Interim Results

22 Novembre 2000 - 8:00AM

UK Regulatory

RNS Number:5078U

CML Microsystems PLC

22 November 2000

CML Microsystems Plc

Interim Results for the

Six months ended 30th September 2000

CML Microsystems Plc, the group which designs, manufactures

and markets a range of semiconductors for use in the

communications industry, announces Interim results for the

six months ended 30th September 2000.

* Turnover from continuing Businesses up 35% from #7.829m to

#10.598m.

* Pre-tax profits from continuing Businesses up 84% from

#1.324m to #2.444m.

* EPS for the six months of 11.17p compared to 10.73p for

the full year ended 31st March 2000.

* Net cash reserves of #9.19m at the interim stage.

* George Gurry, Chairman, said "The market areas that were

most successfully addressed by the Group's products

included wireless data terminals, subscriber-line telecom

functions and personal/private radio communication. There

was a significant market interest for the specialised voice

coding products that the Group offers.

* "I believe that your Company is making satisfying progress in

its performance and I am hopeful that it should continue to do

so. Subject to unforeseen circumstances, I feel confident

that the results for this year can be expected to show a firm

increase."

For further information:

Nigel Clark Lulu Bridges / Sarah Landgrebe

CML Microsystems Plc Tavistock Communications

Tel: 01621 875 500 Tel: 020 7600 2288

CHAIRMAN'S STATEMENT

The results for the opening six-month period show a healthy

gain over the results for each six-month period of last year,

and are indicative of the continuing increase in your

Company's performance that my earlier remarks anticipated

should characterise this current year.

Given the conventions for reporting the figures at this

interim stage, you may find it helpful if my comments include

some context for the disposal of the Group's traffic business

that took place during the comparative reporting period.

On a continuing business's basis, Group sales show a 35% rise

(1999: #7.829m) over the comparative period and operating

profit grew by 78% (1999: #1.227m). A gain of 84% is recorded

at the pre-tax level, assisted by the increase in interest

earnings.

As the reported figures show, the Group's net cash reserves

stood at #9.19m at the interim stage (2000 year end: #6.85m),

and basic earnings per share have risen to 11.27p (10.73p per

share earned for the previous full year).

The Group's operating companies were each successful in

gaining a notable increase in sales into their market

territories during the opening half, although no marked

increase was recorded for the UK market. It is an

increasingly established fact for the Group's business that

end-sales do not necessarily reflect the territory where the

key design-in decisions are reached by or on behalf of the

Group's customers.

The market areas that were most successfully addressed by the

Group's products included wireless data terminals, subscriber-

line telecom functions and personal/private radio

communication. There was a significant market interest for

the specialised voice coding products that the Group offers.

The Group has been active in the design and introduction of a

number of new products that are unlikely to deliver benefit

before next year.

I believe that your Company is making satisfying progress in

its performance and I am hopeful that it should continue to do

so. Subject to unforeseen circumstances, I feel confident

that the results for this year can be expected to show a firm

increase.

G W Gurry

CHAIRMAN

22nd November 2000

CML Microsystems Plc

Interim Statement for the half year

ended 30th September 2000

Group Profit and Loss Account

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

End End End

30/09/00 30/09/99 31/03/00

#'000 #'000 #'000

Turnover 10,598 9,821 19,751

------ ------ ------

Operating Profit 2,191 538 2,462

Exceptional item - (556) (556)

------ ------ ------

Profit/(Loss) on Ordinary

Activities before Interest

and Taxation 2,191 (18) 1,906

Interest Receivable 253 97 247

Interest Payable - (18) (18)

------ ------ ------

Profit on Ordinary

Activities before Taxation 2,444 61 2,135

Taxation (826) (473) (617)

------ ------ ------

Profit/(Loss) on Ordinary

Activities after Taxation 1,618 (412) 1,518

Minority Interest 1 (1) (14)

------ ------ ------

Profit/(Loss) Attributable

to Shareholders 1,619 (413) 1,504

====== ====== ======

Basic Earnings/(Loss)

Per Share 11.27p (2.97)p 10.73p

====== ====== ======

CML Microsystems Plc

Interim Statement for the half year

ended 30th September 2000

Group Balance Sheet

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

End End End

30/09/00 30/09/99 31/03/00

#'000 #'000 #'000

Fixed Assets

Tangible Assets 9,535 9,905 9,817

------ ------ ------

Current Assets

Stocks 2,594 1,313 1,681

Debtors 3,411 3,229 3,014

Investments 6,389 1,843 3,893

Cash at Bank & in Hand 2,803 2,211 2,958

------ ------ ------

15,197 8,596 11,546

Creditors: Amounts falling due

within one year 4,703 2,260 3,856

------ ------ ------

Net Current Assets 10,494 6,336 7,690

------ ------ ------

Deferred Taxation - 82 6

------ ------ ------

Net Assets 20,029 16,159 17,501

====== ====== ======

Capital & Reserves

Called up Share Capital 730 696 716

Share Premium Account 3,223 2,349 2,802

Capital Redemption Reserve 255 255 255

Profit & Loss Account 15,798 12,849 13,704

------ ------ ------

Shareholders' Funds 20,006 16,149 17,477

Minority Interests 23 10 24

------ ------ ------

20,029 16,159 17,501

====== ====== ======

CML Microsystems Plc

Interim Statement for the half year

ended 30th September 2000

Group Cash Flow Statement

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

End End End

30/09/00 30/09/99 31/03/00

#'000 #'000 #'000

Net cash in flow from

operating activities 3,050 1,338 3,783

Returns on investments

and servicing

of finance 254 80 229

Taxation (282) (468) (564)

Capital expenditure and

financial investment (328) (263) (574)

Equity dividends paid (1,217) (974) (974)

------ ------ ------

Net cash in/(out) flow

before financing 1,477 (287) 1,900

Financing 435 - 473

------ ------ ------

Increase/(decrease)

in cash 1,912 (287) 2,373

====== ====== ======

Notes:

Comparative Results

The actual results for the year to 31st March 2000 as shown in

this statement are an abridged version of the company's 2000

accounts which have been filed with the Registrar of

Companies. The report of the auditors on the 2000 accounts

was unqualified. Results for the six months ending 30/09/99

are the unaudited figures published in the Interim Statement

dated 24th November 1999.

Exceptional Item

The exceptional item is the net loss on the disposal of the

Group's interest in Microsense Systems Limited which was

completed on 26th August 1999.

Taxation

The Directors consider that tax will be payable at varying

rates according to the country of incorporation of a

subsidiary and have provided on that basis.

Earnings Per Share

The calculation of earnings per share is based on the profit

attributable to shareholders for the period and on a weighted

average number of shares of 14,367,032 shares (1999 -

13,918,818 shares).

The calculation of earnings per share for the year ended 31st

March 2000 was based on a weighted average number of

14,013,840 shares.

This statement will be sent to shareholders and will be

available from the Company's registered office: Oval Park,

Langford, Essex CM9 6WG.

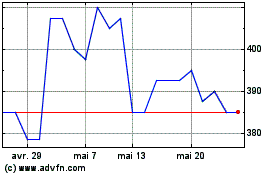

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024