TIDMCML

RNS Number : 3628I

CML Microsystems PLC

14 June 2011

CML Microsystems Plc

PRELIMINARY RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductors, primarily for global

communication and storage markets, announces Preliminary Results

for the year ended 31 March 2011, which show a return to

profitability and the reinstatement of a dividend payment.

Financial Highlights:

-- Revenues up 23% to GBP22.12m (2010: GBP18.02m)

-- Gross profit up 23% to GBP15.37m (2010: GBP12.49m)

-- Profit before tax of GBP2.32m (2010: loss of GBP386k)

-- EPS of 17.64p diluted (2010: loss of 0.16p)

-- Net cash inflow of GBP4.41m (2010: GBP1.78m)

-- Cash reserves at 31 March 2011 of GBP6.25m (2010:

GBP3.88m)

-- Net cash position of GBP2.33m (2010: net debt of

GBP2.09m)

-- Final dividend of 3.5p per ordinary share (2010: nil)

Operational Highlights:

-- Wireless: (c. 43% of revenues) - 28% growth with healthy

contribution from the RF portfolio along with established silicon

platform technology, FirmASIC

-- Storage: (c. 40% of revenues) - 22% growth from the majority

of CML's main customers

-- Wireline telecom: (c. 12% of revenues) - double-digit growth

reversing trend of the last 2 years

-- Equipment: (c. 4% of revenues) - 7% growth due to higher

demand for wireless telemetry products from UK utility

companies.

Regarding Outlook, Chris Gurry, Managing Director of CML,

said:

"This was an important year in the Group's objective for

sustainable business growth and a much improved trading performance

was posted. General conditions within the majority of our focus

market and application areas improved, following the healthier

visibility seen towards the end of the prior year.

"The Board is pleased with the progress made throughout the

period and looks forward to the further advances that are expected

to materialise over the year ahead."

Enquiries:

CML Microsystems plc www.cmlmicroplc.com

Nigel Clark, Financial Tel: 01621 875 500

Director

Chris Gurry, Managing Director

Cenkos Securities plc

Jeremy Warner Allen (Sales) Tel: 020 7397 8900

Stephen Keys (Corporate

Finance)

Walbrook PR Ltd Tel: 020 7933 8780

Paul McManus Mob: 07980 541 893 or

paul.mcmanus@walbrookpr.com

Helen Westaway Mob: 07841 917 679 or

helen.westaway@walbrookpr.com

Chairman's statement

Introduction

These results for the full trading year provide satisfying

further evidence of the clear improvement in performance that your

Company is achieving.

Particular encouragement can be drawn from the positive sales

gains that were posted in all principal Group product areas and

also in most major market territories, as the operating and

financial review makes clear.

The achievement of a return to trading profitability provided

opportunities for your management to reduce Group borrowings from

an opening net debt position to a net cash position by the

financial year end.

Results

To summarise the results, Group revenues for the year just ended

were GBP22.12m (2010: GBP18.02m) while gross profit was GBP15.37m

(2010: GBP12.49m). A profit before tax of GBP2.32m, which is

arrived at after a GBP400k reduction in the estimated value of

investment properties, compares with a loss the previous year

(2010: loss of GBP386k).

Earnings per share of 17.64p diluted (2010: loss of 0.16p)

reflect the benefit of an income tax credit that raised the

Company's post-tax profit to GBP2.68m.

Dividend

Your Directors' believe that shareholders should receive

appropriate benefit according to the performance of their Company.

For the year ended 31 March 2008 the Board took the difficult but

necessary decision to cease payment of a dividend for the first

time since becoming a publicly listed company in 1984. I am pleased

to report that in the present circumstances, the Directors are

recommending payment of a final dividend of 3.5p per ordinary share

to be paid on 5 August 2011 to all shareholders whose names appear

on the register at close of business on 24 June 2011.

As mentioned at the interim stage, your Company transitioned to

Standard Listing status during the year. It is the view of your

Board that this is the most appropriate listing for your Company

given the rising administrative demands of a Premium Listing. This

does not prevent your Board electing to observe selected Premium

Listing rules that it deems appropriate.

Prospects

I see evidence for further progress by your Company in its aim

of continuing future growth. Subject to unforeseen circumstances, I

have confidence that my expectations will be realised.

Once again, I cannot conclude my report to you without

expressing the Board's thanks to your Company's employees for their

skills and commitment towards its success.

GW Gurry

Chairman 14 June 2011

Operating and financial review

OVERVIEW

Over the course of the year under review, we experienced the

very positive effects from the ongoing execution of our sustainable

growth strategy.

The consistent objective has been to combine our resources,

proprietary technology and system-level understanding to develop

and successfully market class-leading semiconductor products that

solve real-world customer problems.

Our progress is highlighted by the material increase in revenue

levels that contained a solid and growing contribution from

products that were conceived and launched more recently.

The level of new product development activities remained healthy

through the year with engineering resources being strengthened to

address the higher number of market opportunities that

materialised.

Trading for the full year matched expectations for a

traditionally slightly weaker second half and an encouraging full

year return to profit was recorded.

FINANCIAL RESULTS

Group revenues for the year ended 31 March 2011 increased to

GBP22.12m representing a 23% improvement over the prior year (2010:

GBP18.02m). This increase was broad based reflecting higher

semiconductor sales into all major geographical locations and

across the three main market areas; namely wireless, storage and

wireline telecom.

The majority of customer transactions were denominated in US

Dollars leading to a slightly positive but immaterial effect on

Group consolidated revenues. No one customer accounted for more

than 9% of total sales.

Gross profit for the year was GBP15.37m equating to a 23%

increase against the prior year (2010: GBP12.49m). The gross margin

remained stable at 69%.

The Group's distribution and administration expenses fell by 2%

to GBP12.73m (2010: 13.03m). Although direct staffing costs

increased year on year, lower depreciation and amortisation charges

coupled with a GBP124k foreign exchange benefit (2010: GBP318k

loss) resulted in an overall positive effect.

At the operating level, prior to other operating income, the

result was a GBP2.64m profit highlighting a GBP3.18m positive swing

from the previous year (2010: GBP0.54m loss).

Other operating income fell from GBP0.56m (2010) to GBP0.39m as

a direct result of lower EU grant monies and a reduction in rental

income from certain of the Group's investment property assets.

The Board decided to act prudently in the face of a difficult

commercial property environment and, after seeking appropriate

advice, reduced the value of its investment properties by

GBP400k.

Net finance costs amounted to GBP260k (2010: GBP303k).

The firm sales growth coupled with stable margins and tight cost

control enabled a profit before tax of GBP2.32m to be recorded

(2010: GBP0.39m loss).

The Group made solid progress with its cash position. Net cash

inflow for the year was GBP4.41m (2010:GBP1.78m) facilitating the

transition from a net debt position of GBP2.09m at 1 April 2010

into a net cash situation of GBP2.33m at 31 March 2011.

Inventory levels at the year-end were slightly up at GBP1.67m

(2010: GBP1.49m) and well within expectations given the strong

revenue increase reported.

An income tax credit of GBP360k was received (2010: GBP363k)

mainly as a result of deferred tax on prior year losses and

development expenditure incurred.

During the year capitalised development expenses amounted to

GBP2.79m (2010: GBP2.82m) whilst a further amount of GBP574k (2010:

GBP563k) was written off to research and development. Total

development costs represented 15% of sales. The Group maintained

its focus on proprietary intellectual property development whilst

also partnering with key complementary technology leaders where

appropriate. Internal resources were strengthened as a result of

the increased number of opportunities that were presented.

Net assets rose to GBP17.52m (2010: GBP12.12m) largely assisted

by the increase in profitability and a reduced liability in respect

of the defined benefit pension scheme. The scheme was closed in

prior years in respect of new entrants and future accruals.

MARKETS REVIEW

Wireless

During the period, wireless product shipments accounted for

close to 43% of Group sales and also represented the largest growth

percentage year on year at approximately 28%. This solid increase

was posted across a wide customer base and consisted of gains from

a number of existing customers coupled with new revenue streams

emanating from more recent design wins.

The resulting product mix included a healthy contribution from

the RF portfolio along with our now established silicon platform

technology, FirmASIC.

From a development perspective, the Group continued to widen the

scope of functionality offered by its semiconductor products.

Through the year this led to the release of a number of new ICs for

analogue and digital two-way radio markets along with data-centric

application areas such as industrial radio data modems and marine

safety (AIS) transponders.

Our development strategy to further expand the product range

continued and we made good progress with evolving towards a

comprehensive device portfolio consisting of RF, baseband and voice

coding ICs.

Storage

The shipment of flash memory controller ICs into the storage

market grew by more than 22% against the prior year culminating in

a total contribution to Group revenues from this category of 40%.

Gains were achieved at the majority of our main customers whilst

certain embryo level customers began to ramp their production

output. Improved trading was evident across each of the major

geographical regions served.

Throughout the year customers utilised our flash memory

controller ICs within a variety of removable media card and solid

state drive applications predominantly targeted at the very robust

storage requirements of the global telecom, networking and embedded

computing markets.

Research and development activities were focused around

maintaining a leading position in the growing sub-markets already

addressed together with expanding the semiconductor portfolio to

embrace similar application areas and opportunities. In this

respect, we sampled first silicon from an announced co-operation

with Toshiba Electronics Europe by the end of the year.

Wireline telecom

The sale of semiconductors into the wireline telecom arena

posted a double-digit increase and reversed the annual trend of the

prior two years. Shipments amounted to just under 12% of Group

revenues. The encouraging signs seen at the end of the previous

year, where newer devices were starting to create design-win

momentum, translated to real gains as customer end products

achieved market acceptance.

A major contributor to the growth achieved was the sale of modem

ICs to customers who manufacture payment terminals for China's

recently established self-service electronic payment service, "Pay

Easy". Traditional applications such as security alarm panels

continued to contribute meaningful revenues.

Development activities were centred on ensuring that the telecom

product range remained price and performance competitive for the

sub-markets addressed. The level of customer design-in activity

continued to be healthy.

Equipment

The Group's equipment division, RDT, posted a 7% revenue

increase to GBP769k (2010: GBP722k) as a consequence of the higher

demand for wireless telemetry products from public utility

companies located in the UK. The UK commercial CCTV market

continued to be quite stagnant from a wireless video product

perspective. Overall contribution to Group sales was just under

4%.

Just prior to the year end the Company signed an agreement with

a large UK water company for the continued supply of telemetry and

data transmission products as part of a multi-year programme.

A new product development project that will permit entry into

the GPRS M2M market neared completion during the final quarter.

Approximately 1% of Group revenues were derived from the sale of

products or services that are categorised outside of the market

areas highlighted in this report.

SUMMARY AND OUTLOOK

This was an important year in the Group's objective for

sustainable business growth and a much improved trading performance

was posted. General conditions within the majority of our focus

market and application areas improved, following the healthier

visibility seen towards the end of the prior year.

Products that emerged from the comparatively high levels of

development expenditure in recent times enabled our global sales

teams and sales channel partners to address a wider scope of

opportunities. As we go forward, that continuing strategy is

expected to drive consistent growth.

There are a number of clear drivers within our wireless

semiconductor markets that should generate a further increase in

sales. These include the gradual analogue to digital migration from

the two-way radio users, expansion of the available market for the

more mature TETRA digital radio standard and continuing escalation

of the mandated use of certain marine safety products (AIS). The

Company has evolved to offer a range of semiconductors with

complementary functionality into each of these sub-sectors and is

well positioned to benefit as the markets advance.

For the storage markets, our expectations are that the majority

of existing customers will continue to grow their business levels

and that we will also continue to expand our customer base. To

date, Group semiconductor solutions for storage markets have been

focused on the mature interface standards used within industrial

and commercial high-reliability application areas. Through this

coming year we will start to deliver flash memory controller ICs

that address complementary areas of the wider market that demand

alternative standard interfaces. These products will be based upon

an evolution of our patented proprietary technology that was first

launched in 1999. This should increase the total available market

noticeably.

The objectives for the year to March 2012 are to maintain a

robust level of appropriate new product development activities

while continuing to expand our global customer base, both directly

and in conjunction with our extensive sales channels. The

escalating product portfolio should enable us to penetrate

customers and secure market opportunities that were previously

closed to us. The overriding objective is to field class leading

semiconductors by having a thorough system-level understanding of

the customer's application.

The Board is pleased with the progress made throughout the

period and looks forward to the further advances that are expected

to materialise over the year ahead.

C.A. Gurry

Managing Director

CML Microsystems Plc

Condensed consolidated income statement

Unaudited Audited

2011 2010

GBP GBP

---------------------------------------------- ------------- -------------

Continuing operations

Revenue 22,121,646 18,023,139

Cost of sales (6,754,114) (5,533,377)

---------------------------------------------- ------------- -------------

Gross profit 15,367,532 12,489,762

Distribution and administration costs (12,728,955) (13,031,511)

---------------------------------------------- ------------- -------------

2,638,577 (541,749)

Other operating income 388,712 562,889

---------------------------------------------- ------------- -------------

Profit from operations 3,027,289 21,140

Share-based payments (43,134) (103,937)

---------------------------------------------- ------------- -------------

Profit/(loss) after share-based payments 2,984,155 (82,797)

Revaluation of investment properties (400,000) -

Finance costs (270,834) (307,344)

Finance income 11,289 4,029

---------------------------------------------- ------------- -------------

Profit/(loss) before taxation 2,324,610 (386,112)

Income tax credit 359,900 362,698

---------------------------------------------- ------------- -------------

Profit/(loss) after taxation attributable to

equity owners of the parent 2,684,510 (23,414)

---------------------------------------------- ------------- -------------

Profit/(loss per share)

Basic 17.87p (0.16)p

---------------------------------------------- ------------- -------------

Diluted 17.64p (0.16)p

---------------------------------------------- ------------- -------------

Condensed consolidated statement of comprehensive income

Unaudited Unaudited Audited Audited

2011 2011 2010 2010

GBP GBP GBP GBP

-------------------------- ---------- ---------- ------------ ------------

Profit/(loss) for the

year 2,684,510 (23,414)

Other comprehensive

income

Foreign exchange

differences (47,869) (68,940)

Actuarial gain/(loss) on

retirement benefit

obligations 2,811,000 (3,726,000)

Income tax on actuarial

gain/(loss) (800,120) 1,043,280

-------------------------- ---------- ---------- ------------ ------------

Net profit/(loss) for the

year directly recognised

in equity/other

comprehensive income 1,963,011 (2,751,660)

-------------------------- ---------- ---------- ------------ ------------

Total comprehensive

income for the year 4,647,521 (2,775,074)

-------------------------- ---------- ---------- ------------ ------------

CML Microsystems Plc

Condensed consolidated statement of financial position

Unaudited Unaudited Audited Audited

2011 2011 2010 2010

GBP GBP GBP GBP

-------------------------------- --------- ---------- --------- ----------

Assets

Non-current assets

Property, plant and equipment 5,230,759 5,303,868

Investment properties 3,450,000 3,850,000

Development costs 3,624,105 4,189,081

Goodwill 3,512,305 3,512,305

Deferred tax asset 2,534,390 3,096,635

-------------------------------- --------- ---------- --------- ----------

18,351,559 19,951,889

Current assets

Inventories 1,665,529 1,488,839

Trade receivables and

prepayments 1,513,209 2,802,359

Current tax assets 5,581 141,468

Cash and cash equivalents 6,245,694 3,883,238

-------------------------------- --------- ---------- --------- ----------

9,430,013 8,315,904

Non-current assets classified as

held for sale properties 419,773 441,408

-------------------------------- --------- ---------- --------- ----------

Total assets 28,201,345 28,709,201

-------------------------------- --------- ---------- --------- ----------

Liabilities

Current liabilities

Bank loans and overdrafts 3,919,411 5,968,290

Trade and other payables 2,524,534 2,679,145

Current tax liabilities 49,244 38,064

-------------------------------- --------- ---------- --------- ----------

6,493,189 8,685,499

Non-current liabilities

Deferred tax liabilities 1,577,253 2,172,206

Retirement benefit obligation 2,607,000 5,728,000

-------------------------------- --------- ---------- --------- ----------

4,184,253 7,900,206

-------------------------------- --------- ---------- --------- ----------

Total liabilities 10,677,442 16,585,705

-------------------------------- --------- ---------- --------- ----------

Net assets 17,523,903 12,123,496

-------------------------------- --------- ---------- --------- ----------

Capital and reserves

attributable to equity owners of

the parent

Share capital 785,335 747,381

Share premium 4,820,086 4,148,288

Share-based payments reserve 297,886 254,752

Foreign exchange reserve 326,480 374,349

Accumulated profits 11,294,116 6,598,726

-------------------------------- --------- ---------- --------- ----------

Shareholders' equity 17,523,903 12,123,496

-------------------------------- --------- ---------- --------- ----------

CML Microsystems Plc

Condensed consolidated cash flow statement

Unaudited Audited

2011 2010

GBP GBP

------------------------------------------------- ----------- -----------

Operating activities

Net profit/(loss) for the year before taxation 2,324,610 (386,112)

Adjustments for:

Depreciation 321,579 660,488

Amortisation of development costs 3,276,015 3,750,089

Revaluation of investment properties 400,000 -

Movement in pensions deficit (437,000) (105,000)

Share-based payments 43,134 103,937

Finance costs 143,834 307,344

Finance income (11,289) (4,029)

Decrease in working capital 926,184 183,122

------------------------------------------------- ----------- -----------

Cash flows from operating activities 6,987,067 4,509,839

Income tax (paid)/refunded (328,310) 237,441

------------------------------------------------- ----------- -----------

Net cash flows from operating activities 6,658,757 4,747,280

------------------------------------------------- ----------- -----------

Investing activities

Purchase of property, plant and equipment (253,035) (49,065)

Investment in development costs (2,786,386) (2,815,066)

Disposal of property, plant and equipment 31,665 9,199

Finance income 11,289 4,029

------------------------------------------------- ----------- -----------

Net cash flows from investing activities (2,996,467) (2,850,903)

------------------------------------------------- ----------- -----------

Financing activities

Issue of ordinary shares 709,752 -

Finance costs (143,834) (307,344)

Decrease in bank loans and short term borrowings (2,048,879) (61,705)

------------------------------------------------- ----------- -----------

Net cash flows from financing activities (1,482,961) (369,049)

------------------------------------------------- ----------- -----------

Increase in cash and cash equivalents 2,179,329 1,527,328

------------------------------------------------- ----------- -----------

Movement in cash and cash equivalents:

At start of year 3,883,238 2,191,960

Increase in cash and cash equivalents 2,179,329 1,527,328

Effects of exchange rate changes 183,127 163,950

------------------------------------------------- ----------- -----------

At end of year 6,245,694 3,883,238

------------------------------------------------- ----------- -----------

CML Microsystems Plc

Condensed consolidated statement of changes in equity

Share Foreign

Share Share -based exchange Accumulated

capital premium payments reserve profits Total

GBP GBP GBP GBP GBP GBP

Audited

-------------- ------- --------- -------- -------- ----------- -----------

At 31 March

2009 747,381 4,148,288 150,815 443,289 9,304,860 14,794,633

-------------- ------- --------- -------- -------- ----------- -----------

Loss for year (23,414) (23,414)

Other

comprehensive

income

Foreign

exchange

differences (68,940) (68,940)

Net actuarial

losses

recognised

directly to

equity (3,726,000) (3,726,000)

Deferred tax

on actuarial

losses 1,043,280 1,043,280

-------------- ------- --------- -------- -------- ----------- -----------

Total

comprehensive

income for

the year - - - (68,940) (2,706,134) (2,775,074)

-------------- ------- --------- -------- -------- ----------- -----------

747,381 4,148,288 150,815 68,940 6,598,726 12,019,559

Transactions

with owners in

their capacity

as owners

Share-based

payments 103,937 103,937

-------------- ------- --------- -------- -------- ----------- -----------

At 31 March

2010 747,381 4,148,288 254,752 374,349 6,598,726 12,123,496

-------------- ------- --------- -------- -------- ----------- -----------

Unaudited

Profit for

year 2,684,510 2,684,510

Other

comprehensive

income

Foreign

exchange

differences (47,869) (47,869)

Net actuarial

profits

recognised

directly to

equity 2,811,000 2,811,000

Deferred tax

on actuarial

losses (800,120) (800,120)

-------------- ------- --------- -------- -------- ----------- -----------

Total

comprehensive

income for

the year - - - (47,869) 4,695,390 4,647,521

-------------- ------- --------- -------- -------- ----------- -----------

Transactions

with owners in

their capacity

as owners

Issue of

ordinary

shares 37,954 671,798 709,752

-------------- ------- --------- -------- -------- ----------- -----------

Share-based

payments in

year 43,134 43,134

-------------- ------- --------- -------- -------- ----------- -----------

At 31 March

2011 785,335 4,820,086 297,886 326,480 11,294,116 17,523,903

-------------- ------- --------- -------- -------- ----------- -----------

CML Microsystems Plc

Notes to the condensed financial statements

1. Segmental analysis

Reported segments and their results in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the chief operating decision maker (C. A.

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

Information about revenue, profit/loss, assets and

liabilities

Unaudited Audited

2011 2010

Semiconductor Equipment Semiconductor

Equipment Components Group Components Group

GBP GBP GBP GBP GBP GBP

---------------- --------- ------------- ------------ --------- ------------- ------------

Revenue

By origination 769,067 34,997,570 35,766,637 721,945 28,256,969 28,978,914

Inter-segmental

revenue - (13,644,991) (13,644,991) - (10,955,775) (10,955,775)

---------------- --------- ------------- ------------ --------- ------------- ------------

Total segmental

revenue 769,067 21,352,579 22,121,646 721,945 17,301,194 18,023,139

---------------- --------- ------------- ------------ --------- ------------- ------------

Profit/(loss)

Segmental result 7,015 2,977,140 2,984,155 (11,483) (71,314) (82,797)

---------------- --------- ------------- --------- -------------

Revaluation of

investment

properties (400,000) -

Finance expense (270,834) (307,344)

Finance income 11,289 4,029

Income tax 359,900 362,698

---------------- --------- ------------- ------------ --------- ------------- ------------

Profit/(loss)

after taxation 2,684,510 (23,414)

---------------- --------- ------------- ------------ --------- ------------- ------------

Assets and

liabilities

Segmental assets 686,913 21,104,688 21,791,601 641,418 20,538,272 21,179,690

---------------- --------- ------------- --------- -------------

Unallocated

corporate

assets

Investment

properties 3,450,000 3,850,000

Properties held

for sale 419,773 419,773 441,408 441,408

------------- -------------

Deferred

taxation 2,534,390 3,096,635

Current tax

receivable 5,581 141,468

---------------- --------- ------------- ------------ --------- ------------- ------------

Consolidated

total assets 28,201,345 28,709,201

---------------- --------- ------------- ------------ --------- ------------- ------------

Segmental

liabilities 113,073 2,411,461 2,524,534 22,232 2,656,913 2,679,145

---------------- --------- ------------- --------- -------------

Unallocated

corporate

liabilities

Deferred

taxation 1,577,253 2,172,206

Current tax

liability 49,244 38,064

Bank loans and

overdrafts 3,919,411 5,968,290

Retirement

benefit

obligation 2,607,000 5,728,000

---------------- --------- ------------- ------------ --------- ------------- ------------

Consolidated

total

liabilities 10,677,442 16,585,705

---------------- --------- ------------- ------------ --------- ------------- ------------

Other segmental information

Unaudited Audited

2011 2010

Semiconductor Semiconductor

Equipment Components Group Equipment Components Group

GBP GBP GBP GBP GBP GBP

------------------ --------- ------------- --------- --------- ------------- ---------

Property, plant

and equipment

additions - 253,036 253,036 415 48,650 49,065

--------- ------------- --------- --------- ------------- ---------

Development cost

additions 70,724 2,715,662 2,786,386 71,931 2,743,135 2,815,066

--------- ------------- --------- --------- ------------- ---------

Depreciation 8,123 313,456 321,579 7,870 652,618 660,488

--------- ------------- --------- --------- ------------- ---------

Amortisation 72,337 3,203,678 3,276,015 72,202 3,677,887 3,750,089

--------- ------------- --------- --------- ------------- ---------

Other significant

non-cash

(income)/expenses - (37,000) (37,000) - (105,000) (105,000)

------------------ --------- ------------- --------- --------- ------------- ---------

Inter-segmental transfers or transactions are entered into under

commercial terms and conditions appropriate to the location of the

entity whilst considering that the parties are related.

Geographical

information

UK Germany Americas Far East Total

GBP GBP GBP GBP GBP

---------------- ----------- ----------- --------- --------- ------------

Unaudited

Year ended 31

March 2011

Revenue by

origination 13,089,263 8,480,848 5,088,589 9,107,937 35,766,637

Inter-segmental

revenue (6,262,733) (7,374,429) - (7,829) (13,644,991)

----------- ----------- --------- --------- ------------

Revenue to third

parties 6,826,530 1,106,419 5,088,589 9,100,108 22,121,646

----------- ----------- --------- --------- ------------

Property, plant

and equipment 5,109,717 81,001 20,920 19,121 5,230,759

----------- ----------- --------- --------- ------------

Investment

properties 3,450,000 - - - 3,450,000

----------- ----------- --------- --------- ------------

Properties held

for sale - - 419,773 - 419,773

----------- ----------- --------- --------- ------------

Goodwill - 3,512,305 - - 3,512,305

----------- ----------- --------- --------- ------------

Development cost 2,029,012 1,595,093 - - 3,624,105

----------- ----------- --------- --------- ------------

Total assets 21,273,261 4,364,616 1,572,651 1,236,758 28,447,282

---------------- ----------- ----------- --------- --------- ------------

Audited

Year ended 31

March 2010

Revenue by

origination 11,003,298 7,174,100 4,373,550 6,427,966 28,978,914

Inter-segmental

revenue (4,809,162) (6,138,276) - (8,337) (10,955,775)

----------- ----------- --------- --------- ------------

Revenue to third

parties 6,194,136 1,035,824 4,373,550 6,419,629 18,023,139

----------- ----------- --------- --------- ------------

Property, plant

and equipment 5,111,636 114,945 58,610 18,677 5,303,868

----------- ----------- --------- --------- ------------

Investment

property 3,850,000 - - - 3,850,000

----------- ----------- --------- --------- ------------

Property held

for sale - - 441,408 - 441,408

----------- ----------- --------- --------- ------------

Goodwill - 3,512,305 - - 3,512,305

----------- ----------- --------- --------- ------------

Development cost 2,661,499 1,527,582 - - 4,189,081

----------- ----------- --------- --------- ------------

Total assets 21,221,729 4,644,453 1,565,384 1,277,635 28,709,201

---------------- ----------- ----------- --------- --------- ------------

2. Dividend paid and proposed

No dividend has been paid in the year end 31 March 2011 or the

year end 31 March 2010. It is proposed to pay a dividend of 3.5p

per Ordinary Share of 5p in respect of the year end 31 March 2011

(2010: Nil per Ordinary Share of 5p in respect of the year end

2010).

3. Income tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of a subsidiary and have

provided on that basis.

Unaudited Audited

2011 2010

GBP GBP

---------------------------- ---------- ----------

UK income tax 293,656 (141,734)

Overseas income tax 186,907 131,877

---------------------------- ---------- ----------

Total current tax credit 480,563 (9,857)

Deferred tax (840,463) (352,841)

---------------------------- ---------- ----------

Reported income tax credit (359,900) (362,698)

---------------------------- ---------- ----------

4. Profit/(loss) per share

The calculation of basic and diluted earnings per share is based

on the profit/(loss) attributable to ordinary shareholders, divided

by the weighted average number of shares in issue during the

year.

Weighted Weighted

average average

number of Profit number of Loss

per per

Profit shares share Loss shares share

2011 2011 2011 2010 2010 2010

GBP No p GBP No p

----------------------- ----------- ---------- -------- -------- ---------- -------

Basic profit/(loss) per

share 2,684,510 15,023,279 17.87 (23,414) 14,947,626 (0.16)

----------------------- ----------- ---------- -------- -------- ---------- -------

Diluted profit/(loss) per

share

Basic profit/(loss) per

share 2,684,510 15,023,279 17.87 (23,414) 14,947,626 (0.16)

Dilutive effect of

share options 194,177 (0.23) 21,332 -

----------------------- ----------- ---------- -------- -------- ---------- -------

Diluted profit/(loss)

per share 2,684,510 15,217,456 17.64 (23,414) 14,968,958 (0.16)

----------------------- ----------- ---------- -------- -------- ---------- -------

5. Investment properties

Investment properties are revalued at each discrete period end

by the directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At the 31 March 2009 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants on an open market basis but in view

of the current market conditions the Directors considered it

prudent to reduce the value of the properties by GBP400,000.

6. Analysis of cash flow movement in net debt

Audited Audited Audited Unaudited Unaudited

Net debt Year end Net debt Year end Net debt

at 31 March at 31 March at

31 March 2010 Cash 31 March 2011 Cash 31 March

2009 Flow 2010 Flow 2011

GBP GBP GBP GBP GBP

------------- ------------ ---------- ------------ ---------- ------------

Cash and

Cash

equivalents 2,191,960 1,691,278 3,883,238 2,362,456 6,245,694

Bank loans

and

overdrafts (6,061,705) 93,415 (5,968,290) 2,048,879 (3,919,411)

------------- ------------ ---------- ------------ ---------- ------------

(3,869,745) 1,784,693 (2,085,052) 4,411,335 2,326,283

------------- ------------ ---------- ------------ ---------- ------------

The cash flow above is a combination of the actual cash flow and

the exchange movement.

7. Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored, however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly competitive

global market, which is undergoing continual and geographical

change. The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier. A substantial proportion of the Group's revenue and

earnings are derived from outside the UK and so the Group's ability

to achieve its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

8. Directors' statement pursuant to the disclosure and

transparency rules

The directors confirm that, to the best of their knowledge:

a. the condensed consolidated financial statements, prepared in

accordance with IFRS as adopted by the EU give a true and fair view

of the assets, liabilities, financial position and loss of the

company and the undertakings included in the consolidation taken as

a whole; and

b. the Chairman's statement and operating and financial review

includes a fair review of the development and performance of the

business and the position of the company and the undertakings

included in the consolidation taken as a whole together with a

description of the principal risks and uncertainties that they

face.

The directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

9. Significant accounting policies

The accounting policies used in preparation of the annual

results announcement are the same accounting policies set out in

the year ended 31 March 2010 financial statements.

10. General

The results for the year have been prepared using the

recognition and measurement principles of international financial

reporting standards as adopted by the EU.

The audited financial information for the year ended 31 March

2010 is based on the statutory accounts for the financial year

ended 31 March 2010 that have been filed with the Registrar of

Companies. The auditors reported on those accounts: their report

was (i) unqualified, (ii) did not include references to any matters

to which the auditors drew attention by way of emphasis without

qualifying the reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2011 are

expected to be finalised and signed following approval by the board

of directors on 24 June 2011 and delivered to the Registrar of

Companies following the Company's annual general meeting on 3

August 2011.

The financial information contained in this announcement does

not constitute statutory accounts for the year ended 31 March 2011

or 2010 as defined by Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com.

11. Approval

The Directors approved this annual results announcement on 13

June 2011.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFWFWDFFSESM

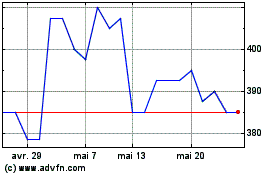

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024