Preliminary Statement of results 2004

Chairman's statement

I am pleased to be able to report that the outlook for the mineral and

exploration industry has greatly improved since the issue of our last annual

report. Metal prices have increased significantly, although unevenly, during the

year. Copper in particular almost doubled within the twelve months ended 31

March 2004, and it is particularly interesting to note that, based on current

metal prices, the projected life of mine revenue from the Parys Mountain mine

would be derived in about equal measure from both zinc and copper, which is

reminiscent of Parys Mountain's long history of copper production in the 18th

and 19th centuries. Obviously, the deterioration of the US dollar relative to

sterling has had a negative effect, but overall the forecast projections for

Parys Mountain based on current metal prices are most encouraging.

Parys Mountain mine

The company's Parys Mountain polymetallic mineral deposit contains an in situ

geological resource of 6.5 million tonnes, containing an estimated - 760 million

pounds of zinc; 330 million pounds of copper; 370 million pounds of lead, 8

million ounces of silver and 60,000 ounces of gold.

The Parys Mountain mine would generate almost equal revenues from zinc and from

copper over the probable and possible resources, with more from zinc and

significant credits for silver in the early years when the probable resources

are mined. The mine would benefit enormously from any increase in the future

prices of any or all of these metals, particularly zinc and copper

During the year the dewatering of the higher levels of the old mine workings at

Parys Mountain was satisfactorily completed by Anglesey Council and others, and

the water quality to the south of the Mountain has improved as a result. The old

workings are separate from the area of our resources, however we believe there

is useful information to be learned from them; additionally they are adjacent to

a significant deposit, the Northern Copper zone, which was explored by major

mining companies, including Noranda in the 1960s and 70s. At that time it was

reported to contain 36,000,000 tonnes at an average grade of 0.66% copper. It

apparently was not assayed for gold.

Financial results

The operating loss before impairment for the year is almost unchanged at

�120,005 compared with �121,299 last year. Of this loss �72,356 represents

interest accruing in respect of the working capital loan from Juno Limited, the

company's major shareholder, and the balance is the costs of evaluating other

projects together with administrative and corporate expenses.

The improvement in metal prices means that there is no requirement to make any

further impairment provision in respect of the accumulated costs of the Parys

Mountain project this year. Indeed based on current metal prices, the impairment

provisions made in the past three years would not have been necessary.

Metal prices

It was encouraging to note that the price of zinc increased substantially during

2003 reaching 45half per pound in December, well above the average of 35half per pound

for 2002. In the first quarter of 2004 the zinc price increased further reaching

a high of 52half per pound in early March. Devaluation of the US dollar against

most producer country currencies was a contributing factor. Nevertheless even

these prices are well below the historical medium or long term prices. The

recent weakness of the US dollar has led to a rise in the operating costs of

most zinc mines.

At the same time, after almost 20 years of excess zinc supply, a major supply

gap is thought be developing in world zinc markets. The opening of the new

Century mine in Australia and the Antamina mine in Peru contributed to the

oversupply of zinc from 2000 to 2002 but there are now no new large mine

developments in the pipeline. At the same time, in 2002 China changed from being

a large net exporter of zinc metal to a net importer with imports of over

370,000 tonnes in 2003, thereby reversing a major negative factor for zinc

supply and zinc price. World wide zinc demand increased 4.2 per cent in 2003.

China is now the largest consumer of zinc in the world and much of the growth is

attributable to metal consumption in China.

At current metal prices approximately 40 per cent of the projected revenue from

the Parys Mountain mine is expected to be derived from zinc (more in earlier

years of production). Growth in zinc consumption is forecast to be strong in

2004 and Brook Hunt UK in its January Metal Bulletin forecast a supply deficit

of over 300,000 tonnes in 2004; this in turn will lead to a reduction in LME

inventories which should also lead to an increase in zinc prices

The price of copper increased strongly in 2003 driven largely by economic

growth. The rapid growth in developing countries in Asia, and especially China,

together with the recovery of the American and European economies, has led to

strong growth in consumption at a time of low metal inventories. Copper

concentrates in particular remain in tight supply and the shortfall in

concentrate has led to significant reductions in treatment charges and reduced

metal production. With few new large mines coming into production a continuation

of the global economic recovery should sustain copper prices at reasonable

levels for the immediate future.

Interestingly, 2003 marks the 15th consecutive year that silver demand has

exceeded supply. This long-running consistent supply deficit is a unique

characteristic of silver and has led some commentators to predict an eventual

dramatic increase in the price of silver when Inventories finally run down.

Parys Mountain contains about 8 million ounces of silver with a gross in situ

value of over $40 million at today's prices.

Outlook

For a number of years the directors have felt that the economics of Parys

Mountain could be greatly enhanced if the mine production rate could be

increased: higher daily production rates lead to better mine economics. There is

no doubt that Parys Mountain has excellent potential for the discovery of the

further resources needed to support higher production rates and with this in

mind a major exploration programme has been planned, with the objective of

delineating new mineral zones. Unfortunately, the weakness in metal prices,

particularly zinc, which existed for about five years prior to 2004, made

financing such an exploration programme difficult, except at share prices that

would be very unattractive to existing shareholders. With the improvement in

metal prices in 2004, and the projected deficit in zinc supply, which should

lead to a longer term sustained increase in the price of zinc, the prospects for

Parys Mountain have improved enormously.

To reactivate and advance the project, the following steps are planned, subject

to financing:

- An update of the 1990 feasibility study, including examination of a 2,000

tonne per day production scenario, twice the rate used in the feasibility study.

- A review and reassessment of the Northern Copper zone to determine (a) if

the zone contains any reasonable gold levels and (b) if there are any higher

grade parts of the zone which could be mined and produced in conjunction with

the polymetallic Engine and White Rock zones.

- An assessment of the viability of the early production of gold and silver

on a small scale. Parts of the Engine zone near the shaft and current

underground development are known to contain high grades of gold that perhaps

could be mined and processed in conjunction with further exploratory work.

- A major drilling programme on exploration targets related to the Engine

zone to the north and east of the current established resource and to the west

of the adjacent White Rock zone.

We are currently examining a number of options for financing the plans set out

above. The directors believe that the company's current share price, being less

than both book value and projected net asset value, does not adequately reflect

the value or potential of the company assets, and would be reluctant to issue

new shares at a low price.

The improved outlook for metal prices, and market sentiment, has opened the

possibility of attracting a joint venture partner to help develop the Parys

Mountain mine and this option is being given careful consideration. At same time

the improved outlook has also opened up other new project opportunities for the

company. A number of these opportunities have been examined in recent months and

this exercise is continuing. I hope be able to report meaningful progress on

these objectives in the not-too-distant future.

I would like to thank shareholders for their continued patience and support

through the lean times of the past few years. I believe we can now look forward

to significant progress and better times ahead.

John F. Kearney

Chairman

Consolidated Unaudited Profit and Loss account for the year ended 31 March 2004

2004 2003

� �

Turnover - continuing operations - -

Operating expenses (49,557) (51,260)

Exceptional item:

Provision for impairment of intangible

assets - (2,000,000)

Operating loss on ordinary activities

before interest & taxation (49,557) (2,051,260)

Interest receivable and similar income 1,908 2,139

Interest payable and similar charges (72,356) (72,178)

Loss on ordinary activities before

taxation (120,005) (2,121,299)

Tax on loss on ordinary activities - -

Loss on ordinary activities after tax

and retained loss for the year (120,005) (2,121,299)

Loss per share - basic (0.1) pence (1.8) pence

Loss per share - diluted (0.1) pence (1.8) pence

Consolidated Unaudited Balance Sheet at 31 March 2004

2004 2003

� �

Fixed assets

Intangible assets 5,217,006 5,156,609

Tangible assets 186,102 186,602

5,403,108 5,343,211

Current assets

Debtors 108,819 106,211

Cash at bank and in hand 1,266 2,260

110,085 108,471

Current liabilities

Creditors - amounts due

within one year (1,456,989) (1,275,473)

Net current liabilities (1,346,904) (1,167,002)

Total assets less current

liabilities 4,056,204 4,176,209

Capital and reserves

Share capital - equity 1,162,414 1,162,414

Share capital - non equity 5,510,833 5,510,833

Share premium account - equity 5,737,146 5,737,146

Profit & loss account - equity (8,354,189) (8,234,184)

Shareholders' funds 4,056,204 4,176,209

Consolidated Unaudited Cash Flows for the year ended 31 March 2004

2004 2003

� �

Net cash outflow from continuing

operating activities (36,095) (57,991)

Returns on investments and servicing

of finance

Interest received 39 18

Interest paid (41) (11)

(2) 7

Capital expenditure and financial

investment

Payments to acquire intangible (9,897) (10,922)

fixed assets

Payments to acquire tangible - (2,000)

fixed assets

Net cash outflow from capital

investment & financial investment (9,897) (12,922)

Net cash outflow before financing (45,994) (70,906)

Financing

Increase in loans 45,000 60,000

(Decrease)/increase in cash (994) (10,906)

These financial statements are unaudited. In 2003 and earlier years the auditors

issued an unqualified but non-standard audit report, making reference to matters

of going concern and the impairment of development expenditure. The company

expects that the audit report for 2004 will be couched in similar terms.

Contacts J F Kearney + (1) 416 362 6686

Ian Cuthbertson + (44) 1248 361333

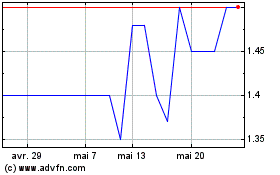

Anglesey Mining (LSE:AYM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Anglesey Mining (LSE:AYM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024