TIDMBANK

RNS Number : 0773B

Fiinu PLC

29 September 2022

29 SEPTEMBER 2022

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation (EU) No.

596/2014 which is part of English Law by virtue of the European

(Withdrawal) Act 2018, as amended. On publication of this

announcement, this information is considered to be in the public

domain.

FIINU PLC

("Fiinu" or the "Company" or the "Group")

Interim results for the six months ended 30 June 2022

Fiinu ( AIM: BANK ), a fintech company and creator of the Plugin

Overdraft(R), announces its unaudited half-year results for the six

months ended 30 June 2022.

Business Highlights

* Previous Board determined an acquisition focused

cash-shell route for the Company

* May 2022: Immedia Broadcast Ltd., the only active

trading business, was sold on 9 May for GBP2.0

Million

* June 2022: Sprift Loan of GBP1.05 Million was sold on

6 June at face-value

* June 2022: Remaining investments in Audioboom plc

sold for a net GBP949k

* June 2022: Board agreed on 9 June to recommend

shareholders to approve the acquisition of FIINU

holdings Limited together with a fund-raise and

readmission to trading on AIM

And immediately following the end of the reporting period ,

* 1 July 2022: the acquisition of Fiinu Holdings

Limited and other matters were approved by

shareholders in general meeting

* 8 July 2022: readmission of the enlarged group to

trading on AIM as Fiinu PLC

Financial Highlights

* All remaining assets and investments of the Group

liquidated in the period

* Cash at period end GBP3.58 Million

* Accounting loss for the period GBP0.1 Million

Chris Sweeney, Fiinu's Chief Executive said:

"With the reverse take-over of Immediate Acquisition PLC and

its subsequent renaming to Fiinu PLC having successfully concluded

we are now engaged in the exciting work required to fully enable

our banking product to be ready for submission within the year

for regulatory approval.

The reverse take-over that resulted in the change of business

and its name to Fiinu took place shortly after the end of the

accounting period and consequently these financial statements

do not reflect the operating performance of the current business.

Since the period end, we have made good progress on several workstreams

that must be completed during mobilisation, including selecting

Tuum as our core banking platform and making various key hires

to strengthen our control functions and operational resilience.

Our Plugin Overdraft(R) is a revolution in UK technology led

consumer banking and we look forward to updating shareholders

on our continued progress in due course."

Key Financials

Due to the sale of the Company's only active business subsidiary,

Immedia Broadcast Limited ("IBL"), prior to the change in business

brought about by the takeover of Fiinu Holdings Limited following

the end of this period in July, the financial statements show

the results of IBL as a single line Net profit from discontinued

operations for this period. The prior periods ended 30 June 2021

and 31 December 2021 have been similarly restated.

Unaudited Unaudited Audited

half year half year year to

to to

30 Jun 30 Jun 31 Dec

2022 2021 2021

(Restated) (Restated)

------------------------------- ------------ ------------- -------------

Revenue - - -

Gross profit - - -

Administrative expenses (983,206) (237,552) (721,972)

Net finance income 69,111 259 72,188

EBITDA* (914,095) (GBP237,293) (GBP649,784)

Loss after income tax (914,095) (GBP237,293) (GBP649,784)

Impairment charge Goodwill / (219,595) - -

Intangibles

Net gain on sale of financial 612,377 - -

assets

Net profit from discontinued

operations 425,699 (190,437) 211,187

Total loss (95,614) (GBP45,230) (GBP438,597)

Debt Nil (GBP81,797) (GBP53,959)

Net funds (cash less debt) 3,577,276 GBP2,006,952 GBP568,829

*Loss before interest, tax, depreciation, amortisation and impairment

charges

Enquiries :

Fiinu PLC via agencybrazil London

Chris Sweeney, Chief Executive Officer

Philip Tansey, Chief Financial Officer +44 (0)1932 548681

info@fiinu.com

SPARK Advisory Partners Limited

(Nomad)

Mark Brady/ Adam Dawes Tel: +44 (0) 203 368 3550

SP Angel Corporate Finance LLP (Stockbroker) Tel: +44 (0) 207 470 0470

Abigail Wayne

Matthew Johnson

Buchanan Communications (Financial

PR adviser)

Chris Lane Tel: +44 (0) 7466 5000

Jack Devoy Email: fiinu@buchanan.uk.com

Brazil London (Press office for +44 (0) 207 785 7383

Fiinu) Email: fiinu@agencybrazil.com

Joshua Van Raalte / Christine Webb

/ Jamie Lester

About Fiinu PLC

Fiinu , founded in 2017, is a fintech group, including Fiinu Bank,

which is authorised by the Bank of England's Prudential Regulatory

Authority [1] . Fiinu's Plugin Overdraft(R) is an unbundled overdraft

solution which allows customers to have an overdraft with Fiinu

Bank without changing their existing bank. The underlying Bank Independent

Overdraft(R) technology platform is bank agnostic, allowing Fiinu

Bank to serve all other banks' customers. Open Banking allows Fiinu's

Plugin Overdraft(R) to attach ("plugin") to the customer's primary

bank account, no matter which bank they may use. Fiinu's vision

is built around Open Banking, and it believes that it increases

competition and innovation in UK banking .

For more information, please visit www.fiinu.com

FIINU PLC

Unaudited Half-Year Results for the six months ended 30 June

2022

PREFACE

Introduction by founder, Dr Marko Sjoblom

We have come a long way in five years, and I am proud to have

this opportunity to introduce Fiinu, a fintech group including

Fiinu Bank, which is authorised by the Bank of England's Prudential

Regulatory Authority [2] .

Our mission is to start a new era of banking and to

revolutionise how people manage their finances, creating better

financial inclusion and increasing financial flexibility for

consumers.

We are currently focused on building a Bank Independent

Overdraft(R) platform for Fiinu Bank, which will promote its

flagship banking product in the UK - its Plugin Overdraft(R), which

will give consumers access to an overdraft facility without the

need to switch banks and current accounts. It will also help to

build credit and avoid rejection stress.

We have obtained evidence that the current macroeconomic

environment, rising inflation, and cost-of-living crisis is

resulting in more demand for an overdraft, and that the gap between

supply and demand of overdraft credit is widening in many

markets.

Background

The journey to where we are today begun when we met with the

Bank of England regulators five years ago and discussed Clayton

Christensen's disruptive innovation theory in relation to creating

a new bank independent overdraft market.

We presented a thematic analysis and details on how to

technically unbundle overdrafts from current accounts without

anyone needing to switch banks - extending access to a broader

population and improving financial inclusion. The Fiinu business

model is based on this. It is technology-led and enabled by Fiinu

Bank, using Open Banking to improve consumer outcomes in the

lending sector.

Customers will be able to link multiple bank accounts to their

dedicated Fiinu Bank overdraft account through Open Banking

application programming interfaces (APIs). The underwriting process

is also led by Open Banking, as opposed to conventional underlying

risk-based underwriting methods.

Overdraft Market Reform

In 2019, FCA research suggested that 62% of the population used

some form of overdraft at least once per annum. However, in 2020,

the Financial Conduct Authority (FCA) introduced one of the biggest

reforms in the overdraft market, which led to the removal of the

unarranged overdraft.

Research by the FCA in 2022 showed that over the last four

years, the number of personal current accounts in the UK has

increased by 15%, from 87 million to over 100 million. However,

approximately 80% of these accounts do not have access to an

overdraft.

The removal of the unarranged overdraft did not remove the

demand for credit but led some consumers to seek alternatives such

as, store cards, catalogue credit, and 'buy now pay later'.

Research by the FCA in 2017 suggested that the credit scores of

people who used these types of non-bank products worsened

significantly.

Access to Fiinu's Plugin Overdraft(R) can help individuals begin

to build their credit pro les through the provision of a credit

limit by a bank lender rather than less mainstream providers.

Financial Inclusion

According to Experian (October 2021), the presence of an

arranged overdraft in a credit file can improve the credit rating

if consumers use it sensibly. Fiinu Bank's Open Banking-led

underwriting model is based on the principle that overdraft limits

will be provided to those who can demonstrate an ability to make

repayments within a reasonable time without adversely impacting

their overall nancial well-being or needing to borrow more

elsewhere to repay Fiinu.

Over the past 12 months, circa 10% of newly opened personal

current accounts in the UK include an agreed overdraft. Fiinu Bank

is adopting a sophisticated approach to assess affordability and to

set credit limits, thereby potentially enabling it to extend its

overdraft credit to a substantially wider population than

traditional banks.

Outlook and the Year Ahead

We are optimistic about the outlook and the year ahead. We have

achieved a sequence of critical milestones, including the granting

of a restricted banking licence, admission to the public market,

and securing GBP14m of funding in challenging market conditions. We

will provide further updates on our progress periodically, as we

continue to meet our milestones during the mobilisation phase of

Fiinu Bank.

Dr. MARKO SJOBLOM

DIRECTOR FIINU PLC

29 September 2022

Business update by Chief Executive Officer, Chris Sweeney

OVERVIEW

I am delighted to have this, my first opportunity to report to

you as CEO of this truly innovative business. In this statement I

will outline what it is that we are working on, what the key

milestones and steps are that must be achieved in order to progress

our business plan and finally, an overview of the financials for

the six months ended 30 June 2022, though it should be clearly

understood that these financials are those of an enterprise that

ceased to have any business activity in May 2022 and changed

entirely upon the reverse take-over with Fiinu that took place on 8

July 2022.

Mobilisation

An essential component of our business plan is the mobilisation

process that encompasses a period, expected to be a year, were our

deposit-taking permission is restricted while we complete the

remaining build out of our bank. This period is vital to our plans

as it allows us the time to recruit colleagues, build and test our

new technologies, commit to third-party suppliers and secure

further investment. Whilst still at an early stage in the process,

I am pleased to report that we have made encouraging progress in

recruiting key people and contracting with our critical technology

partners.

The Management Team & the Board

We continue to build our people capability and we have made

really pleasing progress with a number of key Management and

Executive hires. I am delighted to have such an experienced team

supporting me at executive and management levels and also a Board

comprising an impressive blend of experience from banking, public

company management and governance. This team will be key to the

success of Fiinu over the coming months and years and I am looking

forward to working with them all over that time.

Having this month completed the composition of the Board and

Executive Management Team, focus now moves to the remaining

management roles required. We are actively recruiting the necessary

business capabilities across, customer service, operations,

finance, risk, compliance and HR. This is also supported by a

number of short-term contractors to support our mobilisation and

technology programme delivery.

Technology

Fiinu will be using best in class technology in all its

functions. Prior to our authorisation the team has worked to

identify and assess our key technology partners that are essential

to support the delivery of our business model. A number of which we

have already contracted with to build the necessary technology

'stack' and the front-end customer facing applications. Amongst the

most critical components are (a) open banking connectivity (b)

decision engine (c) customer mobile application (d) banking

platform. The build and configuration of these technology

components has commenced and we look forward to providing further

updates on our progress against our key milestones.

Property

Up until now Fiinu has developed on an entirely virtual basis as

befits any technology enable neo-bank working through a global

pandemic. I am therefore delighted to announce that this month we

have taken occupancy of our new offices in Camberley, Surrey.

Whilst the business will continue to work flexibly this new office

will act as our new HQ and will give us the anchor site to host our

customer service and operational capabilities.

Auditors

We thank Nexia Smith & Williamson, now Evelyn Partners, for

their highly professional support over the recent years for

Immedia. The change in business to that of a banking group

necessitates the move required and we are pleased to welcome Mazars

as auditors for Fiinu PLC and its subsidiaries going forward.

EVENTS SINCE THE START OF 2022

Whilst it is of critical importance to focus on the future of

Fiinu and the work that we need to do in order to achieve that

future and maximise the opportunity for our shareholders, we must

record the events of 2022 from a reporting perspective for the

Fiinu entity which, until 8 July 2022, was known as Immediate

Acquisition PLC and before that, up until 5 May 2022, as Immedia

Group PLC.

In the six months the key events were as follows:

-- Disposal of wholly owned subsidiary, Immedia Broadcast

Limited, for a total consideration of GBP2.0 million comprising

GBP1.718 million paid on completion of the disposal on 9 May 2022

with the balance of GBP282,000 payable in 12 equal monthly

instalments, beginning one month after completion;

-- Executive Directors, Ross Penney and John Trevorrow, stepped down on 9 May 2022;

-- The Company name was changed to Immediate Acquisition Plc.; and,

-- Remaining assets disposed of comprised the Sprift Loan for

cash consideration of GBP1.05m and the sale of the investment in

Audioboom in June .

POST-PERIOD EVENTS

Since the Group's Admission to Trading on AIM on 8 July 2022, we

have been absolutely focused on the key activities that we have to

complete during the mobilisation phase. I am pleased to report that

good progress has already been made, including the selection of

Tuum as the core banking platform to power the Group's Plugin

Overdraft(R) and various hires to strengthen our control functions

and operational resilience. The Group is making good progress with

various other mobilisation activities and I look forward to

updating shareholders on these developments in due course.

CHRIS SWEENEY

CHIEF EXECUTIVE OFFICER

29th September 2022

FIINU PLC

(Fiinu, the Company or the Group) Unaudited Half-Year results

for six months ended 30 June 2022

Consolidated statement of comprehensive income

Note 6 months 6 months ended 12 months ended

ended

30 June 2022 30 June 2021 31 Dec 2021

(unaudited) (unaudited) (audited)

Restated Restated

GBP

GBP GBP

-------------- --------------- ----------------

Continuing operations

Revenue - -

Administrative expenses - -

Gross Profit - -

Administrative expenses 983,286 237,552 (721,972)

Other Income - -

Operating loss (237,552) (721,972)

Finance income 69,111 259 72,188

Finance expense - - -

Loss before tax (914,095) (237,293) (649,784)

Tax - -

Loss from continuing operations (914,095) (237,293) (649,784)

Gain on disposal of investments 612,377 - -

Impairment of goodwill (219,595) - -

and intangible assets

Profit /(Loss) from discontinued

operations 5 425,699 (190,437) 211,187

Total Loss for the period (95,614) (427,730) (438,597)

(Loss) per share (pence)

Basic and Diluted (0.26) (1.24) (1.43)

-------------- --------------- ----------------

Consolidated statement of financial position

30 June 2022 30 June 31 Dec

2021 2021

(unaudited) (audited)

Note (unaudited) GBP GBP

GBP

------------- ------------- ------------

ASSETS

Non-current assets

Goodwill - 191,018

Owned - Intangible assets - 28,577

Owned - Property, plant and

equipment - 106,678

Right of use - Property - 9,230

Investments - 1,175,349

- 1,665,297 1,510,852

Current assets

Inventories 161,556

Trade and other receivables 388,456 2,254,937

Cash 3,577,276 622,788

2,673,931 3,039,281

Total assets 3,965,732 4,339,228 4,550,133

LIABILITIES

Non-Current liabilities

Financial liabilities (39,716)

Provisions (70,000)

(82,679) (109,716)

Current liabilities

Trade and other payables (1,330,817) (1,594,058)

Contract liabilities (101,587)

Financial liabilities (14,242)

(1,780,418) (1,709,887)

Total liabilities (1,330.817) (1,863,097) (1,819,604)

Total net assets 2,634,915 2,476,131 2,730,529

Capital and Reserves

Share capital 3,758,184 3,758,184 3,758,184

Share premium 5,189,313 4,546,541 5,189,313

Merger reserve - 2,245,333 2,245,333

Share based payment reserve 40,218 1,001,218 40,218

Investment valuation reserve - 450,000 836,265

Retained losses (6,352,800) (9,525,145) (9,338,784)

------------- ------------- ------------

Shareholders' funds 2,634,915 2,476,131 2,730,529

------------- ------------- ------------

Consolidated statement of cash flows

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 Dec 2021

2022 2021

Note (unaudited) (unaudited)* (audited)

GBP GBP GBP

------------- -------------- -------------

Operating activities

Profit / (loss) for the period

Continuing operations (521,313) (237,293) (649,784)

Discontinued operations 425,699 (190,437) 211,187

Total (95,614) (427,730) (438,597)

Adjustments for

Depreciation, amortisation 83,812 145,165

Net finance expense / income 4,777 (66,022)

Tax

Non-cash adjustment for share - 121,000 -

options charge

Increase/(decrease) in trade

receivables 86,972 (629,489)

Decrease/(increase) in trade

payables (209,577) (225,234)

Decrease/(increase) in others 24,808 (36,896)

Net cash generated from operations (315,938) (1,251,072)

Investing activities:

Purchase/sale of marketable

securities 949,000 (249,083)

Interest received 69,111 259 72,504

Investment loan 1,050,000 (800,000) (1,050,000)

Acquisition of fixed assets - (4,391) (67,619)

Cash from sale of asset 1,718,000 42

Change in net assets on sale (736,009) -

of subsidiary

Net cash generated / used

by investing activities 3,050,102 (804,132) (1,294,156)

Finance activities

Repayment of bank loan - (833) (5,517)

Repayment of lease liabilities - (55,504) (86,986)

Proceeds from issue of share

capital - 3,000,000 3,000,000

Cost of share issue - (197,229) (197,229)

Interest paid - (1,848) (6,483)

Net cash generated / used

in financing activities - 2,744,586 2,703,784

Net Increase / decrease in

cash 2,954,488 1,624,516 158,556

Cash at beginning of period 622,788 464,232 464,232

------------- -------------- -------------

Cash at end of period 3,577,276 2,088,748 622,788

------------- -------------- -------------

* Comparative figures have been reclassified to reflect the

correct loss on discontinued operations and to reflect the

reclassification of realised gains to revenue for the six months to

30 June 2021

Consolidated statement of changes in equity

Attributable to equity shareholders of the company

Called Share Retained Merger Share Investment Total

up share premium losses reserve based valuation equity

capital payment reserve

reserve

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2021 2,558,184 3,586,541 (8,900,186) 2,245,333 40,218 67,500 (402,410)

Balance at 30

June 2021 3,758,184 5,386,541 (9,404,145) 2,245,333 40,218 450,000 2,476,131

Balance at 31

December 2021 3,758,184 5,189,313 (9,338,783) 2,245,333 40,218 836,265 2,730,529

Balance at 1

January 2022 3,758,184 5,189,313 (9,338,783) 2,245,333 40,218 836,265 2,730,529

Loss for the

period (914,095) (914,095)

Sale of investments 1,448,642 (836,265) 612,377

Impairment of

goodwill and

intangible asset (219,595) (219,595)

Net gain on disposal

of subsidiary 425,699 425,699

Balance at 30

June 2022 3,758,184 5,189,313 6,352,800 - 40,218 - 2,634,915

---------------------- ---------- ---------- ------------ ---------- --------- ----------- ------------

NOTES TO THE FINANCIAL STATEMENTS

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 31 December 2021 have been filed with the Registrar of

Companies. The report of the auditors on these statutory accounts

was unqualified, did not draw to any matters by way of emphasis and

did not contain a statement under section 498(2) or (3) of the Act.

The financial information for the six months ended 30 June 2022 and

30 June 2021 is unaudited.

This announcement was approved by the Board on 29 September

2022.

1. Reporting entity

Fiinu Plc (the "Company" or, the "Group") is a public limited

company incorporated and domiciled in England and Wales. The

address of the Company's registered office, and its principal place

of business, is Wellington Way, Brooklands Business Park,

Weybridge, KT13 0TT, UK. The consolidated financial statements of

the Company as at and for the six months ended 30 June 2022

comprise the Company and its subsidiaries (together referred to as

the "Group").

Fiinu, founded in 2017, is a fintech group, including Fiinu

Bank, authorised by the Bank of England. Fiinu's Plugin

Overdraft(R) is an unbundled overdraft solution which allows

customers to have an overdraft with Fiinu Bank without changing

their existing bank. The underlying Bank Independent Plugin

Overdraft(R) technology platform is bank agnostic, allowing Fiinu

to serve all other banks' customers. Open Banking allows Fiinu's

Plugin Overdraft(R) to attach ("plugin") to the customer's primary

bank account, no matter which bank they may use. Fiinu's vision is

built around Open Banking, and it believes that it increases

competition and innovation in UK banking. Fiinu's business became

that of Fiinu PLC, formerly Immediate Acquisition PLC, only

following the end of the half-year on 8 July 2022.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the United Kingdom. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the United Kingdom.

The financial information has been prepared on the basis of IFRS

that the Directors expect to be adopted by the United Kingdom and

applicable as at 30 June 2022. The Group has chosen not to adopt

IAS 34 "Interim Financial Statements" in preparing the interim

financial information.

3. Significant accounting policies

The accounting policies set out in detail in note 2 of the

Group's consolidated financial statements to 31 December 2021 under

its previous name of Immedia Group PLC have been applied

consistently to these unaudited financial statements to 30 June

2022, with the exception of the adoption of new or amended

standards which have become applicable for accounting periods

commencing on or after 1 January 2022. There are no new standards

or amendments to standards which are material to the accounts for

the half year ended 30 June 2022.

a) Discontinued business

IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations outlines how to account for non-current assets held for

sale (or for distribution to owners). In general terms, assets (or

disposal groups) held for sale are not depreciated, are measured at

the lower of carrying amount and fair value less costs to sell and

are presented separately in the statement of financial position.

Specific disclosures are also required for discontinued operations

and disposals of non-current assets.

The sum of the post-tax profit or loss of the discontinued

operation and the post-tax gain or loss recognised on the

measurement to fair value less cost to sell or fair value

adjustments on the disposal of the assets (or disposal group) is

presented as a single amount on the face of the statement of

comprehensive income. If the entity presents profit or loss in a

separate statement, a section identified as relating to

discontinued operations is presented in that separate statement.

[IFRS 5.33-33A].

Detailed disclosure of revenue, expenses, pre-tax profit or loss

and related income taxes is required either in the notes or in the

statement of comprehensive income in a section distinct from

continuing operations. [IFRS 5.33] Such detailed disclosures must

cover both the current and all prior periods presented in the

financial statements. [IFRS 5.34]

4. Events in the six months ended 30 June 2022

Highlights

-- Disposal of the wholly owned and only active subsidiary,

Immedia Broadcast Limited, for a total consideration of GBP2.0

million comprising GBP1.718 million paid on completion of the

disposal on 9 May 2022 with the balance of GBP282,000 payable in 12

equal monthly instalments, beginning one month after completion

-- Executive Directors, Ross Penney and John Trevorrow, left the Board on 9 May 2022

-- Change of Company name to Immediate Acquisition Plc.

-- Disposal of the Sprift Loan for cash consideration of GBP1.05m on 6 June 2022

-- Disposal of the investment in Audioboom for net proceeds of GBP 0 . 9 m in June 2022 .

Immedia Broadcast Ltd ("IBL")

Owing to the cost of operation, the previous Board determined in

2022 that IBL would trade more efficiently without the financial

and regulatory burden of being traded on AIM and the Group

therefore sought expressions of interest from third parties. None

of these was at a level commensurate with the trading prospects of

IBL so, having received shareholder approval, on 9 May 2022 the

Group sold IBL to AVC Immedia Limited, a company led by CEO Ross

Penney .

Sprift Loan

On 15 July 2021 the Company entered into a cost recovery

agreement with Sprift Technologies Limited ("Sprift") supported by

a loan to Sprift of GBP1.05m.

On 6 June 2022 the Company disposed of the GBP1.05m Sprift Loan

to Mark Horrocks for GBP1.05m in cash consideration. This was a

related party transaction pursuant to AIM Rule 13 and the directors

at that time having consulted with the Company's nominated adviser,

believed that the terms of the disposal were fair and reasonable

insofar as shareholders are concerned .

5. Discontinued business and assets held for sale

Per IFRS 5 - Discontinued business and assets held for sale the

individual line items of the business that has been deemed 'held

for sale' are presented on the face of the income statement as one

line set out as 'Discontinued business' and the assets and

liabilities of that business presented on the statement of position

as two single lines namely 'assets of business held for sale' and

'liabilities of business held for sale'. The only active business

within the Group at 1 January 2022 was that of the wholly owned

subsidiary Immedia Broadcasting Limited (IBL) which was sold in May

for a total consideration of GBP2million.

Set out below are the individual lines that are summarised

within the Income statement by the line "Net profit / (loss)

arising from the disposal of assets held for sale".

Individual Line item 6 months ended 6 months ended 12 months

30 June 2022 30 June 2021 ended 31 December

GBP GBP 2021

GBP

Revenue 838,704 1,086,388 2,940,692

--------------- --------------- -------------------

Cost of sales (383,678) (999,025)

--------------- --------------- -------------------

Gross Profit 581,725 702,710 1,941,668

--------------- --------------- -------------------

Other Income 12,398 12,398

--------------- --------------- -------------------

Administrative expenses (590,015) (900,510) (1,736,712)

--------------- --------------- -------------------

Finance income 317

--------------- --------------- -------------------

Finance costs (626) (5,036) (6,483)

--------------- --------------- -------------------

Other costs (28,970)

--------------- --------------- -------------------

Net Profit / (Loss)

before tax (37,886) (190,437) 211,187

--------------- --------------- -------------------

Tax

--------------- --------------- -------------------

Other gains upon disposal 463,585

--------------- --------------- -------------------

Net profit/(loss) arising

from the disposal of

assets held for sale 425,699 (190,437) 211,187

--------------- --------------- -------------------

6. Post balance sheet date events

Following the disposal of Immedia Broadcast Limited, announced

21 April 2022 and the sale of the Sprift loan in June, the Company

became an AIM Rule 15 cash shell further supported by the sale for

cash of the investment in Audioboom plc and, as such, was required

to make an acquisition or acquisitions which constitute(s) a

reverse takeover under AIM Rule 14 (including seeking re-admission

as an investing company (as defined under the AIM Rules)).

Subsequently, the Board agreed on 9 June to propose the acquisition

of Fiinu holdings Limited which was approved by shareholders at the

general meeting held on 1st July with the transaction completed on

8 July 2022. On completion day the Company adopted new Articles of

Association, changed its name to Fiinu PLC and its London Stock

Exchange mnemonic to "BANK" and appointed new Board directors. Tim

Hipperson (Non-Executive Chairman) and Mark Horrocks (Non-Executive

Director) stepped down from the Board of Directors whilst Simon

Leathers remained as a non-executive director to be joined by the

new appointees:

-- David Hopton - Non-Executive Chairman

-- Chris Sweeney - Chief Executive Officer

-- Marko Sjoblom - Founder and Executive Director

-- Philip Tansey - Chief Financial Officer

-- Jerry Loy - Independent Non-Executive Director and,

-- Huw Evans - Independent Non-Executive Director.

The Company successfully raised GBP8.01 million (before

expenses) via a placing of 40,050,000 new ordinary shares at an

issue price of 20 pence per share (the "Placing"). The net proceeds

of the Placing will be used in combination with the Company's

existing capital resources for regulatory capital, investment in

technology and general operating expenses. The number of shares in

issue immediately after Admission is 265,131,861 giving the Company

a market capitalisation of approximately GBP53 million at the issue

price of 20 pence per share. The Company holds no shares in

treasury.

7. Earnings per share

Unaudited Unaudited Full Year

Half Year Half Year Audited

2021

2022 Number 2021 Number Number

Basic

Weighted average number

of ordinary shares

in issue 37,581,844 35,460,297 31,581,844

Less weighted average

number of own shares (832,374) (832,374) (832,374)

Weighted average number

of shares in issue

for basic earnings

per share 36,749,470 34,627,923 30,749,470

============ ============ ===========

The basic and diluted earnings per share are calculated using

the after tax loss attributable to equity shareholders for the

financial period of GBP95,614 (30 June 2021: loss GBP427,730; 31

December 2021: loss GBP438,597) divided by the weighted average

number of Ordinary shares in issue in each of the relevant periods:

30 June 2022: 37,581,844 shares (30 June 2021: 34,627,923 shares

and 31 December 2021: 37,581,844 shares). For the year-ended 31

December 2021 the opening number in issue was 25,581,844 and with

12,000,000 issued in the year the closing number was 37,581,844.

For the period to 30 June 2022 and the year to 31 December 2021 and

period to 30 June 2021 and in accordance with IAS 33, the diluted

loss per share is stated as the same amount as basic as there is no

dilutive effect.

8. Share capital

Allotted, issued and fully paid:

Number of shares Nominal value

GBP

Ordinary shares with nominal value

of GBP0.10 per share as at:

30 June 2020 14,556,844 1,455,684

Issued in the half year 11,025,000 1,102,500

----------------- --------------

31 December 2020 25,581,844 2,558,184

Issued in the half year 12,000,000 1,200,000

----------------- --------------

30 June 2021 37,581,844 3,758,184

30 June 2022 37,581,844 3,758,184

================= ==============

Following the end of the half-year on 8 July a further

227,550,017 shares, comprising 40,050,000 placement shares and

187,550,017 consideration shares with a nominal value of GBP0.10

per share, were issued as part of the reverse take-over and the

acquisition of Fiinu Holdings Limited as discussed in Note 6.

There are no restrictions on the transfer of shares in Fiinu

Plc. All shares carry equal voting rights.

FORWARD LOOKING STATEMENTS

This document contains certain forward-looking statements which

reflect the knowledge and information available to the Company

during the preparation and up to the publication of this document.

By their very nature, these statements depend upon circumstances

and relate to events that may occur in the future thereby involving

a degree of uncertainty. Although the Group believes that the

expectations reflected in these statements are reasonable, it can

give no assurance that these expectations will prove to have been

correct. Given that these statements involve risks and

uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

The Group undertakes no obligation to update any forward-looking

statements whether because of new information, future events or

otherwise.

[1] Fiinu Bank Limited obtained its UK deposit-taking banking

licence with restrictions from the Prudential Regulation Authority

(PRA) and the Financial Conduct Authority (FCA) in July 2022

[2] Fiinu Bank Limited obtained its UK deposit-taking banking

licence with restrictions from the Prudential Regulation Authority

(PRA) and the Financial Conduct Authority (FCA) in July 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGZLLRVGZZM

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

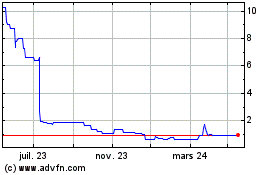

Fiinu (LSE:BANK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Fiinu (LSE:BANK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024