continue to review the forecasts on a monthly

basis applying stress tests to the reforecasts to ensure viability

of the outputs. The Group continue to monitor cash balances,

debtors and cash generation on a daily basis. Based on the results

of these analyses, the Directors have a reasonable expectation that

the Company will be able to continue in operation and meet its

liabilities as they fall due in the next twelve months and over the

three-year period of their assessment.

Risks and uncertainties

The key risks and uncertainties relating to the Group's

operations remain largely consistent with those disclosed in the

Group's Annual Report and Accounts for the year ended 31 March

2023. These are listed below:

-- Financial risk

-- Unfavourable economic conditions and/or changes to government policy

-- Competition

-- Staff skills, retention, recruitment and succession

-- Data governance

The Group seeks to mitigate all these risks through ensuring

that it monitors changes in statutory, regulatory and financial

requirements and maintains good relationships with its clients,

principal contacts within government, regulators and other key

influencers within the sector. The Group is well placed to provide

the full range of services needed by its clients as the external

environment changes.

A detailed explanation of the risks relevant to the Group is on

Page 20 of the Annual Report and Accounts for the year ended 31

March 2023 and is available on the Company's website at

www.aquilaservicesgroup.co.uk .

Fiona Underwood - Executive Director

24 November 2023

Responsibility Statement

The Directors, whose names and functions are set out at the end

of this report, are responsible for preparing the Unaudited Interim

Condensed Consolidated Financial Statements in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority ("DTR") and with International

Accounting Standard 34 on Interim Financial reporting ("IAS 34").

The Directors confirm that, to the best of their knowledge,

(a) this Unaudited Interim Condensed Consolidated Report, which

has been prepared in accordance with UK-adopted International

Accounting Standard 34 gives a true and fair view of the assets,

liabilities, financial position and profit or loss of the Group;

and

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7 and DTR 4.2.8 namely:

-- an indication of key events occurred during the period and

their impact on the Unaudited Interim Condensed Consolidated

Financial Statements and a description of the principal risks and

uncertainties for the second half of the financial year; and

-- material related party transactions that have taken place

during the period and that have materially affected the financial

position or the performance of the business during that period.

Remuneration of Directors and key management personnel

The remuneration of the key management personnel of the Group,

including all directors of subsidiary companies, is set out below

in aggregate for each of the categories specified in IAS 24 Related

Party Disclosures.

6 months to 6 months to Year ended

30 September 30 September 31 March

2023 (unaudited) 2022 (unaudited) 2023

(audited)

GBP'000 GBP'000 GBP'000

Wages and salaries 395 499 1,036

Share-based payments 2 5 5

Post-retirement benefits 17 24 48

------------------ ------------------ ------------

415 528 1,089

================== ================== ============

Claire Banks - Group Finance Director

24 November 2023

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2023

Six months to 30 September 2023 Six months to 30 September 2022 Year ended

31 March

2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 5,923 5,874 12,249

Cost of sales (4,883) (4,796) (9,644)

-------------------------------- -------------------------------- -----------

Gross profit 1,040 1,078 2,605

Administrative expenses (966) (776) (1,828)

-------------------------------- -------------------------------- -----------

Operating profit 74 302 777

Finance income 19 - 17

Impairment of Goodwill - - (120)

-------------------------------- -------------------------------- -----------

Profit before taxation 93 302 674

Income tax expense (25) (58) (156)

-------------------------------- -------------------------------- -----------

Profit for the period 68 244 518

================================ ================================ ===========

Earnings per share attributable to

owners of the parent

Weighted average number of shares: '000 '000 '000

* Basic 39,962 39,962 39,962

* Diluted 41,016 41,016 41,016

Basic earnings per share 0.17p 0.61p 1.29p

Diluted earnings per share 0.16p 0.60p 1.26p

Condensed Consolidated Statement of Financial Position

As at 30 September 2023

30 September 2023 30 September 2022 31 March

2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 3,197 3,317 3,197

Right of use assets 397 229 185

Property, plant and equipment 63 50 49

Investments 71 71 71

------------------ ------------------ ----------

3,728 3,667 3,502

Current assets

Trade and other receivables 3,221 2,574 3,130

Cash and bank balances 1,649 1,718 2,405

------------------ ------------------ ----------

4,870 4,292 5,535

Current liabilities

Trade and other payables 1,703 1,266 2,260

Lease liabilities 105 89 69

Corporation tax 206 222 170

2,014 1,577 2,499

Net current assets 2,856 2,715 3,036

------------------ ------------------ ----------

Non-current lease liabilities 298 150 126

Net assets 6,286 6,232 6,412

================== ================== ==========

Equity

Share capital 1,998 1,998 1,998

Share premium account 1,712 1,712 1,712

Merger reserve 3,042 3,042 3,042

Share-based payment reserve 370 358 364

Retained losses (836) (878) (704)

------------------ ------------------ ----------

Equity attributable to the owners of the parent 6,286 6,232 6,412

Condensed Consolidated Statement of Changes in Equity

Share Share based

Share premium Merger payment Retained Total

capital account reserve reserve losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

1 April 2022 1,998 1,712 3,042 415 (1,025) 6,142

Transfer on

reserves - - - (63) 63 -

Total comprehensive

income - - - - 244 244

Share based

payment charge - - - 6 - 6

Dividend - - - - (160) (160)

Balance at

30 September

2022 1,998 1,712 3,042 358 (878) 6,232

-------- -------- -------- ------------ --------- --------

Transfer on - - - - - -

reserves

Total comprehensive

income - - - - 274 274

Share based

payment charge - - - 6 - 6

Dividend - - - - (100) (100)

Balance at

31 March 2023 1,998 1,712 3,042 364 (704) 6,412

Transfer on - - - - - -

reserves

Total comprehensive

income - - - - 68 68

Share based

payment charge - - - 6 - 6

Dividend - - - - (200) (200)

Balance at

30 September

2023 1,998 1,712 3,042 370 (836) 6,286

======== ======== ======== ============ ========= ========

Condensed Consolidated Statement of Cash Flows

for the six months ended 30 September 2023

Six months to 30 September Six months to 30 September Year ended

31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Profit for the period 68 244 518

Interest received (19) - (17)

Income tax expense 25 58 156

Share based payment charge 6 6 12

Impairment of goodwill - - 120

Depreciation 63 59 124

--------------------------- --------------------------- -----------

Operating cash flows before movement in

working capital 143 367 913

(Increase)/Decrease in trade and other

receivables (91) 19 (537)

(Decrease)/increase in trade and other

payables (557) (652) 343

--------------------------- --------------------------- -----------

Cash generated by operations (505) (266) 719

Income taxes refunded/(paid) 11 20 (130)

Net cash (outflow)/inflow from operating

activities (494) (246) 589

Cash flows from investing activities

Interest received 19 - 17

Purchase of property, plant and equipment (33) (25) (45)

Net cash (outflow) from investing activities (14) (25) (28)

Cash flows from financing activities

Lease liability payments (48) (44) (89)

Dividends paid (200) (160) (260)

Net cash (outflow) from financing activities (248) (204) (349)

Net (decrease)/increase in cash and cash

equivalents (756) (475) 212

Cash and cash equivalents at beginning of the

period 2,405 2,193 2,193

--------------------------- --------------------------- -----------

Cash and cash equivalents at end of the period 1,649 1,718 2,405

=========================== =========================== ===========

Notes to the Condensed set of Financial Statements

for the six months ended 30 September 2023

1. General information

The Company and its subsidiaries (together "the Group") are a

major provider of consultancy services to organisations that

develop, fund or manage affordable housing. It provides specialist

housing, sport, education and treasury management consultancy

services.

The Company is a public limited company domiciled in the United

Kingdom and incorporated under registered number 08988813 in

England and Wales. The Company's registered office is Tempus Wharf,

29a Bermondsey Wall West, London, SE16 4SA.

2. Basis of preparation

The Unaudited Condensed Consolidated Interim Financial

Statements of the Group have been prepared on the basis of the

accounting policies, presentation, methods of computation and

estimation techniques used in the preparation of the audited

accounts for the period ended 31 March 2023 and expected to be

adopted in the financial information by the Company in preparing

its annual report for the year ending 31 March 2024.

This Interim Consolidated Financial Information for the six

months ended 30 September 2023 has been prepared in accordance with

UK-adopted International Accounting Standard 34. This Interim

Consolidated Financial Information is not the Group's statutory

financial statements and should be read in conjunction with the

annual financial statements for the year ended 31 March 2023, which

were prepared in accordance with UK-adopted International

Accounting Standards and have been delivered to the Registrar of

Companies. The auditors reported on those accounts; their report

was unqualified, did not include references to any matters to which

the auditors drew attention by way of emphasis of matter without

qualifying their report and did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

The Interim Consolidated Financial Information for the six

months ended 30 September 2023 is unaudited. In the opinion of the

Directors, the Interim Consolidated Financial Information presents

fairly the financial position, and results from operations and cash

flows for the period.

The Directors have made an assessment of the Group's ability to

continue as a going concern and are satisfied that the Group has

adequate resources to continue in operational existence for the

foreseeable future. The Group, therefore, continues to adopt the

going concern basis in preparing its consolidated financial

statements.

The financial statements are presented in sterling, which is the

Group's functional currency as the UK is the primary environment in

which it operates.

3. Operating segments

The Group has two reportable segments being: consultancy, and

treasury management services, the results of which are included

within the financial information. In accordance with IFRS8

'Operating Segments', information on segment assets is not shown,

as this is not provided to the chief operating decision-maker.

The principal activities of the Group are as follows:

Consultancy - a range of services to support the business needs

of a diverse range of organisations across the housing (including

housing associations and local authorities), education and sports

sectors. Most consultancy projects run over one to two months and

on-going business development is required to ensure a full pipeline

of consultancy work for the employed team.

Treasury Management - a range of services providing treasury

advice and fund-raising services to non-profit making organisations

working in the affordable housing and education sectors. Within

this segment of the business several client organisations enter

fixed period retainers to ensure immediate call-off of the required

services.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment profit represents the

profit earned by each segment, without allocation of central

administration costs, including Directors' salaries, finance costs

and income tax expense. This is the measure reported to the Group's

executives for the purpose of resource allocation and assessment of

segment performance.

6 months 6 Months

to 30 Sept to 30 Sept

2023 2022

GBP'000 GBP'000

Revenue from Consultancy 5,734 5,647

Revenue from Treasury Management 189 227

------------ ------------

5,923 5,874

============ ============

Within consultancy revenues, approximately 8% (2022: 16%) has

arisen from the segment's largest customer; within treasury

management 19% (2022: 20%).

Geographical information

Revenues from external customers, based on location of the

customer, are shown below:

6 months 6 months

to 30 Sept to 30 Sept

2023 2022

GBP'000 GBP'000

UK 5,530 5,658

Europe 268 193

Rest of World 125 23

------------ ------------

5,923 5,874

============ ============

4. Share capital

The Company has one class of share in issue being ordinary

shares with a par value of 5p. Allotted, issued and called up

ordinary shares of GBP0.05 each:

Number Amount called up and fully paid

GBP'000

'000

As at 1 April 2022 39,961 1,998

As at 30 September 2022 39,961 1,998

As at 31 March 2023 39,961 1,998

As at 30 September 2023 39,961 1,998

======= ================================

5. Share-based payment transactions

The Company operates an Unapproved Scheme and an Enterprise

Management Incentives Scheme. The total cost recognised in the

period to 30 September 2023 arising from share-based payment

transactions is GBP6k (30 September 2022: GBP6k).

Unapproved scheme Number Weighted

'000 average exercise

price

Number of options outstanding at 1 April 171 GBP0.35

2023 and 30 September 2023

=======

The exercise price of the options outstanding at 30 September

2023 is GBP0.35

Number Weighted average

EMI scheme '000 exercise price

Number of options outstanding at 1 April

2023 2,196 GBP0.05

Number of options outstanding at 30

September 2023 2,196 GBP0.14

-------

Number of options exercisable at 30

September 2023 1,305 GBP0.05

=======

6. Going concern

The Group has sufficient financial resources to enable it to

continue its operational activities for the foreseeable future.

Accordingly, the Directors consider it appropriate to adopt the

going concern basis in preparing these interim accounts.

7. Dividend

An interim dividend of 0.25p will be paid on 20 December 2023 to

shareholders on the register at 8 December 2023 at a cost of

GBP99,905.

8. Related party disclosures

Balances and transactions between the Group and other related

parties are disclosed below:

During the 6 months to 30 September 2023, Derek Joseph, Chair,

was paid GBP33k (6 months to September 2022: GBP11.7k) which

includes GBP28k (6 months to September 2022: GBP6.7k) of

consultancy fees in relation the Group's international

business.

Richard Wollenberg, non-executive director, accrued fees of

GBP2k (6 months to September 2022: GBP2k). At 30 September 2023,

the balance owed to Richard Wollenberg for services as a

non-executive director was GBP6k (6 months to September 2022:

GBP6k).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VZLFLXFLFFBL

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

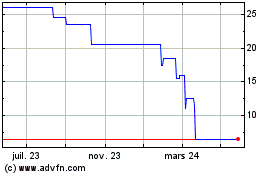

Aquila Services (LSE:AQSG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Aquila Services (LSE:AQSG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025