RNS Number:1578Y

CML Microsystems PLC

12 June 2007

CML MICROSYSTEMS Plc

PRELIMINARY RESULTS

Loss broadly in line with market expectations

CML Microsystems Plc ("CML"), which designs, manufactures and markets a range of

integrated circuits (ICs) for global industrial, professional and consumer

applications within the areas of wireless communication, wireline communication,

storage and networking, with operations based in the UK, Germany, the US,

Singapore, China and Taiwan announces its Preliminary Results for the year

ending 31st March 2007.

Commenting on the results, George Gurry, Chairman said:

"As foreshadowed when reporting on the interim results and the outlook for the

second half, the results for the full year ended 31 March 2007 reflect the

material losses posted for each of the six month trading periods ... the loss is

broadly in line with market expectations for the year."

Financial Summary

* Turnover of #17.77m (2006: #26.33m)

* Loss before tax of #3.21m (2006: Profit before tax of #3.49m)

* Loss per share of 17.53p (2006: Earnings per share of 17.68p)

* Cash in bank and at hand of #3m

* Dividend of 5p per share (2006: 10.5p), payable 3 August 2007

Regarding prospects, George Gurry, Chairman said:

"The opening months of the current year are generally on or slightly ahead of

operating targets, although firm progress will most likely not become evident

before the second half. Action to address the product availability delays of

last year will only begin to bite in coming months.

"I am disappointed with the full year results but encouraged that steps to

tackle issues under management control will bear effect. I am confident,

subject to unforeseen circumstances, in expecting a firm improvement in

performance for this current year, including clear visibility of the point when

the Group will return to profitability."

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com

Nigel Clark, Financial Director 020 7479 7933 (today)

Chris Gurry, Business Development Director 01621 875500 (thereafter)

Parkgreen Communications Ltd 020 7479 7933

Paul McManus 07980 541 893

Ben Knowles 07900 346 978

Chairman's Statement

Introduction

As foreshadowed when reporting on the interim results and the outlook for the

second half, the results for the full year ended 31 March 2007 reflect the

material losses posted for each of the six month trading periods.

The losses at the operating level were much as had been forecast internally, and

arising from the product introduction delays and lost customer issues referred

to in my interim statement, but the overall reported loss is increased under the

new accounting and reporting standards. Notwithstanding that, the loss is

broadly in line with market expectations for the year.

Results

Group revenues amounted to #17.77m (2006: #26.33m) for the year, the decline

attributable largely to the serious reduction in product shipments to a key

customer within the consumer storage market area.

A loss before taxation of #3.21m (2006: Profit before taxation #3.49m) was

recorded although it can be noted that a weaker dollar along with amortisation

and pensions adjustments were significant contributing factors.

The posted loss per share of 17.53p was better than market expectations although

down on the prior year (2006: earnings per share 17.68p).

Cash flow was negative during the year and cash balances reduced by #2.7m

following a #3.2m loss before taxation and the payment of a #1.6m dividend.

Dividend

Your directors have considered the material loss and negative cash flow recorded

for the year just ended, and the pressure that has been placed on cash reserves

and working capital, and they believe it is appropriate to ensure that resources

should be prioritised towards ensuring a return to profitability for your

Company.

The Board has confidence that your Company can achieve its planned progress in

this current year, and is recommending payment of a dividend of 5p per ordinary

share (2006: 10.5p per ordinary share) to be payable on 3rd August 2007 to

shareholders registered on 6th July 2007.

Prospects

The opening months of the current year are generally on or slightly ahead of

operating targets, although firm progress will most likely not become evident

before the second half. Action to address the product availability delays of

last year will only begin to bite in coming months.

I am disappointed with the full year results but encouraged that steps to tackle

issues under management control will bear effect. I am confident, subject to

unforeseen circumstances, in expecting a firm improvement in performance for

this current year, including clear visibility of the point when the Group will

return to profitability.

The progress of any business is always dependent on the quality and dedication

of the people it employs. I am confident that our employees are motivated

towards the success of the Group and its return to profit and the Board wish to

thank the employees worldwide for their dedication and support through the year.

G W Gurry

Chairman

12th June 2007

Business Review

This year can be characterised by good progress with a number of the Company's

growth plans, coupled with certain disappointments that significantly impacted

financial improvement over the prior year.

On a market segmental basis, performance during the year was mixed:

Wireless

A significant reduction in revenues from products shipped into the very low cost

analogue leisure radio market was partially countered by growth in application

areas for voice privacy and digital radio markets. The Company benefited from

historic investments in this area and voice privacy IC shipments for military

digital radios along with revenues from wireless data IC's for telemetry systems

exceeded those that were planned.

Revenues from shipments to professional analogue radio manufacturers continued

to grow and steady progress with customer design-in activity occurred. It is

noteworthy that growth continued in this historic analogue segment alongside

that seen within the newer digital radio markets where the Company is also well

placed and has been active for some years.

Adoption of products based upon the Company's proprietary FirmASIC technology

was encouraging and production volumes began shipping towards the year-end.

Time-to-market with products based upon this technology improved noticeably.

Wireline Telecom

Far-East data modem IC stocking issues were cleared and revenue levels moved

ahead as expected. Shipments of products to manufacturers within the wireless

local loop / fixed wireless terminal markets were particularly pleasing, despite

pricing pressure. It should be noted that business levels with certain customers

within this market sub-segment continue to exhibit uncertainty due to the bid

and tender process that is a pre-requisite to any significant contract awards.

As noted at the interim period, the Company achieved good progress with its

strategy of expanding product integration, reducing time to market and improving

commercial competitiveness.

Storage

In the consumer storage area, revenues were impacted by the decision of the

single largest Group customer to exit the flash memory card market. This

situation was unexpected as we began the year, and occurred whilst the customer

base in the storage segment was relatively low, and during a period where these

customers were in the process of designing-in Group products or in the early

production phase.

This event was unfortunate but has to be considered along with the fact that the

Company intends to become a major player in certain sub-sectors of the storage

market, and volatility can be experienced during the early stages of the growth

phase whilst customer concentration is high.

Outside of the consumer memory card markets, progress was on track and

penetration of the customer base for solid-state drives (SSD) was significant.

SSD storage devices offer a number of benefits over magnetic media for certain

applications such as faster access times, lower current consumption, higher

operating temperatures and improved reliability. The Company has extensive

experience, a strong patent and technology portfolio and world-class products in

this area that all contributed to a noteworthy revenue increase during the year.

Networking

Shipments of IC's into networking applications fell slightly year on year. This

is an area where R&D investment has been substantial and the reduction in

revenues masked the underlying progress that was made and reflected the typical

delay from new product introduction through to customer volume production phase.

Revenues from older, less integrated products fell whilst shipments of newer

technology IC's released to production at the beginning of the year began to

increase as the year-end approached. Investment in the development of support

tools for these new IC's along with reference designs for target market

applications continued.

In a year where revenues have reduced dramatically as a direct result of

unexpected issues associated with a single customer, it is appropriate to

reiterate that during the year the Group had no single customer who represented

more than ten percent of Group revenues and only one customer who represented

more than five percent of Group revenues.

Margins

Gross margins within the Group's historical markets of wireline telecom and

wireless were held at previous year levels and, with the reduction in revenues

experienced within the storage market, the overall gross profit margin improved

slightly to 62% (2006 - 60%). Product delays within consumer storage application

areas contributed to increased pricing pressure towards the year-end.

Overheads

During the year, the majority of customer transactions were in US dollars. The

Group had a partial natural hedge due to significant raw material purchases

being made in US dollars and no further hedging arrangements were entered into.

The weakening of the US dollar had an adverse effect on profits.

Tight control over the overheads was maintained whilst having appropriate regard

for the growth objectives of the business. Despite the increased control

measures, overheads increased and the main contributors to that were accounting

for pensions under IAS 19, the effects of amortisation and the weakening of the

US dollar.

Pensions

Over the last few years the Board, in conjunction with the pension schemes

trustees and actuary, have been working to reduce the scheme deficit in the

Group's defined benefit pension scheme and various measures have been put in

place with this objective in mind. These measures are agreed with the scheme

actuary who conducts a triennial valuation, as required by law. In addition, the

Group has to comply with IAS 19 for the accounting of this liability in the

consolidated financial statements. In arriving at the effect of IAS 19 for

retirement benefit obligations on the income statement, the scheme actuary

calculates the movements in the scheme deficit. It is not practical for the

Company to calculate this and then estimate the effect on internal forecasts, so

any non-recurring charge has the potential to alter results unexpectedly.

During the year, a new set of pension commutation factors were introduced which

had the effect of increasing the past service liabilities of the scheme. This

charge amounted to #587k (2006 - #nil) and has been confirmed as a one off cost.

The net of the current years service cost and the past service costs are added

to the administration cost and this resulted in a charge for the year of #993k

(2006 - #380k) reflecting a year-on-year negative variance of #613k. The

financial income or cost is adjusted in a similar manner and this year's income

amounted to #227k (2006 - cost of #20k) posting a positive comparative variance

of #247k.

Pensions - continued

The net effect of IAS 19 on the income statement was to increase the loss before

taxation by #766k (2006 - decrease profit before tax by #400k). A further

actuarial gain was recorded of #1,063k (2006 - #222k) and this is posted through

the statement of recognised income and expenditure resulting in a scheme

deficit, before any deferred tax adjustment, of #2,289k (2006 - #3,135k).

Taxation

The low taxation credit within the income statement reflects the large

adjustment to the taxation charge on the subsidiary Hyperstone GmbH. This

followed a revised determination by the German tax authority following a tax

inspection that took place on one of the previous owners. The basis on which

certain allowances were claimed in prior years was disallowed and resulted in a

further amount of #450k becoming payable. The whole of this amount was charged

to tax during the year.

Property

In addition to property from which operating subsidiaries trade, the Group owns

a number of investment properties that are stated within the balance sheet at

market value. The remaining property is stated at historical cost. The Board is

mindful of the significant value held in property within the balance sheet and

accordingly took moves during the year to ensure this area of the business

provides a better return for shareholders. The long leasehold premises at

Fareham, Hampshire which was previously held as an investment property was

placed on the market for sale prior to the year end and an investigation

commenced into the possibility of increased development of the Group

headquarters site in Essex.

Development costs

Steady new product progress was made in the wireless and wireline telecom

markets with eight new products being launched during the year. Development of

the networking and storage solutions products fell significantly behind

schedule, as reported at the interim stage. Overall spend on development was

slightly down on the previous year at #4.704m (2006 - #5.063m). The effects of

adopting IAS 38, as opposed to following historical policies under UK GAAP where

all development expenditure was written off during the year incurred, resulted

in a small negative effect on the income statement of approximately #85k.

Working capital and cash flow

With a significant reduction in revenues becoming apparent during the year, and

in keeping with management objectives, inventory levels reduced significantly

and tight financial control was exercised over cash flow. The resulting effect

was that cash balances reduced by #2.7m following a #3.2m loss and the payment

of a #1.6m dividend.

CML Microsystems Plc

Consolidated Income Statement

Unaudited Audited

Year end 31st Year end 31st

March 2007 March 2006

#'000 #'000

Revenue 17,768 26,333

Cost of sales (6,729) (10,473)

Gross Profit 11,039 15,860

Distribution and administration costs (14,985) (13,409)

(3,946) 2,451

Other operating income 660 472

Operating (loss)/profit before adjustments (3,286) 2,923

Share based payments (76) (79)

Operating (loss)/profit after adjustments (3,362) 2,844

Revaluation of investment properties - 695

Finance costs (228) (233)

Finance income 381 180

(Loss)/profit before taxation (3,209) 3,486

Income taxation 591 (853)

(Loss)/profit after taxation attributable to equity

shareholders (2,618) 2,633

(Loss)/earnings per share

Basic (17.53)p 17.68p

Diluted (17.53)p 17.66p

Statement of Recognised Income and Expense

Unaudited Audited

Year end 31st Year end 31st

March 2007 March 2006

#'000 #'000

(Loss)/profit for the period (2,618) 2,633

Foreign exchange differences (346) 350

Actuarial gain 1,063 222

Income tax on actuarial gain (319) (67)

Recognised (losses) and gains relating to the period (2,220) 3,138

CML Microsystems Plc

Consolidated Balance Sheet

Unaudited Audited

31st March 2007 31st March 2006

#'000 #'000

Assets

Non current assets

Tangible assets - Property, plant and equipment 6,803 7,256

Tangible assets - Investment property 2,245 3,845

Intangible assets - Development costs 5,984 6,133

Intangible assets - Goodwill on consolidation 3,512 3,512

Deferred tax asset 1,717 1,165

20,261 21,911

Current assets

Inventories 1,595 2,233

Trade receivables and prepayments 3,057 4,899

Current tax assets 419 537

Cash and cash equivalents 3,000 5,708

8,071 13,377

Non current assets classified as held for

sale - property 1,600 -

9,671 13,377

Total assets 29,932 35,288

Liabilities

Current liabilities

Bank loans and overdrafts 4,000 4,000

Trade and other payables 2,248 3,297

Current tax liabilities 761 365

7,009 7,662

Non current liabilities

Deferred tax liabilities 3,128 3,159

Provisions 30 147

Retirement benefit obligation 2,289 3,135

5,447 6,441

Total liabilities 12,456 14,103

Net Assets 17,476 21,185

Equity

Share capital 747 745

Convertible warrants - 120

Capital reserve 4,148 4,039

Share based payments reserve 238 162

Foreign exchange reserve (36) 310

Accumulated profits 12,379 15,809

Shareholders' equity 17,476 21,185

CML Microsystems Plc

Consolidated Cash Flow Statement

Unaudited Audited

Year end Year end

31st March 2007 31st March 2006

#'000 #'000

Operating activities

Net (loss)/profit for the period before income taxes (3,209) 3,486

Adjustments for:

Revaluation of investment properties - (695)

Depreciation 706 666

Amortisation of development costs 4,789 4,005

Movement in pensions deficit 217 (147)

Share based payments 76 79

Exceptional restructuring costs (117) (273)

Interest expense 228 233

Interest income (381) (180)

Increase/(decrease) in working capital 1,418 (2,533)

Cash flows from operating activities 3,727 4,641

Income tax refunded 236 69

Net cash flows from operating activities 3,963 4,710

Investing activities

Purchase of tangible fixed assets (369) (722)

Investment in intangible assets (4,704) (5,063)

Disposals of tangible fixed assets 56 19

Interest income 381 180

Net cash flows from investing activities (4,636) (5,586)

Financing activities

Issue of ordinary shares - 32

Repayment of bank loan - (377)

Dividends paid to group shareholders (1,564) (1,564)

Interest expense (228) (233)

Net cash flows from financing activities (1,792) (2,142)

Decrease in cash and cash equivalents (2,465) (3,018)

Movement in cash and cash equivalents:

At start of period 5,708 8,449

Decrease (2,465) (3,018)

Effects of exchange rate changes (243) 277

At end of period 3,000 5,708

CML Microsystems Plc

Consolidated Statement of Changes in Equity

Share Convertible Capital Share based Foreign Accumulated Total

Capital Warrants reserves payments Exchange profits

reserve

#'000 #'000 #'000 #'000 #'000 #'000 #'000

At 1st April 2005 744 120 4,007 82 (40) 14,585 19,498

Audited

Shares issued 1 32 33

Foreign Exchange

differences 350 350

Net actuarial gains

recognised directly to

equity 222 222

Deferred tax on

actuarial gains (67) (67)

Dividends paid (1,564) (1,564)

Profit for period 2,633 2,633

Share based payments 80 80

At 1st April 2006 745 120 4,039 162 310 15,809 21,185

Unaudited

Warrants converted/

lapsed 2 (120) 109 9 -

Foreign Exchange

differences (346) (346)

Net actuarial gains

recognised directly to

equity 1,063 1,063

Deferred tax on

actuarial gains (320) (320)

Dividends paid (1,564) (1,564)

Loss for period (2,618) (2,618)

Share based payments 76 76

At 31st March 2007 747 - 4,148 238 (36) 12,379 17,476

CML Microsystems Plc

Notes

1. Presentation of results

The directors approved this Preliminary announcement on 11th June 2007.

The results for the year have been prepared using International Financial

Reporting Standards and the accounting policies as set out the most recently

published financial statements along with the only new accounting policy

relating to non current assets held for sale which have been valued at the lower

of the carrying value or fair value less costs to sell. The reclassification to

current assets takes place when the assets are placed on the open market

available for sale.

The audited financial information for the year ended 31st March 2006 is based on

the statutory accounts for the financial year ended 31st March 2006 that have

been filed with the Registrar of Companies and on which the auditors gave an

unqualified audit opinion.

The financial information contained in this announcement does not constitute

statutory accounts as defined by Section 240 of the Companies Act 1985.

2. Dividend

A dividend of 5p per Ordinary Share (2006: 10.5p per Ordinary Share) is

recommended in respect of the year ended 31st March 2007 and will be paid on 3rd

August 2007 to shareholders on the register as at 6th July 2007.

3. Earnings per share

The calculation of basic and diluted (loss)/earnings per share is based on the

(loss)/profit attributable to shareholders, divided by the weighted average

number of shares in issue during the year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFFFMFSWSEIM

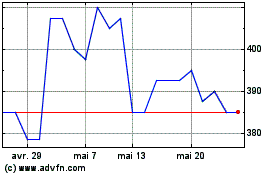

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024