Alliance Trust PLC Alliance Trust Plc - Fixed Rate Note Borrowing

01 Décembre 2023 - 1:53PM

UK Regulatory

TIDMATST

1 December 2023

ALLIANCE TRUST PLC

Fixed rate note borrowing

Alliance Trust PLC (the "Company") has issued EUR70m fixed rate

privately placed notes (the "Notes") in two tranches of EUR20m and

EUR50m respectively, with maturities of 7 and 10 years and coupons

of 4.02% and 4.18%. The closing and settlement date is today with

interest payable semi-annually.

The purpose of this transaction is to obtain fixed rate,

medium-dated Euro denominated financing at a pricing level that the

Company considers attractive. The transaction is expected to

provide the Company with a long-term benefit through a full market

cycle.

The proceeds of the financing will be used to repay some of the

Company's existing floating rate bank borrowings, such that the

Company's current drawn borrowings will remain broadly unchanged.

As a result of these changes, our weighted average borrowing costs

will reduce from 4.7% pa to 3.8% pa.

For more information, please contact:

Mark Atkinson,

Senior Director -- Client Management, Wealth & Retail

Willis Towers Watson

Tel. +44 (0)7918 724303

(END) Dow Jones Newswires

December 01, 2023 07:53 ET (12:53 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

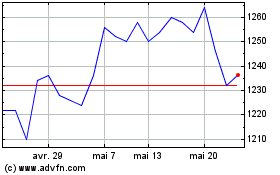

Alliance (LSE:ATST)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Alliance (LSE:ATST)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024