TIDMBRBY

RNS Number : 6180T

Burberry Group PLC

16 November 2023

16 November 2023

BURBERRY GROUP PLC

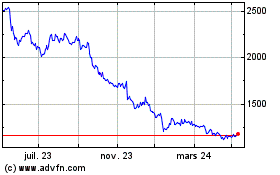

INTERIM RESULTS FOR 26 WEEKSED 30 SEPTEMBER 2023

"We made good progress against our strategic goals, executing

our priorities at pace. We continued to build momentum around our

new creative vision with the launch of our Winter 23 collection in

September, the first designed by Daniel Lee. While the

macroeconomic environment has become more challenging recently, we

are confident in our strategy to realise our potential as the

modern British luxury brand, and we remain committed to achieving

our medium and long-term targets."

- Jonathan Akeroyd, Chief Executive Officer

Period ended 26 weeks 26 weeks YoY % change YoY % change

ended ended Reported CER

GBP million 30 September 1 October FX

2023 2022

-------------- -----------

Revenue 1,396 1,345 4 7

Retail comparable store

sales(*) 10% 5%

Adjusted operating profit

(*) 223 238 (6) 1

Adjusted operating profit

margin(*) 15.9% 17.7% (180bps) (110bps)

Adjusted diluted EPS

(pence) (*) 42.1 44.3 (5) 2

Reported operating profit 223 263 (15)

Reported operating profit

margin 15.9% 19.5% (360bps)

Reported diluted EPS

(pence) 42.1 48.9 (14)

Free cash flow (*) (15) 88 nm(**)

Dividend (pence) 18.3 16.5 11

------------------------------- -------------- ----------- ------------- -------------

(*) See page 11 for definitions of alternative performance

measures, (**) Not meaningful

-- Q2 comparable store sales increased 1%, with EMEIA +10%, Asia Pacific +2%, Americas -10%

-- Significant progress on our plan, executing our priorities at pace

-- Good performance across core outerwear and leather goods categories

o Outerwear comparable store sales up 21% in H1 and 10% in

Q2

o Leather goods comparable store sales up 8% in H1 and 3% in

Q2

-- Delivered a more coherent brand aesthetic with campaigns

generating significantly improved brand clarity , supported by a

series of high-impact activations

-- Launched Winter 23 collection, broadening distribution and

ensuring greater visibility in stores compared with previous

seasons; new product complements core offer and early indicators

are encouraging

-- Continued investment in distribution , opening or

refurbishing 33 stores in the half and refreshed website in line

with our new creative vision

-- Achieved efficiency improvements across the value chain in

terms of product availability, on time delivery and material waste

re-use

-- Strengthened supply chain with the completion of an outerwear

acquisition in Italy in early October

-- GBP400m share buyback completed at end of October, with GBP20 0 m completed in H1

-- Interim dividend of 18.3p, +11% based on 30% of FY23 full year dividend

GUIDANCE

We are confident in our strategy and remain committed to

achieving our medium and long-term targets. The slowdown in luxury

demand globally is having an impact on current trading. If the

weaker demand continues, we are unlikely to achieve our previously

stated revenue guidance for FY24*. In this context, adjusted

operating profit would be towards the lower end of the current

consensus range (GBP552m-GBP668m)**.

Based on the effective foreign exchange rates as of 25 October

2023, we now expect a reduced currency headwind of c.GBP110m to

revenue and c.GBP60m to adjusted operating profit.

*High single-digit revenue CAGR from FY20 base equating to a low

double-digit growth in FY24 YoY.

** As published on our corporate website here .

All metrics and commentary in the Group Financial Highlights and

Business and Financial Review exclude adjusting items unless stated

otherwise.

The financial information contained herein is unaudited.

The following alternative performance measures are presented in

this announcement: CER, adjusted profit measures, comparable sales,

free cash flow, cash conversion, adjusted EBITDA and net debt. The

definitions of these alternative performance measures are in the

Appendix on page 11.

Certain financial data within this announcement have been

rounded. Growth rates and ratios are calculated on unrounded

numbers.

Enquiries

Investors and analysts 020 3367 3524

Julian Easthope VP, Investor Relations julian.easthope@burberry.com

Media 020 3367 3764

Andrew Roberts SVP, Corporate Relations and andrew.roberts@burberry.com

Engagement

----------------- ------------------------------ -----------------------------

-- There will be a virtual presentation for investors and

analysts today at 9.30am (UK time) that can be viewed live on the

Burberry website https://www.burberryplc.com/ and can also be

accessed live via a listen only dial-in facility, click here to

register

-- The supporting slides and an indexed replay will be available

on the website later in the day

-- Burberry will issue its Third Quarter Trading Update on 19 January 2024

Certain statements made in this announcement are forward-looking

statements. Such statements are based on current expectations and

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from any expected future

results in forward-looking statements. Burberry Group plc

undertakes no obligation to update these forward-looking statements

and will not publicly release any revisions it may make to these

forward-looking statements that may result from events or

circumstances arising after the date of this document. Nothing in

this announcement should be construed as a profit forecast. All

persons, wherever located, should consult any additional

disclosures that Burberry Group plc may make in any regulatory

announcements or documents which it publishes. All persons,

wherever located, should take note of these disclosures. This

announcement does not constitute an invitation to underwrite,

subscribe for or otherwise acquire or dispose of any Burberry Group

plc shares, in the UK, or in the US, or under the US Securities Act

1933 or in any other jurisdiction.

Burberry is listed on the London Stock Exchange (BRBY.L) and is

a constituent of the FTSE 100 index. ADR symbol OTC:BURBY.

BURBERRY, the Equestrian Knight Device, the Burberry Check, and

the Thomas Burberry Monogram and Print are trademarks belonging to

Burberry.

www.burberryplc.com

LinkedIn: Burberry

BUSINESS REVIEW

In November 2022, we set out our strategy to realise Burberry's

potential as the modern British luxury brand with a medium-term

target to grow sales to GBP4bn and a longer-term ambition to reach

GBP5bn. During the half, we made significant progress against our

plan, executing our priorities at pace.

We continued to invest in our creative vision with campaigns and

activations that were recognisably Burberry and told a coherent

brand story. Our Winter 23 campaign showcased our new offer with a

distinctive visual language that celebrated our new and enduring

brand codes and placed product centre stage. The strong level of

interest from fashion editors globally led to higher volumes of

editorials with more than two times the reach of our previous

Winter campaign.

We complemented the launch of Winter 23 with a series of city

takeovers in high-impact locations. Our "Burberry Streets"

activations in London, Seoul and Shanghai celebrated the art of

exploration and brought our brand to life through immersive

experiences, installations and events. These initiatives

contributed to our highest level of brand clarity in the last three

years as well as continued growth in consumers who associate

Burberry with 'Britishness' and 'Heritage', which are key to our

luxury positioning.

In terms of our core product categories, outerwear comparable

store sales increased 21% in the half. This was driven by the

strong performance of Heritage rainwear across both men's and

women's. Leather goods comparable store sales advanced 8%, led by

14% growth in bags with ongoing momentum in icons such as the

Vintage Check and new shapes introduced for Winter 23 such as the

Knight bag and Trench tote gaining traction. In parallel, we

continued to expand and evolve ready-to-wear, and introduced a more

complete shoe offering.

The Winter 23 collection, the first designed by Daniel Lee,

arrived in stores in September. Across all categories, we supported

the launch with a higher level of investment in new product than in

previous seasons, enabling us to broaden distribution and ensure

greater visibility in our stores. The new product complements our

existing strong core offer and while it is still too soon to have

an in-depth read on commercial performance, the early indicators

are encouraging.

We continued to build on this momentum with our Summer 24 show,

also in September, that was well attended by high profile talent

from the worlds of music, creative arts and sports. Through the

collection, we further developed the aesthetic and codes for the

brand across leather goods, shoes and ready-to-wear. The response

has been highly positive with global reach from press coverage more

than doubling season on season.

In addition, our beauty business generated an excellent

performance in the half, driven by the successful launch of our

latest fragrance Burberry Goddess.

We continued to invest in distribution, opening or refurbishing

33 stores in the half including New Bond Street London, Rodeo Drive

Los Angeles and Omotesando Tokyo. Financials of the updated stores

continue to show both store productivity and AUR up mid-teens

percentage against equivalent existing stores. We also refreshed

our e-commerce website Burberry.com. Launched to coincide with the

arrival of our Winter 23 collection in stores, the website offers

customers a more elevated and cohesive experience aligned with our

new brand identity.

We further strengthened our supply chain in our core product

categories with completion in early October of the acquisition of a

product development business from our longstanding supplier Pattern

SpA. This strategic investment will enhance our technical outerwear

capabilities and give us greater control over the quality, cost,

delivery, and sustainability of our offer.

At the same time, we maintained support for our communities,

partnering with Tate Britain for 'Sarah Lucas: HAPPY GAS', an

exhibition honouring one of Britain's leading artists. We also

partnered with British artist Keith Khan and LEEDS 2023 to create a

series of bespoke textile artworks at the Burberry Mill in Keighley

to celebrate the 33 distinctive and diverse wards of the city of

Leeds.

We continued to progress our sustainability agenda, introducing

plastic-free packaging as part of our commitment to eliminate

plastic from our consumer packaging by FY26. We also expanded our

aftercare services to help more of our customers extend the life of

their products.

SUMMARY INCOME STATEMENT

Period ended 26 weeks 26 weeks YoY % change YoY % change

GBP million ended ended Reported CER

30 September 1 October FX

2023 2022

Revenue 1,396 1,345 4 7

Cost of sales* (421) (403) 4 6

----------------------------- -------------- ----------- ------------- -------------

Gross profit* 975 942 3 8

Gross margin* 69.8% 70.1% (30bps) 30bps

Net operating expenses* (752) (704) 7 10

Net opex as a % of sales* 53.9% 52.4% 150bps 140bps

----------------------------- -------------- ----------- ------------- -------------

Adjusted operating profit* 223 238 (6) 1

Adjusted operating profit

margin* 15.9% 17.7% (180bps) (110bps)

Adjusting operating items - 25

----------------------------- -------------- ----------- ------------- -------------

Operating profit 223 263

Operating profit margin 15.9% 19.5% (360bps)

Net finance expense (4) (12)

----------------------------- -------------- ----------- ------------- -------------

Profit before taxation 219 251

Taxation (60) (57)

Non-controlling interest (1) (1)

Attributable profit 158 193

Adjusted profit before

taxation* 219 226 (3) 4

Adjusted diluted EPS

(pence)* 42.1 44.3 (5) 2

Diluted EPS (pence) 42.1 48.9 (14)

Weighted average number

of diluted ordinary shares

(millions) 376.1 394.4 (5)

----------------------------- -------------- ----------- ------------- -------------

*Excludes adjusting items. All items below adjusting operating

items are on a reported basis unless otherwise stated.

For detail, see Appendix.

FINANCIAL PERFORMANCE

Revenue by channel

26 weeks 26 weeks YoY % change YoY % change

ended ended Reported CER

30 September 1 October FX

Period ended 2023 2022

GBP million

------------------------- ------------ ------------

Retail 1,124 1,061 6 10

Retail comparable store

sales 10% 5%

Wholesale 241 263 (8) (8)

Licensing 31 21 45 44

------------- ---------- ------------ ------------

Revenue 1,396 1,345 4 7

------------------------- ------------- ---------- ------------ ------------

In the half:

-- Retail sales grew 10% at CER; 6% reported

-- Comparable store sales grew 10% with no impact from space

Comparable store sales growth by region

FY24 vs LY Q1 Q2 H1

Group 18% 1% 10%

Asia Pacific 36% 2% 18%

EMEIA 17% 10% 14%

Americas -8% -10% -9%

--- ---- ---

Asia Pacific grew 18% in the half with a strong Q1 recovery of

36% against a period that saw COVID-19 related disruption in

Mainland China and slowed to 2% in Q2 against a tougher

comparative.

-- Mainland China comparable store sales increased 15% in the

half. Q2 fell 8% as spending shifted offshore with the Chinese

customer group growing 25%

-- South Korea fell 1% in the half with a robust 6% growth in Q1 offset by a 7% decline in Q2

-- Japan saw strong comparable store sales growth up 43% in the

half and 41% in Q2 driven by tourists

-- South Asia Pacific rose 30% in the half and 22% in Q2, also benefitting from tourist demand

EMEIA had another strong half with comparable store sales up

14%, and Q2 +10%.

-- The region benefitted from tourist growth of 39% for the half

with the share of mix from tourists increasing to 51% of retail

sales with a strong performance from American and Asian

tourists

-- Continental Europe outperformed the regional average in the half

-- UK continued to lag Continental Europe in attracting tourism

spend compared with pre-pandemic levels, reflecting the withdrawal

of VAT refunds in the UK since January 2021

Americas declined 9% in the half with Q2 -10%.

-- While the American customer has remained weak overall, we are

pleased with the progress made with our customer acquisition

programme with an increased share of higher income female

clients

By product

We maintained our focus on our core leather and outerwear

categories.

-- Outerwear comparable store sales grew 21% in the half and 10%

in Q2, driven by Heritage rainwear following the launch of our new

visual expression of Burberry

-- Leather goods comparable store sales grew 8% in the half and

3% in Q2. This was driven by bags especially the Vintage Check

line. The new bag pillars launched at the end of the period and are

gaining traction, particularly the Knight bag and Trench tote

-- Ready-to-wear excluding outerwear grew 6% in the half with

men's up 6% and women's increasing 7%

Store footprint

The transformation of our distribution network continued during

the half.

-- Including refurbishments, we increased the number of updated

stores by 33 in the half, bringing the total of stores in new

design to 140

-- We remain on track to complete more than 50% of the network by the end of this financial year

-- Key openings/refurbishments include New Bond Street London,

Rodeo Drive Los Angeles and Omotesando Tokyo

-- We are pleased with the performance of updated stores that

saw both store productivity and AUR higher by mid-teens compared

with equivalent existing stores

Wholesale

Wholesale revenue decreased 8% at both CER and reported rates in

the half driven by a weak Americas performance. We expect the full

year to be down a mid-single digit percentage with the channel

impacted by the macroeconomic environment.

Licensing

Licensing revenue grew 44% at CER and 45% at reported exchange

rates in the half driven by a strong performance in beauty with the

highly successful launch of the Burberry Goddess fragrance.

OPERATING PROFIT ANALYSIS

Adjusted operating profit

Period ended 26 weeks 26 weeks YoY % change YoY % change

GBP million ended ended Reported CER

30 September 1 October FX

2023 2022

------------- ----------

Revenue 1,396 1,345 4 7

Cost of sales* (421) (403) 4 6

Gross profit* 975 942 3 8

Gross margin %* 69.8% 70.1% (30bps) 30bps

Net operating expenses* (752) (704) 7 10

Operating expenses as a

% of sales* 53.9% 52.4% 150bps 140bps

--------------------------- ------------- ---------- ------------ ------------

Adjusted operating profit* 223 238 (6) 1

Adjusted operating margin

%* 15.9% 17.7% (180bps) (110bps)

--------------------------- ------------- ---------- ------------ ------------

*Excludes adjusting items

Adjusted operating profit increased 1% at CER and but fell 6% at

reported with the margin down 110bps and 180bps respectively:

-- Gross margin increased by 30bps at CER with regional and

channel mix benefits as well as lower transportation costs more

than offsetting inflationary pressures, and fell 30bps at

reported

-- Adjusted net operating expenses rose by 10% at CER and 7%

reported due to investments in stores and marketing as well as

impact of inflation of people costs

-- Adjusted operating profit was GBP223m at reported including a

GBP17m foreign exchange headwind (H1 FY23: GBP238m at reported with

GBP31m foreign exchange tailwind)

ADJUSTING ITEMS(*)

Adjusting items were nil (H1 FY23: GBP25m net credit).

Period ended 26 weeks ended 26 weeks ended

GBP million 30 September 1 October

2023 2022

----------------

The impact of COVID-19

Inventory provisions** - 1

Rent concessions - 7

Government grants - 1

COVID-19 adjusting items - 9

Profit on sale of property - 19

Revaluation of deferred consideration

liability - (2)

Restructuring costs - (1)

Adjusting items - 25

--------------------------------------- ----------------

*For detail on adjusting items see note 4 of the Financial

Statements **Includes nil (H1 FY23: GBP1m credit) that has been

recognised through COGS

ADJUSTED PROFIT BEFORE TAX*

After an adjusted net finance charge of GBP4m (H1 FY23: GBP12m),

adjusted profit before tax was GBP219m (H1 FY23: GBP226m).

*For detail on adjusting items see note 4 of the Financial

Statements

TAXATION*

The effective tax rate on adjusted profit increased to 27.2% (H1

FY23: 22.4%) due to the higher UK corporation tax rate. The

reported tax rate on H1 FY24 profit before taxation was also 27.2%

(H1 FY23: 22.7%).

*For detail see note 6 of the Financial Statements

CASH FLOW

R epresented statement of cash flows

Period ended 26 weeks ended 26 weeks ended

GBP million 30 September 1 October

2023 2022

Adjusted operating profit 223 238

Depreciation and amortisation 179 163

Working capital (154) (125)

Other including adjusting items 23 13

------------------------------------------ --------------- --------------

Cash generated from operating activities 271 289

Payment of lease principal and related

cash flows (97) (93)

Capital expenditure (89) (53)

Proceeds from disposal of non-current

assets - 22

Interest (2) (12)

Tax (98) (65)

------------------------------------------ --------------- --------------

Free cash flow* (15) 88

------------------------------------------ --------------- --------------

*For a definition of free cash flow see page 11

Free cash flow was a GBP15m outflow in the half (H1 FY23: GBP88m

inflow) as we continued to invest in product and distribution.

The major components were:

-- Cash generated from operating activities decreased from GBP289m to GBP271m

-- A working capital outflow of GBP154m (H1 FY23: GBP125m)

impacted by changes to the timing of our seasonal collections and

the build of inventory in preparation for festive

-- Capital expenditure of GBP89m (H1 FY23: GBP53m) attributed to

the store network as we continued to roll out our store

refurbishment programme

-- Tax cash outflow of GBP98m (H1 FY23: GBP65m) due to the

higher UK tax rate and one-off payments

Cash net of overdrafts on 30 September 2023 was GBP570m,

compared to GBP961m on 1 April 2023. On 30 September 2023

borrowings were GBP299m from the bond issue leaving cash net of

overdrafts and borrowings of GBP271m (1 April 2023: GBP663m). With

lease liabilities of GBP1,158m, net debt in the period was GBP887m

(1 April 2023: GBP460m). Net Debt/Adjusted EBITDA was 0.9x, at the

upper end of our target range of 0.5x to 1.0x. The increase in

leverage from 0.5x at the FY23 year-end was primarily driven by the

share buyback programme, payment of the final dividend and seasonal

working capital outflows as we approach the festive period.

Period ended 26 weeks ended 26 weeks ended

GBP million 30 September 1 October

2023 2022

Adjusted EBITDA - rolling

12 months 976 896

Cash net of overdrafts (570) (941)

Bond 299 298

Lease debt 1,158 1,139

--------------- ---------------

Net Debt* 887 496

--------------- ---------------

Net Debt/Adjusted EBITDA 0.9x 0.6x

--------------- ---------------

*For a definition of net debt see page 12.

APPIX

Detailed guidance for FY24

Item Financial impact

Impact of retail Space is expected to be broadly stable in FY24.

space on revenues

---------------------------------------------------------

Wholesale revenue Wholesale revenue is expected to decline by a mid-single

digit percentage in FY24.

---------------------------------------------------------

Tax We expect the adjusted effective tax rate to be

around 27%.

---------------------------------------------------------

Currency Based on 25 October effective foreign exchange

rates, the impact of year-on-year exchange rate

movements is now expected to be a c.GBP110m headwind

on revenue and c.GBP60m headwind on adjusted operating

profit.

---------------------------------------------------------

Capex Capex is expected to be around GBP200m including

over 50% of the store network updated by end of

the year.

---------------------------------------------------------

Dividend Interim dividend at 18.3p, 30% of FY23 full year

dividend - progressive dividend policy with pay-out

ratio around 50% of the full year.

---------------------------------------------------------

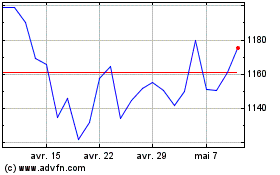

Share buyback GBP400m share buyback completed on 31 October with

20.5m shares acquired at an average price of 1,951p.

---------------------------------------------------------

Note: Guidance based on CER at FY23 rates

GUIDANCE

We are confident in our strategy and remain committed to

achieving our medium and long-term targets. The slowdown in luxury

demand globally is having an impact on current trading. If the

weaker demand continues, we are unlikely to achieve our previously

stated revenue guidance for FY24*. In this context, adjusted

operating profit would be towards the lower end of the current

consensus range (GBP552m-GBP668m)**.

Based on effective foreign exchange rates as of 25 October 2023,

we now expect a reduced currency headwind of c.GBP110m to revenue

and c.GBP60m to adjusted operating profit.

*High single-digit revenue CAGR from FY20 base equating to a low

double-digit growth in FY24

** As published on our corporate website here .

Retail/wholesale revenue by destination*

Period ended 26 weeks 26 weeks ended YoY % change

ended 30 1 October

September

GBP million 2023 2022 Reported CER

FX

------------------------ ----------- --------------- --------- -----

Asia Pacific (94%

retail)* 584 525 11 19

EMEIA (68% retail)* 485 445 9 8

Americas (83% retail)* 296 354 (16) (14)

Total (82% retail) 1,365 1,324 3 7

------------------------ ----------- --------------- ---------

*Mix based on H1 FY24

Retail/wholesale revenue by product division

Period ended 26 weeks 26 weeks ended YoY % change

ended 30 1 October

September

GBP million 2023 2022 Reported CER

FX

-------------------- ----------- --------------- --------- -----

Accessories 498 495 1 4

Women's 391 357 9 13

Men's 399 383 4 8

Children's & other 77 89 (13) (10)

----------- --------------- --------- -----

Total 1,365 1,324 3 7

-------------------- ----------- --------------- --------- -----

Store portfolio*

Directly operated stores

--------------------------------------- ----------

Stores Concessions Outlets Total Franchise

stores

------------------------ ------- ------------ -------- ----------

At 1 April 2023 219 138 56 413 35

Additions 7 1 2 10 2

Closures (10) (4) - (14) (5)

At 30 September

2023 216 135 58 409 32

------- ------------ --------

*Excludes the impact of pop-up stores

----------------------------------------------------------------- ----------

Store portfolio by region*

Directly operated stores

--------------------------------------- ----------

Stores Concessions Outlets Total Franchise

At 30 September 2023 stores

------------------------ ------- ------------ -------- ----------

Asia Pacific 113 94 24 231 8

EMEIA 44 33 19 96 24

Americas 59 8 15 82 -

Total 216 135 58 409 32

------- ------------ --------

*Excludes the impact of pop-up stores

Adjusted operating profit* 26 weeks ended 26 weeks ended % change % change

Period ended 30 September 1 October Reported CER

GBP millions 2023 2022 FX

Retail/wholesale 194 219 (11) (3)

Licensing 29 19 46 45

---------------------------- --------------- --------------- ---------- ---------

Adjusted operating profit 223 238 (6) 1

Adjusted operating profit

margin 15.9% 17.7% (180bps) (110bps)

---------------------------- --------------- --------------- ---------- ---------

*For detail on adjusting items see note 4 of the Financial

Statements

Exchange rates Forecast effective average Actual average exchange

rates for FY24 rates

GBP1= 25 October 29 June 2023 H1 FY24 H1 FY23 FY23

2023

------------- -------------- --------- --------- ------

Euro 1.15 1.16 1.16 1.17 1.16

US Dollar 1.23 1.26 1.26 1.21 1.20

Chinese Renminbi 8.91 9.07 8.97 8.16 8.27

Hong Kong Dollar 9.65 9.87 9.86 9.50 9.43

Korean Won 1,694 1,659 1,654 1,579 1,577

------------- -------------- --------- --------- ------

Profit before tax reconciliation

----------- ----------

Period ended 26 weeks 26 weeks % change % change

GBP million ended ended Reported CER

30 September 1 October FX

2023 2022

Adjusted profit before

tax 219 226 (3) 4

Adjusting items*

COVID-19 related items - 9

Profit on sale of

property - 19

Restructuring costs - (1)

Revaluation of deferred

consideration liability - (2)

Profit before tax 219 251 (13)

-------------- ----------- ----------

*For detail on adjusting items see note 4 of the Financial

Statements

Alternative performance measures

Alternative performance measures (APMs) are non-GAAP measures.

The Board uses the following APMs to describe the Group's financial

performance and for internal budgeting, performance monitoring,

management remuneration target setting and external reporting

purposes.

APM Description and purpose GAAP measure reconciled to

Constant This measure removes the Results at reported rates

Exchange effect of changes in exchange

Rates (CER) rates. The constant exchange

rate incorporates both

the impact of the movement

in exchange rates on the

translation of overseas

subsidiaries' results and

on foreign currency procurement

and sales through the Group's

UK supply chain.

-------------------------------------- --------------------------------------------------------------

Comparable The year-on-year change Retail Revenue:

sales growth in sales from stores trading Period ended 26 weeks 26 weeks

over equivalent time periods YoY% ended ended

and measured at constant 30 September 1 October

foreign exchange rates. 2023 2022

It also includes online ---------------- -------------- -----------

sales. This measure is Comparable

used to strip out the impact sales growth 10% 5%

of permanent store openings Change in

and closings, or those space 0% 1%

closures relating to refurbishments, ---------------- -------------- -----------

allowing a comparison of CER retail 10% 6%

equivalent store performance ---------------- -------------- -----------

against the prior period. FX (4%) 6%

---------------- -------------- -----------

Retail revenue 6% 12%

---------------- -------------- -----------

-------------------------------------- --------------------------------------------------------------

Adjusted Adjusted profit measures Reported Profit:

Profit are presented to provide A reconciliation of reported

additional consideration profit before tax to adjusted

of the underlying performance profit before tax and the Group's

of the Group's ongoing accounting policy for adjusted

business. These measures profit before tax are set out

remove the impact of those in the financial statements.

items which should be excluded

to provide a consistent

and comparable view of

performance.

-------------------------------------- --------------------------------------------------------------

Free Cash Free cash flow is defined Net cash generated from operating

Flow as net cash generated from activities: Period ended 26 weeks 26 weeks

operating activities less GBPm ended ended

capital expenditure plus 30 September 1 October

cash inflows from disposal 2023 2022

of fixed assets and including -------------------- -------------- -----------

cash outflows for lease Net cash generated

principal payments and from operating

other lease related items. activities 171 212

Capex (89) (53)

Lease principal

and related

cash flows (97) (93)

Proceeds from

disposal of

non-current

assets - 22

-------------------- -------------- -----------

Free cash flow (15) 88

-------------------------------------- --------------------------------------------------------------

Cash Conversion Cash conversion is Net cash generated from operating

defined activities:

as free cash flow Period ended 26 weeks 26 weeks

pre-tax/adjusted GBPm ended ended

profit before tax. It 30 September 1 October

provides a measure of 2023 2022

the Group's effectiveness ----------------- -------------- -----------

in converting its profit Free cash

into cash. flow (15) 88

Tax paid 98 65

----------------- -------------- -----------

Free cash

flow before

tax 83 153

----------------- -------------- -----------

Adjusted profit

before tax 219 226

Cash conversion 38% 68%

Net Debt Net debt is defined as Cash net of overdrafts: Period ended As at As at

the lease liability GBPm 30 September 1 October

recognised 2023 2022

on the balance sheet plus ----------------- -------------- -----------

borrowings less cash net Cash net of

of overdrafts. overdrafts 570 941

Lease liability (1,158) (1,139)

Borrowings (299) (298)

----------------- -------------- -----------

Net debt (887) (496)

-------------------------- ------------------------------------------------------------------------

Adjusted Adjusted EBITDA is Reconciliation from operating profit

EBITDA defined to adjusted EBITDA: Period ended 26 weeks 26 weeks

as operating profit, GBPm ended ended

excluding 30 September 1 October

adjusting operating 2023 2022

items, ---------------------- -------------- -----------

depreciation of property, Operating profit 223 263

plant and equipment, Adjusting operating

depreciation items - (25)

of right of use assets Amortisation

and amortisation of of intangible

intangible assets 19 18

assets. Any depreciation Depreciation

or amortisation included of property,

in adjusting operating plant and equipment 49 45

items are not double Depreciation

counted. of right-of-use

Adjusted EBITDA is shown assets 111 100*

for the calculation of ---------------------- -------------- -----------

Net Debt/EBITDA for our Adjusted EBITDA 402 401

leverage ratios. *Excludes GBP3m depreciation on

right-of-use assets included in

adjusting items

-------------------------- ------------------------------------------------------------------------

PRINCIPAL RISKS

At H1 FY24, the principal risks the Group faces for the

remaining 26 weeks of the financial year have been reviewed

relative to the prior year-end. The principal risk ratings are

considered to be consistent with the year-end position. Details of

the principal risks including definitions are set out in the FY23

Annual Report (p121- 144).

CONDENSED Group INCOME statement- UNAUDITED

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023(1)

Note GBPm GBPm GBPm

--------------------------------------- ---- ------------- ---------- --------

Revenue 3 1,396 1,345 3,094

Cost of sales (421) (402) (911)

--------------------------------------- ---- ------------- ---------- --------

Gross profit 975 943 2,183

--------------------------------------- ---- ------------- ---------- --------

Operating expenses (758) (712) (1,572)

Other operating income 6 32 46

--------------------------------------- ---- ------------- ---------- --------

Net operating expenses (752) (680) (1,526)

--------------------------------------- ---- ------------- ---------- --------

Operating profit 223 263 657

Financing

--------------------------------------- ---- ------------- ---------- --------

Finance income 20 6 21

Finance expense (24) (18) (42)

Other financing charge - - (2)

--------------------------------------- ---- ------------- ---------- --------

Net finance expense 5 (4) (12) (23)

--------------------------------------- ---- ------------- ---------- --------

Profit before taxation 219 251 634

Taxation 6 (60) (57) (142)

--------------------------------------- ---- ------------- ---------- --------

Profit for the period 159 194 492

--------------------------------------- ---- ------------- ---------- --------

Attributable to:

Owners of the Company 158 193 490

Non-controlling interest 1 1 2

--------------------------------------- ---- ------------- ---------- --------

Profit for the period 159 194 492

--------------------------------------- ---- ------------- ---------- --------

Earnings per share

Basic 7 42.4 p 49.1p 126.9p

Diluted 7 42.1 p 48.9p 126.3p

--------------------------------------- ---- ------------- ---------- --------

GBPm GBPm GBPm

--------------------------------------- ---- ------------- ---------- --------

Reconciliation of adjusted profit

before taxation:

Profit before taxation 219 251 634

Adjusting operating items:

Cost of sales (income) 4 - (1) (1)

Net operating expense (income) 4 - (24) (22)

Adjusting financing items 4 - - 2

--------------------------------------- ---- ------------- ---------- --------

Adjusted profit before taxation -

non-GAAP measure 219 226 613

--------------------------------------- ---- ------------- ---------- --------

Adjusted earnings per share - non-GAAP

measure

Basic 7 42.4 p 44.5p 123.1p

Diluted 7 42.1 p 44.3p 122.5p

--------------------------------------- ---- ------------- ---------- --------

Dividends per share

Proposed interim (not recognised as

a liability at period end) 8 18.3 p 16.5p 16.5p

Final (not recognised as a liability

at 1 April 2023) 8 N/A N/A 44.5p

--------------------------------------- ---- ------------- ---------- --------

(1) Balances for the 52 weeks to 1 April 2023 have been

audited.

CONDENSED GROUP STATEMENT OF COMPREHENSIVE INCOME -

UNAUDITED

26 weeks 26 weeks 52 weeks to

to to 1 April

30 September 1 October 2023(1)

2023 2022 GBPm

GBPm GBPm

------------------------------------------------------ ------------- ---------- -----------

Profit for the period 159 194 492

Other comprehensive income(2) :

Cash flow hedges (1) 1 1

Foreign currency translation differences (16) 53 14

Tax on other comprehensive income: - (1) (1)

Other comprehensive income for the period, net of tax (17) 53 14

------------------------------------------------------- ------------- ---------- -----------

Total comprehensive income for the period 142 247 506

------------------------------------------------------- ------------- ---------- -----------

Total comprehensive income attributable to:

Owners of the Company 141 245 504

Non-controlling interest 1 2 2

------------------------------------------------------- ------------- ---------- -----------

142 247 506

------------------------------------------------------ ------------- ---------- -----------

(1) Balances for the 52 weeks to 1 April 2023 have been

audited.

(2) All items included in other comprehensive income may

subsequently be reclassified to profit and loss in a future

period.

CONDENSED GROUP BALANCE SHEET - UNAUDITED

As at As at As at

30 September 1 October 1 April

2023 2022 2023(1)

Note GBPm GBPm GBPm

------------------------------------- ---- ------------- ---------- --------

ASSETS

Non-current assets

Intangible assets 9 248 245 248

Property, plant and equipment 10 377 345 376

Right-of-use assets 11 972 947 950

Deferred tax assets 6 204 204 197

Trade and other receivables 12 52 53 52

1,853 1,794 1,823

------------------------------------- ---- ------------- ---------- --------

Current assets

Inventories 13 526 484 447

Trade and other receivables 12 365 338 307

Derivative financial assets 1 3 7

Income tax receivables 87 87 76

Cash and cash equivalents 14 663 1,017 1,026

Assets held for sale 10 13 11 -

------------------------------------- ---- ------------- ---------- --------

1,655 1,940 1,863

------------------------------------- ---- ------------- ---------- --------

Total assets 3,508 3,734 3,686

------------------------------------- ---- ------------- ---------- --------

LIABILITIES

Non-current liabilities

Trade and other payables 15 (70) (84) (76)

Lease liabilities (922) (922) (902)

Borrowings 18 (299) (298) (298)

Deferred tax liabilities 6 - (1) (1)

Retirement benefit obligations (1) (1) (1)

Provisions for other liabilities and

charges 16 (35) (40) (40)

------------------------------------- ---- ------------- ---------- --------

(1,327) (1,346) (1,318)

------------------------------------- ---- ------------- ---------- --------

Current liabilities

Trade and other payables 15 ( 672 ) (498) (477)

Bank overdrafts 17 (93) (76) (65)

Lease liabilities (236) (217) (221)

Derivative financial liabilities (10) (5) (1)

Income tax liabilities (31) (34) (43)

Provisions for other liabilities and

charges 16 (22) (27) (22)

(1,064) (857) (829)

------------------------------------- ---- ------------- ---------- --------

Total liabilities (2,391) (2,203) (2,147)

------------------------------------- ---- ------------- ---------- --------

Net assets 1,117 1,531 1,539

------------------------------------- ---- ------------- ---------- --------

EQUITY

Capital and reserves attributable

to owners of the Company

Ordinary share capital 19 - - -

Share premium account 230 228 230

Capital reserve 41 41 41

Hedging reserve 3 5 4

Foreign currency translation reserve 216 269 232

Retained earnings 620 982 1,026

------------------------------------- ---- ------------- ---------- --------

Equity attributable to owners of the

Company 1,110 1,525 1,533

Non-controlling interest in equity 7 6 6

------------------------------------- ---- ------------- ---------- --------

Total equity 1,117 1,531 1,539

------------------------------------- ---- ------------- ---------- --------

(1) Balances as at 1 April 2023 have been audited.

CONDENSED GROUP STATEMENT OF CHANGES IN EQUITY - UNAUDITED

Attributable to owners

of the Company

-----------------------------

Ordinary Share

share premium Other Retained Non-controlling Total

capital account reserves earnings Total interest equity

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Balance as at 2 April 2022 - 227 263 1,123 1,613 4 1,617

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Profit for the period - - - 193 193 1 194

Other comprehensive income:

Cash flow hedges - - 1 - 1 - 1

Foreign currency translation

differences - - 52 - 52 1 53

Tax on other comprehensive

income - - (1) - (1) - (1)

Total comprehensive income

for the period - - 52 193 245 2 247

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Transactions with owners:

Employee share incentive

schemes

Equity share awards - - - 10 10 - 10

Equity share awards

transferred

to liabilities - - - (2) (2) - (2)

Exercise of share options - 1 - - 1 - 1

Purchase of own shares

Share buy-back - - - (201) (201) - (201)

Held by ESOP trusts - - - (1) (1) - (1)

Dividends paid in the period - - - (140) (140) - (140)

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Balance as at 1 October 2022 - 228 315 982 1,525 6 1,531

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Balance as at 1 April 2023 - 230 277 1,026 1,533 6 1,539

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Profit for the period - - - 158 158 1 159

Other comprehensive income:

Cash flow hedges - - (1) - (1) - (1)

Foreign currency translation

differences - - (16) - (16) - (16)

Total comprehensive income

for the period - - (17) 158 141 1 142

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

Transactions with owners:

Employee share incentive

schemes

Equity share awards - - - 7 7 - 7

Tax on share awards - - - (2) (2) - (2)

Purchase of own shares

Share buy-back(1) 19 - - - (402) (402) - (402)

Dividends paid in the period 8 - - - (167) (167) - (167)

Balance as at 30 September

2023 - 230 260 620 1,110 7 1,117

------------------------------- ---- -------- -------- --------- --------- ----- --------------- -------

(1) Includes GBP201 million paid in relation to the first share

buy-back programme which commenced and completed in period as well

as GBP201 million included within payables related to the second

share buy-back programme which commenced in the period and

completed in the second half of the year. Refer to note 19.

CONDENSED GROUP STATEMENT OF CASH FLOWS - UNAUDITED

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023(1)

Note GBPm GBPm GBPm

--------------------------------------------------- ---- ------------- ---------- --------

Cash flows from operating activities

Profit before tax 219 251 634

Adjustments to reconcile profit before

tax to net cash flows:

Amortisation of intangible assets 19 18 37

Depreciation of property, plant and equipment 49 45 95

Depreciation of right-of-use assets 111 100 212

COVID-19 related rent concessions - (7) (13)

Net impairment charge of property, plant

and equipment 10 - - 2

Net impairment (reversal)/charge of right-of-use

assets 11 - (1) 2

Loss/(gain) on disposal of property, plant

and equipment and intangible assets 3 (19) (19)

Gain on modification of right-of-use assets (1) - (2)

Loss/(gain) on derivative instruments 14 5 (2)

Charge in respect of employee share incentive

schemes 7 10 19

Net finance expense 4 12 23

Working capital changes:

Increase in inventories (76) (46) (10)

Increase in receivables (58) (53) (17)

Decrease in payables and provisions (20) (26) (49)

--------------------------------------------------- ---- ------------- ---------- --------

Cash generated from operating activities 271 289 912

Interest received 21 5 18

Interest paid (23) (17) (40)

Taxation paid (98) (65) (140)

--------------------------------------------------- ---- ------------- ---------- --------

Net cash generated from operating activities 171 212 750

Cash flows from investing activities

Purchase of property, plant and equipment (64) (35) (136)

Purchase of intangible assets (25) (18) (43)

Proceeds from sale of property, plant

and equipment - 22 32

Initial direct costs of right-of-use assets (1) - -

Net cash outflow from investing activities (90) (31) (147)

Cash flows from financing activities

Dividends paid in the period (167) (140) (203)

Payment of deferred consideration for

acquisition of non-controlling interest 15 - (6) (6)

Payment of lease principal (96) (93) (210)

Issue of ordinary share capital - 1 3

Purchase of own shares through share buy-back (200) (180) (400)

Purchase of own shares through share buy-back

- stamp duty and fees (1) (1) (4)

Purchase of own shares by ESOP trusts - (1) (1)

Net cash outflow from financing activities (464) (420) (821)

Net decrease in cash net of overdrafts (383) (239) (218)

Effect of exchange rate changes (8) 3 2

Cash net of overdrafts at beginning of

period 961 1,177 1,177

--------------------------------------------------- ---- ------------- ---------- --------

Cash net of overdrafts 570 941 961

--------------------------------------------------- ---- ------------- ---------- --------

Cash and cash equivalents 14 663 1,017 1,026

Bank overdrafts 17 (93) (76) (65)

--------------------------------------------------- ---- ------------- ---------- --------

Cash net of overdrafts 570 941 961

--------------------------------------------------- ---- ------------- ---------- --------

(1) Balances for the 52 weeks to 1 April 2023 have been

audited.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. Corporate information

Burberry Group plc and its subsidiaries (the Group) is a global

luxury goods manufacturer, retailer and wholesaler. The Group also

licenses third parties to manufacture and distribute products using

the 'Burberry' trademarks. All of the companies which comprise the

Group are controlled by Burberry Group plc (the Company) directly

or indirectly.

2. Accounting policies and Basis of preparation

Basis of preparation

These condensed consolidated interim financial statements are

unaudited but have been reviewed by the auditors and their report

to the Company is set out on page 36. They were approved by the

Board of Directors on 15 November 2023. These condensed

consolidated interim financial statements do not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. Statutory accounts for the 52 weeks to 1 April

2023 were approved by the Board of Directors on 17 May 2023 and

have been filed with the Registrar of Companies. The report of the

auditors on the statutory accounts for the 52 weeks to 1 April 2023

was unqualified and did not contain a statement under Section 498

of the Companies Act 2006.

These condensed consolidated interim financial statements for

the 26 weeks to 30 September 2023 have been prepared in accordance

with the Disclosure Guidance and Transparency Rules of the

Financial Services Authority and with IAS 34, 'Interim Financial

Reporting' as adopted by the UK. This report should be read in

conjunction with the Group's financial statements for the 52 weeks

to 1 April 2023, which have been prepared in accordance with

UK-adopted International Accounting Standards (IFRS).

These condensed consolidated interim financial statements are

presented in GBPm. Financial ratios are calculated using unrounded

numbers.

Going concern

In considering the appropriateness of adopting the going concern

basis in preparing the financial statements, the Directors have

assessed the potential cash generation of the Group. This

assessment covers the period of a minimum of 12 months from the

date of signing the condensed consolidated interim financial

statements. Therefore, the Directors have considered the forecast

for the period up to the subsequent financial year end, the period

ending 29 March 2025, for any indicators that the going concern

basis of preparation is not appropriate.

The scenarios considered by the Directors include a severe but

plausible downside reflecting the Group's base plan adjusted for

severe but plausible impacts from the Group's principal risks,

which are consistent with the principal risks at 1 April 2023. The

scenarios were informed by a comprehensive review of macroeconomic

scenarios using third party projections of macroeconomic data for

the luxury fashion industry. The Group central planning scenario

reflects a balanced projection with a continued focus on growing

markets and maintaining momentum built as part of the strategy. As

a sensitivity, this central planning scenario has been flexed to

reflect a 15% downgrade to revenues in the 18 month period to March

2025, in comparison to the base case, as well as the associated

consequences for EBITDA and cash. Management consider this

represents a severe but plausible downside scenario appropriate for

assessing going concern.

The severe but plausible downside modelled the following risks

occurring simultaneously:

-- A more severe and prolonged reduction in the GDP growth

assumptions in Europe, China, and the Americas compared to the

central planning scenario

-- An increase in geopolitical tension which reduces GDP growth

assumptions compared to the central planning model

-- A severe reduction to our global consumer demand arising from

a change in consumer preference

-- A significant reputational incident such as negative

sentiment propagated through social media

-- The impact of a business interruption event, following a

technology vulnerability, resulting in a two week interruption in

one of our geographies arising from the supply chain impact, and

interruption to one of our channels

-- The occurrence of a one-time physical risk relating to

climate change in FY 2024/25 and the materialisation of a severe

but plausible ongoing market risk relating to climate change in

line with a scenario reflecting a 2degC global temperature increase

compared to pre-industrial levels

-- The payment of a settlement arising from a regulatory or compliance-related matter

-- A short term impact of a 10% weakening in a key non-sterling

currency for the Group before it is recovered through price

adjustment

Further mitigating actions within management control would be

taken under the severe but plausible scenario, including working

capital reduction measures and limiting capital expenditure or

inorganic acquisition spend, but these were not incorporated into

the downside modelling.

The Directors have also considered the Group's current liquidity

and available facilities. As at 30 September 2023, the Group

balance sheet reflects cash net of overdrafts is GBP570 million. In

addition the Group has access to a GBP300 million Revolving Credit

Facility (RCF), which is currently undrawn and not relied upon for

the purpose of this going concern assessment. The Group is in

compliance with the covenants for the RCF and the borrowings raised

via the sustainability bond are not subject to covenants. Details

of cash, overdrafts, borrowings and facilities are set out in notes

14, 17 and 18 of these financial statements.

In all the scenarios assessed, taking into account liquidity and

available resources and before the inclusion of any mitigating

actions within management control, the Group was able to maintain

sufficient liquidity to continue trading, having considered the

going concern period up to 29 March 2025. On the basis of the

assessment performed, the Directors consider it is appropriate to

continue to adopt the going concern basis in preparing the

condensed consolidated interim financial statements for the period

ended 30 September 2023.

Accounting policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the 52 weeks ended 1 April

2023.

Several standards and amendments apply for the first time for

the period ended 30 September 2023, but do not have a material

impact on the condensed consolidated interim financial statements

of the Group. The Group has not early adopted any standard,

interpretation or amendment that has been issues but is not yet

effective.

Key sources of estimation uncertainty

Preparation of the condensed consolidated interim financial

statements in conformity with IFRS requires that management make

certain estimates and assumptions that affect the measurement of

reported revenues, expenses, assets and liabilities and the

disclosure of contingent liabilities.

If in the future such estimates and assumptions, which are based

on management's best estimates at the date of the financial

statements, deviate from actual circumstances, the original

estimates and assumptions will be updated as appropriate in the

period in which the circumstances change.

Estimates are continually evaluated and are based on historical

experience and other factors, including expectations of future

events that are believed to be reasonable under the circumstances.

The key areas where the estimates and assumptions applied have a

significant risk of causing a material adjustment to the carrying

value of assets and liabilities are consistent with those applied

in the Group's financial statements for the 52 weeks to 1 April

2023, as set out on pages 271 to 272 of those financial

statements.

There have been no changes to the significant estimates relating

to impairment, or reversal of impairment, of property plant and

equipment and right-of-use assets, inventory provisioning or

uncertain tax positions in the period.

Key judgements in applying the Group's accounting policies

Judgements are those decisions made when applying accounting

policies which have a significant impact on the amounts recognised

in the Group's financial statements. Key judgements that have a

significant impact on the amounts recognised in the condensed

consolidated interim financial statements for the 26 weeks to 30

September 2023 and the 26 weeks to 1 October 2022 are as

follows:

Where the Group is a lessee, judgement is required in

determining the lease term at initial recognition, and throughout

the lease term, where extension or termination options exist. In

such instances, all facts and circumstances that may create an

economic incentive to exercise an extension option, or not exercise

a termination option, have been considered to determine the lease

term. Considerations include, but are not limited to, the period

assessed by management when approving initial investment, together

with costs associated with any termination options or extension

options. Extension periods (or periods after termination options)

are only included in the lease term if the lease is reasonably

certain to be extended (or not terminated). Where the lease term

has been extended by assuming an extension option will be

recognised, this will result in the initial right-of-use assets and

lease liabilities at inception of the lease being greater than if

the option was not assumed to be exercised. Likewise, assuming a

break option will be exercised will reduce the initial right-of-use

assets and lease liabilities. There have been no significant

judgements in relation to lease term made in the period. Refer to

note 23 for details of a significant judgement made in relation to

lease term after the balance sheet date.

Translation of the results of overseas businesses

The results of overseas subsidiaries are translated into the

Group's presentation currency of sterling each month at the average

exchange rate for the month, weighted according to the phasing of

the Group's trading results. The average exchange rate is used, as

it is considered to approximate the actual exchange rates on the

dates of the transactions. The assets and liabilities of such

undertakings are translated at the closing rates. Differences

arising on the retranslation of the opening net investment in

subsidiary companies, and on the translation of their results, are

recognised in other comprehensive income.

Goodwill and fair value adjustments arising on the acquisition

of a foreign operation are treated as assets and liabilities of the

foreign operation and translated at the closing rate.

The principal exchange rates used were as follows:

Average rate Closing rate

----------------------------------- ------------------------- --------

26 weeks 26 weeks 52 weeks As at As at As at

to to to 30 September 1 October 1 April

30 September 1 October 1 April 2023 2022 2023

2023 2022 2023

---------------------- ------------- ---------- -------- ------------- ---------- --------

Euro 1.16 1.17 1.16 1.15 1.14 1.14

US Dollar 1.26 1.21 1.20 1.22 1.12 1.24

Chinese Yuan Renminbi 8.97 8.16 8.27 8.90 7.95 8.51

Hong Kong Dollar 9.87 9.50 9.43 9.56 8.76 9.73

Korean Won 1,654 1,579 1,577 1,646 1,598 1,613

---------------------- ------------- ---------- -------- ------------- ---------- --------

Adjusted profit before taxation

In order to provide additional consideration of the underlying

performance of the Group's ongoing business, the Group's results

include a presentation of Adjusted operating profit and Adjusted

profit before taxation (adjusted PBT). Adjusted PBT is defined as

profit before taxation and before adjusting items. Adjusting items

are those items which, in the opinion of the Directors, should be

excluded in order to provide a consistent and comparable view of

the performance of the Group's ongoing business. Generally, this

will include those items that are largely one-off and/or material

in nature as well as income or expenses relating to acquisitions or

disposals of businesses or other transactions of a similar nature,

including the impact of changes in fair value of expected future

payments or receipts relating to these transactions. Adjusting

items are identified and presented on a consistent basis each year

and a reconciliation of adjusted PBT to profit before tax is

included in the financial statements. Adjusting items and their

related tax impacts, as well as adjusting taxation items, are added

back to/deducted from profit attributable to owners of the Company

to arrive at adjusted earnings per share. Refer to note 4 for

further details of adjusting items.

3. Segmental analysis

The Chief Operating Decision Maker has been identified as the

Board of Directors. The Board reviews the Group's internal

reporting in order to assess performance and allocate resources.

Management has determined the operating segments based on the

reports used by the Board. The Board considers the Group's business

through its two channels to market, being retail/wholesale and

licensing.

Retail/wholesale revenues are generated by the sale of luxury

goods through Burberry mainline stores, concessions, outlets and

digital commerce as well as Burberry franchisees, prestige

department stores globally and multi-brand specialty accounts. The

flow of global product between retail and wholesale channels and

across our regions is monitored and optimised at a corporate level

and implemented via the Group's inventory hubs and principal

distribution centres situated in Europe, the US, Mainland China and

Hong Kong S.A.R. China.

Licensing revenues are generated through the receipt of

royalties from global licensees of beauty products, eyewear and

from licences relating to the use of non-Burberry trademarks in

Japan.

The Board assesses channel performance based on a measure of

adjusted operating profit. This measurement basis excludes the

effects of adjusting items. The measure of earnings for each

operating segment that is reviewed by the Board includes an

allocation of corporate and central costs. Interest income and

charges are not included in the result for each operating segment

that is reviewed by the Board.

Retail/Wholesale Licensing Total

----------------------------------------- ------------------------- -------------------------

26 weeks 26 weeks 26 weeks 26 weeks 26 weeks 26 weeks

to to to to to to

30 September 1 October 30 September 1 October 30 September 1 October

2023 2022 2023 2022 2023 2022

GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Retail 1,124 1,061 - - 1,124 1,061

Wholesale 241 263 - - 241 263

Licensing - - 32 22 32 22

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Total segment revenue 1,365 1,324 32 22 1,397 1,346

Inter-segment revenue(1) - - (1) (1) (1) (1)

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Revenue from external

customers 1,365 1,324 31 21 1,396 1,345

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Adjusted operating profit 194 219 29 19 223 238

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Adjusting items(2) - 25

Finance income 20 6

Finance expense (24) (18)

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Profit before taxation 219 251

--------------------------- ------------- ---------- ------------- ---------- ------------- ----------

Retail/Wholesale Licensing Total

---------------- --------- -----

52 weeks to 1 April 2023 GBPm GBPm GBPm

-------------------------------- ---------------- --------- -----

Retail 2,501 - 2,501

Wholesale 543 - 543

Licensing - 51 51

-------------------------------- ---------------- --------- -----

Total segment revenue 3,044 51 3,095

Inter-segment revenue(1) - (1) (1)

-------------------------------- ---------------- --------- -----

Revenue from external customers 3,044 50 3,094

-------------------------------- ---------------- --------- -----

Adjusted operating profit 587 47 634

-------------------------------- ---------------- --------- -----

Adjusting items(2) 21

Finance income 21

Finance expense (42)

-------------------------------- ---------------- --------- -----

Profit before taxation 634

-------------------------------- ---------------- --------- -----

1. Inter-segment transfers or transactions are entered into

under the normal commercial terms and conditions that would be

available to unrelated third parties.

2. Refer to note 4 for details of adjusting items.

Additional revenue analysis

All revenue is derived from contracts with customers. The Group

derives Retail and Wholesale revenue from contracts with customers

from the transfer of goods and related services at a point in time.

Licensing revenue is derived over the period the licence agreement

gives the customer access to the Group's trademarks.

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023

Revenue by product division GBPm GBPm GBPm

---------------------------- ------------- ---------- --------

Accessories 498 495 1,125

Women's 391 357 867

Men's 399 383 868

Children's/Other 77 89 184

---------------------------- ------------- ---------- --------

Retail/Wholesale 1,365 1,324 3,044

Licensing 31 21 50

---------------------------- ------------- ---------- --------

Total 1,396 1,345 3,094

---------------------------- ------------- ---------- --------

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023

Revenue by destination GBPm GBPm GBPm

----------------------- ------------- ---------- --------

Asia Pacific 584 525 1,297

EMEIA(1) 485 445 1,004

Americas 296 354 743

Retail/Wholesale 1,365 1,324 3,044

Licensing 31 21 50

----------------------- ------------- ---------- --------

Total 1,396 1,345 3,094

----------------------- ------------- ---------- --------

1. EMEIA comprises Europe, Middle East, India and Africa.

Due to the seasonal nature of the business, Group revenue is

usually expected to be higher in the second half of the year than

in the first half. While some of the Group's operating costs are

also higher in the second half of the year, such as contingent

rentals and sales related employee costs, most of the operating

costs, in particular salaries and fixed rentals, are phased more

evenly across the year. As a result, adjusted operating profit is

expected to be higher in the second half of the financial year.

4. Adjusting items

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023

GBPm GBPm GBPm

-------------------------------------------------- -------------- ---------- --------

Adjusting items

Adjusting operating items

Impact of COVID-19:

Impairment reversal relating to retail cash

generating units - - (6)

Impairment reversal relating to inventory - (1) (1)

COVID-19 related rent concessions - (7) (13)

COVID-19 related government grant income - (1) (2)

Other adjusting items:

Gain on disposal of property - (19) (19)

Restructuring costs - 1 16

Revaluation of deferred consideration liability - 2 2

Total adjusting operating items (pre-tax) - (25) (23)

-------------------------------------------------- -------------- ---------- --------

Adjusting financing items

Finance charge on adjusting items - - 2

Total adjusting financing items (pre-tax) - - 2

-------------------------------------------------- -------------- ---------- --------

Tax on adjusting items - 6 6

-------------------------------------------------- -------------- ---------- --------

Total adjusting items (post-tax) - (19) (15)

-------------------------------------------------- -------------- ---------- --------

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023

GBPm GBPm GBPm

----------------------------------------------- -------------- ---------- --------

Analysis of adjusting operating items:

Included in Cost of sales (Impairment reversal

relating to inventory) - (1) (1)

Included in Operating expenses - 3 12

Included in Other operating income - (27) (34)

Total adjusting operating items - (25) (23)

----------------------------------------------- -------------- ---------- --------

No adjusting items have been recorded for the 26 weeks to 30

September 2023. Adjusting items related to prior periods were as

follows:

Impact of COVID-19

Impairment of retail cash generating units

During the 52 weeks to 1 April 2023, a net impairment reversal

of GBP6 million, and an associated tax charge of GBP1 million, was

recorded following the reassessment of the COVID related impairment

provision. Any charges or reversals from the reassessment of the

original impairment adjusting item, had they arisen, would have

been included in this adjusting item. Refer to note 10 for details

of impairment consideration of retail cash generating units.

Impairment of inventory

During the 26 weeks to 1 October 2022 and the 52 weeks to 1

April 2023, reversals of inventory provisions of GBP1 million were

recorded and presented as adjusting items. This was relating to

inventory which had been provided for as an adjusting item at the

previous year end and had either been sold, or was expected to be

sold, at a higher net realisable value than had been assumed when

the provision had been initially estimated. All other charges and

reversals relating to inventory provisions have been recorded in

adjusted operating profit.

COVID-19-related rent concessions

Eligible rent forgiveness amounts relating to COVID-19 were

treated as negative variable lease payments, which resulted in a

credit of GBP7 million for the 26 weeks to 1 October 2022 and GBP13

million for the 52 weeks to 1 April 2023 recorded in other

operating income. This income was presented as an adjusting item

given that the amendment to IFRS 16 was only applicable for a

limited period of time and it explicitly related to COVID-19. The

amendment expired on 30 June 2022 however the Group continued to

apply the same accounting treatment applying the principles of IFRS

9 for any ongoing COVID-19 related rent forgiveness. A related tax

charge of GBP1 million and GBP3 million was also recognised in the

last half year and full year respectively.

COVID-19-related government grant income

The Group recorded grant income of GBP1 million for the 26 weeks

to 1 October 2022 and GBP2 million for the 52 weeks to 1 April 2023

relating to government support to alleviate the impact of COVID-19

within other operating income. This income was presented as an

adjusting item as it was explicitly related to COVID-19, and the

arrangements were expected to last for a limited period of time. A

related tax charge of GBPnil and GBP1 million was also recognised

in the last half year and full year respectively.

Other adjusting items

Gain on disposal of property

During the 26 weeks to 1 October 2022, the Group completed the

sale of an owned property in the US for cash proceeds of GBP22

million resulting in a net gain on disposal of GBP19 million,

recorded within other operating income. The net gain on disposal

was recognised as an adjusting item, in accordance with the Group's

accounting policy, as it was considered to be material and one-off

in nature. A related tax charge of GBP5 million was also recognised

in the last half year and full year.

Restructuring costs

During the 26 weeks to 1 October 2022, restructuring costs of

GBP1 million (last full year: GBP16 million) were incurred, arising

primarily as a result of the organisational efficiency programme

announced in July 2020, which completed last year, that included

the creation of three new business units to enhance product focus,

increase agility and elevate quality and to further streamline of

office-based functions and facilities. The costs principally

related to impairment charges on non-retail assets and redundancies

and were recorded in operating expenses. They were presented as an

adjusting item, in accordance with the Group's accounting policy,

as the cost of the restructuring programme was considered material

and discrete in nature. A related tax credit of GBPnil and GBP4

million was also recognised in the last half year and full year

respectively.

Items relating to the deferred consideration liability

On 22 April 2016, the Group entered into an agreement to

transfer the economic right of the non-controlling interest in

Burberry Middle East LLC to the Group in exchange for consideration

of contingent payments to be made to the minority shareholder over

the period ending 30 March 2024.

No charge in relation to the revaluation of this balance has

been recognised in operating expenses for the 26 weeks to 30

September 2023 (last half year: GBP2 million; last full year: GBP2

million). No tax was recognised as the future payments are not

considered to be deductible for tax purposes. This was presented as

an adjusting item in accordance with the Group's accounting policy,

as it arose from changes in the value of the liability for expected

future payments relating to the purchase of a non-controlling

interest in the Group.

5. Financing

26 weeks 26 weeks 52 weeks

to to to

30 September 1 October 1 April

2023 2022 2023

GBPm GBPm GBPm

------------------------------------------------- ------------- ---------- --------

Finance income - amortised cost 4 1 3

Bank interest income - fair value through profit

and loss 16 5 18

Finance income 20 6 21

Interest expense on lease liabilities (19) (14) (31)

Interest expense on overdrafts (2) - (2)

Interest expense on borrowings (2) (2) (4)

Bank charges (1) (1) (1)

Other finance expense - (1) (4)

------------------------------------------------- ------------- ---------- --------