TIDMCML

RNS Number : 9387T

CML Microsystems PLC

16 June 2009

?

CML Microsystems Plc

Preliminary results

CML Microsystems Plc ("CML"), which designs, manufactures and markets a broad

range of integrated circuits, primarily for global communication and data

storage markets, announces results for the full year ended 31 March 2009. CML

has operations in the UK, Germany, the US, Singapore, China and Taiwan.

Chairman's Statement

Introduction

The results posted for the full trading year ending 31 March 2009 reflect a

continuation throughout the second half of the depressed trading conditions

reported in the Group's marketplaces at the interim stage.

As anticipated with my concluding comments in the Interim Statement, conditions

throughout the remaining months of the year remained challenging and a clear

reduction in half on half performance was recorded.

Results

Details of the results are reported in the Operating and Financial Review. In

summary, these show that Group revenues for the year posted a 6% decline to

GBP16.09m (2008: GBP17.10m) and gross margin was 5% lower at 63% (2008: 68%).

The lower gross margin results to some extent from variations in product sales

mix.

An increased loss before tax of GBP2.09m (2008: GBP1.73m loss) is consequent to

an accounting rules gain and the positive movement of exchange rates during the

period, in all totalling approximately GBP1m. If this gain is discounted the

loss is broadly in line with market expectations for the year.

The reported loss per ordinary share is 14.29p (2008: 4.13p loss per share).

Dividend

Your directors have given consideration to the savings expected from cost

reduction measures that the Group has already and continues to implement,

together with the funding of operational plans to increase its performance in

the difficult circumstances that presently exist.

They conclude that payment of a dividend would not be an appropriate use of

resources at this present time. The directors therefore do not recommend payment

of a dividend for the year ending 31 March 2009.

Property

The UK freehold properties that the Group had earlier placed on the market have

been withdrawn from sale pending an improvement in commercial property values.

Prospects

The breadth and duration of the markets slowdown has exceeded the expectations I

had when reporting to you at the interim stage.

Sales levels in the opening months of the current year show no improvement over

those of the preceding months, but the Group's product, marketing and business

activities remain rightly focussed towards the growth opportunities identified

as conditions improve.

I have confidence in your Group's ability to achieve a future return to growth.

Operating and Financial Review

Overview

During the year to 31 March 2009 the particularly adverse global market

environment that commenced towards the end of the first-half impacted trading.

Internal progress was made with our product development strategy for driving

sustainable business growth but prevailing market and customer conditions

prevented that progress from driving an annual revenue improvement.

Operational cost efficiencies were receiving management focus prior to the start

of the financial year and that process escalated during the second-half

culminating in a significant reduction in employee levels. These reductions

affected the majority of our trading subsidiaries whilst particular emphasis was

placed on maintaining the resources required to ultimately achieve sustained

growth within our chosen market areas. All costs associated with this exercise

were realised prior to the year-end and are contained within these financial

results.

The uncertain outlook, low visibility and soft trading conditions reported in

recent management statements continued through to the end of the period under

review.

Financial results

Group revenues for the year ended 31 March 2009 were GBP16.09m reflecting a 6%

decrease over the comparable period (2008: GBP17.10m). The majority of customer

transactions were in US dollars and the strengthening of the dollar against

sterling through the year made a positive contribution.

Gross margin fell to 63% (2008: 68%) largely as a result of product mix and a

reduced gross profit of GBP10.20m was recorded for the full year (2008:

GBP11.71m). Reported distribution and administration expenses improved to

GBP12.47m (2008: GBP13.67m) assisted by lower amortisation costs and an

unrealised gain of GBP507k relating to an inter-group loan.

Net finance costs amounted to GBP218k (2008: GBP144k).

The revenue reduction and margin loss were the largest contributing factors to

the group posting an increased loss before tax of GBP2.09m (2008: GBP1.73m

loss).

Continued tight management of the Group's cash resources led to a reduced

outflow of GBP0.69m (2008: GBP2.12m) for the year. Cash balances stood at

GBP2.19m at the 31 March 2009.

A decrease in both raw materials and finished goods saw inventory levels fall to

GBP1.37m (2008: GBP1.75m). This, coupled with lower revenues, resulted in a

working capital reduction of GBP132k. Capital expenditure was GBP66k (2008:

GBP358k)

The Group does not enter into hedging arrangements in respect of foreign

currency exposure although a partial natural hedge exists due to the majority of

raw material purchases and the majority of customer transactions being

denominated in US dollars. Although this affords some protection, our largest

cost centres are located in the UK and Germany resulting in substantial exposure

to foreign currency fluctuations.

The tax expense within the income statement of GBP47k (2008: GBP1.11m credit)

includes a charge of GBP392k in respect of the government enacting the proposal

to withdraw Industrial Buildings Allowances. This event was fully anticipated

and highlighted within the 2008 Annual Report and Accounts.

The Group continued to benefit from the focus on leveraging internal engineering

resources across multiple product and market segments at the expense of external

development resources, where appropriate. Several key new product releases were

made during the year whilst development expenses remained flat at GBP3.97m

(2008: GBP3.95m).

The effect on the income statement of accounting for pensions under IAS 19 was

to increase the administration costs by GBP391k (2008: decrease of GBP259k) and

to increase the finance income by GBP72k (2008: GBP96k). The retirement benefit

obligation liability under IAS 19 grew to GBP1.99m compared to a surplus of

GBP459k at the 31st March 2008.

After careful consideration, and with effect from 31 March 2009, the Company

took the decision to close the UK defined benefit pension scheme in respect of

future benefit accruals. The scheme had already closed to new entrants some

years earlier but, after receiving the latest triennial valuation from

the scheme actuary, it became clear that it continued to represent a significant

and unpredictable future financial exposure. The Company intends to continue

making payments into the scheme in respect of accrued liabilities and has agreed

a multi-year payment plan with the trustees. All affected employees were offered

the chance to join an existing Group Money Purchase Scheme.

MARKETS REVIEW

Wireless

Revenues from the sale of semiconductors into the wireless market were flat

year-on-year with the majority coming from the Far East and European regions.

Customer products through the period included military, professional and leisure

two-way radios, paging devices and narrowband wireless data modems. Our

integrated circuits (IC's) performed a number of functions within each of these

products including signal processing, voice privacy and radio frequency (RF)

transmission and reception.

Growth was recorded in the contribution made from those products built on our

proprietary FirmASIC technology and the RF product family expanded to include a

high-performance IQ modulator along with a flexible quadrature receiver chip.

Initial customer programs with these products are encouraging and support the

underlying strategy to expand the CML silicon footprint within each customer's

end product.

Revenues from the low-cost analogue radio market were subdued as customers chose

to suspend the release of new products in response to the general market

conditions. Semiconductor shipments into China for public utility telemetry and

marine electronics applications continued to perform slightly ahead of

expectations. Overall, the wireless segment proved to be quite resilient through

the year.

Storage

The prominent applications for our semiconductors within this market during the

year were inclusion within removable memory cards and solid-state drive products

in varying form factors. Customer products containing our IC's were typically

used as an alternative to magnetic storage media in commercial and industrial

application areas that demand high-reliability under arduous operating

conditions.

Percentage revenue growth in this segment was close to double-digits with the

Far East and Europe performing particularly well. The growth came from a

combination of historic and new customers. Throughout the particular

sub-segments of the storage market where the Group is active, we continued to

enhance our reputation in relation to product quality, performance and customer

service levels. A growing list of major international organisations built their

products on our proprietary technology

Telecom

The sale of semiconductors into the telecom segment fell significantly for the

second consecutive year and was the main contributor to the overall reduction in

Group revenues. Whilst all geographic regions posted a reduction, the fall in

demand from specific North American security applications was the single biggest

factor. Despite this disappointing performance, the product range remained both

price and performance competitive for the target markets and several new

customer design-wins were achieved.

Networking

Revenue contributions from the networking segment were slightly down against the

prior year and remain at relatively low-levels. Development of the support tools

required to successfully market the product range reached the stage for

promotional activities to commence.

Equipment

The Group's equipment division, Radio Data Technology Ltd, suffered a reduction

in revenues to GBP980k (2008: GBP1.13m) as a direct result of the economic

conditions in the UK delaying the placement of commercial orders for CCTV

transmission equipment. A focused product development plan was initiated and is

expected to drive global growth as conditions improve.

Across all market areas during the year, no customer accounted for more than 10%

of Group revenues and only one customer accounted for more than 5%.

SUMMARY & OUTLOOK

The year under review was a difficult one. Despite a reasonable performance

during the opening few months, global events that commenced towards the end of

the first half impaired our ability to post a trading improvement fur the full

year. Whilst I am encouraged by the resilience exhibited within the wireless

segment and the growth delivered from storage products, forward visibility

remains low and directly affects our ability to anticipate the timing of any

upturn in the markets.

We enter the 2009/10 financial year with a cost base better aligned to recent

revenue levels and remain hopeful that general market conditions improve to

facilitate a return to profitability at the earliest opportunity.

The Board continues to have confidence in the medium term outlook and considers

that actions taken through the year will ultimately deliver positive results.

The strategic and operational focus continues to be on achieving sustainable

growth as conditions improve.

The Company has now been in existence for 40 years and the success achieved

during that time has been fundamentally built on the quality, dedication and

support of the Group's past and present employees worldwide. On behalf of the

Board, I would like to extend our sincere thanks for their loyal support and

effort throughout the year.

CML Microsystems Plc

Condensed Consolidated Income Statement

+--------------------------------------------+----------------+----+----+---------------+

| | Unaudited | | | Audited |

+--------------------------------------------+----------------+----+----+---------------+

| Continuing operations | Year end 31st | | |Year end 31st |

| | March 2009 | | | March 2008 |

+--------------------------------------------+----------------+----+----+---------------+

| | GBP'000 | | | GBP'000 |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Revenue | 16,089 | | | 17,098 |

+--------------------------------------------+----------------+----+----+---------------+

| Cost of sales | (5,887) | | | (5,393) |

+--------------------------------------------+----------------+----+----+---------------+

| Gross Profit | 10,202 | | | 11,705 |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Distribution and administration costs | (12,466) | | | (13,671) |

+--------------------------------------------+----------------+----+----+---------------+

| | (2,264) | | | (1,966) |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Other operating income | 489 | | | 430 |

+--------------------------------------------+----------------+----+----+---------------+

| Loss before share based payments | (1,775) | | | (1,536) |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Share based payments | (101) | | | (48) |

+--------------------------------------------+----------------+----+----+---------------+

| Loss after share based payments | (1,876) | | | (1,584) |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Revaluation of investment properties | 5 | | | - |

+--------------------------------------------+----------------+----+----+---------------+

| Finance costs | (333) | | | (334) |

+--------------------------------------------+----------------+----+----+---------------+

| Finance income | 115 | | | 190 |

+--------------------------------------------+----------------+----+----+---------------+

| Loss before taxation | (2,089) | | | (1,728) |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Income tax (expense)/credit | (47) | | | 1,111 |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Loss after taxation attributable to equity | (2,136) | | | (617) |

| holders of the Company | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Loss per share | | | | |

+--------------------------------------------+----------------+----+----+---------------+

| Basic | (14.29)p | | | (4.13)p |

+--------------------------------------------+----------------+----+----+---------------+

| Diluted | (14.29)p | | | (4.13)p |

+--------------------------------------------+----------------+----+----+---------------+

Condensed Statement of Recognised Income and Expense

+---------------------------------------------+---------------+----+----+---------------+

| | Unaudited | | | Audited |

+---------------------------------------------+---------------+----+----+---------------+

| |Year end 31st | | |Year end 31st |

| | March 2009 | | | March 2008 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| | GBP'000 | | | GBP'000 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Loss for the year | (2,136) | | | (617) |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Foreign exchange differences | 397 | | | 82 |

+---------------------------------------------+---------------+----+----+---------------+

| Actuarial (loss)/gain | (1,671) | | | 1,934 |

+---------------------------------------------+---------------+----+----+---------------+

| Income tax on actuarial (loss)/gain | 507 | | | (580) |

+---------------------------------------------+---------------+----+----+---------------+

| Net (loss)/income for the year directly | (767) | | | 1,436 |

| recognised in equity | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Recognised (losses) and gains relating to | (2,903) | | | 819 |

| the year attributable to equity holders of | | | | |

| the Company | | | | |

+---------------------------------------------+---------------+----+----+---------------+

CML Microsystems Plc

Condensed Consolidated Balance Sheet

+---------------------------------------------+---------------+----+----+---------------+

| | Unaudited | | | Audited |

+---------------------------------------------+---------------+----+----+---------------+

| | 31st March | | | 31st March |

| | 2009 | | | 2008 |

+---------------------------------------------+---------------+----+----+---------------+

| | GBP'000 | | | GBP'000 |

+---------------------------------------------+---------------+----+----+---------------+

| Assets | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Non current assets | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Property, plant and equipment | 5,931 | | | 6,261 |

+---------------------------------------------+---------------+----+----+---------------+

| Investment properties | 3,850 | | | 415 |

+---------------------------------------------+---------------+----+----+---------------+

| Development costs | 5,192 | | | 5,341 |

+---------------------------------------------+---------------+----+----+---------------+

| Goodwill | 3,512 | | | 3,512 |

+---------------------------------------------+---------------+----+----+---------------+

| Deferred tax asset | 2,019 | | | 1,290 |

+---------------------------------------------+---------------+----+----+---------------+

| | 20,504 | | | 16,819 |

+---------------------------------------------+---------------+----+----+---------------+

| Current assets | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Inventories | 1,366 | | | 1,745 |

+---------------------------------------------+---------------+----+----+---------------+

| Trade receivables and prepayments | 2,504 | | | 2,535 |

+---------------------------------------------+---------------+----+----+---------------+

| Current tax assets | 355 | | | 410 |

+---------------------------------------------+---------------+----+----+---------------+

| Cash and cash equivalents | 2,192 | | | 1,891 |

+---------------------------------------------+---------------+----+----+---------------+

| | 6,417 | | | 6,581 |

+---------------------------------------------+---------------+----+----+---------------+

| Non current assets classified as held for | 468 | | | 3,770 |

| sale - property | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Total assets | 27,389 | | | 27,170 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Liabilities | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Current liabilities | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Bank loans and overdrafts | 6,062 | | | 5,075 |

+---------------------------------------------+---------------+----+----+---------------+

| Trade and other payables | 2,069 | | | 2,320 |

+---------------------------------------------+---------------+----+----+---------------+

| Current tax liabilities | 15 | | | 54 |

+---------------------------------------------+---------------+----+----+---------------+

| | 8,146 | | | 7,449 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Non current liabilities | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Deferred tax liabilities | 2,459 | | | 2,125 |

+---------------------------------------------+---------------+----+----+---------------+

| Retirement benefit obligation | 1,990 | | | - |

+---------------------------------------------+---------------+----+----+---------------+

| | 4,449 | | | 2,125 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Total liabilities | 12,595 | | | 9,574 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Net Assets | 14,794 | | | 17,596 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Capital and reserves attributable to equity | | | | |

| holders of the Company | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Share capital | 747 | | | 747 |

+---------------------------------------------+---------------+----+----+---------------+

| Share premium | 4,148 | | | 4,148 |

+---------------------------------------------+---------------+----+----+---------------+

| Share based payments reserve | 151 | | | 50 |

+---------------------------------------------+---------------+----+----+---------------+

| Foreign exchange reserve | 443 | | | 46 |

+---------------------------------------------+---------------+----+----+---------------+

| Accumulated profits | 9,305 | | | 12,605 |

+---------------------------------------------+---------------+----+----+---------------+

| Shareholders' equity | 14,794 | | | 17,596 |

+---------------------------------------------+---------------+----+----+---------------+

CML Microsystems Plc

Condensed Consolidated Cash Flow Statement

+---------------------------------------------+---------------+----+----+---------------+

| | Unaudited | | | Audited |

+---------------------------------------------+---------------+----+----+---------------+

| | Year end | | | Year end |

+---------------------------------------------+---------------+----+----+---------------+

| | 31st March | | | 31st March |

| | 2009 | | | 2008 |

+---------------------------------------------+---------------+----+----+---------------+

| | GBP'000 | | | GBP'000 |

+---------------------------------------------+---------------+----+----+---------------+

| Operating activities | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Net loss for the year before income taxes | (2,089) | | | (1,728) |

+---------------------------------------------+---------------+----+----+---------------+

| Adjustments for: | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Depreciation | 437 | | | 579 |

+---------------------------------------------+---------------+----+----+---------------+

| Amortisation of development costs | 4,183 | | | 4,684 |

+---------------------------------------------+---------------+----+----+---------------+

| Movement in pensions deficit | 319 | | | (355) |

+---------------------------------------------+---------------+----+----+---------------+

| Share based payments | 101 | | | 48 |

+---------------------------------------------+---------------+----+----+---------------+

| Interest expense | 333 | | | 334 |

+---------------------------------------------+---------------+----+----+---------------+

| Interest income | (115) | | | (190) |

+---------------------------------------------+---------------+----+----+---------------+

| Decrease in working capital | 132 | | | 440 |

+---------------------------------------------+---------------+----+----+---------------+

| Cash flows from operating activities | 3,301 | | | 3,812 |

+---------------------------------------------+---------------+----+----+---------------+

| Income tax refunded/(paid) | 225 | | | (747) |

+---------------------------------------------+---------------+----+----+---------------+

| Net cash flows from operating activities | 3,526 | | | 3,065 |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Investing activities | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Purchase of property, plant and equipment | (66) | | | (358) |

+---------------------------------------------+---------------+----+----+---------------+

| Investment in development costs | (3,969) | | | (3,952) |

+---------------------------------------------+---------------+----+----+---------------+

| Disposals of property, plant and equipment | 38 | | | 13 |

+---------------------------------------------+---------------+----+----+---------------+

| Interest income | 115 | | | 190 |

+---------------------------------------------+---------------+----+----+---------------+

| Net cash flows from investing activities | (3,882) | | | (4,107) |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Financing activities | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Increase in short term borrowings | 987 | | | 1,075 |

+---------------------------------------------+---------------+----+----+---------------+

| Dividends paid | - | | | (747) |

+---------------------------------------------+---------------+----+----+---------------+

| Interest expense | (333) | | | (334) |

+---------------------------------------------+---------------+----+----+---------------+

| Net cash flows from financing activities | 654 | | | (6) |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Increase/(decrease) in cash and cash | 298 | | | (1,048) |

| equivalents | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Movement in cash and cash equivalents: | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| At start of year | 1,891 | | | 3,000 |

+---------------------------------------------+---------------+----+----+---------------+

| Increase/(decrease) in cash and cash | 298 | | | (1,048) |

| equivalents | | | | |

+---------------------------------------------+---------------+----+----+---------------+

| Effects of exchange rate changes | 3 | | | (61) |

+---------------------------------------------+---------------+----+----+---------------+

| At end of year | 2,192 | | | 1,891 |

+---------------------------------------------+---------------+----+----+---------------+

CML Microsystems Plc

Condensed Consolidated Statement of Changes in Equity

+---------------------+----------+----------+----------+------------+-------------+----------+

| | Share | Share | Share | Foreign |Accumulated | Total |

| | Capital | Premium | Based | Exchange | Profits | |

| | | |Payments | Reserve | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+---------------------+----------+----------+----------+------------+-------------+----------+

| | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| At 1st April 2007 | 747 | 4,148 | 238 | (36) | 12,379 | 17,476 |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Audited | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Foreign Exchange | | | | 82 | | 82 |

| differences | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Net actuarial gains | | | | | 1,934 | 1,934 |

| recognised directly | | | | | | |

| to equity | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Deferred tax on | | | | | (580) | (580) |

| actuarial gains | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Loss for year | | | | | (617) | (617) |

+---------------------+----------+----------+----------+------------+-------------+----------+

| | 747 | 4,148 | 238 | 46 | 13,116 | 18,295 |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Dividends paid | | | | | (747) | (747) |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Share based | | | (236) | | 236 | - |

| payments | | | | | | |

| transferred on | | | | | | |

| cancellation | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Share based | | | 48 | | | 48 |

| payments | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| At 1st April 2008 | 747 | 4,148 | 50 | 46 | 12,605 | 17,596 |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Unaudited | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Foreign Exchange | | | | 397 | | 397 |

| differences | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Net actuarial | | | | | (1,671) | (1,671) |

| losses recognised | | | | | | |

| directly to equity | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Deferred tax on | | | | | 507 | 507 |

| actuarial losses | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Loss for year | | | | | (2,136) | (2,136) |

+---------------------+----------+----------+----------+------------+-------------+----------+

| | 747 | 4,148 | 50 | 443 | 9,305 | 14,693 |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Dividends paid | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Share based | | | 101 | | | 101 |

| payments in year | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| Share based | | | | | | |

| payments | | | | | | |

| transferred on | | | | | | |

| cancellation | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| | | | | | | |

+---------------------+----------+----------+----------+------------+-------------+----------+

| At 31st March 2009 | 747 | 4,148 | 151 | 443 | 9,305 | 14,794 |

+---------------------+----------+----------+----------+------------+-------------+----------+

CML Microsystems Plc

Notes to the financial statements

1. Segmental Analysis

Primary - Business

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| | Unaudited | Audited |

+---------------------+---------------------------------------+---------------------------------------+

| | 2009 | 2008 |

+---------------------+---------------------------------------+---------------------------------------+

| |Equipment |Semi-conductor | Group |Equipment |Semi-conductor | Group |

| | | components | | | components | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Revenue | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| By origination | 979 | 20,928 | 21,907 | 1,130 | 22,474 | 23,604 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Inter-segmental | - | (5,818) | (5,818) | - | (6,506) | (6,506) |

| revenue | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Segmental revenue | 979 | 15,110 | 16,089 | 1,130 | 15,968 | 17,098 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| (Loss)/Profit | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Segmental results | 54 | (1,930) | (1,876) | 178 | (1,762) | (1,584) |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Net financial | | | (218) | | | (144) |

| income/(expense) | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Revaluation of | | | 5 | | | - |

| investment | | | | | | |

| properties | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Income tax | | | (47) | | | 1,111 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Loss after taxation | | | (2,136) | | | (617) |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Assets and | | | | | | |

| Liabilities | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Segmental assets | 686 | 20,012 | 20,698 | 708 | 20,578 | 21,286 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Unallocated | | | | | | |

| corporate assets | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Investment property | | | 4,317 | | | 4,184 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Deferred taxation | | | 2,019 | | | 1,290 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Current tax | | | 355 | | | 410 |

| receivable | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Consolidated total | | | 27,389 | | | 27,170 |

| assets | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Segmental | 51 | 2,018 | 2,069 | 93 | 2,227 | 2,320 |

| liabilities | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Unallocated | | | | | | |

| corporate | | | | | | |

| liabilities | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Deferred taxation | | | 2,459 | | | 2,125 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Current tax | | | 15 | | | 54 |

| liability | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Bank loans and | | | 6,062 | | | 5,075 |

| overdrafts | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Retirement benefit | | | 1,990 | | | - |

| obligation | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Consolidated total | | | 12,595 | | | 9,574 |

| liabilities | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Other segmental | | | | | | |

| information | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Property plant and | 30 | 36 | 66 | 2 | 356 | 358 |

| Equipment additions | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Development cost | 74 | 3,895 | 3,969 | 72 | 3,880 | 3,952 |

| additions | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Depreciation | 16 | 421 | 437 | 16 | 563 | 579 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Amortisation | 73 | 4,110 | 4,183 | 73 | 4,611 | 4,684 |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

| Other significant | - | 391 | 391 | - | 54 | 54 |

| non cash expenses | | | | | | |

+---------------------+-----------+----------------+----------+-----------+----------------+----------+

Inter-segmental transfers or transactions are entered into under commercial

terms and conditions appropriate to the location of the entity whilst

considering that the parties are related.

CML Microsystems Plc

2. Dividend paid and proposed - Final

Declared and paid during the period

+--------------------------------------------------+------------------+----+------------+

| Equity dividends paid on 5p ordinary shares | Unaudited | | Audited |

+--------------------------------------------------+------------------+----+------------+

| | 2009 | | 2008 |

+--------------------------------------------------+------------------+----+------------+

| | GBP'000 | | GBP'000 |

+--------------------------------------------------+------------------+----+------------+

| | | | |

+--------------------------------------------------+------------------+----+------------+

| 5p per share dividend for year ended 31 March | - | | 747 |

| 2007 | | | |

+--------------------------------------------------+------------------+----+------------+

The directors do not recommend the payment of a dividend in respect of the year

ended 31st March 2009.

3. Income tax

The directors consider that tax will be payable at varying rates according to

the country of incorporation of a subsidiary and have provided on that basis.

+----------------------------------------------+------------+----------+------------+

| | Unaudited | | Audited |

+----------------------------------------------+------------+----------+------------+

| | 2009 | | 2008 |

+----------------------------------------------+------------+----------+------------+

| | GBP'000 | | GBP'000 |

+----------------------------------------------+------------+----------+------------+

| | | | |

+----------------------------------------------+------------+----------+------------+

| UK income tax | (305) | | (364) |

+----------------------------------------------+------------+----------+------------+

| Overseas income tax | 114 | | 329 |

+----------------------------------------------+------------+----------+------------+

| Total current tax | 191 | | (35) |

+----------------------------------------------+------------+----------+------------+

| Deferred tax | (238) | | (1,076) |

+----------------------------------------------+------------+----------+------------+

| Reported income tax charge/(credit) | 47 | | (1,111) |

+----------------------------------------------+------------+----------+------------+

4. Loss per share

The calculation of basic earnings per share is based on the loss attributable to

ordinary shareholders divided by the weighted average number of shares in issue

during the year. The share options are not expected to have a dilutive effect on

the loss per share as the likelihood of exercise is low given the recent share

price movements.

+-----------------------------------+---+---------------------+----+--------------------+

| | | Ordinary 5p shares |

+-----------------------------------+---+-----------------------------------------------+

| | | Weighted Average | | Diluted |

| | | Number | | Number |

+-----------------------------------+---+---------------------+----+--------------------+

| 12 months ended 31 March 2009 | | 14,947,626 | | 14,947,626 |

| (unaudited) | | | | |

+-----------------------------------+---+---------------------+----+--------------------+

| 12 months ended 31 March 2008 | | 14,933,733 | | 14,933,733 |

| (audited) | | | | |

+-----------------------------------+---+---------------------+----+--------------------+

5. Investment Properties

Investment properties are revalued at each discrete period end by the directors

and every third year by independent Chartered Surveyors on an open market basis.

No depreciation is provided on freehold investment properties or on leasehold

investment properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income statement. At the

31st March 2009 the investment properties were professionally valued by Everett

Newlyn, Chartered Surveyors and Commercial Property Consultants on an open

market basis.

6. Analysis of cash flow movement in net debt

+----------------------+----------------+---------------+---------------+--------------+

| | Net debt at | Cash Flow | Exchange | Net debts at |

| | 1st April 2008 | | Movement | 31st March |

| | | | | 2009 |

+----------------------+----------------+---------------+---------------+--------------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+----------------------+----------------+---------------+---------------+--------------+

| Cash and Cash | 1,891 | 298 | 3 | 2,192 |

| equivalents | | | | |

+----------------------+----------------+---------------+---------------+--------------+

| Bank loans and | (5,075) | (987) | - | (6,062) |

| overdrafts | | | | |

+----------------------+----------------+---------------+---------------+--------------+

| | (3,184) | (689) | 3 | (3,870) |

+----------------------+----------------+---------------+---------------+--------------+

7. Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with foreign

currencies and customer dependency. With the majority of the Group's earnings

being linked to the US Dollar a decline in this currency will have a direct

effect on revenue, although since the majority of the cost of sales are also

linked to the US Dollar, this risk is reduced at the gross profit line.

Additionally, though the Group has a very diverse customer base in certain

market segments, key customers can represent a significant amount of revenue.

Key customer relationships are closely monitored, however changes in buying

patterns of a key customer could have an adverse effect on the Group's

performance.

Key risks of non-financial nature

The Group is a small player operating in a highly competitive global market,

which is undergoing continual and geographical change. The Group's ability to

respond to many competitive factors including, but not limited to pricing,

technological innovations, product quality, customer service, manufacturing

capabilities and employment of qualified personnel will be key in the

achievement of its objectives, but its ultimate success will depend on the

demand for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve its financial

objectives could be impacted by risks and uncertainties associated with local

legal requirements, the enforceability of laws and contracts, changes in the tax

laws, terrorist activities, natural disasters or health epidemics.

8. Directors' statement pursuant to the Disclosure and Transparency Rules

The directors confirm that, to the best of their knowledge:

a. the condensed financial statements, prepared in accordance with IFRS as

adopted by the EU give a true and fair view

of the assets,

liabilities, financial position and profit/(loss) of the company and the

undertakings included in the

consolidation taken as a whole; and

b. the Chairman's Statement and Operating and Financial Review includes a

fair review of the development and

performance of the business and

the position of the company and the undertakings included in the

consolidation

taken as a whole together with a description of the

principal risks and uncertainties that they face. .

The directors are also responsible for the maintenance and integrity of the CML

Microsystems Plc website. Legislation in the UK governing the preparation and

dissemination of the financial statements may differ from legislation in other

jurisdictions.

9. General

The directors approved this Annual Results announcement on 15th June 2009.

The results for the year have been prepared using the recognition and

measurement principles of International Financial Reporting Standards as adopted

by the EU and the accounting policies as set out in the most recently published

financial statements with no new accounting policies.

The audited financial information for the year ended 31st March 2008 is based on

the statutory accounts for the financial year ended 31st March 2008 that have

been filed with the Registrar of Companies. The auditors reported on those

accounts: their report was (i) unqualified, (ii) did not include references to

any matters to which the auditors drew attention by way of emphasis without

qualifying the reports and (iii) did not contain statements under section 237(2)

or (3) of the Companies Act 1985. The statutory accounts for the year ended 31st

March 2009 will be filed in due course.

The financial information contained in this announcement does not constitute

statutory accounts for the year ended 31st March 2009 or 2008 as defined by

Section 240 of the Companies Act 1985.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFSFWISUSEFM

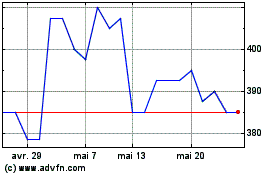

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Août 2024 à Sept 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Sept 2023 à Sept 2024