TIDMCCJI

RNS Number : 2199D

CC Japan Income & Growth Trust PLC

20 June 2023

CC JAPAN INCOME & GROWTH TRUST PLC

LEI: 549300FZANMYIORK1K98

HALF-YEARLY FINANCIAL REPORT ANNOUNCEMENT

FOR THE SIX MONTHSED 30 APRIL 2023

INVESTMENT OBJECTIVE, FINANCIAL INFORMATION AND PERFORMANCE

SUMMARY

INVESTMENT OBJECTIVE

The investment objective of the Company is to provide

shareholders with dividend income combined with capital growth,

mainly through investment in equities listed or quoted in

Japan.

FINANCIAL INFORMATION

At At

30 April 31 October

2023 2022

--------------------------------------------------- ----------- ------------

Net assets GBP222.0m GBP203.6m

--------------------------------------------------- ----------- ------------

Net asset value ("NAV") per Ordinary Share

("Share") (1) 164.8p 151.1p

--------------------------------------------------- ----------- ------------

Share price 153.5p 138.8p

--------------------------------------------------- ----------- ------------

Share price discount to NAV(2) 6.9% 8.1%

--------------------------------------------------- ----------- ------------

Transferable Subscription Share price(3) n/a 0.53p

--------------------------------------------------- ----------- ------------

Annualised Ongoing charges(2) 1.05% 1.06%

--------------------------------------------------- ----------- ------------

Gearing (net)(2) 20.0% 20.9%

--------------------------------------------------- ----------- ------------

(1) Measured on a cum income basis.

(2) This is an Alternative Performance Measure ("APM"). Definitions

of APMs used in this report, together with how these measures have been

calculated are disclosed in this report.

(3) The life of the Company's Transferable Subscription Shares expired

on 28 February 2023 and the listing was cancelled on 15 March 2023.

PERFORMANCE SUMMARY

For the six For the six months

months to to

30 April 30 April

2023 2022

NAV ex-income total return per Share(1,2) +12.3% -2.1%

---------------------------------------------- ------------- -------------------

NAV cum-income total return per Share(1,2) +11.3% -0.7%

---------------------------------------------- ------------- -------------------

Share price total return(1,2) +13.1% -3.7%

---------------------------------------------- ------------- -------------------

Tokyo Stock Exchange Price Index ("Topix")

total return(1) +9.5% -7.8%

---------------------------------------------- ------------- -------------------

Revenue return per Share(1) 2.66p 2.37p

---------------------------------------------- ------------- -------------------

First interim dividend per Share(1) 1.55p 1.40p

---------------------------------------------- ------------- -------------------

(1) Total returns are stated in GBP sterling, including dividend reinvested.

(2) These are APMs.

Source: Coupland Cardiff Asset Management LLP - The Company's Factsheet

April 2023.

CHAIRMAN'S STATEMENT

Performance

Against a backdrop of turbulent world markets during the first

half of the financial year to 30 April 2023 your Company has

recorded positive total returns . For the six months under review,

the Net Asset Value ("NAV") cum income increased by 11.3% while the

share price, again measured by total return rose by 13.1%,

handsomely beating the TOPIX Total Return Index which rose 9.5%. A

second interim dividend of 3.50p per Ordinary Share was paid in

March 2023.

Since inception in December 2015, the cum income NAV has risen

by 103.5% while the Ordinary Share price, including dividends

distributed, has risen by 87.3%. Indeed, income distributions have

represented over 30.0% of our total return over this time. Again,

these results have comfortably outperformed the TOPIX Total Return

Index, which we use for reference, and which has risen by 73.1%

since our launch. Dividends paid to Shareholders over this period

amount to 28.95p per Ordinary Share, representing seven years of

successive dividend growth totalling 63.3%.

Although global stock markets made a steady recovery from

October 2022 lows, the failure of three regional banks in the USA

caused a sharp selloff in March 2023 on concerns of contagion. In

Japan, the banking system is robust, and in your Investment

Manager's view, the risk of deposit flight is negligible. The newly

appointed Governor of the Bank of Japan ("BOJ"), Ueda-San was a

surprise choice to replace the retiring Kuroda-San. Monetary policy

remains accommodating even if the new Governor is laying the

groundwork towards some normalisation of policy. Conversely,

tightening monetary policies throughout the rest of the developed

world led by the Federal Reserve in the USA have consequences for

not only credit but the potential level of global stock markets and

asset prices. Japan is an outlier and liquidity levels remain

supportive of asset and stock prices.

Growing the Company

It is disappointing to report that the Transferable Subscription

Shares ("TSS") issued as a 1 for 5 free bonus to Ordinary

Shareholders in February 2021 expired worthless on the last

business day of February 2023. The issue was designed as an

opportunity for Shareholders to participate in any post Covid-19

normalisation of the Japanese economy. Unfortunately, subsequent

world events and markets conspired against the scheme which could

have raised up to GBP40 million for the Company. While the Ordinary

Share price traded above the Subscription Price level on several

occasions, the level was never sustained to facilitate their

exercise. Your Board is still intent on growing the Company. The

Ordinary Shares closed the period on a discount of 6.9% to NAV. The

Board and Managers are hopeful that with the lapse of the TSS

rights, sustained investment performance and dividend growth will

provide the potential to regain our premium share price. This would

allow resumption of tap issuance. Your Investment Managers and

brokers, Peel Hunt, run a co-ordinated marketing programme to raise

awareness and profile of the Company. It is gratifying to see that

the results of their efforts and the use of media distribution have

resulted in the broadening of our Shareholder base with more retail

Shareholders coming onto our register through the platforms. The

website has been revamped and it is easy to follow us at

www.ccjapanincomeandgrowthtrust.com . The excellent monthly

newsletter is a good way of monitoring progress.

Income & Interim Dividend

Net revenue increased by nearly 12.4% in the first half of the

year, compared with the same period last year. The Board has

declared a first interim dividend of 1.55p per Ordinary Share, an

increase of 10.7% over last year, payable on 4 August 2023 to those

Shareholders recorded on the register as at 7 July 2023 with an

ex-dividend date of 6 July 2023.

Outlook

While inflation is not so rampant in Japan compared to many

other countries, it continues to broaden and climb with core

inflation running at over 3.4%. This should encourage domestic

flows back to the stock market which offers higher yields compared

to the zero return on bank deposits. Surprisingly, local investors

are still selling into strength with the TOPIX hitting a 33 year

high up 10.1% in sterling terms in the calendar year to the end of

April 2023. However, foreign investors are returning, attracted by

economic trends, policy developments, attractive stock valuations

and not least extensive media and press coverage hailing that the

long bear market in Japan is finally over. Certainly, Warren Buffet

has recently highlighted the growing attractions of Japan and has

increased the stakes in the five trading companies that Berkshire

Hathaway first acquired in 2020. The trend of returning cash to

shareholders through share buy backs and dividends has been further

stimulated by recent announcements by the Tokyo Stock Exchange

("TSE") and Japan's Financial Services Agency ("FSA"). Their

measures are designed to accelerate the restructuring of the many

companies that trade below book value, while encouraging greater

balance sheet efficiencies and radical overhaul of capital

allocation. This is all evidence of a continuing and refreshing

commitment to corporate governance reform.

The economy is increasingly gaining traction post the pandemic

and with China's reopening in January 2023. We are seeing increased

confidence in corporate earnings and consistent improvement in the

level of dividend distributions across our holdings in the

portfolio. Against this, the growing disparity of interest rates

between sterling and the yen continues to put pressure on the

currency cross rate, reducing Japanese income on translation to

sterling if the yen continues to weaken.

Continued geopolitical tension especially between China and the

USA in addition to the unpredictability of the North Korean regime,

also remains a risk. Providing that these tensions do not worsen,

the outlook for Japan is increasingly rosy, particularly for

investors who recognise that income is a critical component of

total return, which encapsulates our mandate.

Your Board has every confidence in Richard Aston and his team to

continue to produce good results by holding and identifying

attractive companies across a broad spectrum. There is no shortage

of investment opportunity in Japan.

Harry Wells

Chairman

19 June 2023

INVESTMENT MANAGER'S REPORT

The Company's NAV cum-income rose by 11.3.% on a total return

basis for the six months ended 30 April 2023. This return includes

a second interim dividend of 3.50p, a 4.5% increase over the second

interim dividend of the previous year. This extends the track

record of consecutive annual dividend increases that the Company

has established since inception in December 2015 and is firm

evidence of the underlying improvement in corporate governance in

Japan.

This strong performance has come at a time of significant

geopolitical, economic and operational uncertainties and the

current reporting period has been no exception. However, there are

signs that current developments in international relations and

global monetary policy, as well as the ongoing improvements in

corporate governance, are beginning to define a new era for Japan.

Certainly, the retirement of Bank of Japan ("BOJ") Governor,

Haruhiko Kuroda after a ten-year tenure as the head of the Central

Bank, and at a time when deflationary forces he set out to overcome

are easing, creates a very different backdrop for his successor,

Kazuo Ueda.

The outgoing Governor retained his capacity to surprise right to

the end with the unexpected announcement following the BOJ December

Policy Meeting that the board had decided to expand the range in

which long term policy rates (10 year Japanese Government Bond

yields) will be allowed to fluctuate. This was the first reversal

of the easy monetary policies established in the Joint Statement by

the Government of Shinzo Abe and the BOJ in 2013.

While this shift is modest in comparison to the increase of

interest rates around the world, it does indicate that even in

Japan, the process of normalisation of monetary policy has begun.

This proved a significant boost to the bank holdings in the

portfolio, Sumitomo Mitsui Financial Group and Mitsubishi UFJ

Financial Group, which made notable positive contributions to

performance despite a sell-off in March 2023 following the

turbulence of regional bank failures in the US.

The largest positive contribution to return was Socionext, a new

holding established at its Initial Public Offering ("IPO") in

October 2022. This company designs and develops System on Chip

("SoC") solutions for a range of industries with particular

emphasis on opportunities in mobile communications, next generation

automobiles and applications in artificial intelligence. This was

the first IPO we had chosen to participate in for a number of years

due to concerns about the appropriateness, strategy and valuation

of many new listings. Socionext satisfied our requirements for

financial strength, management quality and attention to shareholder

return which gave us the confidence to invest. We believe that the

new issue market is an important source of potential investment

opportunities but will continue to exercise prudence.

There was notable weakness in the shares of many domestically

focussed companies despite the steady removal of Covid-19

restrictions and the reopening of international borders to inbound

visitors. In response to rising inflation it appears that many

companies have initially sought to control their costs by reducing

demand for online advertising (Carta Holdings), market research

(Intage) and even recruitment (Dip, TechnoPro). We do not believe

that the short-term reversal of well-established trends will affect

the expectations for these companies as the Japanese economy

responds to the challenges ahead.

Portfolio Positioning

The global outlook remains uncertain with economic trends across

the major regions as well as international relations very

unpredictable. These uncertainties increase the importance of

identifying investment opportunities based on their individual

characteristics, both in an operational context, and from a

valuation perspective. We own a portfolio of companies across a

broad range of industries, which we believe individually each have

the same underlying attributes of business growth opportunities

combined with financial strength, management quality and a

commitment to shareholder return. This mitigates some of the risks

for a patient investor.

Portfolio activity seeks to benefit from the volatility that the

uncertainties create, and this has seen new positions established

in Socionext (Semiconductor design), Nissan Chemical (performance

materials and agrochemicals), Jaccs (consumer financial services)

and EnJapan (online recruiting services). The Company has also

added to positions in Nippon Parking Development, Mitsubishi UFJ

Financial Group, Noevir and Technopro into recent share price

weakness. The holding in Toyota Motor has been reduced

significantly while TRE Holdings, SB Technology and Industrial

Infrastructure REIT have been eliminated entirely as in each case

concerns have emerged on the ability of the company to deliver

rising shareholder returns over the medium-term.

Outlook

We believe that Japanese equities currently offer investors a

compelling combination of ongoing considerations that warrant

attention from even the most diehard detractors, not least the

domestic individual investor. The favourable current economic

momentum, stable political environment, supportive policy

initiatives, corporate governance reforms and valuation appeal have

created a potent force which builds on the steady market

foundations established in the years that preceded the Covid-19

pandemic.

Fiscal Year 2022 to the end of March 2023 saw aggregate

dividends and share buybacks authorised by listed companies both

hit record highs. Despite this very positive outcome resulting from

developments highlighted to date, the opportunity for further

growth is very clear given the high level of dividend cover and

overall financial health of Japanese companies. Raising awareness

of capital efficiency is a key component of the recent initiatives

announced by the Tokyo Stock Exchange and Japan's Financial

Services Agency and these can be expected to underpin the

additional improvements that investors seek and ultimately enhance

the exciting investment potential of the much-maligned Japanese

equity market.

Richard Aston

Coupland Cardiff Asset Management LLP

19 June 2023

TOP TEN SECTORS AND HOLDINGS

AS AT 30 APRIL 2023

TOP 10 SECTORS % of net

Sector assets

------------------------------ ----------

Information & Communications 13.1

Electrical Appliances 13.1

Chemicals 12.3

Banks 10.9

Services 8.4

Wholesale 6.3

Insurance 6.3

Transport Equipment 5.6

Securities & Commodities 4.9

Other Financing Business 4.4

------------------------------ ----------

Top Ten 85.3

------------------------------ ----------

Other Sectors* 12.7

------------------------------ ----------

Other net assets 2.0

------------------------------ ----------

Total 100.0

------------------------------ ----------

* Other Sectors comprise of 4 sectors, which individually, is

less than 4.2% each of the net assets.

TOP 10 EQUITY HOLDINGS

% of net

Company Sector assets

------------------------------ ------------------------------ ---------

Sumitomo Mitsui Financial

Group Banks 5.9

Mitsubishi UFJ Financial

Group Banks 5.0

Nippon Telegraph & Telephone Information & Communications 4.7

Socionext Electrical Appliances 4.6

Itochu Wholesale 3.9

Shin-Etsu Chemical Chemicals 3.6

Softbank Information & Communications 3.5

Sompo Holdings Insurance 3.5

SBI Holdings Securities & Commodities 3.4

Noevir Holdings Chemicals 3.2

------------------------------ ------------------------------ ---------

Top Ten 41.3

-------------------------------------------------------------- ---------

Other equity holdings n/a 56.7

------------------------------ ------------------------------ ---------

Total holdings 98.0

-------------------------------------------------------------- ---------

Other net assets 2.0

-------------------------------------------------------------- ---------

Total 100.0

-------------------------------------------------------------- ---------

TOP TEN CONTRACTS FOR DIFFERENCE (CFDs)

Absolute

Absolute value Market

as a %

value of Value

Company Sector GBP'000 net assets GBP'000

------------------------------ ------------------------------ --------- ----------- --------

Sumitomo Mitsui Financial

Group Banks 2,616 1.2 757

Mitsubishi UFJ Financial

Group Banks 2,212 1.0 441

Nippon Telegraph & Telephone Information & Communications 2,079 0.9 504

Socionext Electrical Appliances 2,057 0.9 1,145

Itochu Wholesale 1,749 0.8 452

Shin-Etsu Chemical Chemicals 1,596 0.7 25

Softbank Information & Communications 1,546 0.7 33

Sompo Holdings Insurance 1,535 0.7 185

SBI Holdings Securities & Commodities 1,528 0.7 (191)

Noevir Holdings Chemicals 1,405 0.6 (2)

------------------------------ ------------------------------ --------- ----------- --------

Top Ten CFDs 18,323 8.2 3,349

-------------------------------------------------------------- --------- ----------- --------

Other CFDs n/a 25,197 11.4 (567)

------------------------------ ------------------------------ --------- ----------- --------

Total CFDs 43,520 19.6 2,782

-------------------------------------------------------------- --------- ----------- --------

INTERIM MANAGEMENT REPORT

The Directors are required to provide an Interim Management

Report in accordance with the Financial Conduct Authority ("FCA")

Disclosure Guidance and Transparency Rules. The Chairman's

Statement and the Investment Manager's Report in this half-yearly

financial report provide details of the important events which have

occurred during the period and their impact on the financial

statements. The following statements on principal and emerging

risks and uncertainties, related party transactions, going concern

and the Directors' Responsibility Statement, together, constitute

the Interim Management Report for the Company for the six months

ended 30 April 2023. The outlook for the Company for the remaining

six months of the year ending 31 October 2023 is discussed in the

Chairman's Statement and the Investment Manager's Report.

PRINCIPAL AND EMERGING RISKS AND UNCERTAINTIES

The Board is responsible for the management of risks faced by

the Company and delegates this role to the Audit and Risk Committee

(the "Committee"). The Committee carries out, at least annually, a

robust assessment of principal and emerging risks and uncertainties

and monitors the risks on an ongoing basis.

The Committee has a dynamic risk management register in place to

help identify key risks in the business and oversee the

effectiveness of internal controls and processes. The risk

management register and associated risk heat map provide a visual

reflection of the Company's identified risks, including principal

and emerging risks. The Company's risks fall into three

categories:

-- Strategic and Business risks, including investment

performance, market, geopolitical and leverage risk;

-- Operational and Financial risks, including cyber and business interruption; and

-- Regulatory and Compliance risks, including climate change.

The Committee considers both the impact and the probability of

each risk occurring and ensures appropriate controls are in place

to reduce risk to an acceptable level. A detailed explanation of

the principal and emerging risks and uncertainties to the Company

are detailed in the Company's most recent Annual Report for the

year ended 31 October 2022, which can be found on the Company's

website at www.ccjapanincomeandgrowthtrust.com .

Since the publication of the 2022 Annual Report and Accounts on

24 January 2023, there continues to be increased risk levels within

the global economy. The ongoing conflict in Ukraine, the subsequent

impact on global economies, deteriorating international relations

and increasing levels of inflation worldwide have undoubtedly

raised investment risk. Rising interest rates and mismatches in

asset liability pricing have led to the failure of three US banks

and created fears of global contagion. The Board closely monitors

and assesses these continued uncertainties as to how they could

impact and effect the Company's trading position apropos our

investment objectives, portfolio and thus our Shareholders and

where appropriate endeavour to mitigate the risk.

RELATED PARTY TRANSACTIONS

The Company's Investment Manager is Coupland Cardiff Asset

Management LLP. Coupland Cardiff Asset Management LLP is considered

a related party under the Listing Rules. The Investment Manager is

entitled to receive a management fee payable monthly in arrears at

the rate of one-twelfth of 0.75% of Net Asset Value per calendar

month. Investment management fees paid during the six-month period

to 30 April 2023 were GBP824,000. There is no performance fee

payable to the Investment Manager. There have been no changes to

the related party transactions that could have a material effect on

the financial position or performance of the Company since the year

ended 31 October 2022. Further information can be found in note 12

to the financial statements.

GOING CONCERN

The Board has a reasonable expectation that the Company has

adequate resources to continue in operational existence for at

least twelve months from 19 June 2023. In reaching this conclusion,

the Directors have considered the liquidity of the Company's

portfolio of investments as well as its cash position, income, and

expense flows. The Company's net assets as at 30 April 2023 were

GBP222 million (30 April 2022: GBP217.0 million). As at 30 April

2023, the Company held GBP217.6 million (30 April 2022: GBP213.9

million) in quoted investments. In addition, as at 30 April 2023,

the Company had gross exposure to Contracts for Difference of

GBP43.5 million (30 April 2022: GBP42.8 million). The total

expenses (excluding finance costs and taxation) for the six months

ended 30 April 2023 were GBP1.2 million (30 April 2022: GBP1.2

million). The Company has a GBP12 million (or its equivalent in

Japanese yen) bank overdraft facility with Northern Trust Company

and as at 30 April 2023, GBP0.9 million (30 April 2022: GBP1.9

million) had been utilised on the Japanese yen bank account.

As part of their assessment, the Board has performed stress

testing and liquidity analysis on the Company's portfolio of

investments, giving careful consideration to the consequences for

the Company of continuing uncertainties in the global economy and

increased geo political tension worldwide A prolonged and deep

global or Japanese stock market decline would lead to a fall in

investment values.

The Company currently has sufficient liquidity available to meet

any future obligations.

DIRECTORS' RESPONSIBILITY STATEMENT

The Disclosure Guidance and Transparency Rules (DTR) of the UK

Listing Authority require the Directors to confirm their

responsibilities in relation to the preparation and publication of

the Interim Management Report and Financial Statements.

The Directors confirm to the best of their knowledge that:

-- This set of unaudited condensed financial statements

contained within the half-yearly financial report has been prepared

in accordance with FRS 104 Interim Financial Reporting and the

Statement of Recommended Practice "Financial Statements of

Investment Companies and Venture Capital Trusts" issued by the

Association of Investment Companies issued in July 2022 ("AIC

SORP").

-- This Interim Management Report, together with the Chairman's

Statement and Investment Manager's Report, includes a fair review

of the information required by 4.2.7R and 4.2.8R of the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Harry Wells

Chairman

For and on behalf of the Board of Directors

19 June 2023

UNAUDITED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

SIX MONTHS TO 30 APRIL 2023

Six months to 30 Six months to 30 Year ended 31 October

April 2023 April 2022 2022*

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----- ---------------------- -------------------- ---------------------- ----------------- ------------- ------------- ---------------------- ---------------------- ---------------------

Gains/(losses)

on investment - 20,330 20,330 - (3,791) (3,791) - (18,118) (18,118)

Currency

(losses)/gains - (2) (2) - 55 55 - (209) (209)

Income 4 4,581 - 4,581 4,141 - 4,141 8,878 - 8,878

Investment

management

fee (163) (652) (815) (167) (669) (836) (327) (1,306) (1,633)

Other expenses (343) - (343) (327) - (327) (664) - (664)

Return on

ordinary

activities

before

finance costs

and taxation 4,075 19,676 23,751 3,647 (4,405) (758) 7,887 (19,633) (11,746)

Finance costs 5 (35) (87) (122) (43) (98) (141) (69) (185) (254)

Return on

ordinary

activities

before

taxation 4,040 19,589 23,629 3,604 (4,503) (899) 7,818 (19,818) (12,000)

Taxation 6 (455) - (455) (414) - (414) (888) - (888)

Return on

ordinary

activities

after

taxation 3,585 19,589 23,174 3,190 (4,503) (1,313) 6,930 (19,818) (12,888)

---------------- ----- ---------------------- -------------------- ----------------- ------------- ---------------------- ---------------------- ---------------------

Return per

Ordinary

Share -

undiluted 10 2.66p 14.54p 17.20p 2.37p (3.34)p (0.97)p 5.14p (14.71)p (9.57)p

---------------- ----- ---------------------- -------------------- ---------------------- ----------------- ------------- ------------- ---------------------- ---------------------- ---------------------

Return per

Ordinary

Share -

diluted 10 n/a** n/a** n/a** 1.97p (2.79)p (0.82)p 4.29p (12.26)p (7.97)p

---------------- ----- ---------------------- -------------------- ---------------------- ----------------- ------------- ------------- ---------------------- ---------------------- ---------------------

*Audited

** The life of the Company's Transferable Subscription Shares expired on

28 February 2023.

The total column of the above statement is the profit and loss account of

the Company. All revenue and capital items in the above statement derive

from continuing operations.

Both the supplementary revenue and capital columns are both prepared under

guidance from the Association of Investment Companies. There is no other

comprehensive income and therefore the return for the period is also the

total comprehensive income for the period.

The notes form part of these interim financial statements.

UNAUDITED CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 30 APRIL 2023

30 April 30 April 31 October

2023 2022 2022*

Note GBP'000 GBP'000 GBP'000

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Fixed assets

Investments at fair value through

profit or loss 3 217,592 213,896 199,642

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Current assets

Cash and cash equivalents - - 1,413

Cash collateral in respect of Contracts

for Difference ("CFDs") 486 43 433

Amounts due in respect of CFDs 5,063 2,311 2,680

Other debtors 4,168 3,260 4,434

9,717 5,614 8,960

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Creditors: amounts falling due within

one year

Cash and cash equivalents - Bank overdraft (2,240) (226) -

Amounts payable in respect of CFDs (2,280) (1,659) (2,780)

Other creditors (749) (581) (2,240)

(5,269) (2,466) (5,020)

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Net current assets 4,448 3,148 3,940

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Total assets less current liabilities 222,040 217,044 203,582

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Net assets 222,040 217,044 203,582

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

Capital and reserves

Share capital 8 1,348 1,348 1,348

Share premium 98,067 98,067 98,067

Special reserve 64,671 64,671 64,671

Capital reserve

* Revaluation gains on investment held at period end 21,671 19,673 5,841

* Other capital reserve 29,941 27,665 26,182

Revenue reserve 6,342 5,620 7,473

Total Shareholders' funds 222,040 217,044 203,582

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

NAV per share - Ordinary Shares -

undiluted (pence) 11 164.80p 161.09p 151.10p

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

NAV per share - Ordinary Shares -

diluted (pence) 11 n/a** 161.08p 152.75p

--------------------------------------------------------------------------------------------- ---------- -------------------- -------------------------- --------------------------------------------------

*Audited

** The life of the Company's Transferable Subscription Shares expired

on 28 February 2023.

Approved by the Board of Directors and authorised for issue on 19 June

2023 and signed on their behalf by:

Harry Wells

Director

CC Japan Income & Growth Trust plc is incorporated in England and Wales

with registration number 9845783.

The notes form part of these interim financial statements.

UNAUDITED CONDENSED STATEMENT OF CHANGES IN EQUITY

SIX MONTHS TO 30 APRIL 2023

Share Share Special Capital Revenue

capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ---------- -------------------------- ---------------- ----------------- ---------------------------- -------------------------------- ---------------------

Balance at 1 November

2022 1,348 98,067 64,671 32,023 7,473 203,582

Return on ordinary

activities after taxation - - - 19,589 3,585 23,174

Dividends paid - - - (4,716) (4,716)

Balance at 30 April

2023 1,348 98,067 64,671 51,612 6,342 222,040

----------------------------------- ---------- -------------------------- ---------------- ----------------- ---------------------------- -------------------------------- ---------------------

SIX MONTHS TO 30

APRIL 2022

Share Share Special Capital Revenue

capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ---------- -------------------------- ---------------- ----------------- ---------------------------- -------------------------------- ---------------------

Balance at 1 November

2021 1,348 98,067 64,671 51,841 6,943 222,870

Return on ordinary

activities after taxation - - - (4,503) 3,190 (1,313)

Dividends paid - - - - (4,513) (4,513)

Balance at 30 April

2022 1,348 98,067 64,671 47,338 5,620 217,044

----------------------------------- ---------- -------------------------- ---------------- ----------------- ---------------------------- -------------------------------- ---------------------

Year ended 31 October

2022 (Audited)

Share Share Special Capital Revenue

capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ---------- -------------------------- ---------------- ----------------- ---------------------------- -------------------------------- ---------------------

Balance at 1 November

2021 1,348 98,067 64,671 51,841 6,943 222,870

Return on ordinary

activities after taxation - - - (19,818) 6,930 (12,888)

Dividends paid - - - - (6,400) (6,400)

Balance at 31 October

2022 1,348 98,067 64,671 32,023 7,473 203,582

----------------------------------- ---------- -------------------------- ---------------- ----------------- ---------------------------- -------------------------------- ---------------------

The Company's distributable reserves consist of the Special reserve,

Revenue reserve and Capital reserve attributable to realised profits.

The notes form part of these interim financial statements.

UNAUDITED CONDENSED STATEMENT OF CASH

FLOWS

SIX MONTHS TO 30 APRIL 2023

Six months Six months Year ended

to 30 April to 30 April 31 October

2023 2022 2022*

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------- ------------- ------------

Operating activities cash flows

Return on ordinary activities before finance

costs and taxation** 23,751 (758) (11,746)

Adjustment for:

(Gains)/losses on investments (17,383) 4,631 18,106

Movement in CFD transactions (2,936) (1,008) (646)

Increase/(decrease) in other debtors (546) 31 (6)

Increase in other creditors 144 132 3

Tax withheld on overseas income (455) (414) (888)

------------- ------------- ------------

Net cash flow from operating activities 2,575 2,614 4,823

---------------------------------------------- ------------- ------------- ------------

Investing activities cash flows

Purchases of investments (27,622) (18,053) (43,572)

Proceeds from sales of investments 26,232 19,912 46,864

Net cash flow (used in)/from investing

activities (1,390) 1,859 3,292

---------------------------------------------- ------------- ------------- ------------

Financing activities cash flows

Equity dividends paid (4,716) (4,513) (6,400)

Finance costs paid (122) (138) (254)

Net cash used in financing activities (4,838) (4,651) (6,654)

(Decrease)/Increase in cash and cash

equivalents (3,653) (178) 1,461

------------- ------------- ------------

Cash and cash equivalents at the beginning

of the period 1,413 (48) (48)

Cash and cash equivalents at the end

of the period (2,240) (226) 1,413

---------------------------------------------- ------------- ------------- ------------

*Audited

** Inflow from cash dividends received were GBP3,612,000 (30 April 2022:

GBP3,758,000 and 31 October 2022: GBP8,038,000).

The notes form part of these interim financial statements.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. GENERAL INFORMATION

CC Japan Income & Growth Trust plc (the "Company") was

incorporated in England and Wales on 28 October 2015 with

registered number 9845783, as a closed-ended investment company.

The Company commenced its operations on 15 December 2015 and, on

the same day, trading of the Ordinary Shares commenced on the

London Stock Exchange, with t he Company's shares admitted to the

Official List of the UK Listing Authority with a premium listing.

The Company carries on business as an investment trust within the

meaning of Chapter 4 of Part 24 of the Corporation Tax Act

2010.

The Company's investment objective is to provide Shareholders

with dividend income combined with capital growth, mainly through

investment in equities listed or quoted in Japan.

The principal activity of the Company is that of an investment

trust company within the meaning of section 1158 of the Corporation

Tax Act 2010.

The Company's registered office is 6(th) Floor, 125 London Wall,

London, EC2Y 5AS.

2. ACCOUNTING POLICIES

The interim financial statements have been prepared in

accordance with FRS 104 Interim Financial Reporting and the

Statement of Recommended Practice "Financial Statements of

Investment Trust Companies and Venture Capital Trusts" issued by

the Association of Investment Companies in July 2022.

This half-yearly Financial Report is unaudited and does not

include all the information required for full annual financial

statements. The half-yearly Financial Report should be read in

conjunction with the Annual Report and Accounts of the Company for

the year ended 31 October 2022. The Annual Report and Accounts for

the year ended 31 October 2022 were prepared in accordance with FRS

102 The Financial Reporting Standard applicable in the UK and

Republic of Ireland ("FRS 102") and received an unqualified audit

report. The financial information for the year ended 31 October

2022 in this half-yearly Financial Report has been extracted from

the audited Annual Report and Accounts for that year end. The

accounting policies in this Half-yearly Financial Report are

consistent with those applied in the Annual Report and Accounts for

the year ended 31 October 2022.

The interim financial statements have been presented in GBP

sterling (GBP).

3. INVESTMENTS

As at 31

As at 30 As at 30 October

April 2023 April 2022 2022

(Unaudited) (Unaudited) (Audited)

----------------------------------- --------- ---------------------- ---------------------- ----------------------

GBP'000 GBP'000 GBP'000

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Investments listed on a recognised

overseas investment exchange 217,592 213,896 199,642

----------------------------------- ---------------------- ----------------------

217,592 213,896 199,642

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Fair Value Measurements of Financial Assets and Financial Liabilities

The financial assets and liabilities are either carried in the balance

sheet at their fair value, or the balance sheet amount is a reasonable

approximation of fair value (due from brokers, dividends receivable,

accrued income, due to brokers, accruals and cash and cash equivalents).

The valuation techniques for investments and derivatives used by the

Company are explained in the accounting policies notes 2 (b and c) in

the Annual report for the year ended 31 October 2022.

The table below sets out fair value measurements using fair value hierarchy.

Level 1 Level 2 Level 3 Total

30 April 2023 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Assets:

Equity investments 217,592 - - 217,592

CFDs - Unrealised fair value

gains - 5,063 - 5,063

Liabilities:

CFDs - Unrealised fair value

losses - (2,280) - (2,280)

----------------------------------- --------- ---------------------- ----------------------

Total 217,592 2,783 - 220,375

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Level 1 Level 2 Level 3 Total

30 April 2022 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Assets:

Equity investments 213,896 - - 213,896

CFDs - Unrealised fair value

gains - 2,311 - 2,311

Liabilities:

CFDs - Unrealised fair value

losses - (1,659) - (1,659)

----------------------------------- --------- ---------------------- ----------------------

Total 213,896 652 - 214,548

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Level 1 Level 2 Level 3 Total

31 October 2022 (Audited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Assets:

Equity investments 199,642 - - 199,642

CFDs- Unrealised fair value

gains - 2,680 - 2,680

Liabilities:

CFDs - Unrealised fair value

losses - (2,780) - (2,780)

----------------------------------- --------- ---------------------- ---------------------- ----------------------

Total 199,642 (100) - 199,542

----------------------------------- --------- ---------------------- ---------------------- ----------------------

There were no transfers between levels during the period (2022: same).

Categorisation within the hierarchy has been determined on the basis

of the lowest level input that is significant to the Fair Value measurement

of the relevant asset as follows:

Level 1 - valued using quoted prices in active markets for identical

assets.

Level 2 - valued by reference to valuation techniques using observable

inputs including quoted prices.

Level 3 - valued by reference to valuation techniques using inputs that

are not based on observable market data. There are no Level 3 investments

as at 30 April 2023 (2022: nil).

4. INCOME

Six months Six months Year ended

to 30 April to 30 April 31 October

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

----------------------------------- --------- ---------------------- ---------------------- ----------------------

GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------------------- ---------------------- ----------------------

Income from investments:

Overseas dividends 4,552 4,141 8,878

Deposit interest 29 - -

Total 4,581 4,141 8,878

---------------------------------------------- ---------------------- ---------------------- ----------------------

Overseas dividend income is translated into sterling on receipt.

5. FINANCE COSTS

Six months Six months Year ended

to 30 April to 30 April 31 October

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

--------------------------------- ----------- ------------- ------------- ------------

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------- ------------- ------------

Interest paid - 100% charged to revenue 13 19 23

CFD finance cost and structuring fee -

20% charged to revenue 22 24 45

Structuring fees - 20% charged to revenue - - 1

------------- ------------- ------------

35 43 69

---------------------------------------------- ------------- ------------- ------------

CFD finance cost and structuring fee -

80% charged to capital 87 96 181

Structuring fees - 80% charged to capital - 2 4

------------- ------------- ------------

87 98 185

---------------------------------------------- ------------- ------------- ------------

Total finance costs 122 141 254

---------------------------------------------- ------------- ------------- ------------

6. TAXATION

Six months to 30 Six months to 30

April 2023 April 2022

(Unaudited) (Unaudited)

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ --------- ---------- --------- ---------- -------- ----------

Analysis of tax charge in the

period:

Overseas withholding tax 455 - 455 414 - 414

--------- ---------- --------- ---------- --------

Total tax charge for the period 455 - 455 414 - 414

------------------------------------------ --------- ---------- --------- ---------- -------- ----------

Year ended 31 October

2022

(Audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

------------------------------------------ --------- ---------- ---------

Analysis of tax charge in the

year:

Overseas withholding tax 888 - 888

--------- ----------

Total tax charge for the year 888 - 888

------------------------------------------ --------- ---------- ---------

7. INTERIM DIVID

During the six months ended 30 April 2023, the Company paid a dividend

of 3.50p per Ordinary Share in respect of the year ended 31 October

2022.

These interim financial statements have been prepared in accordance

with the requirements of section 838 of the Companies Act 2006 and constitute

the Company's interim accounts for the purpose of justifying the payment

of an interim dividend for the year ending 31 October 2023.

The Directors have declared an interim dividend for the six months ended

30 April 2023 of 1.55p (2022: 1.40p) per Ordinary Share. The dividend

will be paid on 4 August 2023, to Ordinary Shareholders who appear on

the register as at the close of business on 7 July 2023. The Ordinary

Shares will go ex-dividend on 6 July 2023 and the dividend will be funded

from the Company's Revenue reserve.

8. SHARE CAPITAL

Share capital represents the nominal value of shares that have been

issued. The share premium includes any premium received on issue of

share capital. Any transaction costs associated with the issuing of

shares are deducted from share premium.

As at 30 April 2023 As at 30 April 2022

(Unaudited) (Unaudited)

No. of shares GBP'000 No. of shares GBP'000

-------------------------------- -------------- -------- -------------- --------

Allotted, issued & fully paid:

Ordinary Shares of 1p

Opening balance 134,730,610 1,348 134,730,610 1,348

-------------- -------- -------------- --------

Closing balance 134,730,610 1,348 134,730,610 1,348

-------------------------------- -------------- -------- -------------- --------

As at 31 October

2022 (Audited)

No. of shares GBP'000

-------------------------------- -------------- --------

Allotted, issued & fully paid:

Ordinary Shares of 1p

Opening balance 134,730,610 1,348

-------------- --------

Closing balance 134,730,610 1,348

-------------------------------- -------------- --------

Since the period end, the Company has issued no further Ordinary Shares,

with 134,730,610 Ordinary Shares in issue as at 19 June 2023.

9. FINANCIAL COMMITMENTS

As at 30 April 2023 there were no commitments in respect of unpaid calls

and underwritings (30 April 2022: nil and 31 October 2022: nil).

10. RETURN PER ORDINARY SHARE

Total return per Ordinary Share is based on the return on

ordinary activities, including income, for the period after

taxation of GBP23,174,000 (30 April 2022: GBP1,313,000 and 31

October 2022: GBP12,888,000) and the weighted average number of

Ordinary Shares in issue for the period to 30 April 2023 of

134,730,610 (30 April 2022: 134,730,610 and 31 October 2022:

134,730,610); Ordinary Shares-diluted in issue for the period/year

to 30 April 2022/31 October 2022 respectively of 161,676,732.

The returns per Ordinary Share were as follows:

As at 30 April 2023 As at 30 April 2022 As at 31 October

2022

(Unaudited) (Unaudited) (Audited)

----------------- -------------------------------- ---------------------------------- -----------------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

----------------- -------- ---------- ---------- -------- ---------- ------------ ---------- --------- ------------

Return per

Ordinary

Share-undiluted 2.66p 14.54p 17.20p 2.37p (3.34)p (0.97)p 5.14p (14.71)p (9.57)p

----------------- -------- ---------- ---------- -------- ---------- ------------ ---------- --------- ------------

Return per

Ordinary

Share-diluted* n/a n/a n/a 1.97p (2.79)p (0.82)p 4.29p (12.26)p (7.97)p

----------------- -------- ---------- ---------- -------- ---------- ------------ ---------- --------- ------------

* This table shows the effect of dilution on returns had the Transferable

Subscription Shares ("TSS") been exercised in full. However, the TSS expired

on the last business day of February 2023 and none were exercised so there

was no dilution of Ordinary Shares.

11. NET ASSET VALUE PER SHARE

Total shareholders' funds and the NAV per share attributable to the Ordinary

Shareholders at the period end calculated in accordance with the Articles

of Association were as follows:

NAV per Ordinary Share - undiluted

As at As at As at 31 October

30 April 2023 30 April 2022 2022

(Unaudited) (Unaudited) (Audited)

Net Asset Value (GBP'000) 222,040 217,044 203,582

Ordinary Shares in issue 134,730,610 134,730,610 134,730,610

----------------------------------------------- ------------------ -------------------------- ------------------------

NAV per Ordinary Share - undiluted 164.80p 161.09p 151.10p

----------------------------------------------- ------------------ -------------------------- ------------------------

NAV per Ordinary Share - diluted

As at As at As at 31 October

30 April 2023 30 April 2022 2022

(Unaudited) (Unaudited) (Audited)

Subscription shares issue - 26,946,122 26,946,122

Proceeds from exercise of TSS

(GBP'000) - 43,383 43,383

Adjusted NAV for exercise of

TSS (GBP'000) 222,040 260,427 246,965

Ordinary Shares - post exercise

of TSS 134,730,610 161,676,732 161,676,732

----------------------------------------------- ------------------ -------------------------- ------------------------

NAV per Ordinary Share - diluted 164.80p 161.08p 152.75p

----------------------------------------------- ------------------ -------------------------- ------------------------

12. RELATED PARTY TRANSACTIONS

Transactions with the Investment Manager and the Alternative

Investment Fund Investment Manager ("AIFM")

The Company provides additional information concerning its

relationship with the Investment Manager and AIFM, Coupland Cardiff

Asset Management LLP. Investment Management fees for the six-month

period ended 30 April 2023 were GBP824,000 (30 April 2022:

GBP836,000 and 31 October 2022: GBP1,633,000). The Investment

Management fees outstanding at the period ended 30 April 2023 were

GBP136,000 (30 April 2022: GBP133,000 and 31 October 2022:

GBP134,000).

Research purchasing agreement

The Markets in Financial Instruments Directive II ("MiFID II")

treats investment research provided by brokers and independent

research providers as a form of "inducement" to investment managers

and requires research to be paid separately from execution costs.

In the past, the costs of broker research were primarily borne by

the Company as part of execution costs through dealing commissions

paid to brokers. With effect from 3 January 2018, this practice has

changed, as brokers subject to MiFID II are now required to price,

and charge for, research separately from execution costs. Equally,

the rules require the Investment Manager, as an investment Manager,

to ensure that the research costs borne by the Company are paid for

through a designated Research Payment Account ("RPA") funded by

direct research charges to the Investment Manager's clients,

including the Company.

The research charge for the year 1 January 2023 to 31 December

2023, as agreed between the Investment Manager and the Company, was

$34,000 (31 December 2022: $34,000).

Directors' fees and shareholdings

Directors' fees are payable at the rate of GBP27,000 per annum

for each Director other than the Chairman, who is entitled to

receive GBP40,500. The Chairman of the Audit and Risk Committee is

also entitled to an additional fee of GBP5,500 per annum and the

Senior Independent Director ("SID") is entitled to an additional

fee of GBP1,000 per annum.

The Directors had the following ordinary shareholdings in the

Company, all of which were beneficially owned.

Ordinary

Ordinary Ordinary Shares

Shares as Shares as as at 31

at 30 April at 30 April October

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

--------------------- ------------- ------------- ----------

Harry Wells 40,000 40,000 40,000

Peter Wolton 67,250 67,250 67,250

Kate Cornish-Bowden 50,000 40,000 40,000

June Aitken 41,251 40,000 40,372

Craig Cleland 40,000 40,000 40,000

--------------------- ------------- ------------- ----------

13. POST BALANCE SHEET EVENTS

There are no post balance sheet events other than as disclosed

in this half-yearly financial report.

14. STATUS OF THIS REPORT

These interim financial statements are not the Company's

statutory accounts for the purposes of section 434 of the Companies

Act 2006. They are unaudited. The half-yearly financial report will

be made available to the public at the registered office of the

Company.

The report will also be available on the Company's website

www.ccjapanincomeandgrowthtrust.com

The information for the year ended 31 October 2022 has been

extracted from the last published audited financial statements,

unless otherwise stated. The audited financial statements have been

delivered to the Registrar of Companies. The Auditors reported on

those accounts and their report was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under sections 498(2) or 498(3) of the Companies Act

2006.

GLOSSARY AND ALTERNATIVE PERFORMANCE MEASURES ('APM')-

Administrator

The Company's administrator, the current such administrator

being Apex Listed Companies Services (UK) Limited. Apex Group

acquired Sanne Group in August 2022 and subsequently the name of

the Company's Administrator and Company Secretary changed from

Sanne Fund Services (UK) Limited to Apex Listed Companies Services

(UK) Limited.

AIC

Association of Investment Companies.

Alternative Investment Fund or "AIF"

An investment vehicle under AIFMD. Under AIFMD (see below) the

Company is classified as an AIF.

Alternative Investment Fund Managers' Directive or "AIFMD"

The UK version of a European Union Directive which came into

force on 22 July 2013 and which is part of UK law by virtue of the

European Union (Withdrawal) Act 2018, as amended by The Alternative

Investment Fund Managers (Amendment etc.) (EU Exit) Regulations

2019.

Alternative Performance Measure or "APM"

A financial measure of historical or future financial

performance, financial position, or cash flows, other than a

financial measure defined or specified in the applicable financial

reporting framework.

Annual General Meeting or "AGM"

A meeting held once a year, which Shareholders are entitled to

attend, and where they can vote on resolutions to be put forward at

the meeting and ask Directors questions about the Company.

CFD or Contract for Difference

A financial instrument, which provides exposure to an underlying

equity with the provider financing the cost to the buyer with the

buyer receiving the difference of any gain or paying for any

loss.

Cum Dividend

A dividend that has been declared but not yet paid out.

Custodian

An entity that is appointed to safeguard a company's assets.

Depositary

Certain AIFs must appoint depositaries under the requirements of

AIFMD. A depositary's duties include, inter alia, safekeeping of

the Company's assets and cash monitoring. Under AIFMD the

depositary is appointed under a strict liability regime. The

Company's Depositary is Northern Trust Investor Services Limited

(with effect from 27 November 2021).

Dividend

Income receivable from an investment in shares.

Discount (APM)

The amount, expressed as a percentage, by which the share price is less

than the NAV per Ordinary Share.

As at 30 April 2023

----------------------------------------- ----------------------- ----------

NAV per Ordinary Share a 164.8

Share price b 153.5

Discount (b÷a)-1 6.9%

------------------------------------------ ------------------------ ----------

Ex-dividend date

The date from which you are not entitled to receive a dividend

which has been declared and is due to be paid to Shareholders.

Financial Conduct Authority or "FCA"

The independent body that regulates the financial services

industry in the UK.

Gearing (APM)

A way to magnify income and capital returns, but which can also magnify

losses. The Company may be geared through the CFDs and if utilised, the

overdraft facility, with The Northern Trust Company.

As at 30 April 2023 GBP'000

---------------------------------- ----------------- ----------- --------- -----------

CFD Notional Market Value* a 43,520

Non-base cash borrowings** b 861

NAV c 222,040

Gearing (net) ((a+b)/c) 20.0%

-------------------------------------------- ---------------------- ------ -----------

* CFD positions in underlying asset

value.

** Non-base cash borrowings represents

borrowings in Yen

Gross assets (APM)

The Company's total assets including any leverage amount.

Index

A basket of stocks which is considered to replicate a particular

stock market or sector.

Investment trust

A closed end investment company which is based in the United

Kingdom ("UK") and which meets certain tax conditions which enables

it to be exempt from UK corporation tax on its capital gains. This

Company is an investment trust.

Leverage (APM)

Under the Alternative Investment Fund Managers Directive ("AIFMD"),

leverage is any method by which the exposure of an Alternative Investment

Fund ("AIF") is increased through borrowing of cash or securities or

leverage embedded in derivative positions.

Under AIFMD, leverage is broadly similar to gearing, but is expressed

as a ratio between the assets (excluding borrowings) and the net assets

(after taking account of borrowing). Under the gross method, exposure

represents the sum of the Company's positions after deduction of cash

balances, without taking account of any hedging or netting arrangements.

Under the commitment method, exposure is calculated without the deduction

of cash balances and after certain hedging and netting positions are

offset against each other.

Under both methods the AIFM has set current maximum limits of leverage

for the Company of 200%.

Gross Commitment

As at 30 April 2023 GBP'000 GBP'000

------------------------------------ --------------- ------------ --------------

Security Market value a 217,592 217,592

CFD Notional market value b 43,520 43,520

Cash and cash equivalents c 3,732 1,719

NAV d 222,040 222,040

Leverage (a+b+c)/d 119% 118%

------------------------------------- -------------- ------------ --------------

Market liquidity

The extent to which investments can be bought or sold at short

notice.

Net assets

An investment company's assets less its liabilities.

Net Asset Value (NAV) per Ordinary Share

Net assets divided by the number of Ordinary Shares in issue

(excluding any shares held in treasury).

Net exposure

The difference between the Company's long positions and short

positions

Ordinary Shares

Ordinary shares of GBP0.01 each in the capital of the

Company.

Ongoing charges (APM)

A measure, expressed as a percentage of average NAV, of the regular,

recurring annualised costs of running an investment company.

Period ended 30 April 2023

--------------------------------------- ---------------- ----------------

Average NAV a 221,537,147

Annualised expenses b 2,316,000

Ongoing charges (b÷a) 1.05%

---------------------------------------- ----------------- ----------------

Portfolio

A collection of different investments constructed and held in

order to deliver returns to Shareholders and to spread risk.

Share Premium to Net Asset Value (APM)

The amount, expressed as a percentage, by which the share price

is more than the Net Asset Value per share.

Share buyback

A purchase of a company's own shares. Shares can either be

bought back for cancellation or held in treasury.

Share Price

The price of a share as determined by buyers and sellers on the

relevant stock exchange.

Treasury shares

A company's own shares held in Treasury account by the Company,

but which are available to be resold in the market.

Total return (APM)

A measure of performance that includes both income and capital returns.

This takes into account capital gains and reinvestment of dividends paid

out by the Company into its Ordinary Shares on the ex-dividend date.

Period ended 30 April 2023 Share price NAV

------------------------------------------- --------- ---------------- --------

Opening at 1 November 2022 (in

pence) a 138.8 151.1

Closing at 30 April 2023 (in

pence) b 153.5 164.8

Price movement (b÷a)-1 c 10.6% 9.1%

Dividend reinvestment* d 2.5% 2.2%

Total return (c+d) 13.1% 11.3%

------------------------------------------- ---------- ---------------- --------

* The dividend reinvestment is calculated on the assumption that

dividends paid out by the Company are reinvested into the shares of

the Company at NAV at the ex-dividend date.

Volatility

A measure of how much a share moves up and down in price over a

period of time.

COMPANY INFORMATION

DIRECTORS, INVESTMENT MANAGER AND ADVISERS

DIRECTORS INVESTMENT MANAGER

Harry Wells (Chairman) Coupland Cardiff Asset Management

Kate Cornish-Bowden (Audit & Risk LLP

Committee Chair) 31-32 St James's Street

Peter Wolton (Senior Independent Director) London

June Aitken SW1A 1HD

Craig Cleland Website - www.couplandcardiff.com

BROKER REGISTERED OFFICE*

Peel Hunt LLP 6(th) Floor

100 Liverpool Street 125 London Wall

London London

EC2M 2AT EC2Y 5AS

DEPOSITARY AND CUSTODIAN COMPANY SECRETARY AND ADMINISTRATOR

Northern Trust Investor Services Limited Apex Listed Companies Services

50 Bank Street (UK) Limited

London 6(th) Floor, 125 London Wall

E14 5NT London

EC2Y 5AS

Website - www.apexgroup.com

REGISTRAR AUDITOR

Link Group Johnston Carmichael LLP

10th Floor Central Square 7-11 Melville Street

29 Wellington Street Edinburgh

Leeds EH3 7PE

LS1 4DL

LEGAL ADVISER

Stephenson Harwood LLP

1 Finsbury Circus,

London

EC2M 7SH

COMPANY SECURITY INFORMATION AND IDENTIFICATION CODES

WEBSITE www.ccjapanincomeandgrowthtrust.com

ISIN GB00BYSRMH16

SEDOL BYSRMH1

BLOOMBERG TICKER CCJI LDN

LEGAL ENTITY IDENTIFIER (LEI) 549 300 FZANMYIORK 1K98

GLOBAL INTERMEDIARY IDENTIFICATION 6 HEK HT - 99 999 -SL - 826

NUMBER (GIIN)

* Registered in England no. 9845783

For further information contact:

Apex Listed Companies Services (UK) Limited

Tel: 020 3327 9270

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VKLFFXQLBBBV

(END) Dow Jones Newswires

June 20, 2023 02:00 ET (06:00 GMT)

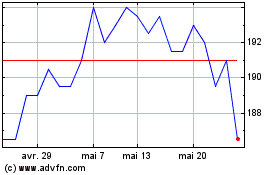

Cc Japan Income & Growth (LSE:CCJI)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Cc Japan Income & Growth (LSE:CCJI)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024