TIDMCML

RNS Number : 5972N

CML Microsystems PLC

15 June 2010

CML MICROSYSTEMS Plc

PRELIMINARY RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and markets a broad

range of semiconductors, primarily for global communication and data storage

markets, announces its Preliminary Results for the year ended 31 March 2010.

Commenting on the results, George Gurry, Chairman of CML, said:

"I am pleased to report an improved financial performance given the difficult

trading conditions that were present through a large part of the year. The

Interim Statement during November 2009 commented on my belief that actions being

taken would further our aims for a return to profitability and I can report the

Group traded positively during the second half."

Financial Highlights:

· Revenue up 12.0% to GBP18.02m (2009: GBP16.09m)

· Gross profit up 22.5% to GBP12.49m (2009: GBP10.2m)

· Profit before tax of GBP21,000 (2009: Loss of GBP1.78m)

· Loss per share of 0.16p (2009: Loss of 14.29p)

· Net cash inflow of GBP1.78m (2009: outflow GBP0.69m)

· Cash reserves at 31 March 2010 of GBP3.88m

· Net debt position reduced to GBP2.09m (2009: GBP3.78m)

· No dividend

Operational highlights:

· Wireless: (41% of revenues) - up 3%, FirmASIC products gained traction, RF

portfolio expanded.

· Storage: (40% of revenues) - up 40%, reduced customer dependency, new

design wins to widen applications.

· Telecom: (13% of revenues) - fractionally down, opportunities to take

market share from competition.

Regarding outlook, Chris Gurry, Managing Director of CML, said:

"The healthier visibility reported in the IMS of 16 February 2010 has continued

beyond the year end and it is hoped that recent trading conditions can be

maintained and built upon in the course of the current financial year. Our focus

for FY2011 is to maintain operating costs in the region of existing levels,

leverage the ongoing investment in new product developments and continue to grow

our customer base in pursuit of sustainable growth in revenue and a return to

annual profitability."

Enquiries:

+-------------------------------+-----------------------------+

| CML Microsystems plc | www.cmlmicroplc.com |

+-------------------------------+-----------------------------+

| Nigel Clark, Financial | Tel: 01621 875 500 |

| Director | |

+-------------------------------+-----------------------------+

| Chris Gurry, Managing | |

| Director | |

+-------------------------------+-----------------------------+

| | |

+-------------------------------+-----------------------------+

| Cenkos Securities plc | |

+-------------------------------+-----------------------------+

| Jeremy Warner Allen (Sales) | Tel: 020 7397 8900 |

+-------------------------------+-----------------------------+

| Stephen Keys (Corporate | |

| Finance) | |

+-------------------------------+-----------------------------+

| | |

+-------------------------------+-----------------------------+

| Walbrook PR Ltd | Tel: 020 7933 8780 |

+-------------------------------+-----------------------------+

| Paul McManus | Mob: 07980 541 893 |

| | paul.mcmanus@walbrookpr.com |

+-------------------------------+-----------------------------+

Chairman's Statement

I am pleased to report an improved financial performance given the difficult

trading conditions that were present through a large part of the year. The

Interim Statement during November 2009 commented on my belief that actions being

taken would further our aims for a return to profitability and I can report the

Group traded positively during the second half.

Revenue rose by 12% to GBP18.02m. Tight control of expenses and healthier

margins enabled the Group to post a profit of GBP21k at the operating level

(prior to share based payments, finance costs and taxation), which compares to a

loss of GBP1.77m for the previous year.

The Group generated over GBP1.7m of cash and the reported loss per ordinary

share is 0.16p (2009: 14.29p loss per share).

Prior to 2008, the Company declared payment of a dividend in each of the 24

years it traded as a public company. Despite the pleasing second half

performance your Directors consider that the priority is to reduce Group debt

through improved trading and conclude that payment of a dividend would not be an

appropriate use of resources at this present time.

The directors therefore do not recommend payment of a dividend for the year

ending 31 March 2010.

Within the financial statements, other operating income relates predominantly to

UK freehold commercial properties that the Group owns and leases to third

parties. The Board continued to devote appropriate resources to realising

capital value from these assets although no transactions occurred during the

year under review.

As reported in a statement released 29 March 2010, the Board is proposing to

adopt a standard listing under the FSA's revised listing rules and a circular

will be sent to shareholders later this month.

Prospects

The Company has experienced one of the most turbulent multi-year periods in its

long history. During this time we have improved gross margins, streamlined the

cost base, and strategically expanded our addressable market area while

continually investing in the key product development programs that will help

drive our future growth. As a result of the ongoing commitment and contribution

from our global employee base, the Company is well placed to capitalise on the

opportunities ahead. On behalf of the Board I would like to thank them for the

vital role they play.

Subject to unforeseen circumstances, I have confidence that we will see a

present full year return to profitability.

GW Gurry

Chairman

14th June 2010

Operating and Financial Review

OVERVIEW

Throughout the year to 31March 2010 we continued the drive towards our ultimate

objective for sustainable business growth.

We increased revenues in our major target markets by continuing to define,

develop and deliver high-quality, innovative semiconductor solutions to our

customers, enabling them to produce world-class products for global

communications and data storage applications. We increased our customer base

and the size of our total addressable markets by releasing a number of new

devices offering compelling solutions to real world commercial and technical

issues.

Trading for the full year to 31 March 2010 comprised two materially different

six-month periods. The weak market environment to 30 September 2009 subsequently

translated into a firmer second half performance enabling the business to

recover a substantial amount of the losses that were reported at the interims.

By the year-end, market conditions within certain segments had reached an

improved level and order book visibility extended beyond the prevailing four to

six week timeframe.

Throughout the period, we continued with forward-looking new product development

expenditure whilst maintaining focus on the cost efficiencies initiated over the

prior two years.

FINANCIAL RESULTS

Group revenues for the year ended 31 March 2010 were GBP18.02m representing an

increase of 12% over the prior year (2009: GBP16.09m). This increase reflected

marginal percentage growth in the value of semiconductors shipped into the

Group's largest market segment, wireless, coupled with stronger unit shipment

growth from the storage segment. The strengthening of the US dollar against

sterling positively assisted reported sales levels.

Gross profit for the year was GBP12.49m (2009: GBP10.2m), an increase of 22%.

The overall gross margin improved to 69% (2009: 63%) as a combined result of

product mix and cost efficiencies initiated during the prior year.

Distribution and administration costs increased to GBP13.03m (2009: GBP12.47m)

predominantly due to a loss on foreign exchange being recorded of GBP318k

against a prior year profit of GBP1m. One inter group loan accounted for a large

proportion of the year on year swing and, prior to the year end, currency

exposure was removed by placing the loan with the operating company to which it

relates and denominating it in the local currency.

Net finance costs increased to GBP303k (2009: GBP218k) as a result of lower

interest income and higher pension finance costs.

The higher revenue level and improved gross margin narrowed the reported loss

before tax to GBP386k (2009: GBP2.09m loss).

Net cash inflow for the year was GBP1.78m (2009: outflow GBP0.69m) resulting in

cash reserves of GBP3.88m at 31 March 2010. The Group's net debt position was

GBP2.09m (2009: GBP3.87m).

Inventory levels increased slightly to GBP1.49m (2009: GBP1.37m) in response to

improved sales levels whilst capital expenditure remained negligible at GBP49k

(2009: GBP66k).

Overall, the Company received a net tax refund of GBP237k, principally due to

R&D tax credits from an ongoing extensive engineering program.

Development expenses fell to GBP2.82m (2009: GBP3.97m) following a headcount

reduction during the previous financial year and lower development costs

associated with certain proprietary software configurable silicon platforms. A

number of customer-specific programs complemented a healthy level of standard

new product introductions and development activities.

The effect on the income statement of accounting for pensions under

international accounting standards (as opposed to cash accounting) was to

decrease the administration costs by GBP105k (2009: increase of GBP391k) and to

increase the finance costs by GBP117k (2009: income of GBP72k). Net assets fell

to GBP12.12m (2009: GBP14.79m) mainly due to a pension fund liability increase

that grew to GBP5.73m (2009: GBP1.99m) despite a GBP2.2m improvement in the

value of the plan assets. This increase in liability is a result of significant

changes in the principal actuarial assumptions used. The scheme has been closed

to new entrants for a number of years and was closed in respect of future

accruals to existing members on 31 March 2009.

MARKETS REVIEW

Wireless

During the year under review, the Group developed and marketed semiconductor

devices performing a range of functions within customer end products that serve

sub-segments of the overall wireless communications market. These customer

products include voice-centric professional, business and leisure two-way radios

along with data-only paging, marine safety (AIS) and narrowband wireless

equipment. Our customer base was global and included a number of military

accounts.

Sales revenue from the wireless segment overall was marginally up against the

prior year with the largest contributing territories being the Far East and

Europe. Notable gains were recorded from our proprietary FirmASIC technology and

we continued to take market share in the large and mature analogue two way radio

market whilst simultaneously positioning ourselves to be a leading technology

supplier for the newer digital radio standards as they emerge.

The early stage RF product portfolio expanded to include quadrature modulator,

transceiver and direct conversion products and we continued to build a good

reputation in this key market area.

Storage

Within the storage market, the prominent applications for our semiconductors

were inclusion within removable memory cards and solid-state drive products in

varying form factors. Customer products containing our IC's were typically used

as an alternative to rotating hard disk media in commercial and industrial

application areas that demand high-reliability under arduous operating

conditions.

Volume and revenue growth in this segment was particularly strong and came from

a combination of existing and new customers. Advances were recorded in all major

regions although geographically, the majority of revenue came from customers

headquartered in the USA.

The Company achieved a number of design-wins inside customer products aimed at

emerging opportunities for secure storage cards within the mobile financial

services sector and content protection facilities for the software industry.

New product development resources were directed at standard products that will

expand our total addressable market and were complemented by a number of

customer-specific programs expected to start generating meaningful revenues over

the next twelve to eighteen months.

Telecom

Unit shipments into the telecom segment were flat year on year and did not

follow the Group's overall trading pattern of a stronger second half. We saw

encouraging signs that the newer devices within the product range were starting

to create momentum at the expense of the legacy product portfolio although

visibility within this market area remained variable.

Customers located in Europe and the Far East comprised the majority of revenues

from this segment. Applications were numerous and included industrial wireline

communication modules, commercial alarm panels, telephone exchanges and dial-up

modems for the healthcare industry.

Equipment

The Group's non-semiconductor division, RDT, suffered a reduction in revenues to

GBP722k (2009: GBP979k) as a result of the economic conditions in the UK

delaying the placement of commercial orders for CCTV transmission equipment.

The market showed early signs of improvement just prior to the financial year

end although forward order book visibility remained at low levels through the

period end.

New product developments were focussed on expanding the addressable sub market

application areas for wireless video systems and data transmission products.

Sales recorded from the wireless and storage segments accounted for 80% of Group

revenues. Overall, no single customer accounted for more than 10% of Group

revenues and only two customers accounted for more than 5%.

SUMMARY AND OUTLOOK

Notwithstanding the recording of a trading loss, the year under review resulted

in a better outcome than expected at the midway point and a significant

sequential improvement. The effects of global economic events on our markets

improved during the second half and, coupled with a lower cost base and higher

gross margin, the Company made satisfactory progress.

The healthier visibility reported in the IMS of 16 February 2010 has continued

beyond the year end and it is hoped that recent trading conditions can be

maintained and built upon in the course of the current financial year. Our focus

for FY2011 is to maintain operating costs in the region of existing levels,

leverage the ongoing investment in new product developments and continue to grow

our customer base in pursuit of sustainable growth in revenue and a return to

annual profitability.

In closing I would like to echo the Chairman's comments and thank each and every

one of our employees for their loyal support and vital contribution to the

future success of the Company.

C.A. Gurry

Managing Director

CML Microsystems Plc

Condensed Consolidated Income Statement

+-------------------------------------+--------------+--+--------------+

| | Unaudited | | Audited |

+-------------------------------------+--------------+--+--------------+

| | Year End | | Year End |

| Continuing operations | 31 March | | 31 March |

| | 2010 | | 2009 |

+-------------------------------------+--------------+--+--------------+

| | GBP'000 | | GBP'000 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Revenue | 18,023 | | 16,089 |

+-------------------------------------+--------------+--+--------------+

| Cost of sales | (5,533) | | (5,887) |

+-------------------------------------+--------------+--+--------------+

| Gross Profit | 12,490 | | 10,202 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Distribution and administration | (13,032) | | (12,466) |

| costs | | | |

+-------------------------------------+--------------+--+--------------+

| | (542) | | (2,264) |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Other operating income | 563 | | 489 |

+-------------------------------------+--------------+--+--------------+

| Profit/(loss) before share based | 21 | | (1,775) |

| payments | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Share based payments | (104) | | (101) |

+-------------------------------------+--------------+--+--------------+

| Loss after share based payments | (83) | | (1,876) |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Revaluation of investment | - | | 5 |

| properties | | | |

+-------------------------------------+--------------+--+--------------+

| Finance costs | (307) | | (333) |

+-------------------------------------+--------------+--+--------------+

| Finance income | 4 | | 115 |

+-------------------------------------+--------------+--+--------------+

| Loss before taxation | (386) | | (2,089) |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Income tax credit/(expense) | 363 | | (47) |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Loss after taxation attributable to | | | |

| equity owners of the Parent | (23) | | (2,136) |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Loss per share | | | |

+-------------------------------------+--------------+--+--------------+

| Basic | (0.16)p | | (14.29)p |

+-------------------------------------+--------------+--+--------------+

| Diluted | (0.16)p | | (14.29)p |

+-------------------------------------+--------------+--+--------------+

Condensed Consolidated Statement of Comprehensive Income

+-------------------------------------+--------------+--+--------------+

| | Unaudited | | Audited |

+-------------------------------------+--------------+--+--------------+

| | Year End | | Year End |

| | 31 March | | 31 March |

| | 2010 | | 2009 |

+-------------------------------------+--------------+--+--------------+

| | GBP'000 | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Loss for the year | (23) | | (2,136) |

+-------------------------------------+--------------+--+--------------+

| Other comprehensive income: | | | |

+-------------------------------------+--------------+--+--------------+

| Foreign exchange differences | (69) | | 397 |

+-------------------------------------+--------------+--+--------------+

| Actuarial loss on retirement | (3,726) | | (1,671) |

| benefit obligations | | | |

+-------------------------------------+--------------+--+--------------+

| Income tax on actuarial loss | 1,043 | | 507 |

+-------------------------------------+--------------+--+--------------+

| Net loss for the year directly | | | |

| recognised in equity/other | (2,752) | | (767) |

| comprehensive income | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Total comprehensive income for the | (2,775) | | (2,903) |

| year | | | |

+-------------------------------------+--------------+--+--------------+

CML Microsystems Plc

Condensed Consolidated Statement of Financial Position

+-------------------------------------+--------------+--+--------------+

| | Unaudited | | Audited |

+-------------------------------------+--------------+--+--------------+

| | 31 March | | 31 March |

| | 2010 | | 2009 |

+-------------------------------------+--------------+--+--------------+

| | GBP'000 | | GBP'000 |

+-------------------------------------+--------------+--+--------------+

| Assets | | | |

+-------------------------------------+--------------+--+--------------+

| Non current assets | | | |

+-------------------------------------+--------------+--+--------------+

| Property, plant and equipment | 5,304 | | 5,931 |

+-------------------------------------+--------------+--+--------------+

| Investment properties | 3,850 | | 3,850 |

+-------------------------------------+--------------+--+--------------+

| Development costs | 4,189 | | 5,192 |

+-------------------------------------+--------------+--+--------------+

| Goodwill | 3,512 | | 3,512 |

+-------------------------------------+--------------+--+--------------+

| Deferred tax asset | 3,097 | | 2,019 |

+-------------------------------------+--------------+--+--------------+

| | 19,952 | | 20,504 |

+-------------------------------------+--------------+--+--------------+

| Current assets | | | |

+-------------------------------------+--------------+--+--------------+

| Inventories | 1,489 | | 1,366 |

+-------------------------------------+--------------+--+--------------+

| Trade receivables and prepayments | 2,802 | | 2,504 |

+-------------------------------------+--------------+--+--------------+

| Current tax assets | 142 | | 355 |

+-------------------------------------+--------------+--+--------------+

| Cash and cash equivalents | 3,883 | | 2,192 |

+-------------------------------------+--------------+--+--------------+

| | 8,316 | | 6,417 |

+-------------------------------------+--------------+--+--------------+

| Non current assets classified as | | | |

| held for | 441 | | 468 |

| sale - properties | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Total assets | 28,709 | | 27,389 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Liabilities | | | |

+-------------------------------------+--------------+--+--------------+

| Current liabilities | | | |

+-------------------------------------+--------------+--+--------------+

| Bank loans and overdrafts | 5,968 | | 6,062 |

+-------------------------------------+--------------+--+--------------+

| Trade and other payables | 2,680 | | 2,069 |

+-------------------------------------+--------------+--+--------------+

| Current tax liabilities | 38 | | 15 |

+-------------------------------------+--------------+--+--------------+

| | 8,686 | | 8,146 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Non current liabilities | | | |

+-------------------------------------+--------------+--+--------------+

| Deferred tax liabilities | 2,172 | | 2,459 |

+-------------------------------------+--------------+--+--------------+

| Retirement benefit obligation | 5,728 | | 1,990 |

+-------------------------------------+--------------+--+--------------+

| | 7,900 | | 4,449 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Total liabilities | 16,586 | | 12,595 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Net Assets | 12,123 | | 14,794 |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Capital and reserves attributable | | | |

| to equity owners of the Parent | | | |

+-------------------------------------+--------------+--+--------------+

| Share capital | 747 | | 747 |

+-------------------------------------+--------------+--+--------------+

| Share premium | 4,148 | | 4,148 |

+-------------------------------------+--------------+--+--------------+

| Share based payments reserve | 255 | | 151 |

+-------------------------------------+--------------+--+--------------+

| Foreign exchange reserve | 374 | | 443 |

+-------------------------------------+--------------+--+--------------+

| Accumulated profits | 6,599 | | 9,305 |

+-------------------------------------+--------------+--+--------------+

| Shareholders' equity | 12,123 | | 14,794 |

+-------------------------------------+--------------+--+--------------+

CML Microsystems Plc

Condensed Consolidated Cash Flow Statement

+-------------------------------------+--------------+--+--------------+

| | Unaudited | | Audited |

+-------------------------------------+--------------+--+--------------+

| | Year End | | Year End |

| | 31 March | | 31 March |

| | 2010 | | 2009 |

+-------------------------------------+--------------+--+--------------+

| | GBP'000 | | GBP'000 |

+-------------------------------------+--------------+--+--------------+

| Operating activities | | | |

+-------------------------------------+--------------+--+--------------+

| Net loss for the year before income | (386) | | (2,089) |

| taxes | | | |

+-------------------------------------+--------------+--+--------------+

| Adjustments for: | | | |

+-------------------------------------+--------------+--+--------------+

| Depreciation | 661 | | 437 |

+-------------------------------------+--------------+--+--------------+

| Amortisation of development costs | 3,750 | | 4,183 |

+-------------------------------------+--------------+--+--------------+

| Movement in pensions deficit | (105) | | 319 |

+-------------------------------------+--------------+--+--------------+

| Share based payments | 104 | | 101 |

+-------------------------------------+--------------+--+--------------+

| Interest expense | 307 | | 333 |

+-------------------------------------+--------------+--+--------------+

| Interest income | (4) | | (115) |

+-------------------------------------+--------------+--+--------------+

| Decrease in working capital | 183 | | 132 |

+-------------------------------------+--------------+--+--------------+

| Cash flows from operating | 4,510 | | 3,301 |

| activities | | | |

+-------------------------------------+--------------+--+--------------+

| Income tax refunded | 237 | | 225 |

+-------------------------------------+--------------+--+--------------+

| Net cash flows from operating | 4,747 | | 3,526 |

| activities | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Investing activities | | | |

+-------------------------------------+--------------+--+--------------+

| Purchase of property, plant and | (49) | | (66) |

| equipment | | | |

+-------------------------------------+--------------+--+--------------+

| Investment in development costs | (2,815) | | (3,969) |

+-------------------------------------+--------------+--+--------------+

| Disposals of property, plant and | 9 | | 38 |

| equipment | | | |

+-------------------------------------+--------------+--+--------------+

| Interest income | 4 | | 115 |

+-------------------------------------+--------------+--+--------------+

| Net cash flows from investing | (2,851) | | (3,882) |

| activities | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Financing activities | | | |

+-------------------------------------+--------------+--+--------------+

| (Decrease)/increase in short term | (62) | | 987 |

| borrowings | | | |

+-------------------------------------+--------------+--+--------------+

| Interest expense | (190) | | (333) |

+-------------------------------------+--------------+--+--------------+

| Net cash flows from financing | (252) | | 654 |

| activities | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Increase in cash and cash | 1,644 | | 298 |

| equivalents | | | |

+-------------------------------------+--------------+--+--------------+

| | | | |

+-------------------------------------+--------------+--+--------------+

| Movement in cash and cash | | | |

| equivalents: | | | |

+-------------------------------------+--------------+--+--------------+

| At start of year | 2,192 | | 1,891 |

+-------------------------------------+--------------+--+--------------+

| Increase in cash and cash | 1,644 | | 298 |

| equivalents | | | |

+-------------------------------------+--------------+--+--------------+

| Effects of exchange rate changes | 47 | | 3 |

+-------------------------------------+--------------+--+--------------+

| At end of year | 3,883 | | 2,192 |

+-------------------------------------+--------------+--+--------------+

CML Microsystems Plc

Condensed Consolidated Statement of Changes in Equity

+-------------------+-------+--+---------+--------+----------+----------+----------+----------+-------------+---------+

| | | | Share Based Payments | Foreign | Accumulated | |

| Unaudited | Share | Share | | Exchange | Profits | Total |

| | Capital |Premium | | Reserve | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| At 31 March 2008 | 747 | 4,148 | 50 | 46 | 12,605 | 17,596 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Loss for year | | | | | (2,136) | (2,136) |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Other comprehensive | | | | | | |

| income: | | | | | | |

+---------------------------+--+---------+-----------------------------------------+----------+-------------+---------+

| Foreign Exchange | | | | | | |

| differences | | | | 397 | | 397 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Defined benefit | | | | | | |

| pension scheme | | | | | (1,671) | (1,671) |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Tax on defined | | | | | | |

| benefit pension | | | | | 507 | 507 |

| scheme | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Total | | | | | | |

| comprehensive | - | - | - | 397 | (3,300) | (2,903) |

| income for the | | | | | | |

| year | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | 747 | 4,148 | 50 | 443 | 9,305 | 14,693 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Transactions with owners in their capacity as | | | | | | |

| owners: | | | | | | |

+-------------------------------------------------+----------+----------+----------+----------+-------------+---------+

| Share based | | | 101 | | | 101 |

| payments | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| At 31 March 2009 | 747 | 4,148 | 151 | 443 | 9,305 | 14,794 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Loss for year | | | | | (23) | (23) |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Other comprehensive | | | | | | |

| income: | | | | | | |

+---------------------------+--+---------+-----------------------------------------+----------+-------------+---------+

| Foreign Exchange | | | | (69) | | (69) |

| differences | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Defined benefit | | | | | | |

| pension scheme | | | | | (3,726) | (3,726) |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Tax on defined | | | | | | |

| benefit pension | | | | | 1,043 | 1,043 |

| scheme | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Total | | | | | | |

| comprehensive | - | - | - | (69) | (2,706) | (2,775) |

| income for the | | | | | | |

| year | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | 747 | 4,148 | 151 | 374 | 6,599 | 12,019 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| Transactions with owners in their capacity as | | | | | | |

| owners: | | | | | | |

+-------------------------------------------------+----------+----------+----------+----------+-------------+---------+

| Share based | | | | | | |

| payments | | | | | | |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | | | 104 | | | 104 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| At 31 March 2010 | 747 | 4,148 | 255 | 374 | 6,599 | 12,123 |

+-------------------+----------+---------+-----------------------------------------+----------+-------------+---------+

| | | | | | | | | | | |

+-------------------+-------+--+---------+--------+----------+----------+----------+----------+-------------+---------+

CML Microsystems Plc

Notes to the condensed financial statements

1. Segmental Analysis

+------------------+----+----+----------+----------------+-----------+-----------+----------------+-----------+

| | Unaudited | Audited |

+------------------+-------------------------------------------------+----------------------------------------+

| | Year End | Year End |

+------------------+-------------------------------------------------+----------------------------------------+

| | 31 March 2010 | 31 March 2009 |

+------------------+-------------------------------------------------+----------------------------------------+

| | |Semi-conductor | | |Semi-conductor | |

| | Equipment | components | Group |Equipment | components | Group |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Revenue | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| By origination | 722 | 28,257 | 28,979 | 979 | 20,928 | 21,907 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Inter-segmental | - | (10,956) | (10,956) | - | (5,818) | (5,818) |

| revenue | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Segmental | 722 | 17,301 | 18,023 | 979 | 15,110 | 16,089 |

| revenue | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Profit/(Loss) | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Segmental result | (12) | (71) | (83) | 54 | (1,930) | (1,876) |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Financial | | | (307) | | | (333) |

| expense | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Financial income | | | 4 | | | 115 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Revaluation of | | | | | | |

| investment | | | - | | | 5 |

| properties | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Income tax | | | 363 | | | (47) |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Loss after | | | 23 | | | (2,136) |

| taxation | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Assets and | | | | | | |

| Liabilities | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Segmental assets | 641 | 20,538 | 21,179 | 686 | 20,012 | 20,698 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Unallocated corporate | | | | | | |

| assets | | | | | | |

+-----------------------+---------------+----------------+-----------+-----------+----------------+-----------+

| Investment | | | 4,291 | | | 4,317 |

| property | | | | | | |

| (Including held | | | | | | |

| for sale) | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Deferred | | | 3,097 | | | 2,019 |

| taxation | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Current tax | | | 142 | | | 355 |

| receivable | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Consolidated | | | 28,709 | | | 27,389 |

| total assets | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Segmental | 23 | 2,657 | 2,680 | 51 | 2,018 | 2,069 |

| liabilities | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Unallocated corporate | | | | | | |

| liabilities | | | | | | |

+-----------------------+---------------+----------------+-----------+-----------+----------------+-----------+

| Deferred | | | 2,172 | | | 2,459 |

| taxation | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Current tax | | | 38 | | | 15 |

| liability | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Bank loans and | | | | | | |

| overdrafts | | | 5,968 | | | 6,062 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Retirement | | | | | | |

| benefit | | | 5,728 | | | 1,990 |

| obligation | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Consolidated | | | | | | |

| total | | | 16,586 | | | 12,595 |

| liabilities | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Other segmental | | | | | | |

| information | | | | | | |

+----------------------------+----------+----------------+-----------+-----------+----------------+-----------+

| Property, plant | | | | | | |

| and equipment | - | 49 | 49 | 30 | 36 | 66 |

| additions | | | | | | |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Development cost | | | | | | |

| additions | 72 | 2,743 | 2,815 | 74 | 3,895 | 3,969 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Depreciation | 8 | 653 | 661 | 16 | 421 | 437 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| Amortisation | 72 | 3,678 | 3,750 | 73 | 4,110 | 4,183 |

+------------------+--------------------+----------------+-----------+-----------+----------------+-----------+

| | | | | | | | | |

+------------------+----+----+----------+----------------+-----------+-----------+----------------+-----------+

Geographical information

+---------------------------+---------+---------+----------+---------+----------+

| | UK | Germany | Americas | Far | Total |

| | | | | East | |

+---------------------------+---------+---------+----------+---------+----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+---------------------------+---------+---------+----------+---------+----------+

| Unaudited | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Year ended 31 March 2010 | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Revenue by origination | 11,003 | 7,174 | 4,373 | 6,428 | 28,978 |

+---------------------------+---------+---------+----------+---------+----------+

| Inter-segmental revenue | (4,809) | (6,138) | - | (8) | (10,955) |

+---------------------------+---------+---------+----------+---------+----------+

| Revenue to third parties | 6,194 | 1,036 | 4,373 | 6,420 | 18,023 |

+---------------------------+---------+---------+----------+---------+----------+

| | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Property, plant and | 5,111 | 115 | 59 | 19 | 5,304 |

| equipment | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Investment properties | 3,850 | - | - | - | 3,850 |

+---------------------------+---------+---------+----------+---------+----------+

| Goodwill | - | 3,512 | - | - | 3,512 |

+---------------------------+---------+---------+----------+---------+----------+

| Development cost | 2,661 | 1,528 | - | - | 4,189 |

+---------------------------+---------+---------+----------+---------+----------+

| Total assets | 21,222 | 4,644 | 1,565 | 1,278 | 28,709 |

+---------------------------+---------+---------+----------+---------+----------+

| | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Audited | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Year ended 31 March 2009 | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Revenue by origination | 9,043 | 3,427 | 4,569 | 4,868 | 21,907 |

+---------------------------+---------+---------+----------+---------+----------+

| Inter-segmental revenue | (2,521) | (2,794) | (503) | - | (5,818) |

+---------------------------+---------+---------+----------+---------+----------+

| Revenue to third parties | 6,522 | 633 | 4,066 | 4,868 | 16,089 |

+---------------------------+---------+---------+----------+---------+----------+

| | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Property, plant and | 5,627 | 197 | 79 | 28 | 5,931 |

| equipment | | | | | |

+---------------------------+---------+---------+----------+---------+----------+

| Investment properties | 3,850 | - | - | - | 3,850 |

+---------------------------+---------+---------+----------+---------+----------+

| Goodwill | - | 3,512 | - | - | 3,512 |

+---------------------------+---------+---------+----------+---------+----------+

| Development cost | 3,626 | 1,566 | - | - | 5,192 |

+---------------------------+---------+---------+----------+---------+----------+

| Total assets | 20,280 | 3,883 | 1,713 | 1,513 | 27,389 |

+---------------------------+---------+---------+----------+---------+----------+

Reported segments and their results in accordance with IFRS 8, is based on

internal management reporting information that is regularly reviewed by the

chief operating decision maker (C Gurry). The measurement policies the Group

uses for segmental reporting under IFRS 8 are the same as those used in its

financial statements. No comparative figures needed restating to comply with the

fact that IFRS 8 needed to be applied retrospectively.

Inter-segmental transfers or transactions are entered into under commercial

terms and conditions appropriate to the location of the entity whilst

considering that the parties are related.

2. Dividend paid and proposed

No dividend has been paid or proposed in the year end 31 March 2010 or the year

end 31 March 2009.

3. Income tax

The directors consider that tax will be payable at varying rates according to

the country of incorporation of a subsidiary and have provided on that basis.

+------------------------------------------+------------+--+------------+

| | Unaudited | | Audited |

+------------------------------------------+------------+--+------------+

| | Year End | | Year End |

+------------------------------------------+------------+--+------------+

| | 31 March | | 31 March |

| | 2010 | | 2009 |

+------------------------------------------+------------+--+------------+

| | GBP'000 | | GBP'000 |

+------------------------------------------+------------+--+------------+

| | | | |

+------------------------------------------+------------+--+------------+

| UK income tax | (142) | | (305) |

+------------------------------------------+------------+--+------------+

| Overseas income tax | 132 | | 114 |

+------------------------------------------+------------+--+------------+

| Total current tax credit | (10) | | (191) |

+------------------------------------------+------------+--+------------+

| Deferred tax | (353) | | 238 |

+------------------------------------------+------------+--+------------+

| Reported income tax (credit)/charge | (363) | | 47 |

+------------------------------------------+------------+--+------------+

4. Loss per share

The calculation of basic and diluted earnings per share is based on the loss

attributable to ordinary shareholders divided by the weighted average number of

shares in issue during the year.

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| |Unaudited | Weighted |Unaudited | Audited | Weighted |Audited |

| | Loss | average | Loss per | Loss | average | Loss |

| | | number | share | | number | per |

| | | of | | | of | share |

| | | shares | | | shares | |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| | 2010 | 2010 | 2010 | 2009 | 2009 | 2009 |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| | GBP | Number | p | GBP | Number | p |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| Basic loss per share | (23,414) | 14,947,626 | (0.16) | (2,135,844) | 14,947,626 | (14.29) |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| | | | | | | |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| Diluted loss per | | | | | | |

| share | | | | | | |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| Basic loss per share | (23,414) | 14,947,626 | (0.16) | (2,135,844) | 14,947,626 | (14.29) |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| Dilutive effect of | - | 21,332 | - | - | - | - |

| share options | | | | | | |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

| Diluted loss per | (23,414) | 14,968,958 | (0.16) | (2,135,844) | 14,947,626 | (14.29) |

| share | | | | | | |

+----------------------+-----------+------------+-----------+-------------+------------+---------+

5. Investment Properties

Investment properties are revalued at each discrete period end by the directors

and every third year by independent Chartered Surveyors on an open market basis.

No depreciation is provided on freehold investment properties or on leasehold

investment properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income statement. At the

31 March 2009 the investment properties were professionally valued by Everett

Newlyn, Chartered Surveyors and Commercial Property Consultants on an open

market basis.

6. Analysis of cash flow movement in net debt

+------------------+---------+---------+---------+-----------+-----------+

| |Audited |Audited |Audited |Unaudited |Unaudited |

+------------------+---------+---------+---------+-----------+-----------+

| | Net | Year | Net | Year | Net |

| |debt at | end |debt at | end | debt at |

| | 31 | 31 | 31 | 31 | 31 |

| | March | March | March | March | March |

| | 2008 | 2009 | 2009 | 2010 | 2010 |

| | | Cash | | Cash | |

| | | Flow | | Flow | |

+------------------+---------+---------+---------+-----------+-----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+------------------+---------+---------+---------+-----------+-----------+

| Cash and Cash | 1,891 | 301 | 2,192 | 1,691 | 3,883 |

| equivalents | | | | | |

+------------------+---------+---------+---------+-----------+-----------+

| Bank loans and | (5,075) | (987) | (6,062) | 94 | (5,968) |

| overdrafts | | | | | |

+------------------+---------+---------+---------+-----------+-----------+

| | (3,184) | (686) | (3,870) | 1,785 | (2,085) |

+------------------+---------+---------+---------+-----------+-----------+

The cash flow above is a combination of the actual cash flow and the exchange

movement.

7. Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with foreign

currencies and customer dependency. With the majority of the Group's earnings

being linked to the US Dollar a decline in this currency will have a direct

effect on revenue, although since the majority of the cost of sales are also

linked to the US Dollar, this risk is reduced at the gross profit line.

Additionally, though the Group has a very diverse customer base in certain

market segments, key customers can represent a significant amount of revenue.

Key customer relationships are closely monitored, however changes in buying

patterns of a key customer could have an adverse effect on the Group's

performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly competitive global market,

which is undergoing continual and geographical change. The Group's ability to

respond to many competitive factors including, but not limited to pricing,

technological innovations, product quality, customer service, manufacturing

capabilities and employment of qualified personnel will be key in the

achievement of its objectives, but its ultimate success will depend on the

demand for its customers' products since the Group is a component supplier.

A substantial proportion of the Group's revenue and earnings are derived

from outside the UK and so the Group's ability to achieve its financial

objectives could be impacted by risks and uncertainties associated with local

legal requirements, the enforceability of laws and contracts, changes in the tax

laws, terrorist activities, natural disasters or health epidemics.

8. Directors' statement pursuant to the Disclosure and Transparency Rules

The directors confirm that, to the best of their knowledge:

a. the condensed consolidated financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the assets,

liabilities, financial position and loss of the company and the undertakings

included in the consolidation taken as a whole; and

b. the Chairman's Statement and Operating and Financial Review

includes a fair review of the development and performance of the business and

the position of the company and the undertakings included in the consolidation

taken as a whole together with a description of the principal risks and

uncertainties that they face.

The directors are also responsible for the maintenance and integrity of the

CML Microsystems Plc website. Legislation in the UK governing the preparation

and dissemination of the financial statements may differ from legislation in

other jurisdictions.

9. Significant accounting policies

The accounting policies used in preparation of the Annual Results

Announcement are the same accounting policies set out in the year ended 31 March

2009 financial statements except for the adoption of:

IAS 1 Presentation of Financial Statements (Revised 2007) and IFRS 8

Operating Segments

The adoption of IAS 1 (Revised 2007) makes certain changes to the format and

titles of the primary statements and to the presentation of some items within

these statements. IAS 1 affects the presentation of shareholder changes in

equity and introduces "Consolidated statement of comprehensive income". In

accordance with the new standard the entity does not present a "Statement of

recognised income and expense", as was presented in the 31 March 2009 financial

statements. Further, a "Consolidated statement of changes in equity" is now

presented as a primary statement. The adoption of IFRS 8 has not affected the

identified operating segments for the Group.

10. General

The results for the year have been prepared using the recognition and

measurement principles of International Financial Reporting Standards as adopted

by the EU.

The audited financial information for the year ended 31st March 2009 is based on

the statutory accounts for the financial year ended 31st March 2009 that have

been filed with the Registrar of Companies. The auditors reported on those

accounts: their report was (i) unqualified, (ii) did not include references to

any matters to which the auditors drew attention by way of emphasis without

qualifying the reports and (iii) did not contain statements under section 498(2)

or (3) of the Companies Act 2006.

The statutory accounts for the year ended 31st March 2010 are expected to be

finalised and signed following approval by the board of directors on 25 June

2010 and delivered to the Registrar of Companies following the Company's Annual

General Meeting on 22 July 2010.

The financial information contained in this announcement does not constitute

statutory accounts for the year ended 31st March 2010 or 2009 as defined by

Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com.

11. Approval

The directors approved this Annual Results Announcement on 14 June 2010.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFDFMLFSSEEM

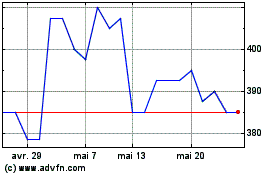

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024