TIDMCML

RNS Number : 5032R

CML Microsystems PLC

20 November 2012

CML Microsystems Plc

INTERIM RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductors, primarily for global

communication and data storage markets, announces Interim Results

for the six months ended 30 September 2012, in line with management

expectations.

Financial Highlights:

-- Revenues up 3.3% to GBP12.70m (2011 H1: GBP12.29m)

-- Gross profit up 2.6% to GBP8.73m (2011 H1: GBP8.51m)

-- Profit before tax up 19.5% to GBP2.41m (2011 H1: GBP2.02m)

-- Basic EPS up 13.5% of 11.20p (2011 H1: 9.87p)

-- Positive cash flow of GBP1.27m

-- Net cash position of GBP6.51m (2011 H1: GBP4.37m) - with bank

borrowings reduced by GBP1.66m to GBP1.35m

Operational Highlights:

-- Good revenue growth in the Americas, a modest increase in

sales to the Far East whereas Europe continues to be

challenging

-- Continued growth of semiconductor flash memory controllers

-- Industrial wireless voice and data products were lower in H1

but balanced by order intake for H2

-- Products sales for Telecom applications was broadly flat

Regarding Outlook, Chris Gurry, Managing Director of CML,

said:

"Top level trading performance through the first half year was

ahead of the comparable period and once again reflected the Group's

focus on delivering sustainable growth.

"Firm progress was made in the solid state Storage market and

expansion of the controller product range to include the SATA

interface standard is now fully supported by production released

solutions. The industrial SATA controller market is a key growth

area for the Group and customer design-in activity is on track to

begin generating meaningful revenues during the year ahead.

"Within Wireless, despite the potential for sporadic contracts

to cause comparable period inconsistencies, the underlying trend is

one of positive growth. The on-going customer adoption of the

Group's more recent RF, baseband and data modem portfolio validates

medium term growth objectives along with the continuing R&D

investment strategy.

"Global economic conditions continue to affect customer

sentiment in some areas, and whilst the possibility exists for

customer buying patterns to be impacted, trading since 1 October

serves to underpin Board expectations for a firm full year advance

in both revenues and profitability."

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Managing Director Tel: 01621 875 500

Nigel Clark, Financial

Director

Cenkos Securities plc

Jeremy Warner Allen (Sales) Tel: 020 7397 8900

Stephen Keys (Corporate

Finance)

Walbrook PR Ltd Tel: 020 7933 8780

Paul McManus Mob: 07980 541 893 or paul.mcmanus@walbrookpr.com

Helen Westaway Mob: 07841 917 679 or helen.westaway@walbrookpr.com

Chairman's Statement

I am pleased to report that your company has posted increased

sales and profitability for the six-months opening trading period

ended 30 September 2012. Although market conditions remained

difficult in some areas, the results reported align generally with

management expectations.

Sales revenues for the period showed an increase to GBP12.70m

(2011: GBP12.29m) while pre-tax profit rose to GBP2.41m (2011:

GBP2.02m).

A further reduction in the figure for bank loans and overdrafts

to GBP1.35m (2011: GBP3.01m) was achieved. The growing balance

sheet strength assisted the removal of all bank lien and charges

over Group owned properties.

In general, trading is proceeding pretty much as expected and I

see little comment that I might usefully add relating to the first

half trading results. When taken with the anticipated second

half-year performance, I feel confident that results for the full

year to 31 March 2013 will meet market expectations.

Speaking on behalf of the Board, I once again express our thanks

and appreciation to our global employees for their efforts and

commitment towards the Group's success.

G. W. Gurry

Chairman

20 November 2012

Operating and Financial Review

The six-month trading period to 30 September 2012 saw Group

revenues increase by just over 3% to GBP12.70m (2011: GBP12.29m)

representing steady progress amidst the backdrop of generally

challenging economic times. Geographically, the Group experienced

double digit percentage growth within the Americas along with a

modest increase into the Far East region. Trading with Europe

continued to be challenging and experienced a marginal decline

against the comparable six-months.

The period under review showed continued growth from the sale of

semiconductor flash memory controller products into industrial

solid state Storage applications. Revenues moved firmly ahead

against the prior year interim figure with most of the top Storage

customers increasing their purchase levels.

The sale of Group products into industrial wireless voice and

data application areas was somewhat lower against the prior

half-year period although order intake for delivery during the

second half leaves full year expectations for further advances in

Wireless shipments unchanged.

Revenues from the sale of Group semiconductors into Telecom

applications were broadly flat.

The Group's equipment division, RDT, saw revenues drop to

GBP308k (2011: GBP415k) as trading in its dominant UK security

markets remained weak.

Gross margin remained stable at 69% leading to a reported gross

profit of GBP8.73m (2011: GBP8.51m). Distribution and

administration costs fell slightly to GBP6.42m (2011: 6.52m) and

this helped to deliver an operational profit (before other income,

share-based payments and finance costs) of GBP2.32m against a

comparable period figure of GBP1.99m.

Other operating income, principally rental proceeds from group

owned industrial properties, rose slightly to GBP124k (2011:

GBP89k).

Focussed management of Group cash resources led to a net finance

income being recorded of GBP5k against a prior year first half cost

of GBP37k.

Profit before tax amounted to GBP2.41m representing a 19%

increase on the comparable half-year period. (2011: GBP2.02m).

A combination of increased revenues, static gross margin and

reduced operating costs generated positive cash flow of GBP1.27m.

This increase was posted after payment of a GBP631k cash dividend.

At the period end the Group had cash reserves of GBP7.86m (2011:

GBP7.38m) and bank borrowings of GBP1.35m (2011: GBP3.01m).

Summary & Outlook

Top level trading performance through the first half year was

ahead of the comparable period and once again reflected the Group's

focus on delivering sustainable growth.

Firm progress was made in the solid state Storage market and

expansion of the controller product range to include the SATA

interface standard is now fully supported by production released

solutions. The industrial SATA controller market is a key growth

area for the Group and customer design-in activity is on track to

begin generating meaningful revenues during the year ahead.

Within Wireless, despite the potential for sporadic contracts to

cause comparable period inconsistencies, the underlying trend is

one of positive growth. The on-going customer adoption of the

Group's more recent RF, baseband and data modem portfolio validates

medium term growth objectives along with the continuing R&D

investment strategy.

Global economic conditions continue to affect customer sentiment

in some areas, and whilst the possibility exists for customer

buying patterns to be impacted, trading since 1 October serves to

underpin Board expectations for a firm full year advance in both

revenues and profitability.

C. A. Gurry

Managing Director

20 November 2012

Condensed Consolidated Income Statement

for the six months ended September 2012

Unaudited Unaudited Audited

Six months Six months Year end

end end

30/09/12 30/09/11 31/03/12

GBP'000 GBP'000 GBP'000

------------------------------------- ---------- ---------- --------

Continuing operations

Revenue 12,698 12,293 23,409

Cost of sales (3,965) (3,785) (7,197)

------------------------------------- ---------- ---------- --------

Gross profit 8,733 8,508 16,212

Distribution and administration

costs (6,416) (6,521) (13,050)

------------------------------------- ---------- ---------- --------

2,317 1,987 3,162

Other operating income 124 89 459

------------------------------------- ---------- ---------- --------

Profit before share-based payments 2,441 2,076 3,621

Share-based payments (38) (24) (63)

------------------------------------- ---------- ---------- --------

Profit after share-based payments 2,403 2,052 3,558

Revaluation of investment properties - - 328

Finance costs - (41) (39)

Finance income 5 4 102

------------------------------------- ---------- ---------- --------

Profit before taxation 2,408 2,015 3,949

Income tax expense (638) (489) (633)

------------------------------------- ---------- ---------- --------

Profit for period attributable

to equity owners of the parent 1,770 1,526 3,316

------------------------------------- ---------- ---------- --------

Earnings per share

Basic 11.20p 9.87p 21.06p

------------------------------------- ---------- ---------- --------

Diluted 11.13p 9.78p 20.94p

------------------------------------- ---------- ---------- --------

Condensed Consolidated Statement of Comprehensive Income

for the six months ended September 2012

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/12 30/09/11 31/03/12

GBP'000 GBP'000 GBP'000

------------------------------------ ------------ ------------ --------

Profit for the period 1,770 1,526 3,316

Other comprehensive income:

Foreign exchange differences (65) 56 6

Actuarial loss on retirement

benefit obligations - - (1,962)

Income tax on actuarial loss - - 458

------------------------------------ ------------ ------------ --------

Other comprehensive income for

the period net of tax (65) 56 (1,498)

------------------------------------ ------------ ------------ --------

Total comprehensive income for

the period net of tax attributable

to equity owners of the business 1,705 1,582 1,818

------------------------------------ ------------ ------------ --------

Condensed Consolidated Statement of Financial Position

as at 30 September 2012

Unaudited Unaudited Audited

30/09/12 30/09/11 31/03/12

GBP'000 GBP'000 GBP'000

---------------------------------- --------- --------- --------

Assets

Non-current assets

Property, plant and equipment 5,132 5,165 5,156

Investment properties 3,450 3,450 3,450

Development costs 4,372 4,385 4,154

Goodwill 3,512 3,512 3,512

Deferred tax asset 2,398 2,608 2,731

---------------------------------- --------- --------- --------

18,864 19,120 19,003

---------------------------------- --------- --------- --------

Current assets

Inventories 2,017 1,686 1,781

Trade receivables and prepayments 2,693 1,104 1,566

Current tax assets - - 135

Cash and cash equivalents 7,864 7,383 7,742

---------------------------------- --------- --------- --------

12,574 10,173 11,224

---------------------------------- --------- --------- --------

Non-current assets classified

as held for

sale - properties 103 430 105

---------------------------------- --------- --------- --------

Total assets 31,541 29,723 30,332

---------------------------------- --------- --------- --------

Liabilities

Current liabilities

Bank loans and overdrafts 1,354 3,014 2,501

Trade and other payables 3,604 3,375 2,604

Current tax liabilities 255 276 102

---------------------------------- --------- --------- --------

5,213 6,665 5,207

---------------------------------- --------- --------- --------

Non-current liabilities

Deferred tax liabilities 1,671 1,816 1,672

Retirement benefit obligation 4,542 2,607 4,542

---------------------------------- --------- --------- --------

6,213 4,423 6,214

---------------------------------- --------- --------- --------

Total liabilities 11,426 11,088 11,421

---------------------------------- --------- --------- --------

Net assets 20,115 18,635 18,911

---------------------------------- --------- --------- --------

Capital and reserves attributable

to equity owners of the parent

Share capital 793 788 788

Share premium 4,959 4,872 4,872

Share-based payments reserve 146 69 108

Foreign exchange reserve 268 382 333

Accumulated profits 13,949 12,524 12,810

---------------------------------- --------- --------- --------

Shareholders' equity 20,115 18,635 18,911

---------------------------------- --------- --------- --------

Condensed Consolidated cash flow statement

for the six months ended 30 September 2012

Unaudited Unaudited Audited

Six months Six months Year end

end end

30/09/12 30/09/11 31/03/12

GBP'000 GBP'000 GBP'000

------------------------------------------------- ---------- ---------- --------

Operating activities

Profit for the period before income taxes 2,408 2,015 3,950

Adjustments for:

Depreciation 109 94 213

Amortisation of development costs 1,146 1,460 2,944

Revaluation of investment properties - - 69

Movement in pensions deficit - - 66

Share-based payments 38 24 63

Interest expense - 41 39

Interest income (5) (4) (7)

Decrease in working capital (362) 1,239 (492)

------------------------------------------------- ---------- ---------- --------

Cash flows from operating activities 3,334 4,869 6,845

Income tax refunded/(paid) 19 (118) (398)

------------------------------------------------- ---------- ---------- --------

Net cash flows from operating activities 3,353 4,751 6,447

------------------------------------------------- ---------- ---------- --------

Investing activities

Purchase of property, plant and equipment (88) (33) (145)

Investment in development costs (1,460) (2,247) (3,518)

Disposals of property, plant and equipment - 2 9

Disposal of assets held for sale - - 669

Interest income 5 4 7

------------------------------------------------- ---------- ---------- --------

Net cash flows from investing activities (1,543) (2,274) (2,978)

------------------------------------------------- ---------- ---------- --------

Financing activities

Issue of ordinary shares 92 55 55

Decrease in bank loans and short-term borrowings (1,146) (905) (1,419)

Dividend paid to Group shareholders (631) (550) (550)

Finance cost - (41) (39)

------------------------------------------------- ---------- ---------- --------

Net cash flows from financing activities (1,685) (1,441) (1,953)

------------------------------------------------- ---------- ---------- --------

Increase in cash and cash equivalents 125 1,036 1,516

------------------------------------------------- ---------- ---------- --------

Movement in cash and cash equivalents:

At start of period/year 7,742 6,246 6,246

Increase in cash and cash equivalents 125 1,036 1,516

Effects of exchange rate changes (3) 101 (19)

------------------------------------------------- ---------- ---------- --------

At end of period/year 7,864 7,383 7,742

------------------------------------------------- ---------- ---------- --------

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2012

Foreign

Share Share Share-based exchange Accumulated

capital premium payments reserve profits Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------- ------- ----------- -------- ----------- -------

At 1 April 2011 785 4,820 298 326 11,295 17,524

--------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 1,526 1,526

Other comprehensive income:

Foreign exchange differences 56 56

--------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income

for the period - - - 56 1,526 1,582

--------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners

in their capacity as owners:

Dividend paid (550) (550)

Issue of ordinary shares 3 52 55

--------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with

owners in their capacity

as owners: 3 52 - - (550) (495)

Share-based payments transferred

on cancellation (253) 253 -

Share-based payments 24 24

--------------------------------- ------- ------- ----------- -------- ----------- -------

At 30 September 2011 788 4,872 69 382 12,524 18,635

--------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 1,790 1,790

Other comprehensive income:

Foreign exchange differences (49) (49)

Net actuarial profits recognised

directly to equity (1,962) (1,962)

Deferred tax on actuarial

losses 458 458

--------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income

for the period - - - (49) 286 237

--------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 39 39

--------------------------------- ------- ------- ----------- -------- ----------- -------

At 31 March 2012 788 4,872 108 333 12,810 18,911

--------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 1,770 1,770

Other comprehensive income:

Foreign exchange differences (65) (65)

--------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income

for the period - - - (65) 1,770 1,705

--------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners

in their capacity as owners:

Dividend paid (631) (631)

Issue of ordinary shares 5 87 92

--------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with

owners in their capacity

as owners: 5 87 - - (631) (539)

--------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 38 38

--------------------------------- ------- ------- ----------- -------- ----------- -------

At 30 September 2012 793 4,959 146 268 13,949 20,115

--------------------------------- ------- ------- ----------- -------- ----------- -------

Notes to the Condensed Financial Statements

1. Segmental analysis

Business segments

Unaudited Unaudited Audited

Six months end Six months end Year end

30/09/12 30/09/11 31/03/12

------------------------------ ------------------------------ -------------------------------

Semi- Semi- Semi-

conductor conductor conductor

Equipment components Group Equipment components Group Equipment components Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Revenue

By origination 308 20,824 21,132 415 21,444 21,859 759 38,245 39,004

Inter-segmental

revenue - (8,434) (8,434) - (9,566) (9,566) - (15,595) (15,595)

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Segmental revenue 308 12,390 12,698 415 11,878 12,293 759 22,650 23,409

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Profit/(loss)

Segmental result (68) 2,471 2,403 4 2,048 2,052 (55) 3,613 3,558

------------------- --------- ---------- --------- ---------- --------- ----------

Revaluation of

investment

properties - - 328

Net financial

income 5 (37) 63

Income tax (638) (489) (633)

------- ------- --------

Profit after

taxation 1,770 1,526 3,316

------- ------- --------

Assets and

liabilities

Segmental assets 659 24,931 25,590 606 22,629 23,235 611 23,300 23,911

------------------- --------- ---------- --------- ---------- --------- ----------

Unallocated

corporate

assets

Investment property

(including held

for sale) 3,553 3,880 3,555

Deferred taxation 2,398 2,608 2,731

Current tax

receivable - - 135

------- ------- --------

Consolidated total

assets 31,541 29,723 30,332

------- ------- --------

Segmental

liabilities 298 3,306 3,604 91 3,284 3,375 183 2,421 2,604

------------------- --------- ---------- --------- ---------- --------- ----------

Unallocated

corporate

assets

Deferred taxation 1,671 1,816 1,672

Current tax

liability 255 276 102

Bank loans and

overdrafts 1,354 3,014 2,501

Retirement benefit

obligation 4,542 2,607 4,542

------- ------- --------

Consolidated total

liabilities 11,426 11,088 11,421

------- ------- --------

Other segmental

information

Property, plant

and equipment

additions 88 - 88 32 1 33 4 141 145

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Development cost

additions 1,425 35 1,460 2,206 41 2,247 78 3,440 3,518

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Depreciation 108 1 109 90 4 94 6 207 213

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Amortisation 1,114 32 1,146 1,427 33 1,460 74 2,870 2,944

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Other significant

non-cash income - - - - - - - (42) (42)

------------------- --------- ---------- ------- --------- ---------- ------- --------- ---------- --------

Geographical segments

UK Germany Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------- ------- -------- -------- --------

Unaudited

Six months ended 30 September 2012

Revenue by origination 6,121 6,407 3,106 5,498 21,132

Inter-segmental revenue (3,134) (5,300) - - (8,434)

----------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 2,987 1,107 3,106 5,498 12,698

----------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,926 58 134 14 5,132

----------------------------------- ------- ------- -------- -------- --------

Investment properties including

held for sale 3,450 - 103 - 3.553

----------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------- ------- ------- -------- -------- --------

Development cost 2,029 2,343 - - 4,372

----------------------------------- ------- ------- -------- -------- --------

Total assets 22,176 5,894 1,562 1,909 31,541

----------------------------------- ------- ------- -------- -------- --------

Unaudited

Six months ended 30 September 2011

Revenue by origination 7,182 6,275 2,887 5,515 21,859

Inter-segmental revenue (4,244) (5,295) - (27) (9,566)

----------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 2,938 980 2,887 5,488 12,293

----------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 5,062 67 16 20 5,165

----------------------------------- ------- ------- -------- -------- --------

Investment properties including

held for sale 3,450 - 430 - 3,880

----------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------- ------- ------- -------- -------- --------

Development cost 2,321 2,064 - - 4,385

----------------------------------- ------- ------- -------- -------- --------

Total assets 21,495 4,920 1,770 1,538 29,723

----------------------------------- ------- ------- -------- -------- --------

Audited

Year ended 31 March 2012

Revenue by origination 12,362 10,529 6,279 9,835 39,005

Inter-segmental revenue (6,706) (8,859) - (31) (15,596)

----------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 5,656 1,670 6,279 9.804 23,409

----------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,968 56 116 16 5,156

----------------------------------- ------- ------- -------- -------- --------

Investment properties including

held for sale 3,450 - 105 - 3,555

----------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------- ------- ------- -------- -------- --------

Development cost 1,908 2,246 - - 4,154

----------------------------------- ------- ------- -------- -------- --------

Total assets 22,883 5,059 1,185 1,205 30,332

----------------------------------- ------- ------- -------- -------- --------

Reported segments and their results in accordance with IFRS 8,

is based on internal management reporting information that is

regularly reviewed by the chief operating decision maker. The

measurement policies the Group uses for segmental reporting under

IFRS 8 are the same as those used in its financial statements.

2. Dividend paid and proposed

A dividend of 4p per 5p ordinary share in respect of the year

ended 31 March 2012 was paid on 3 August 2012 (2011: 3.5p per

ordinary share of 5p in respect of the year ended 31 March 2011).

No dividend is proposed in respect of the six months period ended

30 September 2012 (2011: GBPNil per ordinary share of 5p in respect

of the period ended 30 September 2011).

3. Income tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

Unaudited Unaudited Audited

Six months Six months Year end

end end

30/09/12 30/09/11 31/03/12

GBP'000 GBP'000 GBP'000

------------------------------ ---------- ---------- --------

UK income tax charge/(credit) - 170 (134)

Overseas income tax charge 326 175 447

------------------------------ ---------- ---------- --------

Total current tax charge 326 345 313

Deferred tax charge 312 144 320

------------------------------ ---------- ---------- --------

Reported income tax charge 638 489 633

------------------------------ ---------- ---------- --------

4. Earnings per share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

Ordinary 5p shares

----------------------

Weighted

average Diluted

number number

----------------------------------- ---------- ----------

Six months ended 30 September 2012 15,809,707 15,903,421

----------------------------------- ---------- ----------

Six months ended 30 September 2011 15,467,789 15,600,977

----------------------------------- ---------- ----------

Year end 31 March 2012 15,743,946 15,835,323

----------------------------------- ---------- ----------

5. Investment properties

Investment properties are revalued at each discrete period end

by the Directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At 31 March 2012 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants on an open market basis.

6. Analysis of cash flow movement in net debt

Net cash Six months Net cash Six months Net cash Six months Net cash

at end at end at end at

01/04/11 30/09/11 30/09/11 31/03/12 31/03/12 30/09/12 30/09/12

Cash flow Cash flow Cash flow

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- ---------- -------- ---------- -------- ---------- --------

Cash and cash equivalents 6,246 1,137 7,383 359 7,742 122 7,864

Bank loans and overdrafts (3,919) 905 (3,014) 513 (2,501) 1,147 (1,354)

-------------------------- -------- ---------- -------- ---------- -------- ---------- --------

2,327 2,042 4,369 872 5,241 1,269 6,510

-------------------------- -------- ---------- -------- ---------- -------- ---------- --------

The cash flow above is a combination of the actual cash flow and

the exchange movement.

During the period the security held by the Company's bankers

over land and buildings was extinguished.

7. Retirement benefit obligations

The Directors have not obtained an actuarial report in respect

of the defined benefit pension scheme for the purpose of this Half

Yearly Report.

8. Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency would have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored, however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly-competitive

global market, which is undergoing continual geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

9. Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

a. the condensed financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the

assets, liabilities, financial position and profit of the Group and

the undertakings included in the consolidation taken as a whole;

and

b. the condensed set of financial statements have been prepared

in accordance with IAS 34 "Interim Financial Reporting"; and

c. the Chairman's statement and operating and financial review

include a fair review of the development and performance of the

business and the position of the Company and the undertakings

included in the consolidation taken as a whole together with a

description of the principal risks and uncertainties that they

face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

10. Basis of preparation

The basis of preparation and accounting policies used in

preparation of the Half Yearly Financial Report are the same

accounting policies set out in the year ended 31 March 2012

financial statements.

11. General

Other than already stated within the Chairman's statement and

the operating and financial review there have been no important

events during the first six months of the financial year that have

impacted this Half Yearly Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 8 above.

In the segmental analysis (note 1) inter-segmental transfers or

transactions are entered into under commercial terms and conditions

appropriate to the location of the entity whilst considering that

the parties are related.

This interim management report includes a fair review of the

information required by DTR 4.2.7/8 (indication of important events

and their impact, and description of principal risks and

uncertainties for the remaining six months of the financial

year).

This Half Yearly Financial Report does not include all the

information and disclosures required in the Annual Report, and

should be read in conjunction with the consolidated Annual Report

for the year ended 31 March 2012.

The financial information contained in this Half Yearly

Financial Report has been prepared using International Financial

Reporting Standards as adopted by the European Union. This Half

Yearly Financial Report does not constitute statutory accounts as

defined by Section 434 of the Companies Act 2006. The financial

information for the year ended 31 March 2012 is based on the

statutory accounts for the financial year ended 31 March 2012 that

have been filed with the Registrar of Companies and on which the

Auditor gave an unqualified audit opinion.

11. General (continued)

The auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Financial Report has not been audited or reviewed

by the Group Auditor.

A copy of this Half Yearly Report can be viewed on the Company

website www.cmlmicroplc.com.

12. Approval

The Directors approved this Half Yearly Report on 20 November

2012.

GLOSSARY

GPRS general packet radio services

M2M machine to machine

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGGWWGUPPGMB

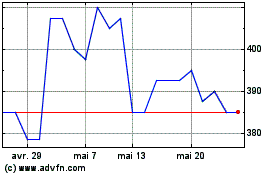

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024